Question

Questions a. Based on the GDP growth rate graph, how might the slowdown and contraction in GDP growth have influenced large U.S. banks' decisions regarding

Questions

a. Based on the GDP growth rate graph, how might the slowdown and contraction in GDP growth have influenced large U.S. banks' decisions regarding dividend payouts during the financial crisis?

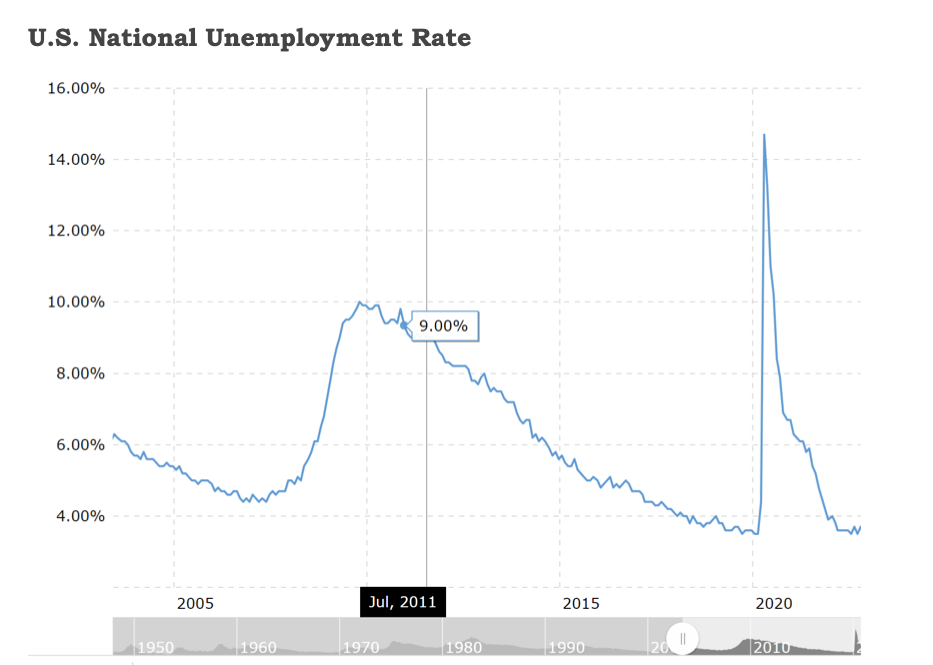

b. Given the sharp increase in unemployment from 2008 to 2010, how might this have affected banks' profitability and, in turn, their dividend policies?

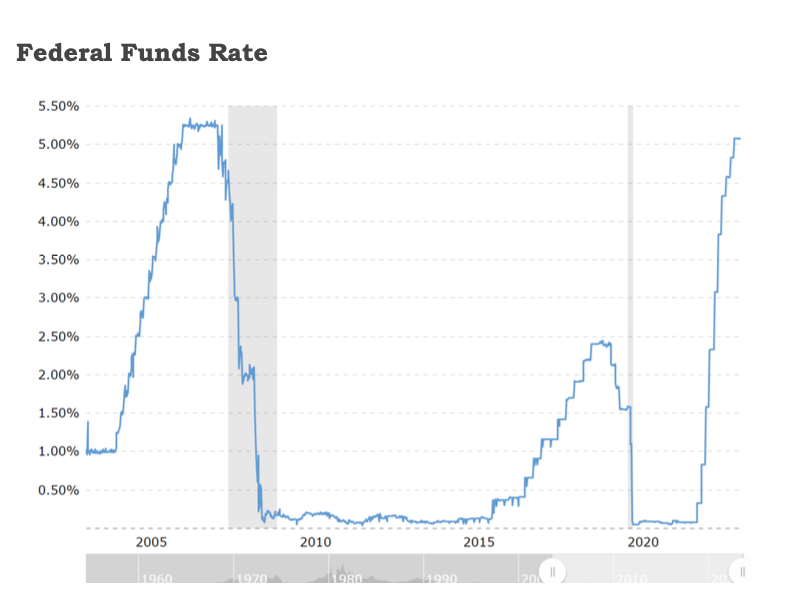

c. How could the aggressive cuts in the Federal Funds Rate by the Federal Reserve during the financial crisis have impacted banks' dividend policies?

d. Considering the overall macroeconomic backdrop during the financial crisis (as illustrated in the graphs), what might have been some of the key considerations for large U.S. banks when deciding on their dividend policies?

e. Post-crisis, as the economy started recovering (as evidenced by GDP growth and a decrease in unemployment), how might banks have revised their dividend policies, and what factors might they have considered when doing so?

f. In class, we frequently talked about the 2022 banking crisis. Fully explain at least 3 key factors leading to the 2022 banking crisis.

From: : : : : : : : : : : : : : : : : : : : L L - . 2005 To: 3 2 2 3 U.S. National Unemployment Rate Federal Funds Rate

From: : : : : : : : : : : : : : : : : : : : L L - . 2005 To: 3 2 2 3 U.S. National Unemployment Rate Federal Funds Rate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started