Questions

- Are the projects identical or comparable using standard NPV, given that they have different project lives?

- What methods or means would you consider to resolve a conflict here if it exists (no need to do the calculations)?

- Consider the sensitivity of both projects to changes in WACC.

- How do the changes in WACC impact NPV?

- Does this help you in choosing between the two, and if so, how?

- Which project should the Hotel choose and why?

Case

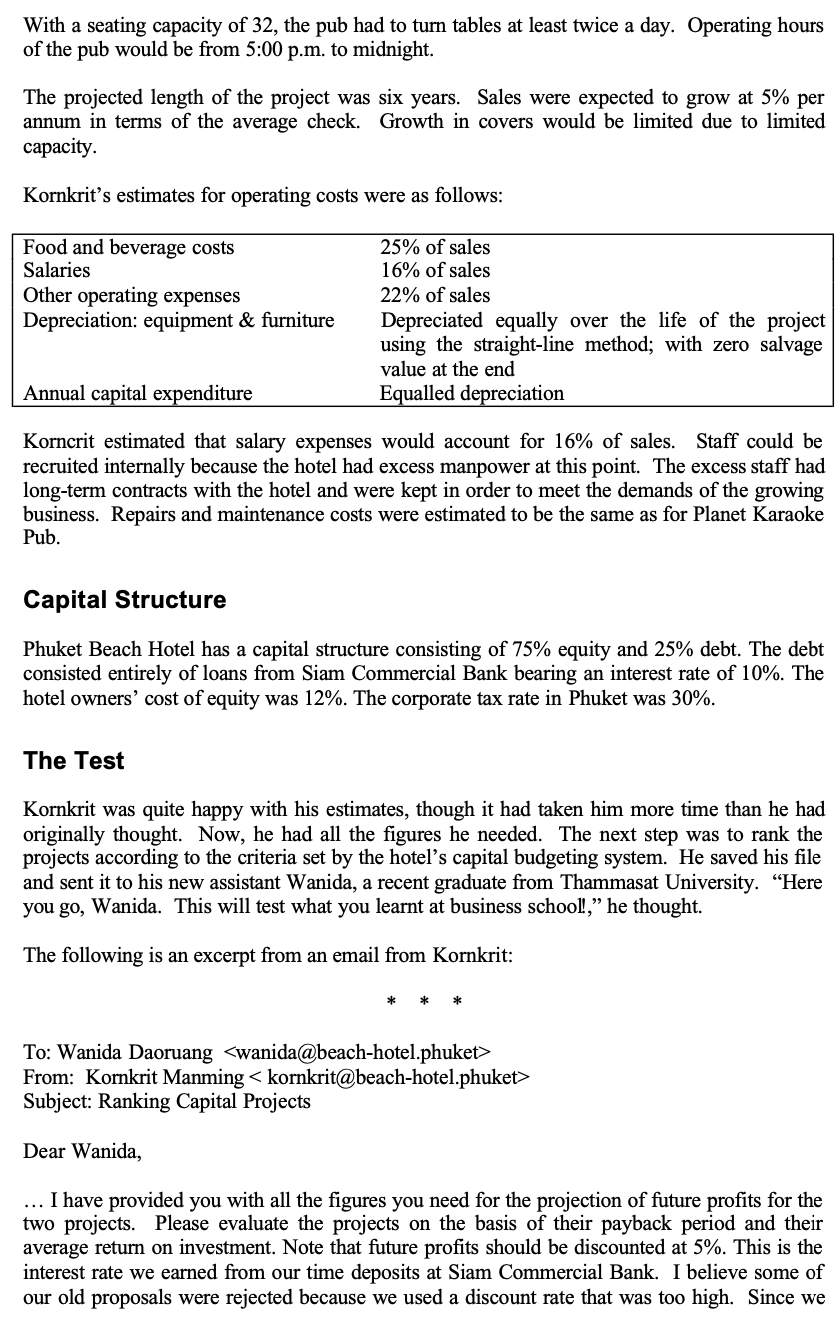

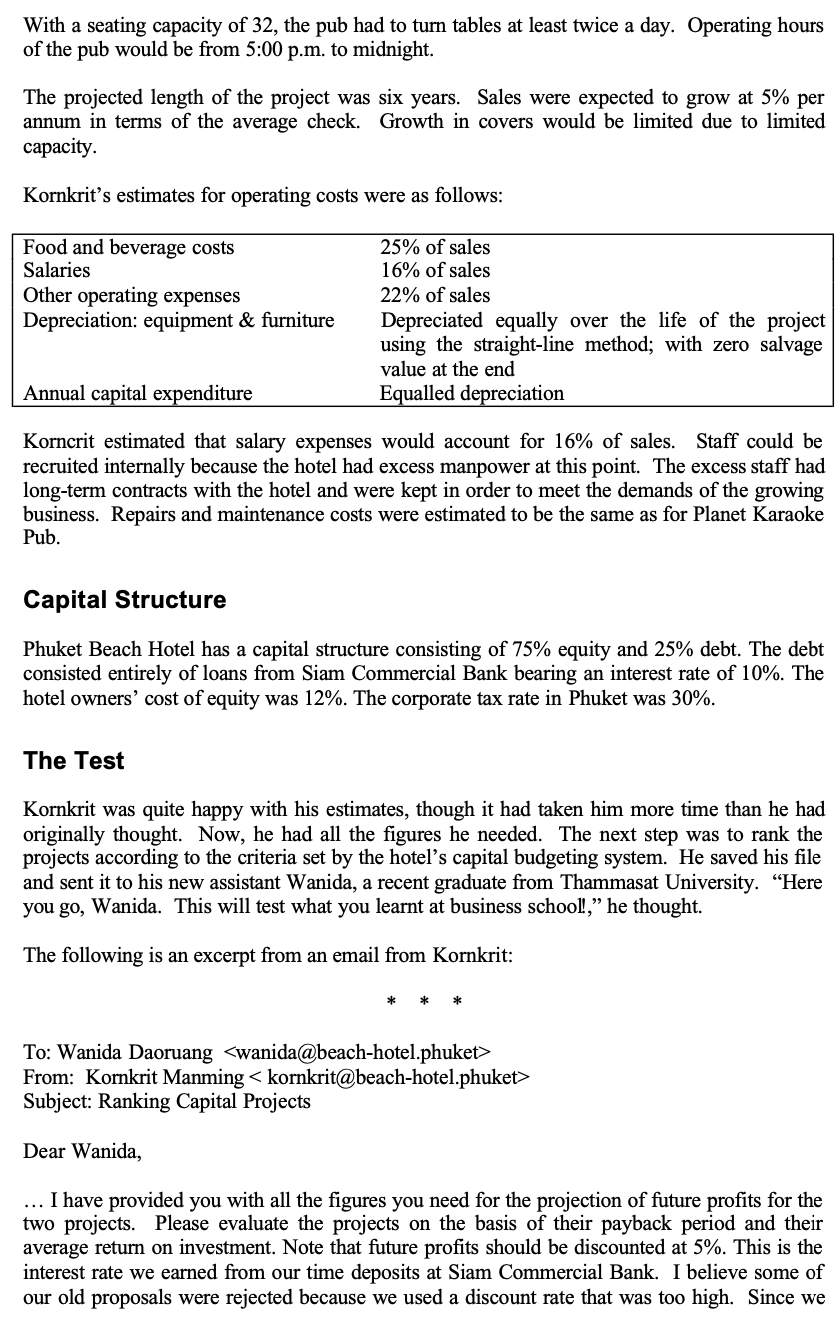

The Mutually Exclusive Projects Mike's discussion with Kornkrit went as follows: Mike: I see you have been busy. But I still need you to evaluate the offer from Planet Karaoke Pub for me, and to give me any positive or negative insights that you think are significant Kornkrit: No problem. I can present to you a detailed analysis within this week. But don't you think we should provide more alternatives for the hotel owners to decide? Mike: That's what I've been thinking. Perhaps we can create a pub by ourselves. Karaoke pubs are spreading fast in Thailand. A number of surveys have shown that they attract a lot of customers and tourists. Kornkrit: That sounds like a good idea. Mike: Please assess the projects carefully. You may ask your new assistant Wanida to help you. This is simple, isn't it? Kornkrit: I think the most difficult part is to estimate future profits and allocate overhead costs to the each project. I'll work on this first. Then I'll ask Wanida to rank the projects according to their payback period and return on investment. Mike: Good. I would like to have the results of your analysis next Monday. Kornkrit's Analyses Kornkrit began his evaluation by reviewing the offer from Planet Karaoke Pub and estimating the revenues and costs associated with an alternative project, Beach Karaoke Pub. Planet Karaoke Pub To make the space ready for lease, the hotel had to set up partitions and a small kitchen. Various estimates of the up-front renovation costs ranged between 770,000 baht and 1,000,000 baht. The costs would be depreciated over the life of the project using the straight- line method, with zero salvage value. Since the existing toilets, elevators and carpets would be utilised to support this project, Korncrit believed that a fair share of these overhead expenses should be allocated to the project. The pro rata allocation of the costs of these facilities, based on the floor area of the space used for the project, amounted to 55,000 baht. Due to the foreseeable increase in activity, Korncrit would like to charge this project for an increase in repair and maintenance costs of 10,000 baht per annum. The pub would pay all utility and other expenses. Beach Karaoke Pub The project would require an up-front investment ranging between 800,000 and 1,200,000 baht. This represented the cost of a modern-style dcor. Other capital investment, including chairs, bar tables, kitchen set-up and karaoke equipment, would amount to 900,000 baht. Kornkrit expected revenue to be generated 50% from walk-ins and 50% from hotel guests. Estimated total sales would be 4,672,000 baht for the first year of operation. Kornkrit arrived at this figure by assuming an average of 64 covers per day with an average check of 200 baht. With a seating capacity of 32, the pub had to turn tables at least twice a day. Operating hours of the pub would be from 5:00 p.m. to midnight. The projected length of the project was six years. Sales were expected to grow at 5% per annum in terms of the average check. Growth in covers would be limited due to limited capacity. Kornkrit's estimates for operating costs were as follows: Food and beverage costs Salaries Other operating expenses Depreciation: equipment & furniture 25% of sales 16% of sales 22% of sales Depreciated equally over the life of the project using the straight-line method; with zero salvage value at the end Equalled depreciation Annual capital expenditure Korncrit estimated that salary expenses would account for 16% of sales. Staff could be recruited internally because the hotel had excess manpower at this point. The excess staff had long-term contracts with the hotel and were kept in order to meet the demands of the growing business. Repairs and maintenance costs were estimated to be the same as for Planet Karaoke Pub. Capital Structure Phuket Beach Hotel has a capital structure consisting of 75% equity and 25% debt. The debt consisted entirely of loans from Siam Commercial Bank bearing an interest rate of 10%. The hotel owners' cost of equity was 12%. The corporate tax rate in Phuket was 30%. The Test Kornkrit was quite happy with his estimates, though it had taken him more time than he had originally thought. Now, he had all the figures he needed. The next step was to rank the projects according to the criteria set by the hotel's capital budgeting system. He saved his file and sent it to his new assistant Wanida, a recent graduate from Thammasat University. Here you go, Wanida. This will test what you learnt at business school!, he thought. The following is an excerpt from an email from Kornkrit: To: Wanida Daoruang

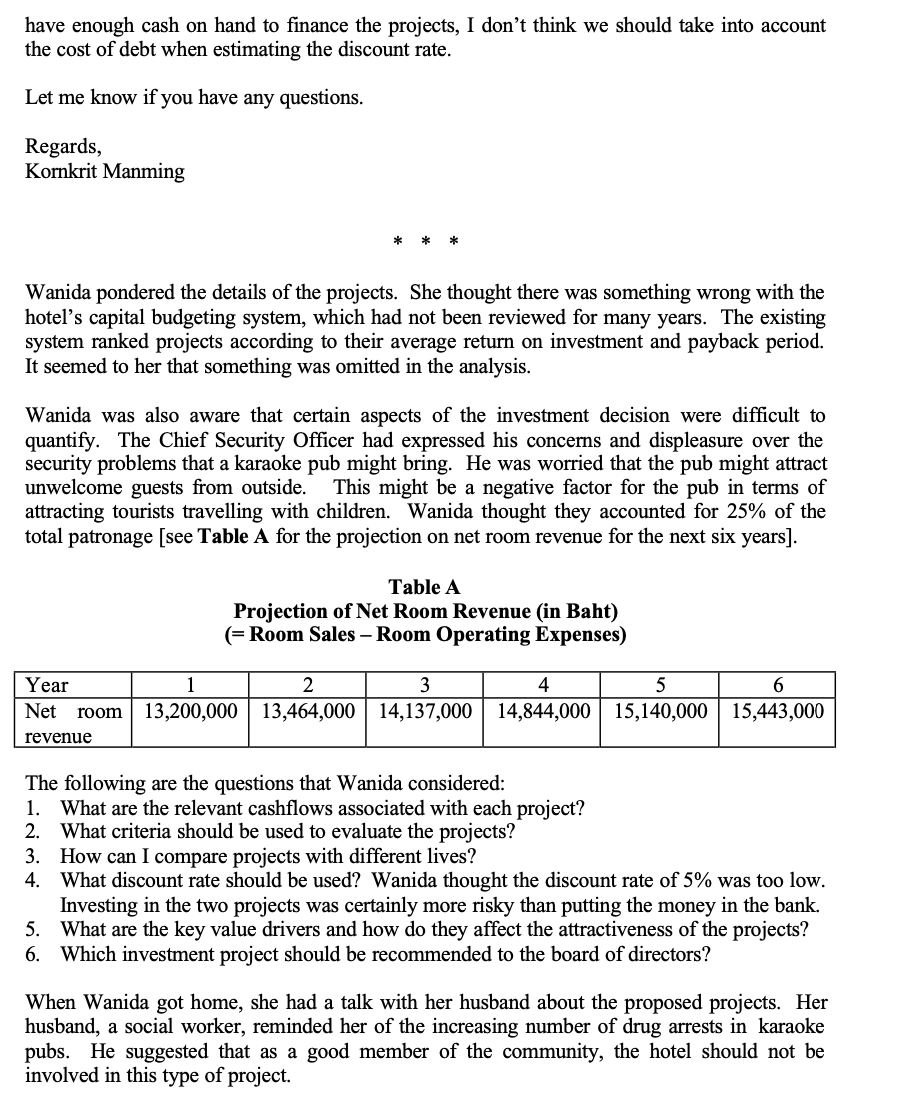

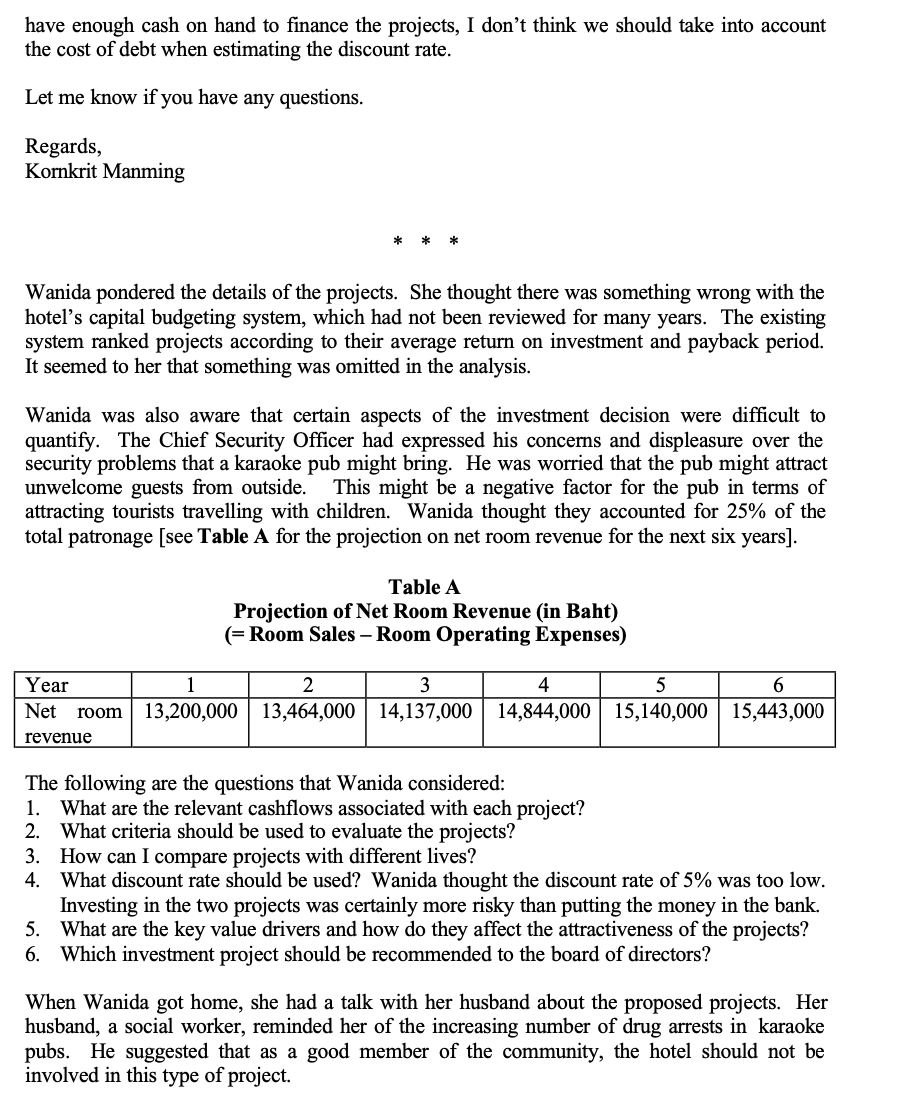

From: Kornkrit Manming Subject: Ranking Capital Projects Dear Wanida, ... I have provided you with all the figures you need for the projection of future profits for the two projects. Please evaluate the projects on the basis of their payback period and their average return on investment. Note that future profits should be discounted at 5%. This is the interest rate we earned from our time deposits at Siam Commercial Bank. I believe some of our old proposals were rejected because we used a discount rate that was too high. Since we have enough cash on hand to finance the projects, I don't think we should take into account the cost of debt when estimating the discount rate. Let me know if you have any questions. Regards, Kornkrit Manming * * * Wanida pondered the details of the projects. She thought there was something wrong with the hotel's capital budgeting system, which had not been reviewed for many years. The existing system ranked projects according to their average return on investment and payback period. It seemed to her that something was omitted in the analysis. a Wanida was also aware that certain aspects of the investment decision were difficult to quantify. The Chief Security Officer had expressed his concerns and displeasure over the security problems pub might bring. He was worried pub might attract unwelcome guests from outside. This might be a negative factor for the pub in terms of attracting tourists travelling with children. Wanida thought they accounted for 25% of the total patronage [see Table A for the projection on net room revenue for the next six years). Table A Projection of Net Room Revenue (in Baht) (=Room Sales - Room Operating Expenses) Year Net room revenue 1 2 3 13,200,000 13,464,000 14,137,000 4 5 6 14,844,000 15,140,000 15,443,000 The following are the questions that Wanida considered: 1. What are the relevant cashflows associated with each project? 2. What criteria should be used to evaluate the projects? 3. How can I compare projects with different lives? 4. What discount rate should be used? Wanida thought the discount rate of 5% was too low. Investing in the two projects was certainly more risky than putting the money in the bank. 5. What are the key value drivers and how do they affect the attractiveness of the projects? 6. Which investment project should be recommended to the board of directors? When Wanida got home, she had a talk with her husband about the proposed projects. Her husband, a social worker, reminded her of the increasing number of drug arrests in karaoke pubs. He suggested that as a good member of the community, the hotel should not be involved in this type of project. The Mutually Exclusive Projects Mike's discussion with Kornkrit went as follows: Mike: I see you have been busy. But I still need you to evaluate the offer from Planet Karaoke Pub for me, and to give me any positive or negative insights that you think are significant Kornkrit: No problem. I can present to you a detailed analysis within this week. But don't you think we should provide more alternatives for the hotel owners to decide? Mike: That's what I've been thinking. Perhaps we can create a pub by ourselves. Karaoke pubs are spreading fast in Thailand. A number of surveys have shown that they attract a lot of customers and tourists. Kornkrit: That sounds like a good idea. Mike: Please assess the projects carefully. You may ask your new assistant Wanida to help you. This is simple, isn't it? Kornkrit: I think the most difficult part is to estimate future profits and allocate overhead costs to the each project. I'll work on this first. Then I'll ask Wanida to rank the projects according to their payback period and return on investment. Mike: Good. I would like to have the results of your analysis next Monday. Kornkrit's Analyses Kornkrit began his evaluation by reviewing the offer from Planet Karaoke Pub and estimating the revenues and costs associated with an alternative project, Beach Karaoke Pub. Planet Karaoke Pub To make the space ready for lease, the hotel had to set up partitions and a small kitchen. Various estimates of the up-front renovation costs ranged between 770,000 baht and 1,000,000 baht. The costs would be depreciated over the life of the project using the straight- line method, with zero salvage value. Since the existing toilets, elevators and carpets would be utilised to support this project, Korncrit believed that a fair share of these overhead expenses should be allocated to the project. The pro rata allocation of the costs of these facilities, based on the floor area of the space used for the project, amounted to 55,000 baht. Due to the foreseeable increase in activity, Korncrit would like to charge this project for an increase in repair and maintenance costs of 10,000 baht per annum. The pub would pay all utility and other expenses. Beach Karaoke Pub The project would require an up-front investment ranging between 800,000 and 1,200,000 baht. This represented the cost of a modern-style dcor. Other capital investment, including chairs, bar tables, kitchen set-up and karaoke equipment, would amount to 900,000 baht. Kornkrit expected revenue to be generated 50% from walk-ins and 50% from hotel guests. Estimated total sales would be 4,672,000 baht for the first year of operation. Kornkrit arrived at this figure by assuming an average of 64 covers per day with an average check of 200 baht. With a seating capacity of 32, the pub had to turn tables at least twice a day. Operating hours of the pub would be from 5:00 p.m. to midnight. The projected length of the project was six years. Sales were expected to grow at 5% per annum in terms of the average check. Growth in covers would be limited due to limited capacity. Kornkrit's estimates for operating costs were as follows: Food and beverage costs Salaries Other operating expenses Depreciation: equipment & furniture 25% of sales 16% of sales 22% of sales Depreciated equally over the life of the project using the straight-line method; with zero salvage value at the end Equalled depreciation Annual capital expenditure Korncrit estimated that salary expenses would account for 16% of sales. Staff could be recruited internally because the hotel had excess manpower at this point. The excess staff had long-term contracts with the hotel and were kept in order to meet the demands of the growing business. Repairs and maintenance costs were estimated to be the same as for Planet Karaoke Pub. Capital Structure Phuket Beach Hotel has a capital structure consisting of 75% equity and 25% debt. The debt consisted entirely of loans from Siam Commercial Bank bearing an interest rate of 10%. The hotel owners' cost of equity was 12%. The corporate tax rate in Phuket was 30%. The Test Kornkrit was quite happy with his estimates, though it had taken him more time than he had originally thought. Now, he had all the figures he needed. The next step was to rank the projects according to the criteria set by the hotel's capital budgeting system. He saved his file and sent it to his new assistant Wanida, a recent graduate from Thammasat University. Here you go, Wanida. This will test what you learnt at business school!, he thought. The following is an excerpt from an email from Kornkrit: To: Wanida Daoruang From: Kornkrit Manming Subject: Ranking Capital Projects Dear Wanida, ... I have provided you with all the figures you need for the projection of future profits for the two projects. Please evaluate the projects on the basis of their payback period and their average return on investment. Note that future profits should be discounted at 5%. This is the interest rate we earned from our time deposits at Siam Commercial Bank. I believe some of our old proposals were rejected because we used a discount rate that was too high. Since we have enough cash on hand to finance the projects, I don't think we should take into account the cost of debt when estimating the discount rate. Let me know if you have any questions. Regards, Kornkrit Manming * * * Wanida pondered the details of the projects. She thought there was something wrong with the hotel's capital budgeting system, which had not been reviewed for many years. The existing system ranked projects according to their average return on investment and payback period. It seemed to her that something was omitted in the analysis. a Wanida was also aware that certain aspects of the investment decision were difficult to quantify. The Chief Security Officer had expressed his concerns and displeasure over the security problems pub might bring. He was worried pub might attract unwelcome guests from outside. This might be a negative factor for the pub in terms of attracting tourists travelling with children. Wanida thought they accounted for 25% of the total patronage [see Table A for the projection on net room revenue for the next six years). Table A Projection of Net Room Revenue (in Baht) (=Room Sales - Room Operating Expenses) Year Net room revenue 1 2 3 13,200,000 13,464,000 14,137,000 4 5 6 14,844,000 15,140,000 15,443,000 The following are the questions that Wanida considered: 1. What are the relevant cashflows associated with each project? 2. What criteria should be used to evaluate the projects? 3. How can I compare projects with different lives? 4. What discount rate should be used? Wanida thought the discount rate of 5% was too low. Investing in the two projects was certainly more risky than putting the money in the bank. 5. What are the key value drivers and how do they affect the attractiveness of the projects? 6. Which investment project should be recommended to the board of directors? When Wanida got home, she had a talk with her husband about the proposed projects. Her husband, a social worker, reminded her of the increasing number of drug arrests in karaoke pubs. He suggested that as a good member of the community, the hotel should not be involved in this type of project