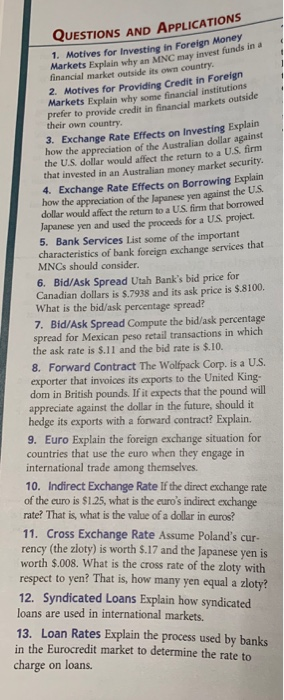

QUESTIONS AND APPLICATIONS 1. Motives for Investing in Foreign Money Markets Explain why an MMNC may invest funds ina financial market outside its own country 2. Motives for Providing Credit in Foreign Markets Explain why some financial institutions prefer to provide credit in financial markets outside their own country 3. Exchange Rate Effects on Investing Explairn how the appreciation of the Australian dollar against the U.S. dollar would affect the return to a U.S. firm that invested in an Australian money market security 4. Exchange Rate Effects on Borrowing Explain how the appreciation of the Japanese yen against the U.S dollar would affect the return to a US. firm that borrowed Japanese yen and used the proceds for a US project. Bank Services List some of the important characteristics of bank foreign exchange services that 5. MNCs should consider. 6. Bid/Ask Spread Utah Bank's bid price for Canadian dollars is $.7938 and its ask price is $.8100. What is the bid/ask percentage spread? 7. Bid/Ask Spread Compute the bid/ask percentage spread for Mexican peso retail transactions in which the ask rate is S.11 and the bid rate is $.10. 8. Forward Contract The Wolfpack Corp. is a US. exporter that invoices its exports to the United King dom in British pounds. If it expects that the pound will appreciate against the dollar in the future, should it hedge its exports with a forward contract? Explain. 9. Euro Explain the foreign exchange situation for countries that use the euro when they engage in international trade among themselves 10. Indirect Exchange Rate If the direct exchange rate of the euro is $1.25, what is the euro's indirect exchange rate? That is, what is the value of a dollar in euros? 11. Cross Exchange Rate Assume Poland's cur- rency (the zloty) is worth $.17 and the Japanese yen is worth $.008. What is the cross rate of the zloty with respect to yen? That is, how many yen equal a zloty? 12. Syndicated Loans Explain how syndicated loans are used in international markets. 13. in the Eurocredit market to determine the rate to charge on loans Loan Rates Explain the process used by banks