questions from 14-18 please

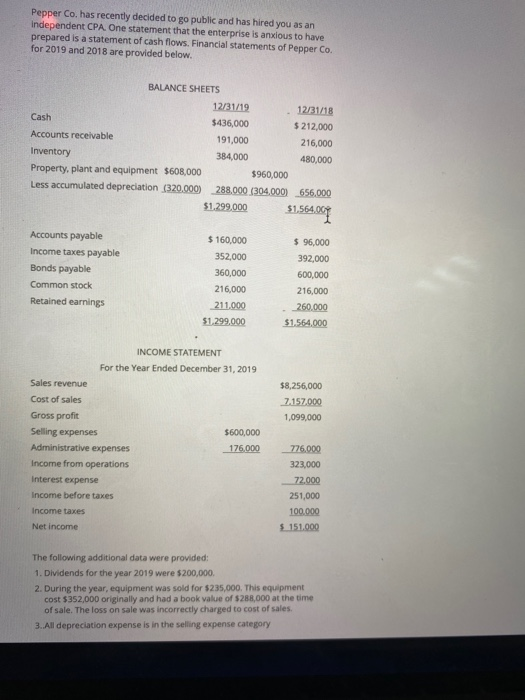

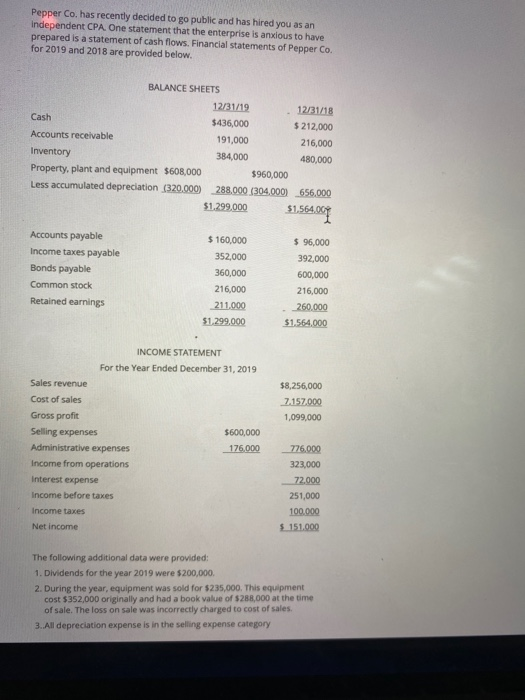

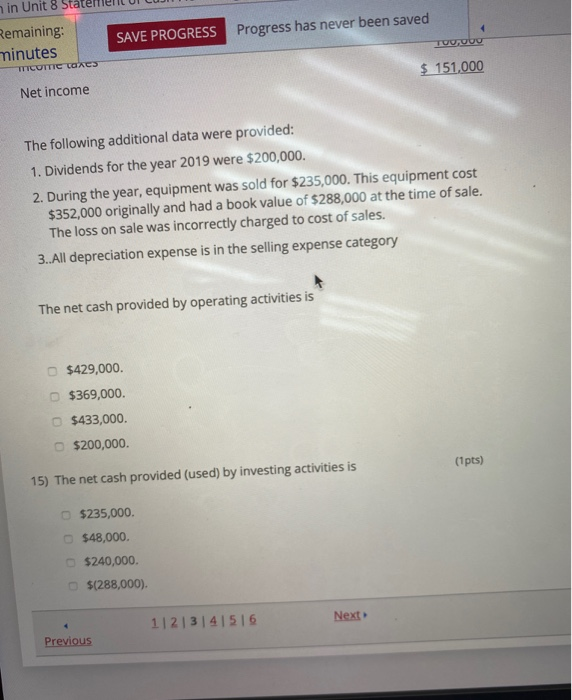

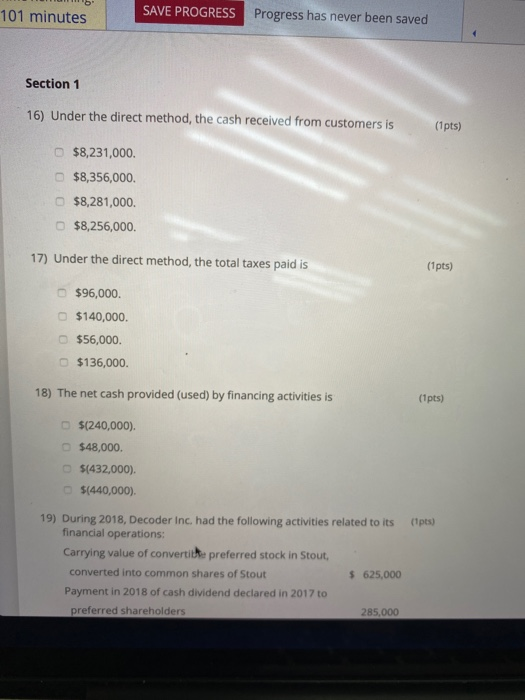

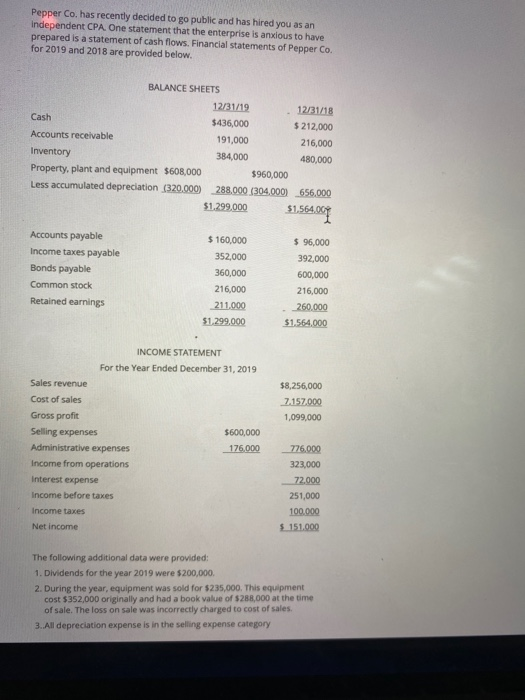

Pepper Co. has recently decided to go public and has hired you as an Independent CPA. One statement that the enterprise is andous to have prepared is a statement of cash flows. Financial statements of Pepper Co. for 2019 and 2018 are provided below. BALANCE SHEETS 12/31/19 12/31/18 Cash $436,000 $ 212,000 Accounts receivable 191,000 216,000 Inventory 384,000 480,000 Property, plant and equipment $608,000 $960,000 Less accumulated depreciation (320.000) 288.000 (304,000) 656.000 $1.299.000 $1,564.002 Accounts payable Income taxes payable Bonds payable Common stock Retained earnings $ 160,000 352,000 360,000 216,000 211.000 $1.299.000 $ 96,000 392,000 600,000 216,000 260.000 $1.564.000 INCOME STATEMENT For the Year Ended December 31, 2019 Sales revenue $8,256,000 7.157.000 1,099,000 $600,000 176.000 Cost of sales Gross profit Selling expenses Administrative expenses Income from operations Interest expense Income before taxes Income taxes Net income 776,000 323,000 72,000 251,000 100.000 $ 151,000 The following additional data were provided: 1. Dividends for the year 2019 were $200,000 2. During the year, equipment was sold for $235,000. This equipment cost $352,000 originally and had a book value of $288,000 at the time of sale. The loss on sale was incorrectly charged to cost of sales 3. All depreciation expense is in the selling expense category in Unit 8 Stal Remaining: minutes SAVE PROGRESS Progress has never been saved TUO,000 TCUTTIC COACS $ 151,000 Net income The following additional data were provided: 1. Dividends for the year 2019 were $200,000. 2. During the year, equipment was sold for $235,000. This equipment cost $352,000 originally and had a book value of $288,000 at the time of sale. The loss on sale was incorrectly charged to cost of sales. 3.All depreciation expense is in the selling expense category The net cash provided by operating activities is $429,000. $369,000. $433,000. $200,000 (1 pts) 15) The net cash provided (used) by investing activities is $235,000. $48,000. $240,000 $(288,000) 11213141516 Next Previous 101 minutes SAVE PROGRESS Progress has never been saved Section 1 16) Under the direct method, the cash received from customers is (1pts) $8,231,000 $8,356,000 $8,281,000 $8,256,000 17) Under the direct method, the total taxes paid is (1 pts) $96,000 $140,000 $56,000. $136,000. 18) The net cash provided (used) by financing activities is (1pts) $(240,000) $48,000. $(432,000). 5(440,000). (1 pts) 19) During 2018, Decoder Inc. had the following activities related to its financial operations: Carrying value of convertithe preferred stock in Stout converted into common shares of Stout $ 625,000 Payment in 2018 of cash dividend declared in 2017 to preferred shareholders 285,000