Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions and Problems For the following questions, unless specified otherwise, interest rates are quoted as annual percentage rates (APRs) compounded annually Basic (Questions 129) 1

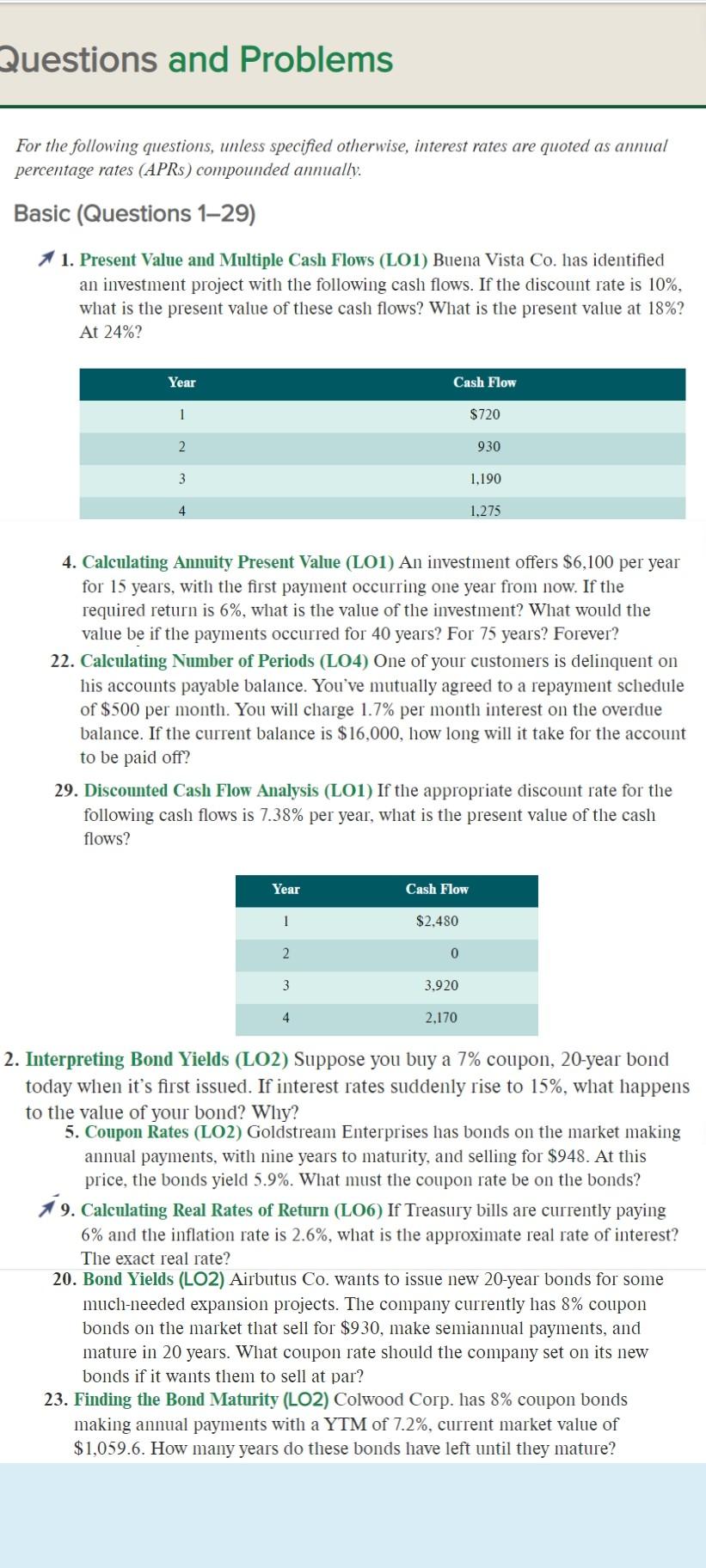

Questions and Problems For the following questions, unless specified otherwise, interest rates are quoted as annual percentage rates (APRs) compounded annually Basic (Questions 129) 1 1. Present Value and Multiple Cash Flows (L01) Buena Vista Co. has identified an investment project with the following cash flows. If the discount rate is 10%, what is the present value of these cash flows? What is the present value at 18%? At 24%? Year Cash Flow 1 $720 2 930 3 1.190 4 1.275 4. Calculating Annuity Present Value (L01) An investment offers $6,100 per year for 15 years, with the first payment occurring one year from now. If the required return is 6%, what is the value of the investment? What would the value be if the payments occurred for 40 years? For 75 years? Forever? 22. Calculating Number of Periods (L04) One of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $500 per month. You will charge 1.7% per month interest on the overdue balance. If the current balance is $16,000, how long will it take for the account to be paid off? 29. Discounted Cash Flow Analysis (L01) If the appropriate discount rate for the following cash flows is 7.38% per year, what is the present value of the cash flows? Year Cash Flow 1 $2,480 2 0 3 3.920 4 2,170 2. Interpreting Bond Yields (L02) Suppose you buy a 7% coupon, 20-year bond today when it's first issued. If interest rates suddenly rise to 15%, what happens to the value of your bond? Why? 5. Coupon Rates (LO2) Goldstream Enterprises has bonds on the market making annual payments, with nine years to maturity, and selling for $948. At this price, the bonds yield 5.9%. What must the coupon rate be on the bonds? 1 9. Calculating Real Rates of Return (LO6) If Treasury bills are currently paying 6% and the inflation rate is 2.6%, what is the approximate real rate of interest? The exact real rate? 20. Bond Yields (LO2) Airbutus Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8% coupon bonds on the market that sell for $930, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? 23. Finding the Bond Maturity (LO2) Colwood Corp. has 8% coupon bonds making annual payments with a YTM of 7.2%, current market value of $1,059.6. How many years do these bonds have left until they mature

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started