questions

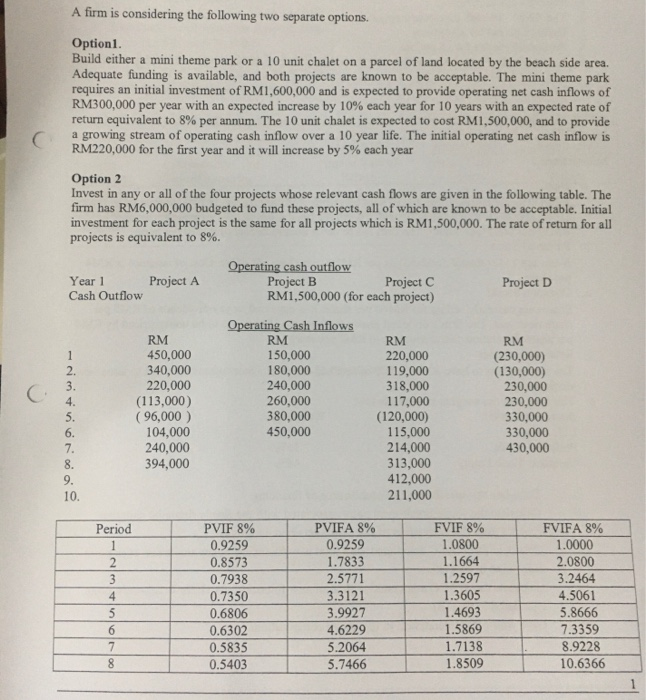

A firm is considering the following two separate options. Option1. Build either a mini theme park or a 10 unit chalet on a parcel of land located by the beach side area. Adequate funding is available, and both projects are known to be acceptable. The mini theme park requires an initial investment of RM1,600,000 and is expected to provide operating net cash inflows of RM300,000 per year with an expected increase by 10% each year for 10 years with an expected rate of return equivalent to 8% per annum. The 10 unit chalet is expected to cost RM1,500,000, and to provide a growing stream of operating cash inflow over a 10 year life. The initial operating net cash inflow is RM220,000 for the first year and it will increase by 5% each year Option 2 Invest in any or all of the four projects whose relevant cash flows are given in the following table. The firm has RM6,000,000 budgeted to fund these projects, all of which are known to be acceptable. Initial investment for each project is the same for all projects which is RM1,500,000. The rate of return for all projects is equivalent to 8%. Operating cash outflow Year 1 Project A Project B Project C Project D Cash Outflow RM1,500,000 (for each project) Operating Cash Inflows RM RM RM RM 450,000 150,000 220,000 (230,000) 2. 340,000 180,000 119,000 (130,000) 220,000 240,000 318,000 230,000 (113,000) 260,000 117,000 230,000 5. ( 96,000) 380,000 (120,000) 330,000 6. 104,000 450,000 115,000 330,000 240,000 214,000 430,000 8. 394,000 313,000 9. 412,000 10. 211,000 c 4. - in vivono Period 1 2. 3 4 5 6 7 8 PVIF 8% 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 PVIFA 8% 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 FVIF 8% 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 FVIFA 8% 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 ACCA 501 BUSINESS ACCOUNTING & FINANCE 10 0.5002 0.4632 6.2469 6.7101 1.9990 2.1589 12.4876 14.4866 Compute the following for each option. 1. The NPV for each option 2. The ANPV for each investment option 3. Payback period for all options 4. Profitability index for all options 5. Recommend which alternative is more favorable in terms of accept-reject or ranking decisions. A firm is considering the following two separate options. Option1. Build either a mini theme park or a 10 unit chalet on a parcel of land located by the beach side area. Adequate funding is available, and both projects are known to be acceptable. The mini theme park requires an initial investment of RM1,600,000 and is expected to provide operating net cash inflows of RM300,000 per year with an expected increase by 10% each year for 10 years with an expected rate of return equivalent to 8% per annum. The 10 unit chalet is expected to cost RM1,500,000, and to provide a growing stream of operating cash inflow over a 10 year life. The initial operating net cash inflow is RM220,000 for the first year and it will increase by 5% each year Option 2 Invest in any or all of the four projects whose relevant cash flows are given in the following table. The firm has RM6,000,000 budgeted to fund these projects, all of which are known to be acceptable. Initial investment for each project is the same for all projects which is RM1,500,000. The rate of return for all projects is equivalent to 8%. Operating cash outflow Year 1 Project A Project B Project C Project D Cash Outflow RM1,500,000 (for each project) Operating Cash Inflows RM RM RM RM 450,000 150,000 220,000 (230,000) 2. 340,000 180,000 119,000 (130,000) 220,000 240,000 318,000 230,000 (113,000) 260,000 117,000 230,000 5. ( 96,000) 380,000 (120,000) 330,000 6. 104,000 450,000 115,000 330,000 240,000 214,000 430,000 8. 394,000 313,000 9. 412,000 10. 211,000 c 4. - in vivono Period 1 2. 3 4 5 6 7 8 PVIF 8% 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 PVIFA 8% 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 FVIF 8% 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 FVIFA 8% 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 ACCA 501 BUSINESS ACCOUNTING & FINANCE 10 0.5002 0.4632 6.2469 6.7101 1.9990 2.1589 12.4876 14.4866 Compute the following for each option. 1. The NPV for each option 2. The ANPV for each investment option 3. Payback period for all options 4. Profitability index for all options 5. Recommend which alternative is more favorable in terms of accept-reject or ranking decisions