Questions

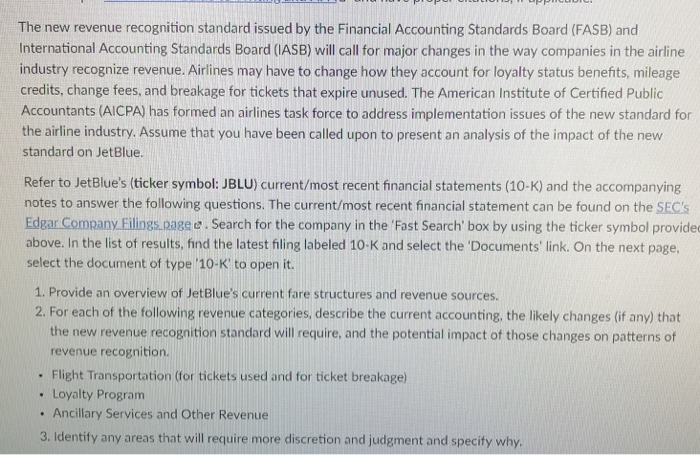

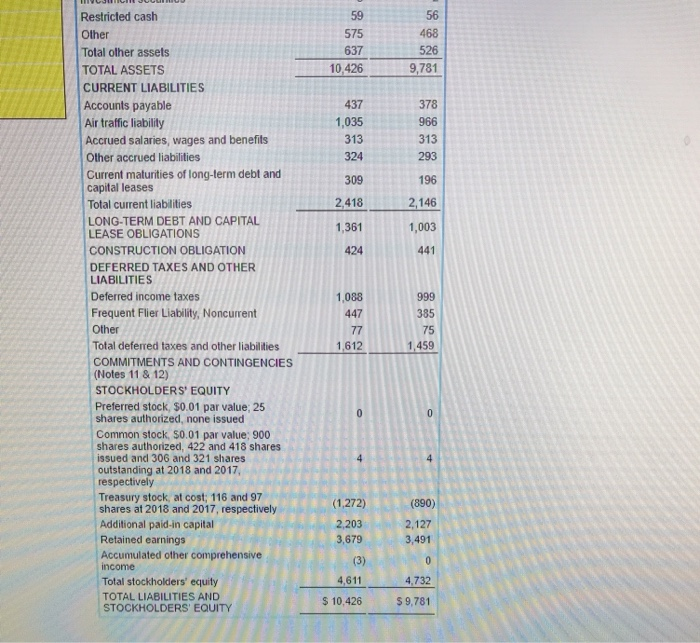

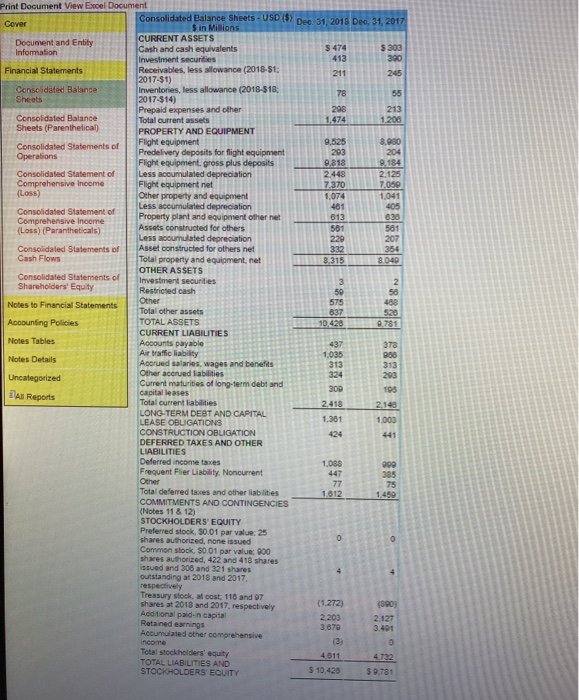

Balance Sheet

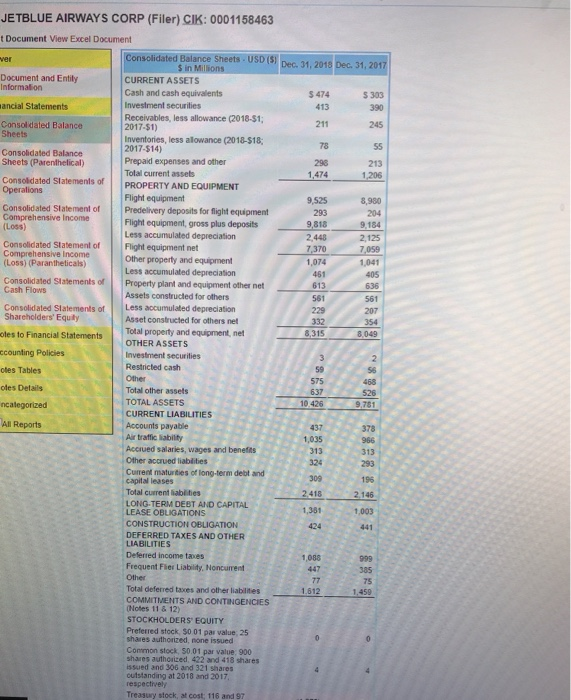

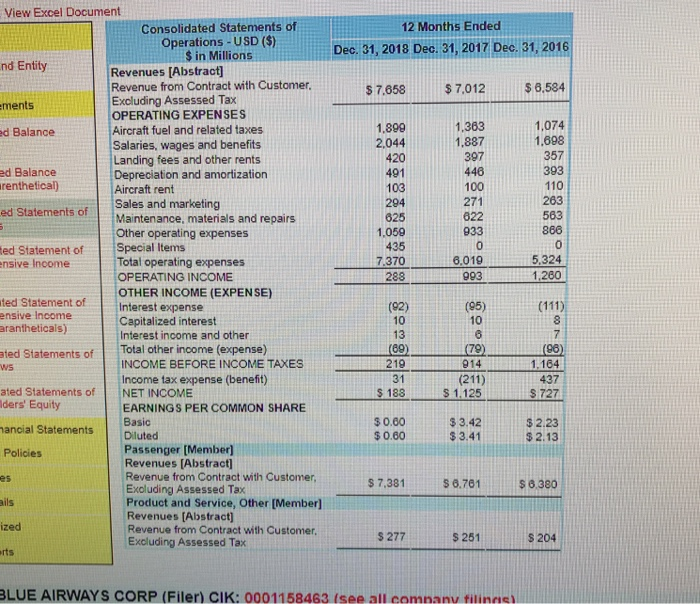

Net Income

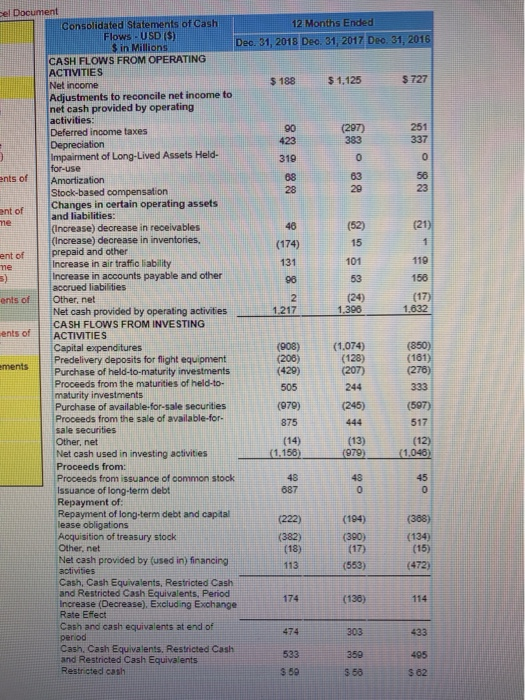

Statement of Cash Flows

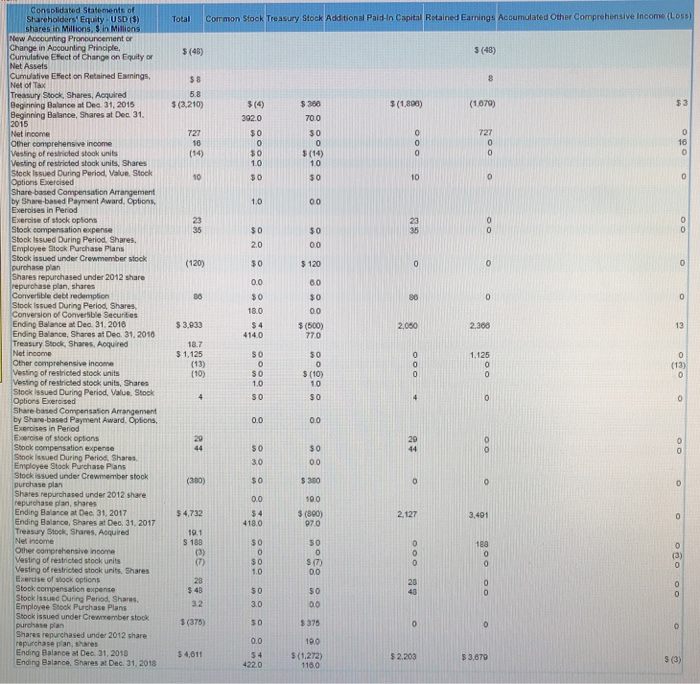

Statement of Shareholders Equity

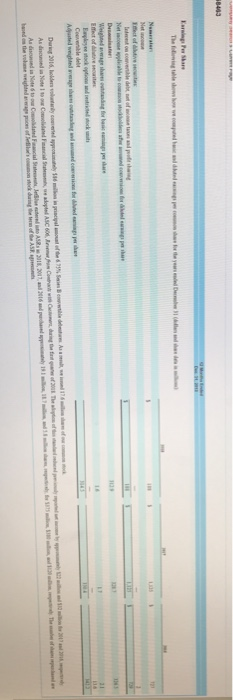

Earnings Per Share

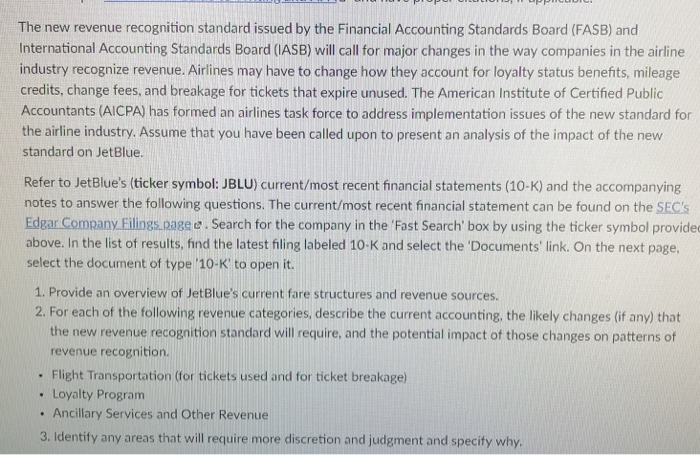

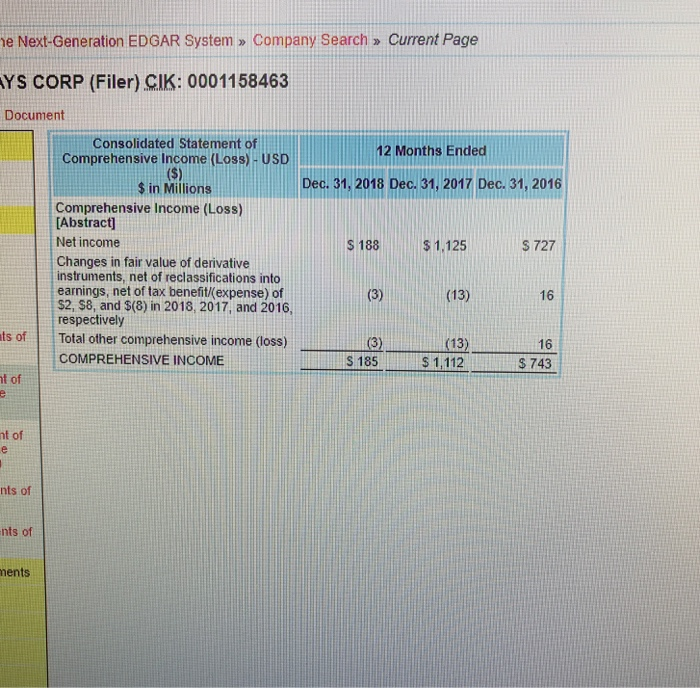

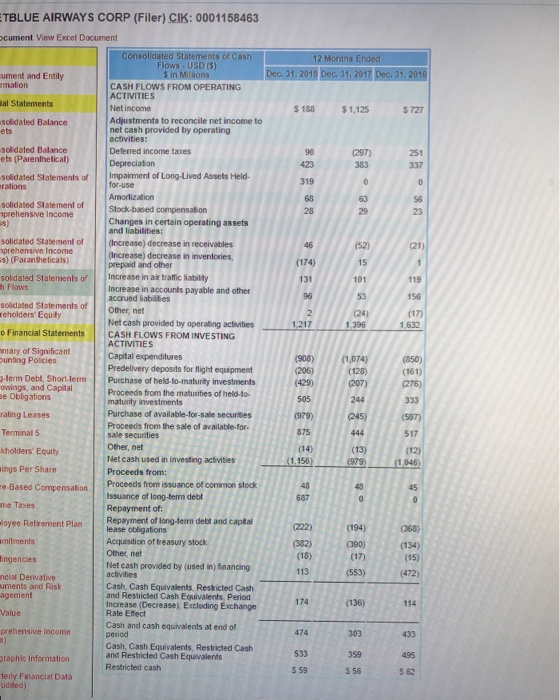

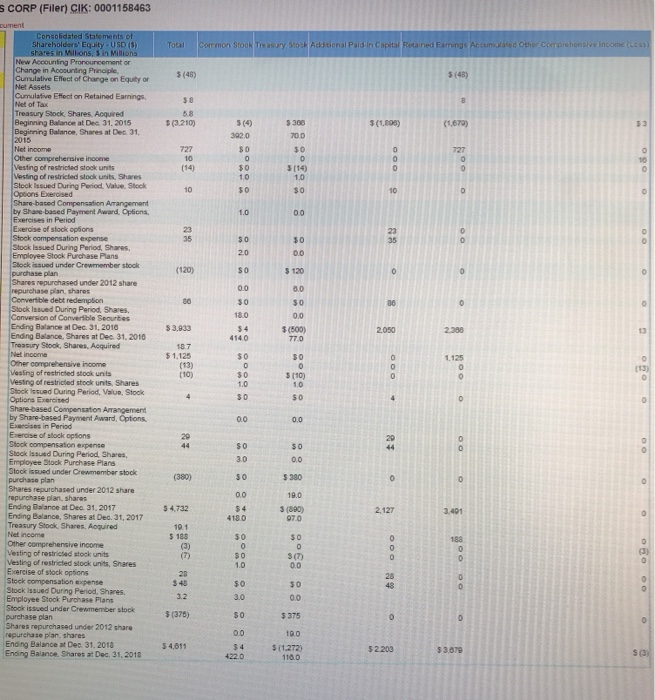

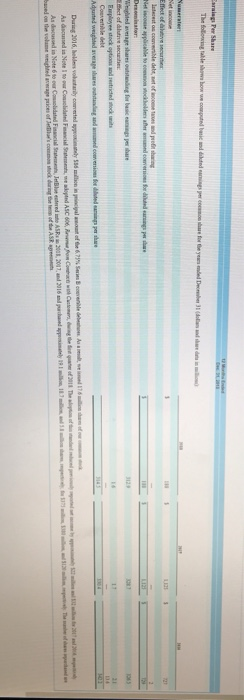

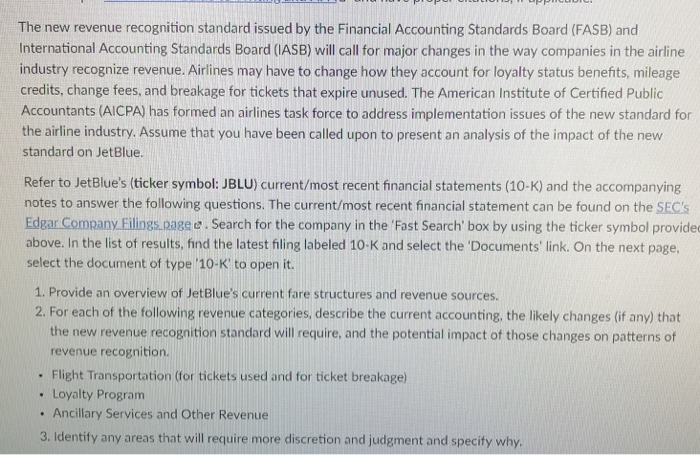

The new revenue recognition standard issued by the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) will call for major changes in the way companies in the airline industry recognize revenue. Airlines may have to change how they account for loyalty status benefits, mileage credits, change fees, and breakage for tickets that expire unused. The American Institute of Certified Public Accountants (AlCPA) has formed an airlines task force to address implementation issues of the new standard for the airline industry. Assume that you have been called upon to present an analysis of the impact of the new standard on JetBlue. Refer to JetBlue's (ticker symbol: JBLU) current/most recent financial statements (10-K) and the accompanying notes to answer the following questions. The current/most recent financial statement can be found on the SEC'S Edear Company Filings page e . Search for the company in the Fast Search' box by using the ticker symbol provide above. In the list of results, find the latest filing labeled 10-K and select the Documents' link. On the next page select the document of type '10-K' to open it. 1. Provide an overview of JetBlue's current fare structures and revenue sources. 2. For each of the following revenue categories, describe the current accounting, the likely changes (if any) that the new revenue recognition standard will require, and the potential impact of those changes on patterns of revenue recognition . Flight Transportation (for tickets used and for ticket breakage) . Loyalty Program . Ancillary Services and Other Revenue 3. Identify any areas that will require more discretion and judgment and specify why JETBLUE AIRWAYS CORP (Filer) CIK: 0001158463 t Document View Excel Document Consolidated Balance Sheets USD (S) Deo. 31, 2018 Dec. 31,2017 $ in Millions Document and Entily Informalion CURRENT ASSETS Cash and cash equivalents Investment securities Receivables, less allowance (2018-$1 2017-$1) Inventories, less allowance (2018-$18 2017-$14) Prepaid expenses and other Tolal current assets $ 474 413 211 78 298 1,474 S 303 ancial Statements Consoldated Balance Sheets 245 Consolidated Balance Sheets (Parenthelical) 213 Consoldated Statements of PROPERTY AND EQUIPMENT Operalions Flight equipment 8,980 Consolidated Statement of Comprehensive Income Predelivery deposits for fight equpment Flight equipment, gross plus deposits Less accumulated depreciation 9,818 2,448 Consolidated Statement of Comprehensive Income (Loss) (Parantheticals) 9184 2,125 7,059 1,041 Flight equipment net Other property and equipment Less accumulated depreciation 1,074 Consolidated Statements o Cash Flows Property plant and equipment other net 613 561 636 Assets constructed for others Consolidated Slatements ofLess accumulated depreciation Shareholders' Equity Asset constructed for others net Total property and equipment, net 332 8,315 otes to Financial Statements ccounting Policies otes Tables ofes Details 8,049 OTHER ASSETS Investment securities Restricted cash Total other assets 637 526 9,781 TOTAL ASSETS CURRENT LIABILITIES Accounts payable All Reports 437 Air traffic liability Acciued salaies, wages and benetts 313 313 Other accrued liablities Current maturties of long-term debt and capital leases Total current liablities LONG TERM DEBT AND CAPITAL LEASE OBLIGATIONS CONSTRUCTION OBLIGATION DEFERRED TAXES AND OTHER LIABILITIES Deferred income taves 2146 1,381 1,003 424 1,088 Frequent Fier Liability, Noncurrent Total deferred taxes and other liabilites COMMITMENTS AND CONTINGENCIES Notes 11 &12) STOCKHOLDERS EQUITY Preferred stock, $0 01 par value, 25 shares authorized, none issued Common stock, 50.01 par value, 900 shares authorized, 422 and 418 shares issued and 306 and 321 shares cutstanding at 2018 and 2017 respectively 1.459 Treasuny stock, at cost 116 and 97 Restricted cash Other Total other assets TOTAL ASSETS 59 575 637 10,426 56 468 526 9,781 9 CURRENT LIABILITIES Accounts payable Air traffic liability Accrued salaries, wages and benefits Other accrued liabilities Current maturities of long-term debt and capital leases Total current liabilities LONG-TERM DEBT AND CAPITAL LEASE OBLIGATIONS CONSTRUCTION OBLIGATION DEFERRED TAXES AND OTHER LIABILITIES Deferred income taxes Frequent Flier Liability, Noncurrent Other Total deferred taxes and other liabilities COMMITMENTS AND CONTINGENCIES (Notes 11& 12) 437 1,035 313 324 309 2,418 378 966 293 196 146 1,003 441 1,361 424 1,088 75 1,459 1,612 STOCKHOLDERS' EQUITY Preferred stock, $0.01 par value; 25 shares authorized, none issued Common stock, $0.01 par value; 900 shares authorized, 422 and 418 shares issued and 306 and 321 shares outstanding at 2018 and 2017, respectively Treasury stock, at cost; 116 and 97 shares at 2018 and 2017, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive (1,272) 2,203 3,679 (890) 2.127 3,491 4,611 4.732 Total stockholders' equity TOTAL LIABILITIES AND $10,426 9,781 STOCKHOLDERS' EQUITY e Next-Generation EDGAR System , Company Search , Current Page YS CORP (Filer) CIK: 0001158463 Documen Consolidated Statement of 12 Months Ended Comprehensive Income (Loss)-USD $ in Milions Dec. 31, 2018 Dec. 31, 2017 Dec. 31, 2016 Comprehensive Income (Loss) Abstract Net income $ 188 $ 1,.125 S727 Changes in fair value of derivative instruments, net of reclassifications into earnings, net of tax benefit/(expense) of $2, $8, and $(8) in 2018, 2017, and 2016, respectively (13) 16 ts of Total other comprehensive income (loss) 3)(13) COMPREHENSIVE INCOME 16 S 743 S 185 $ 1,112 t of t of nts of nts of ments TBLUE AIRWAYS CORP (Filer) CIK: 0001158463 cument View Excel Document ted Statementsorcash Flows-USD (S) 12 Months Ended in Mili ument and Entily al Statements solidated Balance CASH FLOWS FROM OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash provided by operating S 188 $1,125 S 727 activities: Deferred income taxes solidated Balance ets (Parenthelical) 90 251 337 solidated Slatements of Impairment of Long-Lived Assets Held- rations 319 for-use Amortization solidated Slatement of prehensive Income 28 Changes in certain operating assets and liabilities: solidated Statement of(Increase) decrease in receivables prehensive Income s) (Parantheticals) (Increase) decrease in inventories, prepaid and other (174) soldated Statements of h Flows Increase in air traffic liabilty 119 Increase in accounts payable and other accrued liabilties Other, net soldated Statements of reholders Equity (17) 1,632 Net cash provided by operaling activities 1,396 o Financial Statements | | CASH FLOwS FROM NVESTNG mary of Significant unting Policies ACTIVITIES Capital expenditures Predelivery deposits for flight equipment (908)(1,074)(850) 429)207) (979) 245) (128) (161) -term Debt, Short-lermPurchase of held-to-matuity investments owings, and Capital e Obligations Proceeds from the maturities of held-to- maturty investments Purchase of available-for-sale securities Proceeds from the sale of available-for. raling Leases Terminal 5 sholders' Equity ings Per Share e-Based Compensation me Taxes o Repayment of long-term debt and capital sale secunities 517 Other, net (14) 1.156) (12) Net cash used in investing activities Proceeds from: Proceeds from issuance of common stock Issuance of long-term debt Repayment of: oyee Retirement Plan 222)(194) 366) lease obligations Acquisition of treasury stock Other, net Net cash provided by (used in) financing (382) (390) (18) 113 (134) (17) ingencies ncial Derivative uments and Risk gement Cash, Cash Equivalents. Reshicted Cash and Restricted Cash Equivalents, Period Increase (Decrease, Excleoding Exchange 174 (136) Rate Effect Cash and cash equivalents at end of perio Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents Restricted cash prehensive Income 474 303 359 s 56 433 533 praphic Information 5 62 terly Financial Data udited) S CORP (Filer) CIK: 0001158463 Shareholders Equity USD (S) New Accounting 5 (43) Cumulative Effect of Cumulafive Effect on Retained Earnings, Net of Tax Treasury Stock, Shares Acquired Beginning Balance at Dec. 31, 2015 (3210) $(1,096) Begirning Balance, Shares at Dee. 31. Other comprehersive income Vesting of restricted stock units Vesting of restricted stock units, Shares Stock issued During Period, Value Stock Options Exercised s (14) by Shase-based Payment Award. Optons Exercises in Period Exercise of stock opions Stock Issued During Period, Shares Employee Stock Purchase Plans Sock issued under Crewmember stock S 120 Shares repurchased under 2012 share Convertible debt redemption Stock Issued During Period, Shares Ending Balance at Dec. 31, 2010 Ending Balance, Shares at Dec. 31, 2010 Treasury Stook, Shares, Acquired $ 3,933 $ (500) 2.050 2.386 1.125 Vesing of restricted stook unts vesing of restricted stock units, Shares Stock lssued During Period, Value, Stock Share-based Compensation by Share-based Payment Award Exercise of stock opsions Stock compensaton expense Stook lssued During Period, Shares, Employee Stock Purchase Plans Stock issued under Crewmember stock purchase plan Shares repurchased under 2012 share Ending Balance at Dea 31, 2017 Ending Balance, Shares at Dec. 31, 2017 Treasury Stock, Shares, Aoquired 2.127 188 Other comprehensive income esting of restricted stock units Vesting of restricted stook units, Shares Exercise of stock options Stock compensation Stock Issued During Period, Shares Employee Stock Purchase Plans 3 48 3 (375) 375 purchase plan Shares repurchased under 2012 share repurehase p/an, shares Ending Balance at Dec 31, 201a Ending Balance. Shares at Dec. 31, 2018 5 4.611 $4 $ (1272) 3.679 s (3) Print Document View Excel Document Consolidated Balance Sheets-USD (S) Dee 31, 2018 Deo, 31, 201 $ in Milions CURRENT ASSETS Cash and cash equivalents Document and Entity 3 474 5 303 securities Receivables, less allowance (2018-$1 2017-$1) Inventories, less allowance (2018-$18 Conso idated Balance Sheets 17-314) Prepaid expenses and other Total current assets PROPERTY AND EQUIPMENT Sheets (Parenthetical Consolidated Statements of Flight equipment Operations 8.880 Predelivery deposits for flight equipment equipement, gross plus deposits 9,164 Less accumulated depreciation Flight equipment net Other property and equipment Less accumulated depreciation 2.448 Comprehensive Income (Loss) Consolidated Statement oProperty plant and equipment other net Comprehensive Income Assets constructed for others 561 acoumulated depreciation Consolidaled Statements ofAsset constructed for others net Cash Flows Senslcate Statements of OTHERASSE nvestment securities Restricted cash Shareholders' Equity Notes to Financial Statements Accounting Policies Notes Tables Notes Details Total other assets TOTAL ASSETS CURRENT LIABILITIES Accounts payable Air traffic liability Accrued salaries, wages and benefits Other accrued labilities Current maturities of long-term debt and Total ourrent lablities LONG-TERM DEBT AND CAPITAL LEASE OBLIGATIONS CONSTRUCTION OBLIGATION DEFERRED TAXES AND OTHER LIABILITIES Deferred income tacces 1,003 1,088 Frequent Filer Lisbility. Noncurrent Total defered taxes and other liablities COMMITMENTS AND CONTINGENCIES (Notes 11 & 12) STOCKHOLDERS EQUITY Preferred stock, $0.01 par value: 25 shares authorized, none issued common stock. SO 01 par value: 00 shares authorized, 422 and 418 shares ssued and 308 and 321 shares outstanding at 2018 and 2017 Tressury stock, at cost; 110 and 97 shares at 2018 and 2017, respectively (1.272) Additional paid-n capital 3401 income Total stockholders equity TOTAL LIABILITIES AND $ 9,781 View Excel Document Consolidated Statements of 12 Months Ended Operations - USD ($) $ in Millions Dec. 31, 2018 Dec. 31, 2017 Dec. 31, 2016 nd Entity Revenues [Abstract] $ 7.658 $7.012 $584 Revenue from Contract with Customer. Excluding Assessed Tax OPERATING EXPENSES Aircraft fuel and related taxes Salaries, wages and benefits Landing fees and other rents Depreciation and amortization Aircraft rent Sales and marketing Maintenance, materials and repairs Other operating expenses ments 1,074 1.698 357 393 1,363 1,887 397 446 100 271 622 933 1,899 2,044 420 d Balance ed Balance renthetical) 103 294 263 563 866 ed Statements of 1,059 435 7.370 288 ed Statement of Special Items nsive Inoome Total operating expenses OPERATING INCOME OTHER INCOME (EXPENSE) 6,019 993 5,324 1,280 nt of Interest expense ted Statement ensive Income arantheticals) (92) Capitalized interest Interest income and other 13 ated Statements of Total other income (expense) 1.164 437 S 727 Ws INCOME BEFORE INCOME TAXES Income tax expense (benefit) NET INCOME ated Statements of 1.125 Iders' Equity ancial StatementsDiluted Policies EARNINGS PER COMMON SHARE $0.60 $0.60 Basic 3 3.42 3.41 $ 2.23 $ 2.13 Passenger [Member) Revenues [Abstract] Revenue from Contract with Cust Exoluding Assessed Tax Product and Service, Other [Member] Revenues [Abstract] Revenue from Contract with Customer Excluding Assessed Tax omer $ 7.381 s0.701 8.380 es ized S 277 $ 251 S 204 BLUE AIRWAYS CORP (Filer) CIK: 0001158463 (see all company tilngs Consolidated Statements of Cash Flows USD S) $ in Millions 12 Months Ended Deo. 31, 2018 Deo. 31, 2017 Deo.31, 2016 ASH FLOWS FROM OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash provided by operating activities Deferred income taxes $ 188 $ 1,125 $ 727 90 251 (297) 383 Impairment of Long-Lived Assets Held- 319 nts of Amortization 28 23 Stock-based compensation Changes in certain operating assets ent ofand liabilities: (21 Increase) decrease in receivables (Increase) decrease in inventories (174) 131 ent ofprepaid and other Increase in air traffic liability 101 110 Increase in accounts payable and other accrued liabilities 156 ents ofOther, net nt of ACTIVITIES ments Purchase of Net cash provided by operating activities 1,396 1,632 CASH FLOWS FROM INVESTING (908)(1.074) Capital expenditures Predelivery deposits for flight equipment (128) (181) (429) Proceeds from the matunities of held-to- (245) Purchase of available-for-sale securities Proceeds from the sale of available-for- sale securities Other, net Net cash used in investing activities Proceeds from: Proceeds from issuance of common stock Issuance of long-term debt Repayment of Repayment of long-term debt and capital lease obligations 875 517 (14) (13) (1,046 687 (194) (390) (134) Other, net Net cash provided by (used in) financing activities Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents, Period Increase (Decrease), Excluding Exchange Rate Efect Cash and cash equivalents at end of period Cash. Cash Equivalents, Restricted Cash and Restricted Cash Equivalents (553) (472) (136) 474 303 533 495 Restricted cash 3 58 3 62 Consolidated Statements of Shareholders Equity USD (S) TotalCormon Stock Treasury Stock Additional Paid-n Capital Rstained Earnings Accumulated Other Comprehensive Income (Loss) in Millions, S in Millions New Accounting Pronouncement o Change in Accounting Principle, Cumulative Efect of Change on Equity or Net Assets $ (48) s (48) Cumulative Efect on Retained Earnings Net of Tax Treasury Stock, Shares, Acquiresd Beginning Balance at Dec 31, 2015 Beginning Balance. Shares at Dec 31 5.8 $ (3,210) s (4) 392.0 $366 700 s (1.800) (1,679) Net income 16 Other comprehensive inoome Vesing of resiricted stook units Vesting of restricted stock units, Shares (14) s (14) Issued During Period, Value, Stock Options Exercised Share-based Compensation Arrangement Share-based Payment Award. Options, Exeroises in Period Exeroise of stock opions Stock compensation expense Stock Issued During Period. Shares, Employee Stook Purchase Plans Stock issued under Crewmember stock purchase pan Shares repurchased under 2012 share (120) 120 pan, shares 60 Converible debt redempion Stock Issued During Period, Shares, Conversion of Converible Securities Ending Balance at Deo. 31.2016 Ending Balance, Shares at Dea. 31, 2010 Treasury Stock, Shares, Aoquired 18.0 3,833 s (500) 770 2.060 13 414.0 $ 1,125 1.125 (13) esting of restricted stock units Vesting of restricted stock units, Shares Stock issued During Period, Value. Stock Options Exercised Share based Compensation Arrangement by Share-based Payment Exeroises in Period Exeroise of stock optons Stock compensation expense Stook lesued During Period, Shares Employee Stock Purchase Plans Stock issued under Crewmember stook purchase plan Shares repurchased under 2012 share s (10) Award. Options, 0.0 s 380 plan, shares Ending Balance at Dec 31, 2017 Ending Balance, Shares at Dec. 31, 2017 Treasury Stock, Shares, Acquired Ne income Other comprehensive inoome Vesing of restricted stock units Vesting of restricted stook units, Shares Exercise of stock options Stock compensation expense Stook Issued Ouring Period, Shares, Employee Stock Purchase Plans Stook issued under Crewnmember stook purchase plan Shares repurchased under 2012 share repurchase plan, shares Ending Balance at Dec. 31, 2018 Ending Balance. Shares at Dec. 31. 2018 4,732 $ (800) 97.0 2,127 3,491 418.0 S 188 30 s (375) 375 19.0 (1,272) 4,011 $ 2,203 $ 3,870 s (3) 422.0 116.0 The new revenue recognition standard issued by the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) will call for major changes in the way companies in the airline industry recognize revenue. Airlines may have to change how they account for loyalty status benefits, mileage credits, change fees, and breakage for tickets that expire unused. The American Institute of Certified Public Accountants (AlCPA) has formed an airlines task force to address implementation issues of the new standard for the airline industry. Assume that you have been called upon to present an analysis of the impact of the new standard on JetBlue. Refer to JetBlue's (ticker symbol: JBLU) current/most recent financial statements (10-K) and the accompanying notes to answer the following questions. The current/most recent financial statement can be found on the SEC'S Edear Company Filings page e . Search for the company in the Fast Search' box by using the ticker symbol provide above. In the list of results, find the latest filing labeled 10-K and select the Documents' link. On the next page select the document of type '10-K' to open it. 1. Provide an overview of JetBlue's current fare structures and revenue sources. 2. For each of the following revenue categories, describe the current accounting, the likely changes (if any) that the new revenue recognition standard will require, and the potential impact of those changes on patterns of revenue recognition . Flight Transportation (for tickets used and for ticket breakage) . Loyalty Program . Ancillary Services and Other Revenue 3. Identify any areas that will require more discretion and judgment and specify why JETBLUE AIRWAYS CORP (Filer) CIK: 0001158463 t Document View Excel Document Consolidated Balance Sheets USD (S) Deo. 31, 2018 Dec. 31,2017 $ in Millions Document and Entily Informalion CURRENT ASSETS Cash and cash equivalents Investment securities Receivables, less allowance (2018-$1 2017-$1) Inventories, less allowance (2018-$18 2017-$14) Prepaid expenses and other Tolal current assets $ 474 413 211 78 298 1,474 S 303 ancial Statements Consoldated Balance Sheets 245 Consolidated Balance Sheets (Parenthelical) 213 Consoldated Statements of PROPERTY AND EQUIPMENT Operalions Flight equipment 8,980 Consolidated Statement of Comprehensive Income Predelivery deposits for fight equpment Flight equipment, gross plus deposits Less accumulated depreciation 9,818 2,448 Consolidated Statement of Comprehensive Income (Loss) (Parantheticals) 9184 2,125 7,059 1,041 Flight equipment net Other property and equipment Less accumulated depreciation 1,074 Consolidated Statements o Cash Flows Property plant and equipment other net 613 561 636 Assets constructed for others Consolidated Slatements ofLess accumulated depreciation Shareholders' Equity Asset constructed for others net Total property and equipment, net 332 8,315 otes to Financial Statements ccounting Policies otes Tables ofes Details 8,049 OTHER ASSETS Investment securities Restricted cash Total other assets 637 526 9,781 TOTAL ASSETS CURRENT LIABILITIES Accounts payable All Reports 437 Air traffic liability Acciued salaies, wages and benetts 313 313 Other accrued liablities Current maturties of long-term debt and capital leases Total current liablities LONG TERM DEBT AND CAPITAL LEASE OBLIGATIONS CONSTRUCTION OBLIGATION DEFERRED TAXES AND OTHER LIABILITIES Deferred income taves 2146 1,381 1,003 424 1,088 Frequent Fier Liability, Noncurrent Total deferred taxes and other liabilites COMMITMENTS AND CONTINGENCIES Notes 11 &12) STOCKHOLDERS EQUITY Preferred stock, $0 01 par value, 25 shares authorized, none issued Common stock, 50.01 par value, 900 shares authorized, 422 and 418 shares issued and 306 and 321 shares cutstanding at 2018 and 2017 respectively 1.459 Treasuny stock, at cost 116 and 97 Restricted cash Other Total other assets TOTAL ASSETS 59 575 637 10,426 56 468 526 9,781 9 CURRENT LIABILITIES Accounts payable Air traffic liability Accrued salaries, wages and benefits Other accrued liabilities Current maturities of long-term debt and capital leases Total current liabilities LONG-TERM DEBT AND CAPITAL LEASE OBLIGATIONS CONSTRUCTION OBLIGATION DEFERRED TAXES AND OTHER LIABILITIES Deferred income taxes Frequent Flier Liability, Noncurrent Other Total deferred taxes and other liabilities COMMITMENTS AND CONTINGENCIES (Notes 11& 12) 437 1,035 313 324 309 2,418 378 966 293 196 146 1,003 441 1,361 424 1,088 75 1,459 1,612 STOCKHOLDERS' EQUITY Preferred stock, $0.01 par value; 25 shares authorized, none issued Common stock, $0.01 par value; 900 shares authorized, 422 and 418 shares issued and 306 and 321 shares outstanding at 2018 and 2017, respectively Treasury stock, at cost; 116 and 97 shares at 2018 and 2017, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive (1,272) 2,203 3,679 (890) 2.127 3,491 4,611 4.732 Total stockholders' equity TOTAL LIABILITIES AND $10,426 9,781 STOCKHOLDERS' EQUITY e Next-Generation EDGAR System , Company Search , Current Page YS CORP (Filer) CIK: 0001158463 Documen Consolidated Statement of 12 Months Ended Comprehensive Income (Loss)-USD $ in Milions Dec. 31, 2018 Dec. 31, 2017 Dec. 31, 2016 Comprehensive Income (Loss) Abstract Net income $ 188 $ 1,.125 S727 Changes in fair value of derivative instruments, net of reclassifications into earnings, net of tax benefit/(expense) of $2, $8, and $(8) in 2018, 2017, and 2016, respectively (13) 16 ts of Total other comprehensive income (loss) 3)(13) COMPREHENSIVE INCOME 16 S 743 S 185 $ 1,112 t of t of nts of nts of ments TBLUE AIRWAYS CORP (Filer) CIK: 0001158463 cument View Excel Document ted Statementsorcash Flows-USD (S) 12 Months Ended in Mili ument and Entily al Statements solidated Balance CASH FLOWS FROM OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash provided by operating S 188 $1,125 S 727 activities: Deferred income taxes solidated Balance ets (Parenthelical) 90 251 337 solidated Slatements of Impairment of Long-Lived Assets Held- rations 319 for-use Amortization solidated Slatement of prehensive Income 28 Changes in certain operating assets and liabilities: solidated Statement of(Increase) decrease in receivables prehensive Income s) (Parantheticals) (Increase) decrease in inventories, prepaid and other (174) soldated Statements of h Flows Increase in air traffic liabilty 119 Increase in accounts payable and other accrued liabilties Other, net soldated Statements of reholders Equity (17) 1,632 Net cash provided by operaling activities 1,396 o Financial Statements | | CASH FLOwS FROM NVESTNG mary of Significant unting Policies ACTIVITIES Capital expenditures Predelivery deposits for flight equipment (908)(1,074)(850) 429)207) (979) 245) (128) (161) -term Debt, Short-lermPurchase of held-to-matuity investments owings, and Capital e Obligations Proceeds from the maturities of held-to- maturty investments Purchase of available-for-sale securities Proceeds from the sale of available-for. raling Leases Terminal 5 sholders' Equity ings Per Share e-Based Compensation me Taxes o Repayment of long-term debt and capital sale secunities 517 Other, net (14) 1.156) (12) Net cash used in investing activities Proceeds from: Proceeds from issuance of common stock Issuance of long-term debt Repayment of: oyee Retirement Plan 222)(194) 366) lease obligations Acquisition of treasury stock Other, net Net cash provided by (used in) financing (382) (390) (18) 113 (134) (17) ingencies ncial Derivative uments and Risk gement Cash, Cash Equivalents. Reshicted Cash and Restricted Cash Equivalents, Period Increase (Decrease, Excleoding Exchange 174 (136) Rate Effect Cash and cash equivalents at end of perio Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents Restricted cash prehensive Income 474 303 359 s 56 433 533 praphic Information 5 62 terly Financial Data udited) S CORP (Filer) CIK: 0001158463 Shareholders Equity USD (S) New Accounting 5 (43) Cumulative Effect of Cumulafive Effect on Retained Earnings, Net of Tax Treasury Stock, Shares Acquired Beginning Balance at Dec. 31, 2015 (3210) $(1,096) Begirning Balance, Shares at Dee. 31. Other comprehersive income Vesting of restricted stock units Vesting of restricted stock units, Shares Stock issued During Period, Value Stock Options Exercised s (14) by Shase-based Payment Award. Optons Exercises in Period Exercise of stock opions Stock Issued During Period, Shares Employee Stock Purchase Plans Sock issued under Crewmember stock S 120 Shares repurchased under 2012 share Convertible debt redemption Stock Issued During Period, Shares Ending Balance at Dec. 31, 2010 Ending Balance, Shares at Dec. 31, 2010 Treasury Stook, Shares, Acquired $ 3,933 $ (500) 2.050 2.386 1.125 Vesing of restricted stook unts vesing of restricted stock units, Shares Stock lssued During Period, Value, Stock Share-based Compensation by Share-based Payment Award Exercise of stock opsions Stock compensaton expense Stook lssued During Period, Shares, Employee Stock Purchase Plans Stock issued under Crewmember stock purchase plan Shares repurchased under 2012 share Ending Balance at Dea 31, 2017 Ending Balance, Shares at Dec. 31, 2017 Treasury Stock, Shares, Aoquired 2.127 188 Other comprehensive income esting of restricted stock units Vesting of restricted stook units, Shares Exercise of stock options Stock compensation Stock Issued During Period, Shares Employee Stock Purchase Plans 3 48 3 (375) 375 purchase plan Shares repurchased under 2012 share repurehase p/an, shares Ending Balance at Dec 31, 201a Ending Balance. Shares at Dec. 31, 2018 5 4.611 $4 $ (1272) 3.679 s (3) Print Document View Excel Document Consolidated Balance Sheets-USD (S) Dee 31, 2018 Deo, 31, 201 $ in Milions CURRENT ASSETS Cash and cash equivalents Document and Entity 3 474 5 303 securities Receivables, less allowance (2018-$1 2017-$1) Inventories, less allowance (2018-$18 Conso idated Balance Sheets 17-314) Prepaid expenses and other Total current assets PROPERTY AND EQUIPMENT Sheets (Parenthetical Consolidated Statements of Flight equipment Operations 8.880 Predelivery deposits for flight equipment equipement, gross plus deposits 9,164 Less accumulated depreciation Flight equipment net Other property and equipment Less accumulated depreciation 2.448 Comprehensive Income (Loss) Consolidated Statement oProperty plant and equipment other net Comprehensive Income Assets constructed for others 561 acoumulated depreciation Consolidaled Statements ofAsset constructed for others net Cash Flows Senslcate Statements of OTHERASSE nvestment securities Restricted cash Shareholders' Equity Notes to Financial Statements Accounting Policies Notes Tables Notes Details Total other assets TOTAL ASSETS CURRENT LIABILITIES Accounts payable Air traffic liability Accrued salaries, wages and benefits Other accrued labilities Current maturities of long-term debt and Total ourrent lablities LONG-TERM DEBT AND CAPITAL LEASE OBLIGATIONS CONSTRUCTION OBLIGATION DEFERRED TAXES AND OTHER LIABILITIES Deferred income tacces 1,003 1,088 Frequent Filer Lisbility. Noncurrent Total defered taxes and other liablities COMMITMENTS AND CONTINGENCIES (Notes 11 & 12) STOCKHOLDERS EQUITY Preferred stock, $0.01 par value: 25 shares authorized, none issued common stock. SO 01 par value: 00 shares authorized, 422 and 418 shares ssued and 308 and 321 shares outstanding at 2018 and 2017 Tressury stock, at cost; 110 and 97 shares at 2018 and 2017, respectively (1.272) Additional paid-n capital 3401 income Total stockholders equity TOTAL LIABILITIES AND $ 9,781 View Excel Document Consolidated Statements of 12 Months Ended Operations - USD ($) $ in Millions Dec. 31, 2018 Dec. 31, 2017 Dec. 31, 2016 nd Entity Revenues [Abstract] $ 7.658 $7.012 $584 Revenue from Contract with Customer. Excluding Assessed Tax OPERATING EXPENSES Aircraft fuel and related taxes Salaries, wages and benefits Landing fees and other rents Depreciation and amortization Aircraft rent Sales and marketing Maintenance, materials and repairs Other operating expenses ments 1,074 1.698 357 393 1,363 1,887 397 446 100 271 622 933 1,899 2,044 420 d Balance ed Balance renthetical) 103 294 263 563 866 ed Statements of 1,059 435 7.370 288 ed Statement of Special Items nsive Inoome Total operating expenses OPERATING INCOME OTHER INCOME (EXPENSE) 6,019 993 5,324 1,280 nt of Interest expense ted Statement ensive Income arantheticals) (92) Capitalized interest Interest income and other 13 ated Statements of Total other income (expense) 1.164 437 S 727 Ws INCOME BEFORE INCOME TAXES Income tax expense (benefit) NET INCOME ated Statements of 1.125 Iders' Equity ancial StatementsDiluted Policies EARNINGS PER COMMON SHARE $0.60 $0.60 Basic 3 3.42 3.41 $ 2.23 $ 2.13 Passenger [Member) Revenues [Abstract] Revenue from Contract with Cust Exoluding Assessed Tax Product and Service, Other [Member] Revenues [Abstract] Revenue from Contract with Customer Excluding Assessed Tax omer $ 7.381 s0.701 8.380 es ized S 277 $ 251 S 204 BLUE AIRWAYS CORP (Filer) CIK: 0001158463 (see all company tilngs Consolidated Statements of Cash Flows USD S) $ in Millions 12 Months Ended Deo. 31, 2018 Deo. 31, 2017 Deo.31, 2016 ASH FLOWS FROM OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash provided by operating activities Deferred income taxes $ 188 $ 1,125 $ 727 90 251 (297) 383 Impairment of Long-Lived Assets Held- 319 nts of Amortization 28 23 Stock-based compensation Changes in certain operating assets ent ofand liabilities: (21 Increase) decrease in receivables (Increase) decrease in inventories (174) 131 ent ofprepaid and other Increase in air traffic liability 101 110 Increase in accounts payable and other accrued liabilities 156 ents ofOther, net nt of ACTIVITIES ments Purchase of Net cash provided by operating activities 1,396 1,632 CASH FLOWS FROM INVESTING (908)(1.074) Capital expenditures Predelivery deposits for flight equipment (128) (181) (429) Proceeds from the matunities of held-to- (245) Purchase of available-for-sale securities Proceeds from the sale of available-for- sale securities Other, net Net cash used in investing activities Proceeds from: Proceeds from issuance of common stock Issuance of long-term debt Repayment of Repayment of long-term debt and capital lease obligations 875 517 (14) (13) (1,046 687 (194) (390) (134) Other, net Net cash provided by (used in) financing activities Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents, Period Increase (Decrease), Excluding Exchange Rate Efect Cash and cash equivalents at end of period Cash. Cash Equivalents, Restricted Cash and Restricted Cash Equivalents (553) (472) (136) 474 303 533 495 Restricted cash 3 58 3 62 Consolidated Statements of Shareholders Equity USD (S) TotalCormon Stock Treasury Stock Additional Paid-n Capital Rstained Earnings Accumulated Other Comprehensive Income (Loss) in Millions, S in Millions New Accounting Pronouncement o Change in Accounting Principle, Cumulative Efect of Change on Equity or Net Assets $ (48) s (48) Cumulative Efect on Retained Earnings Net of Tax Treasury Stock, Shares, Acquiresd Beginning Balance at Dec 31, 2015 Beginning Balance. Shares at Dec 31 5.8 $ (3,210) s (4) 392.0 $366 700 s (1.800) (1,679) Net income 16 Other comprehensive inoome Vesing of resiricted stook units Vesting of restricted stock units, Shares (14) s (14) Issued During Period, Value, Stock Options Exercised Share-based Compensation Arrangement Share-based Payment Award. Options, Exeroises in Period Exeroise of stock opions Stock compensation expense Stock Issued During Period. Shares, Employee Stook Purchase Plans Stock issued under Crewmember stock purchase pan Shares repurchased under 2012 share (120) 120 pan, shares 60 Converible debt redempion Stock Issued During Period, Shares, Conversion of Converible Securities Ending Balance at Deo. 31.2016 Ending Balance, Shares at Dea. 31, 2010 Treasury Stock, Shares, Aoquired 18.0 3,833 s (500) 770 2.060 13 414.0 $ 1,125 1.125 (13) esting of restricted stock units Vesting of restricted stock units, Shares Stock issued During Period, Value. Stock Options Exercised Share based Compensation Arrangement by Share-based Payment Exeroises in Period Exeroise of stock optons Stock compensation expense Stook lesued During Period, Shares Employee Stock Purchase Plans Stock issued under Crewmember stook purchase plan Shares repurchased under 2012 share s (10) Award. Options, 0.0 s 380 plan, shares Ending Balance at Dec 31, 2017 Ending Balance, Shares at Dec. 31, 2017 Treasury Stock, Shares, Acquired Ne income Other comprehensive inoome Vesing of restricted stock units Vesting of restricted stook units, Shares Exercise of stock options Stock compensation expense Stook Issued Ouring Period, Shares, Employee Stock Purchase Plans Stook issued under Crewnmember stook purchase plan Shares repurchased under 2012 share repurchase plan, shares Ending Balance at Dec. 31, 2018 Ending Balance. Shares at Dec. 31. 2018 4,732 $ (800) 97.0 2,127 3,491 418.0 S 188 30 s (375) 375 19.0 (1,272) 4,011 $ 2,203 $ 3,870 s (3) 422.0 116.0