Question

Questions: C. Prepare 1999 adjusting journal entries for the following items and post them to the T-accounts. I) Abercrombie & Fitch employees counted the company's

Questions: C. Prepare 1999 adjusting journal entries for the following items and post them to the T-accounts.

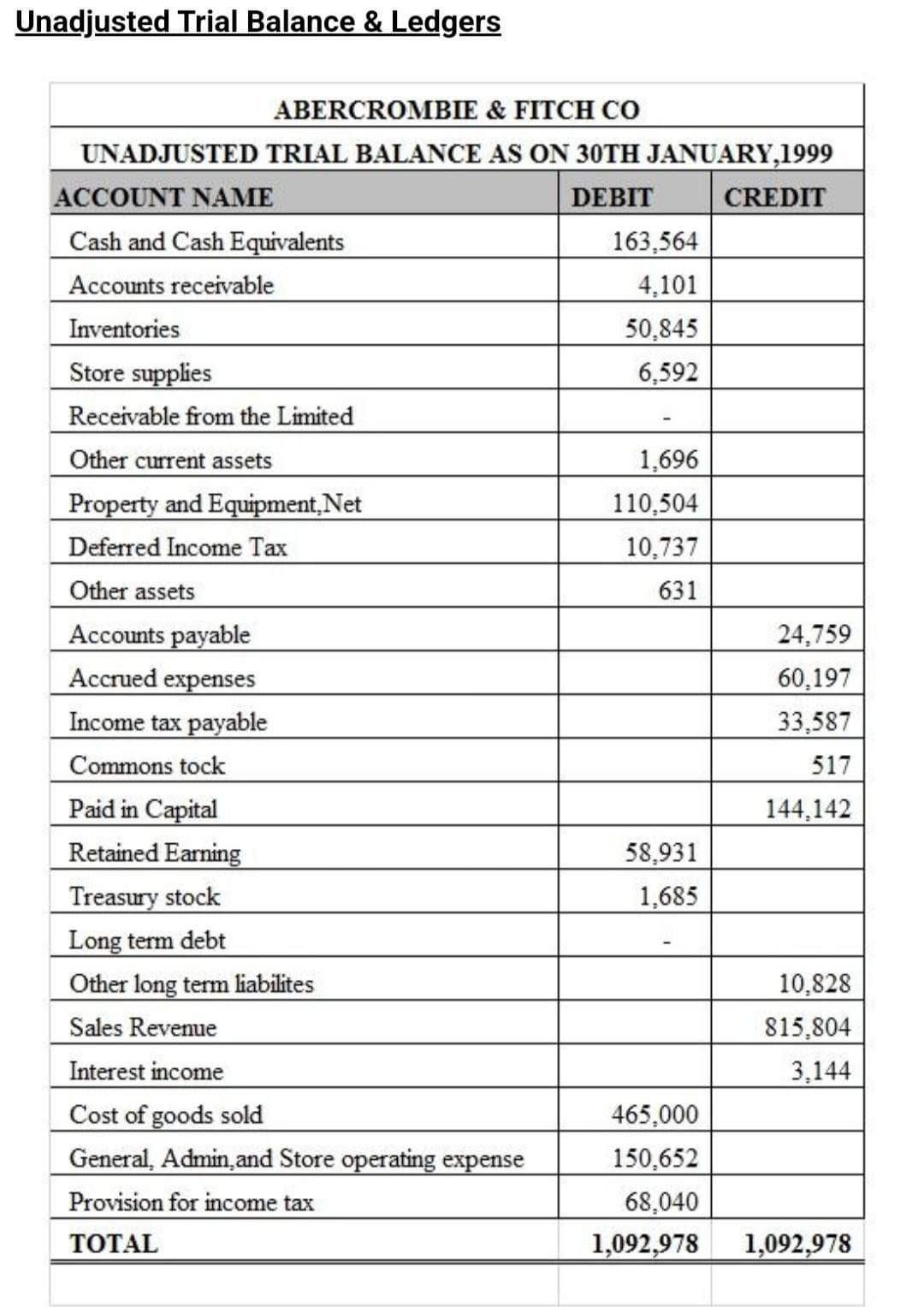

I) Abercrombie & Fitch employees counted the company's merchandise inventory on January 30, 1999. The cost of inventory in stock on that day was $43,992.

II) Abercrombie & Fitch employees counted the company's store supplies on January 30, 1999. The cost of store supplies on that day was $5,887 (store supplies used are included in store operating expenses)

III) Assume that all of the activity in the "Other current assets" account is related to the company's insurance policies. The unadjusted amount in "Other current assets" (Hint $1,696) represents the beginning balance for prepaid insurance premiums plus all cash payments for insurance during the year. At January 30, 1999, the amount of insurance that had not expired was $691.

IV) The company recorded $20,946 of depreciation-part of general, administrative, and store operating expenses-on the property and equipment.

V) Abercrombie and Fitch employees' last payday was January 21. At year-end there were 10 days of wages that had not been recorded. This amounted to $3,685 including all related payroll taxes.

d. Prepare an adjusted trial balance as at January 30, 1999 using the ending balances in the T-accounts obtained after recording the adjustments listed in part c.

e. Prepare the fiscal 1999 income statement.

f. Close the temporary T-accounts and provide the fiscal 1999 closing entry.

g. Prepare the January 30, 1999 balance sheet.

Unadiusted Trial Balance \& LedaersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started