Answered step by step

Verified Expert Solution

Question

1 Approved Answer

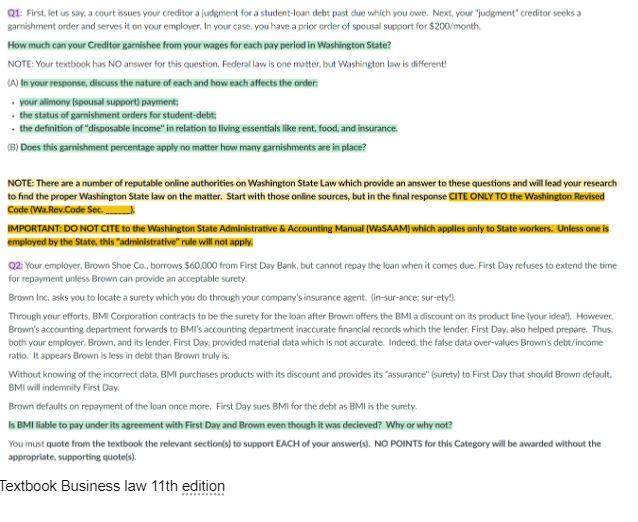

questions are in green highlighted area with the text above Q1: First. let is say, a court bsues your creditor a judsment for a student-loan

questions are in green highlighted area with the text above

Q1: First. let is say, a court bsues your creditor a judsment for a student-loan debt past due which you owe. Next, your "judgment" creditor seeks a garnishment order and serves it on your employer. In your ease, you have a prior erder of spousal support for $200month How much can your Creditor gamishee from your wages for each pay period in Washington State? NOTE: Your textbook has NO answer for this question. Federnl law is one mutter, but Washington law is different! (A) In your response, discuss the nature of each and how each affects the order - your almony (spousal support) payment; - the status of garnishment orders for student-debt: - the definition of "disposable income" in relation to living essentials like rent, food, and insurance. (8) Does this gamishment percentage apply no matter how many garnishments are in place? NOTE: There are a number of reputable online authorities on Washington State Law which provide an answer to these questions and will lead your research to find the proper Washington State law on the matter. Start with those online sources, but in the final response CITE ONLY TO the Washington Revised Code Wa.Rev.Code Sec. IMPORTANT: DO NOT CITE to the Washington State Administrative s Accounting Manual IWaSAAM) which applies only to State workers. Unless one is employed by the State, this "adininistrative" rule will not apply Q2: Your employer, Brown Shoe Ca, borrows $60,000 trom First Day Bank, but cannot repay the loan when it comes due. First Day refuses to extend the time for repayment unless Brown can provide an acceptable surety. Brown Inc. asks you to locate a surety which you do through your company's insurance agent, (in-sur-ance: sur-ety?): Through your efforts, BMI Corpocation contracts to be the surety for the loan after Brown offers the BM1 a discount on its product line frour idea?), However, Brown's accounting department forwards to BMi's accounting department inaccurate financial records which the lender. First Day, also helped prepare. Thus, both your employer, Brown, and its lender, First Day, provided material data which is not accurate. Indeed, the false data over-values Brown's debt/ income ratio. It appears Brown is less in debt than Brown truly is. Without knowing of the incorrect data. BMI purchases probucts with its discount and provides its "assurance" (surefy/ to First Day that should Brown defautt. BMI will indemnity First Day. Brown defauts on repayment of the loan once more. First Day sues BMI for the debt as BMI is the surety. Is BMI liable to pay under its agreement with First Day and Brown even though it was decieved? Why or why not? You must quote from the textbook the relevant section(s) to support EACH of your answer(s). NO POINTS for this Category will be awarded without the appropriate, supporting quoto(s). Textbook Business law 11 th edition Q1: First. let is say, a court bsues your creditor a judsment for a student-loan debt past due which you owe. Next, your "judgment" creditor seeks a garnishment order and serves it on your employer. In your ease, you have a prior erder of spousal support for $200month How much can your Creditor gamishee from your wages for each pay period in Washington State? NOTE: Your textbook has NO answer for this question. Federnl law is one mutter, but Washington law is different! (A) In your response, discuss the nature of each and how each affects the order - your almony (spousal support) payment; - the status of garnishment orders for student-debt: - the definition of "disposable income" in relation to living essentials like rent, food, and insurance. (8) Does this gamishment percentage apply no matter how many garnishments are in place? NOTE: There are a number of reputable online authorities on Washington State Law which provide an answer to these questions and will lead your research to find the proper Washington State law on the matter. Start with those online sources, but in the final response CITE ONLY TO the Washington Revised Code Wa.Rev.Code Sec. IMPORTANT: DO NOT CITE to the Washington State Administrative s Accounting Manual IWaSAAM) which applies only to State workers. Unless one is employed by the State, this "adininistrative" rule will not apply Q2: Your employer, Brown Shoe Ca, borrows $60,000 trom First Day Bank, but cannot repay the loan when it comes due. First Day refuses to extend the time for repayment unless Brown can provide an acceptable surety. Brown Inc. asks you to locate a surety which you do through your company's insurance agent, (in-sur-ance: sur-ety?): Through your efforts, BMI Corpocation contracts to be the surety for the loan after Brown offers the BM1 a discount on its product line frour idea?), However, Brown's accounting department forwards to BMi's accounting department inaccurate financial records which the lender. First Day, also helped prepare. Thus, both your employer, Brown, and its lender, First Day, provided material data which is not accurate. Indeed, the false data over-values Brown's debt/ income ratio. It appears Brown is less in debt than Brown truly is. Without knowing of the incorrect data. BMI purchases probucts with its discount and provides its "assurance" (surefy/ to First Day that should Brown defautt. BMI will indemnity First Day. Brown defauts on repayment of the loan once more. First Day sues BMI for the debt as BMI is the surety. Is BMI liable to pay under its agreement with First Day and Brown even though it was decieved? Why or why not? You must quote from the textbook the relevant section(s) to support EACH of your answer(s). NO POINTS for this Category will be awarded without the appropriate, supporting quoto(s). Textbook Business law 11 th editionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started