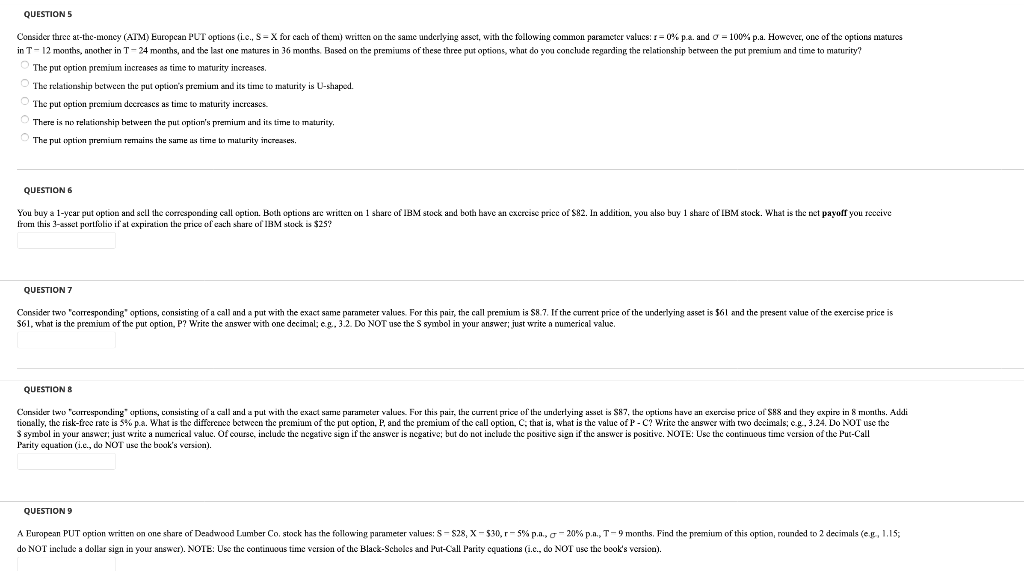

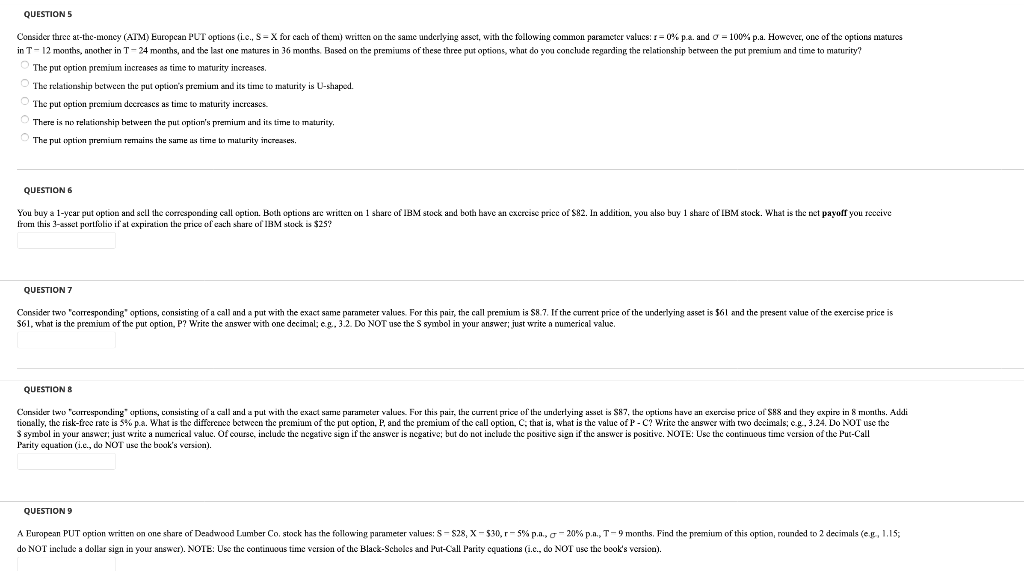

QUESTIONS Consider three at-the-moncy (ATM) European PUT options (i.c., S-X for cach of them, written on the same underlying assct, with the following common parameter values: r=0% p.a. and 0 = 100% p.a. However, one of the options matures in T-12 months, another in T-24 months, and the last one matures in 36 months. Based on the premiums these three put options, what do you conclude regarding the relationship between the put premium and time to maturity? The put option premium increases as time to maturity increases. The relationship between the put option's premium and its time to maturity is U-shaped. The put option premium decrcases as time to maturity increases. There is no relicticinship between the put option's premium and its time to maturity. The put upation premium remains the same is time to maturity increases. QUESTION 6 You buy a 1-year put option and sell the corresponding call option. Both options are written on 1 share of IBM stock and both have an exercise price of $82. In addition, you also buy 1 share of IBM stock. What is the net payoff you receive from this 3-asset portfolio ir at expiration the price of each share of IBM stuck is $28? QUESTION 7 Consider two corresponding" options, consisting of a call and a put with the exact same parameter values. For this pair, the call premium is 88.7. If the current price of the underlying asset is 561 and the present value of the exercise price is $61, what is the premium of the put option, P? Write the answer with one decimal; c. 32. DO NOT use the symbol in your answer; just write a numerical value. QUESTIONS Consider two corresponding plans, consisting of a call and a put with the exact same parameter values. For this pair, the current price of the underlying asset is $87, the options have an exercise price of SX8 and they expire in 8 months. Aucli tionally, the risk-free rate is 5% p.a. What is the difference between the premium of the put option, P, and the premium of the call option, that is what is the value of P-C? Write the answer with two decimals, c... 3.24. DO NOT use the $ symbol in your answer: just write a numerical value. Of course, include the negative sign if the answer is negative; but do not include the positive sign if the answer is positive. NOTE: Use the continuous time version of the Put-Call Parily equation (1.c., o NOT use the book's version) QUESTION 9 A European PUT option written on one share of Deadwood Lumber Co, stock has the following parameter values: 5-828, X - 530,r-5%..., 0-20%p.a., T- 9 months. Find the premium of this option, rounded to 2 decimals (eg, 1.15; do NOT include a dollar sign in your answer). NOTE: Use the continuous time version of the Black-Scholes and Put-Call Parity equations (i.c., do NOT use the book's version)