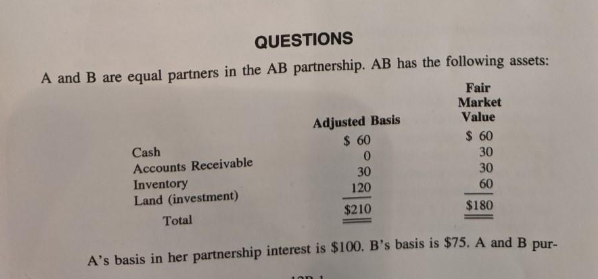

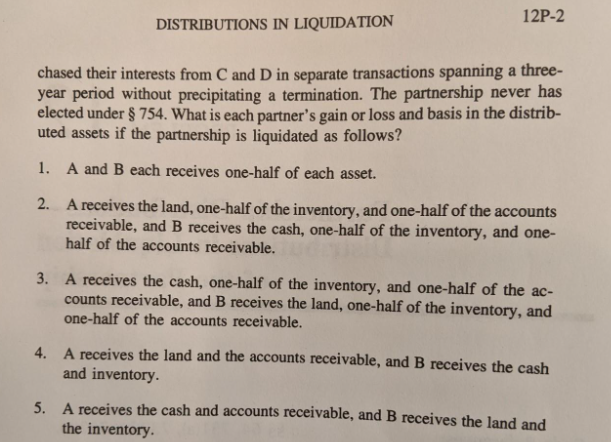

QUESTIONS A and B are equal partners in the AB partnership. AB has the following assets: Fair Market Adjusted Basis Value $ 60 $ 60 Cash 0 30 Accounts Receivable 30 30 Inventory 120 60 Land (investment) $210 $180 Total A's basis in her partnership interest is $100. B's basis is $75. A and B pur- on 1 12P-2 DISTRIBUTIONS IN LIQUIDATION chased their interests from C and D in separate transactions spanning a three- year period without precipitating a termination. The partnership never has elected under $ 754. What is each partner's gain or loss and basis in the distrib- uted assets if the partnership is liquidated as follows? 1. A and B each receives one-half of each asset. 2. A receives the land, one-half of the inventory, and one-half of the accounts receivable, and B receives the cash, one-half of the inventory, and one- half of the accounts receivable. 3. A receives the cash, one-half of the inventory, and one-half of the ac- counts receivable, and B receives the land, one-half of the inventory, and one-half of the accounts receivable. 4. A receives the land and the accounts receivable, and B receives the cash and inventory. 5. A receives the cash and accounts receivable, and B receives the land and the inventory. QUESTIONS A and B are equal partners in the AB partnership. AB has the following assets: Fair Market Adjusted Basis Value $ 60 $ 60 Cash 0 30 Accounts Receivable 30 30 Inventory 120 60 Land (investment) $210 $180 Total A's basis in her partnership interest is $100. B's basis is $75. A and B pur- on 1 12P-2 DISTRIBUTIONS IN LIQUIDATION chased their interests from C and D in separate transactions spanning a three- year period without precipitating a termination. The partnership never has elected under $ 754. What is each partner's gain or loss and basis in the distrib- uted assets if the partnership is liquidated as follows? 1. A and B each receives one-half of each asset. 2. A receives the land, one-half of the inventory, and one-half of the accounts receivable, and B receives the cash, one-half of the inventory, and one- half of the accounts receivable. 3. A receives the cash, one-half of the inventory, and one-half of the ac- counts receivable, and B receives the land, one-half of the inventory, and one-half of the accounts receivable. 4. A receives the land and the accounts receivable, and B receives the cash and inventory. 5. A receives the cash and accounts receivable, and B receives the land and the inventory