Questions are below. Only answer problems #5 - #9.

I have already answered problems #1-4, my data is below.

Problems #5-#9 are listed in order below.

Please help, Ive submitted this question 4x and recieved no help. I will rate! Thank you

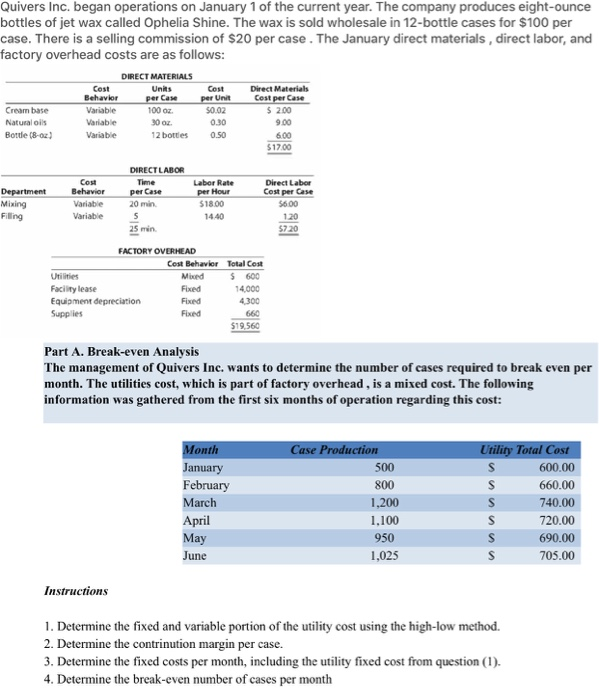

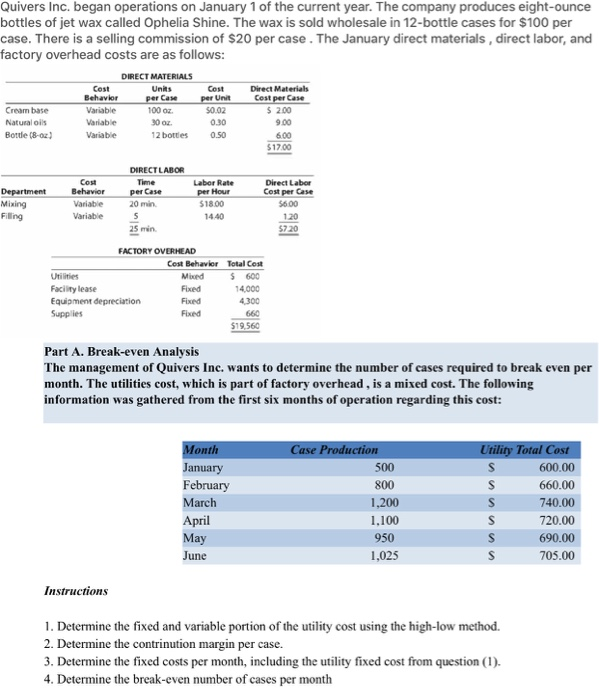

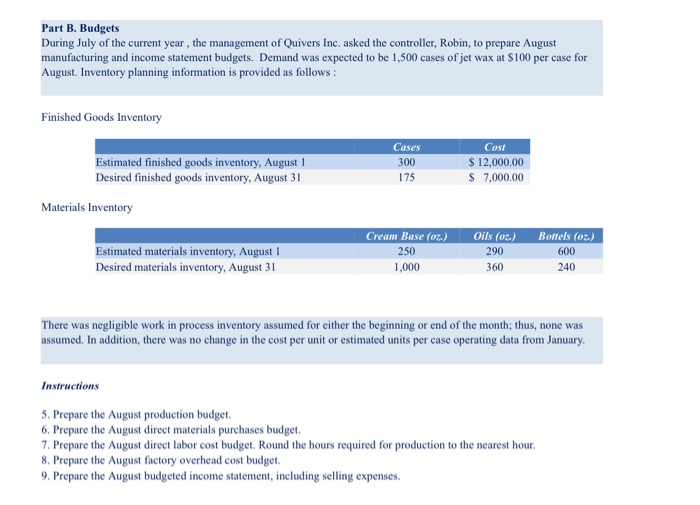

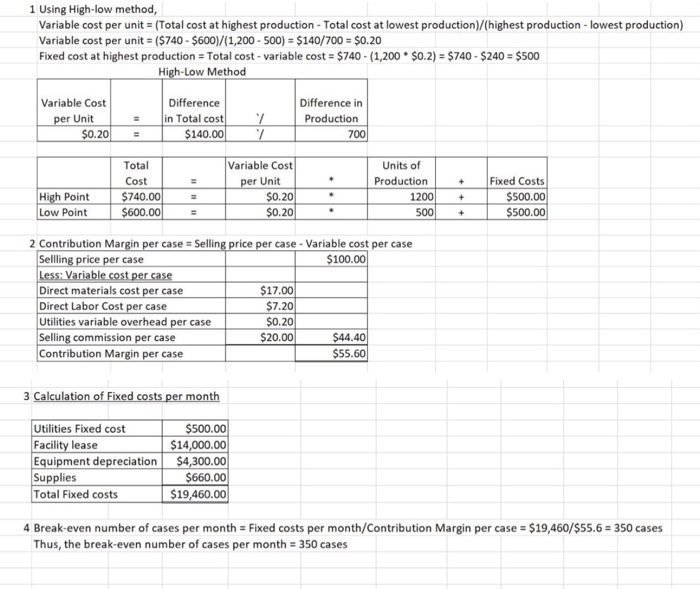

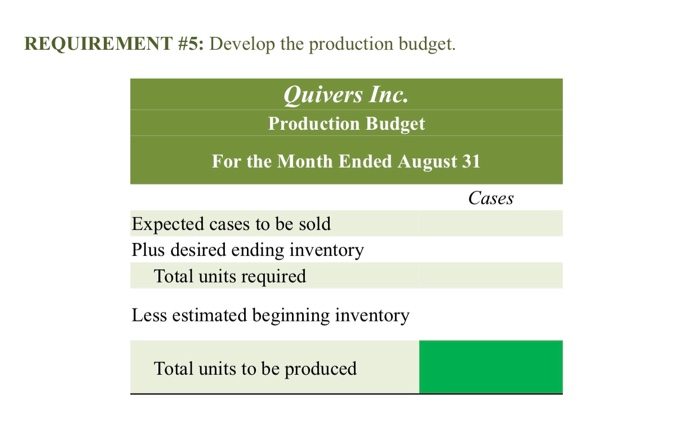

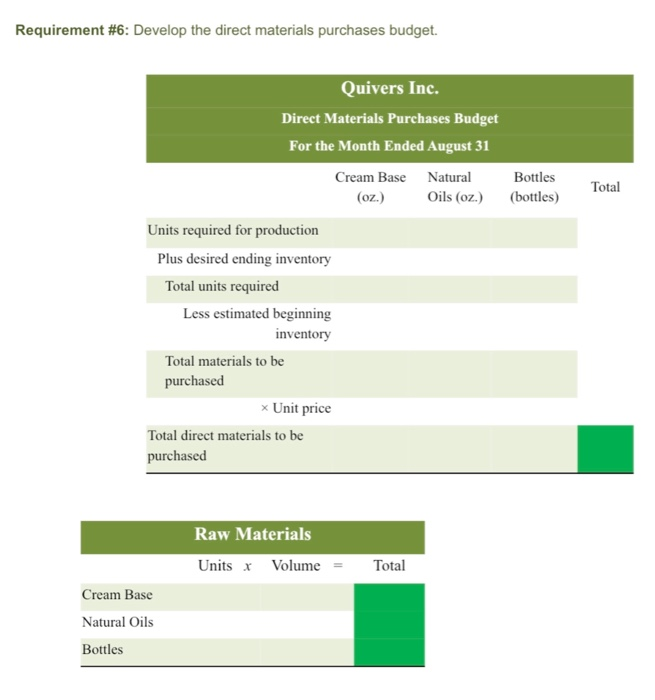

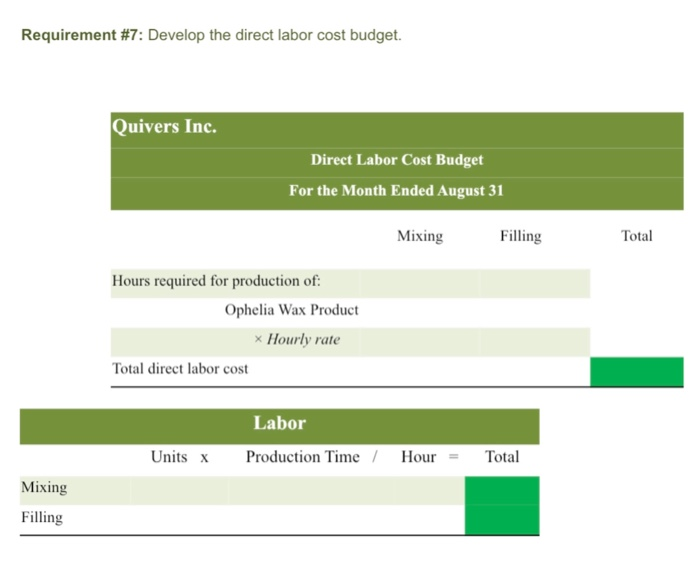

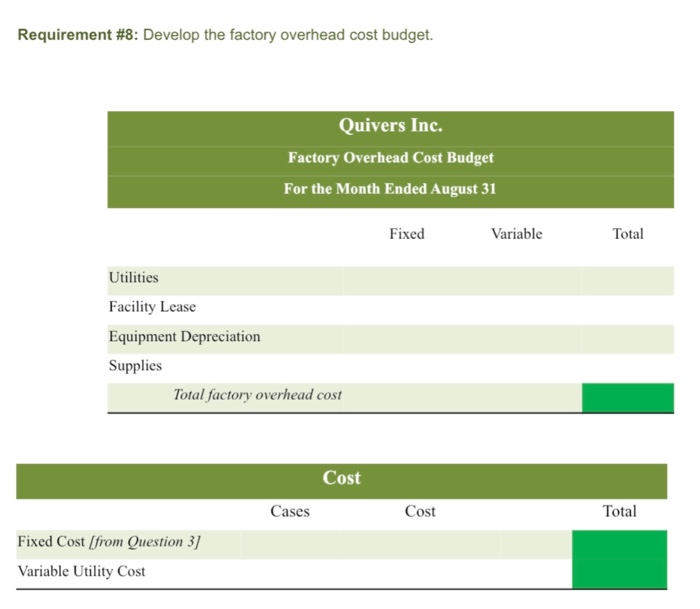

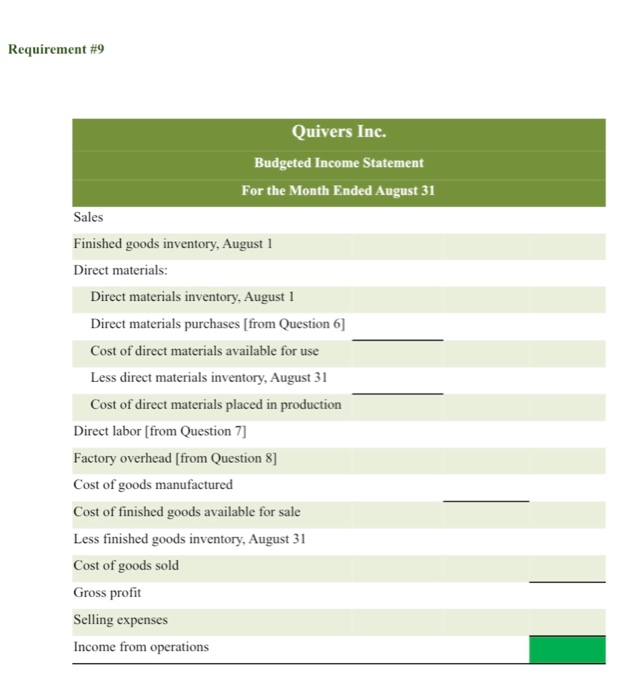

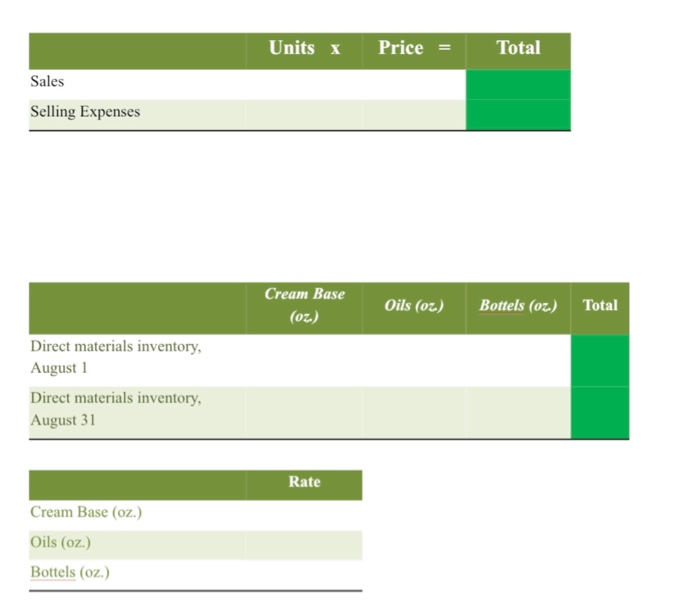

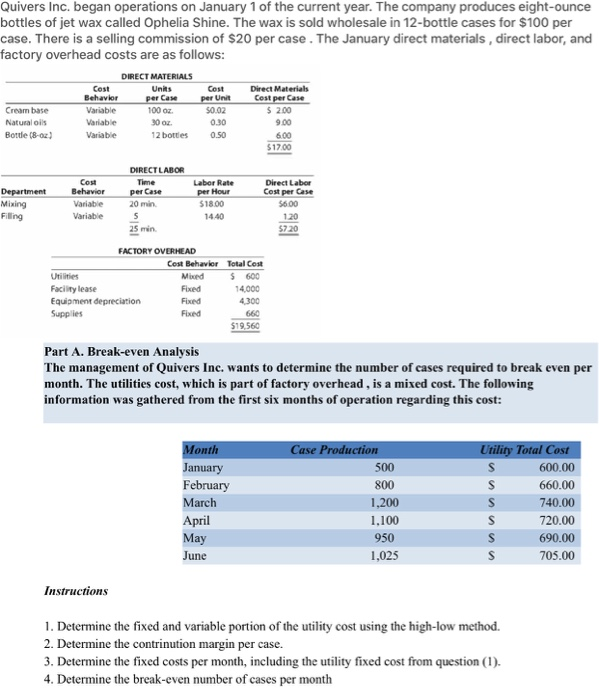

Quivers Inc. began operations on January 1 of the current year. The company produces eight-ounce bottles of jet wax called Ophelia Shine. The wax is sold wholesale in 12-bottle cases for $100 per case. There is a selling commission of $20 per case. The January direct materials, direct labor, and factory overhead costs are as follows: DIRECT MATERIALS Cost Units Cost Direct Materials Behavior per Case per Unit Cost per Case Creambase Variable 100 oz. 50.02 $ 200 Natural oils Variable 30 oz. 0.30 9.00 Bottle (8-02) Variable 12 bottles 0.50 6.00 $17.00 Department Mixing Filling Behavior Variable Variable DIRECT LABOR Time per Case 20 min 5 25 min Labor Rate per Hour $18.00 14.40 Direct Labor Cost per Case 56.00 120 5720 FACTORY OVERHEAD Cost Behavior Total Cost Utilities Mixed $ 600 Facility lease Fixed 14.000 Equipment depreciation Fixed 4300 Supplies Fixed 660 519,560 Part A. Break-even Analysis The management of Quivers Inc. wants to determine the number of cases required to break even per month. The utilities cost, which is part of factory overhead, is a mixed cost. The following information was gathered from the first six months of operation regarding this cost: Month January February March April May June Case Production 500 800 1,200 1.100 950 1,025 Utility Total Cost 600.00 s 660.00 s 740.00 s 720.00 S 690.00 $ 705.00 Instructions 1. Determine the fixed and variable portion of the utility cost using the high-low method. 2. Determine the contrinution margin per case. 3. Determine the fixed costs per month, including the utility fixed cost from question (1). 4. Determine the break-even number of cases per month Part B. Budgets During July of the current year, the management of Quivers Inc. asked the controller, Robin, to prepare August manufacturing and income statement budgets. Demand was expected to be 1,500 cases of jet wax at $100 per case for August. Inventory planning information is provided as follows: Finished Goods Inventory Estimated finished goods inventory, August 1 Desired finished goods inventory, August 31 Cases 300 175 Cost $ 12,000.00 $ 7,000.00 Materials Inventory Estimated materials inventory, August 1 Desired materials inventory, August 31 Cream Base (oz.) 250 1,000 Oils (oz.) 290 360 Bortels (oz) 600 240 There was negligible work in process inventory assumed for either the beginning or end of the month; thus, none was assumed. In addition, there was no change in the cost per unit or estimated units per case operating data from January Instructions 5. Prepare the August production budget. 6. Prepare the August direct materials purchases budget. 7. Prepare the August direct labor cost budget. Round the hours required for production to the nearest hour 8. Prepare the August factory overhead cost budget. 9. Prepare the August budgeted income statement, including selling expenses. 1 Using High-low method, Variable cost per unit = (Total cost at highest production - Total cost at lowest production)/(highest production - lowest production) Variable cost per unit = ($740 - $600)/(1,200-500) = $140/700 = $0.20 Fixed cost at highest production = Total cost - variable cost = $740 - (1,200 $0.2) = $740 - $240 = $500 High-Low Method Variable Cost per Unit $0.20 Difference in Total cost $140.00 7 7 Difference in Production 700 + Total Cost $740.00 $600.00 High Point Low Point Variable Cost per Unit $0.20 $0.20 Units of Production 1200 500 + Fixed Costs $500.00 $500.00 + 2 Contribution Margin per case = Selling price per case - Variable cost per case Sellling price per case $100.00 Less: Variable cost per case Direct materials cost per case $17.00 Direct Labor Cost per case $7.20 Utilities variable overhead per case $0.20 Selling commission per case $20.00 $44.40 Contribution Margin per case $55.60 3 Calculation of Fixed costs per month Utilities Fixed cost $500.00 Facility lease $14,000.00 Equipment depreciation $4,300.00 Supplies $660.00 Total Fixed costs $19,460.00 4 Break-even number of cases per month = Fixed costs per month/Contribution Margin per case = $19,460/$55.6 = 350 cases Thus, the break-even number of cases per month = 350 cases REQUIREMENT #5: Develop the production budget. Quivers Inc. Production Budget For the Month Ended August 31 Cases Expected cases to be sold Plus desired ending inventory Total units required Less estimated beginning inventory Total units to be produced Requirement #6: Develop the direct materials purchases budget. Total Quivers Inc. Direct Materials Purchases Budget For the Month Ended August 31 Cream Base Natural Bottles (oz.) Oils (oz.) (bottles) Units required for production Plus desired ending inventory Total units required Less estimated beginning inventory Total materials to be purchased * Unit price Total direct materials to be purchased Raw Materials Units X Volume Total Cream Base Natural Oils Bottles Requirement #7: Develop the direct labor cost budget. Quivers Inc. Direct Labor Cost Budget For the Month Ended August 31 Mixing Filling Total Hours required for production of: Ophelia Wax Product * Hourly rate Total direct labor cost Labor Production Time / Hour Units x Total Mixing Filling Requirement #8: Develop the factory overhead cost budget. Quivers Inc. Factory Overhead Cost Budget For the Month Ended August 31 Fixed Variable Total Utilities Facility Lease Equipment Depreciation Supplies Total factory overhead cost Cost Cases Cost Total Fixed Cost (from Question 3) Variable Utility Cost Requirement #9 Quivers Inc. Budgeted Income Statement For the Month Ended August 31 Sales Finished goods inventory, August 1 Direct materials: Direct materials inventory, August 1 Direct materials purchases (from Question 6] Cost of direct materials available for use Less direct materials inventory, August 31 Cost of direct materials placed in production Direct labor (from Question 7] Factory overhead [from Question 8] Cost of goods manufactured Cost of finished goods available for sale Less finished goods inventory, August 31 Cost of goods sold Gross profit Selling expenses Income from operations Units x Price Total Sales Selling Expenses Cream Base (oz.) Oils (oz) Bottels (oz.) Total Direct materials inventory, August 1 Direct materials inventory, August 31 Rate Cream Base (oz.) Oils (oz.) Bottels (oz.)