Question

QUESTIONS: A. Improper Classification of WriteOff of Accounts Receivable as Acquisition Costs: According to the SEC, [A]s part of the cover up, Peregrine personnel wrote

QUESTIONS:

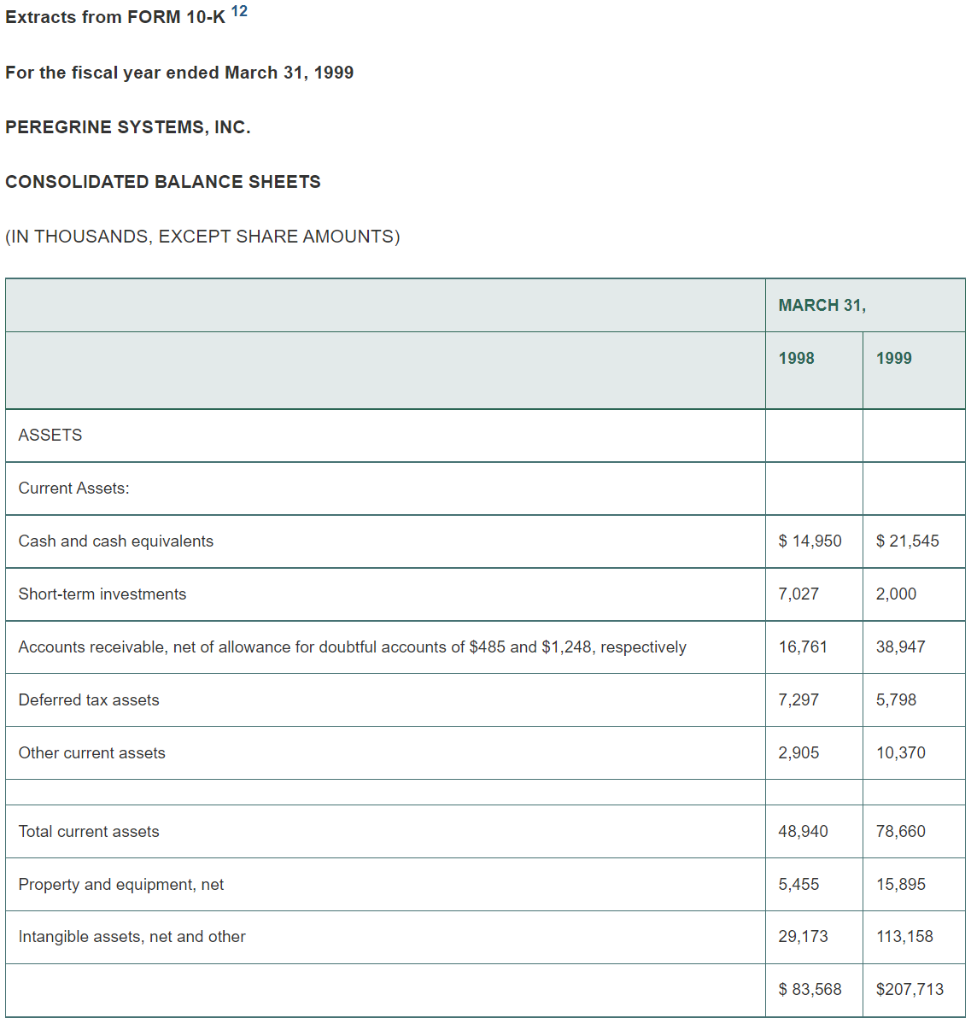

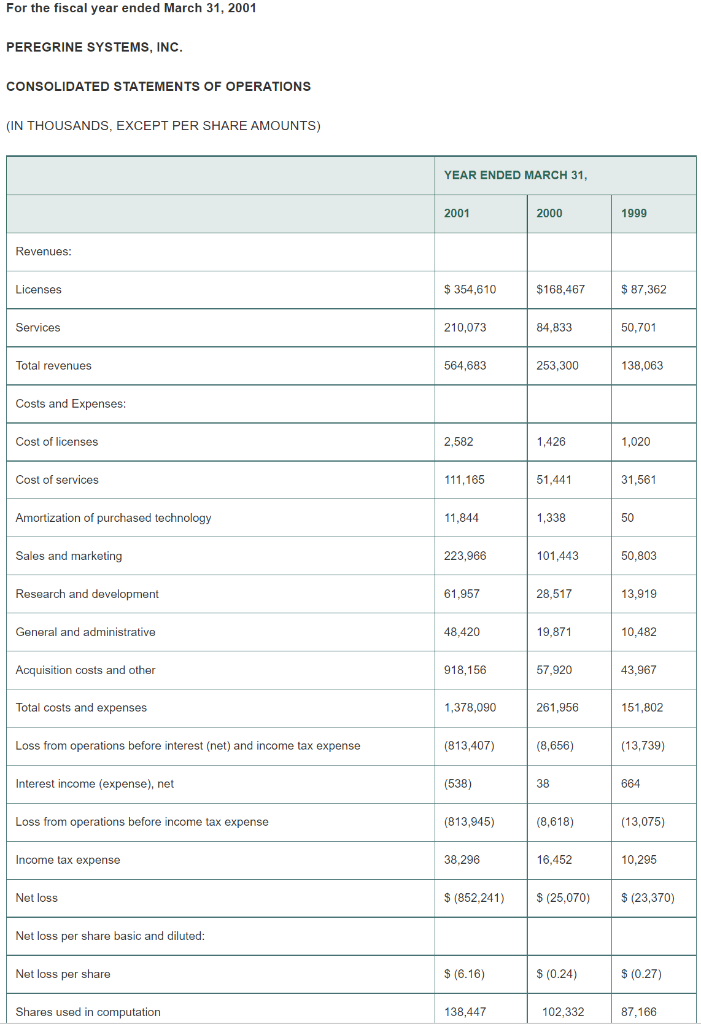

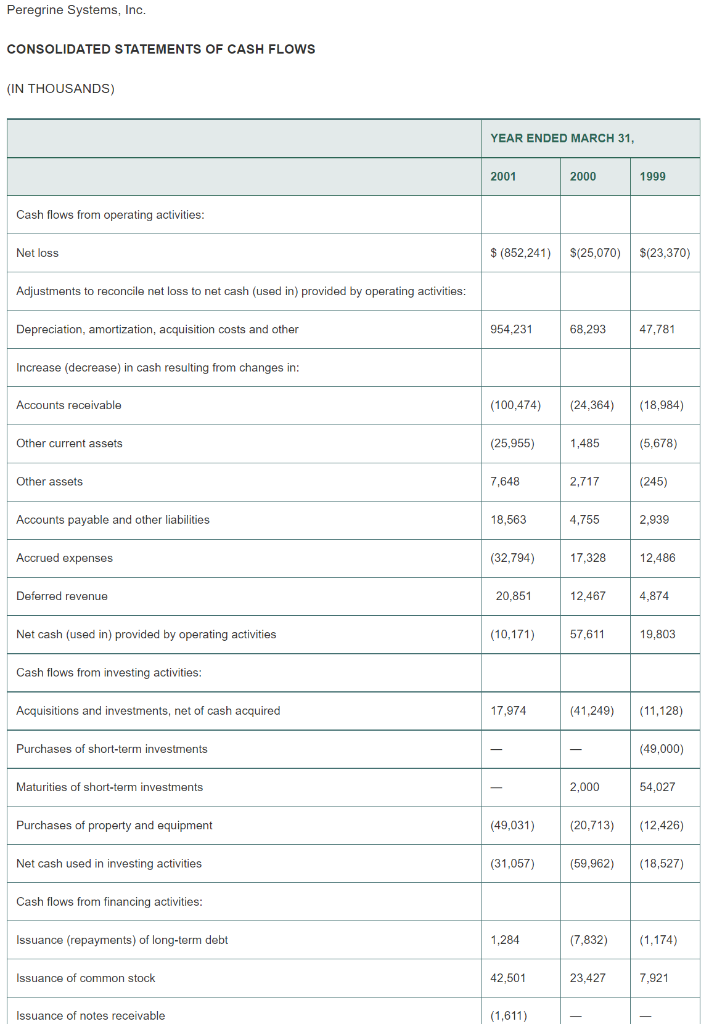

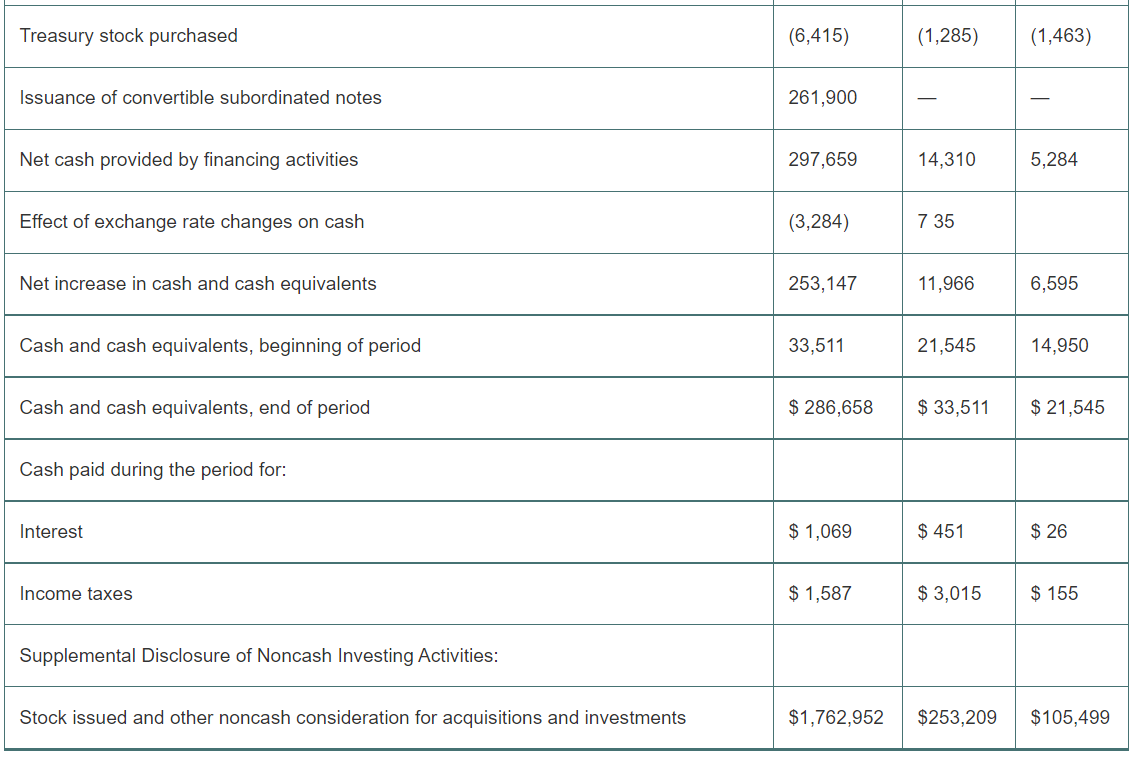

A. Improper Classification of WriteOff of Accounts Receivable as Acquisition Costs: According to the SEC, [A]s part of the cover up, Peregrine personnel wrote off millions of dollars in uncollectibleprimarily shamreceivables, to acquisition related accounts (LR 18205A). 1. Explain how this would affect the signal of CFFO lagging, or falling behind, operating income that would normally indicate an overstatement of revenue. 2. Explain how the improper writeoff of accounts receivable as acquisition costs would affect the signal of accounts receivable increasing as a percentage of sales.

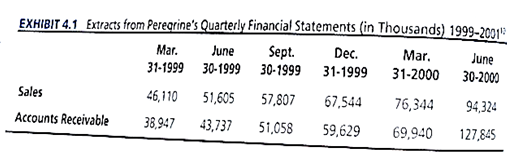

B. Calculation of Accounts Receivable as a Percentage of the Trailing 12 Months Sales: Now examine Exhibit 4.1 below and use the sales and receivable amounts from Peregrines quarterly financial statements to calculate accounts receivable as a percentage of the trailing 12 months sales for fiscal 2000-Q3, 2000-Q4,and 2001Q1. Comment on your calculations as a signal of overstatement of revenue.

THANKS

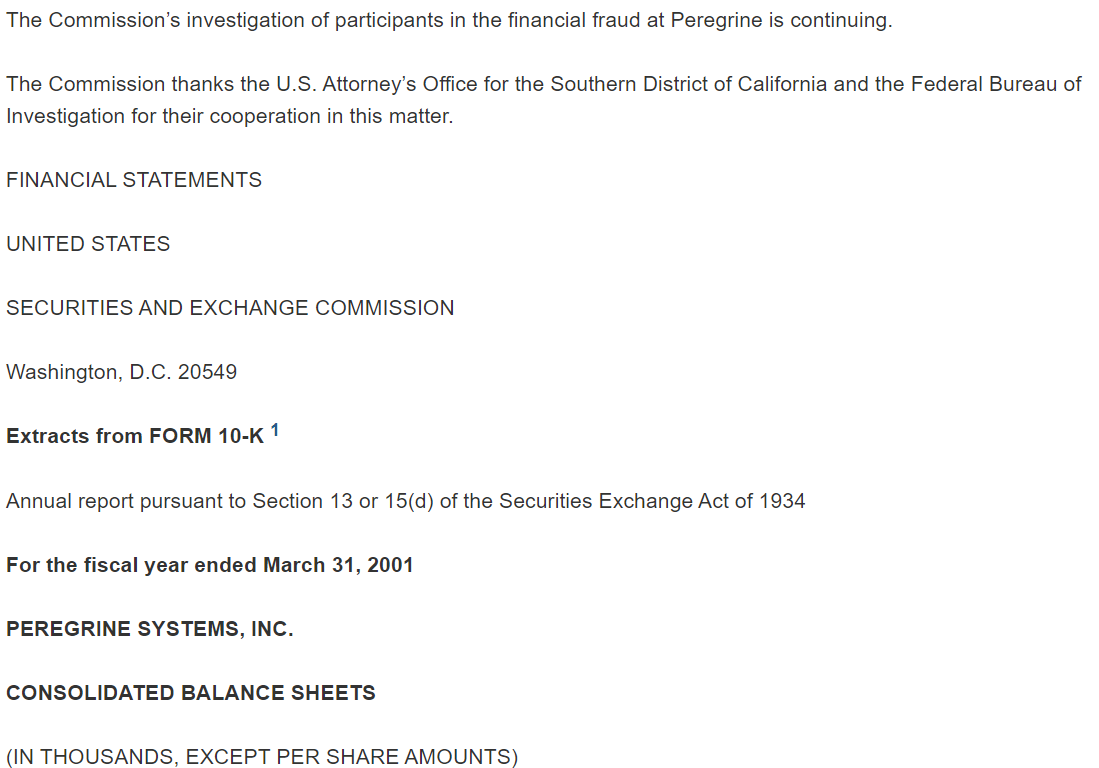

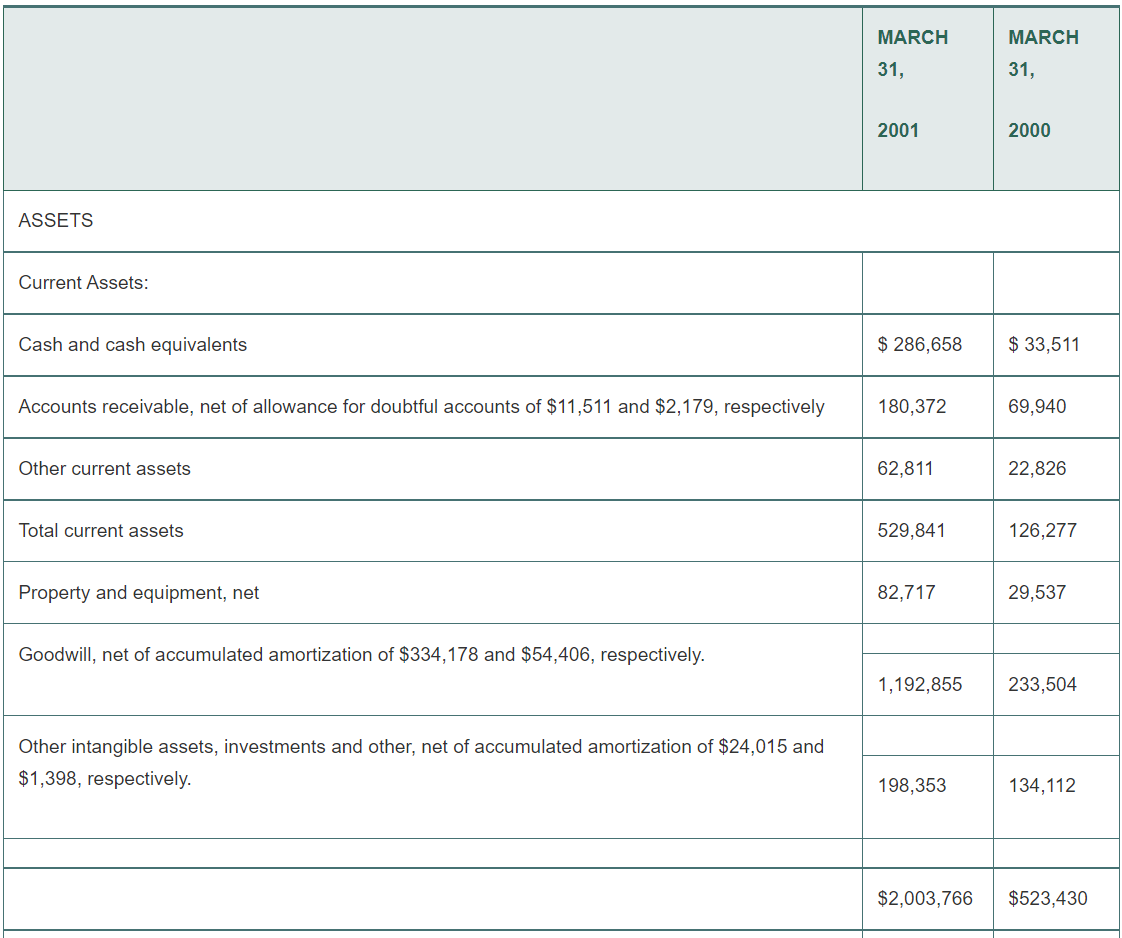

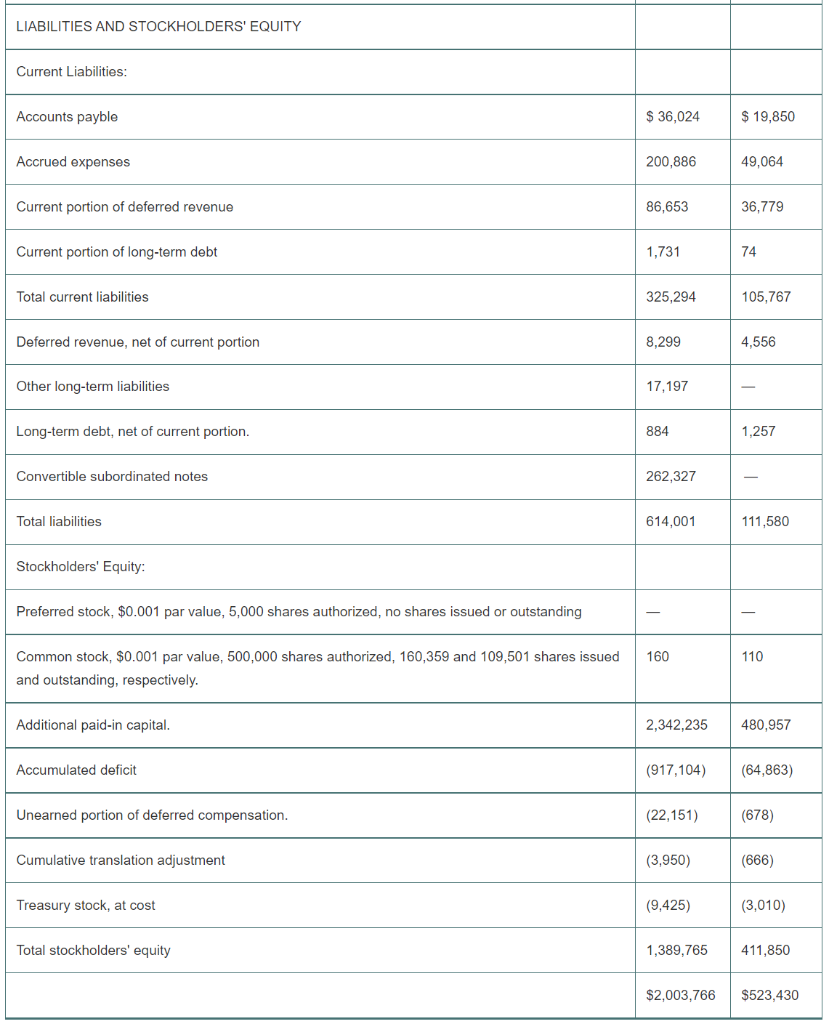

The Commission's investigation of participants in the financial fraud at Peregrine is continuing. The Commission thanks the U.S. Attorney's Office for the Southern District of California and the Federal Bureau of Investigation for their cooperation in this matter. FINANCIAL STATEMENTS UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Extracts from FORM 10-K 1 Annual report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 For the fiscal year ended March 31, 2001 PEREGRINE SYSTEMS, INC. CONSOLIDATED BALANCE SHEETS Extracts from FORM 10-K 12 For the fiscal year ended March 31, 1999 PEREGRINE SYSTEMS, INC. CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE AMOUNTS) For the fiscal year ended March 31, 2001 PEREGRINE SYSTEMS, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) Peregrine Systems, Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (IN THOUSANDS) EXHIBIT 4.1 Extracts from Perearine's Ouarterlv Financial Statoments lin Thau unnde. innn ... The Commission's investigation of participants in the financial fraud at Peregrine is continuing. The Commission thanks the U.S. Attorney's Office for the Southern District of California and the Federal Bureau of Investigation for their cooperation in this matter. FINANCIAL STATEMENTS UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Extracts from FORM 10-K 1 Annual report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 For the fiscal year ended March 31, 2001 PEREGRINE SYSTEMS, INC. CONSOLIDATED BALANCE SHEETS Extracts from FORM 10-K 12 For the fiscal year ended March 31, 1999 PEREGRINE SYSTEMS, INC. CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE AMOUNTS) For the fiscal year ended March 31, 2001 PEREGRINE SYSTEMS, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) Peregrine Systems, Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (IN THOUSANDS) EXHIBIT 4.1 Extracts from Perearine's Ouarterlv Financial Statoments lin Thau unnde. innn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started