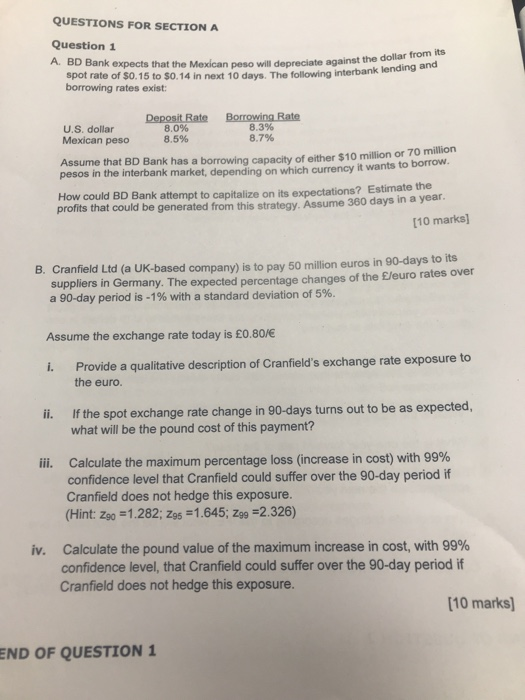

QUESTIONS FOR SECTION A Question1 A. BD Bank expects that the Mexican peso will depreciate against the dollar from its spot rate of $0.15 to $0.14 in next 10 days. borrowing rates exist The following interbank lending and U.S. dollar Mexican peso 8.0% 8.5% 8.3% 8.7% Assume that BD Bank has a borrowing capacity of either pesos in the interbank market, depending on which currency it wants to million ro . $10 million or 70 How could BD Bank attempt to capitalize on its expectations? Estimate the profits that could be generated from this strategy. Assume 360 days in a year. [10 marks] B. Cranfield Ltd (a UK-based company) is to pay 50 million euros in 90-days to its suppliers in Germany. The expected percentage changes of the /euro rates over a 90-day period is-1% with a standard deviation of 5%. Assume the exchange rate today is 0.80/ i. Provide a qualitative description of Cranfield's exchange rate exposure to i. If the spot exchange rate change in 90-days turns out to be as expected, the euro. what will be the pound cost of this payment? Calculate the maximum percentage loss (increase in cost) with 99% confidence level that Cranfield could suffer over the 90-day period if Cranfield does not hedge this exposure. (Hint: Zg.-1.282, 295 1.645; Z99-2326) iii. Calculate the pound value of the maximum increase in cost, with 99% confidence level, that Cranfield could suffer over the 90-day period if iv. Cranfield does not hedge this exposure. 10 marks ND OF QUESTION 1 QUESTIONS FOR SECTION A Question1 A. BD Bank expects that the Mexican peso will depreciate against the dollar from its spot rate of $0.15 to $0.14 in next 10 days. borrowing rates exist The following interbank lending and U.S. dollar Mexican peso 8.0% 8.5% 8.3% 8.7% Assume that BD Bank has a borrowing capacity of either pesos in the interbank market, depending on which currency it wants to million ro . $10 million or 70 How could BD Bank attempt to capitalize on its expectations? Estimate the profits that could be generated from this strategy. Assume 360 days in a year. [10 marks] B. Cranfield Ltd (a UK-based company) is to pay 50 million euros in 90-days to its suppliers in Germany. The expected percentage changes of the /euro rates over a 90-day period is-1% with a standard deviation of 5%. Assume the exchange rate today is 0.80/ i. Provide a qualitative description of Cranfield's exchange rate exposure to i. If the spot exchange rate change in 90-days turns out to be as expected, the euro. what will be the pound cost of this payment? Calculate the maximum percentage loss (increase in cost) with 99% confidence level that Cranfield could suffer over the 90-day period if Cranfield does not hedge this exposure. (Hint: Zg.-1.282, 295 1.645; Z99-2326) iii. Calculate the pound value of the maximum increase in cost, with 99% confidence level, that Cranfield could suffer over the 90-day period if iv. Cranfield does not hedge this exposure. 10 marks ND OF QUESTION 1