Questions from Coorporate FinanceFinancial Reportingplease answer it by typing(not handwriting) thx a lot, and please give specific details and if give out sheets if neccesary!

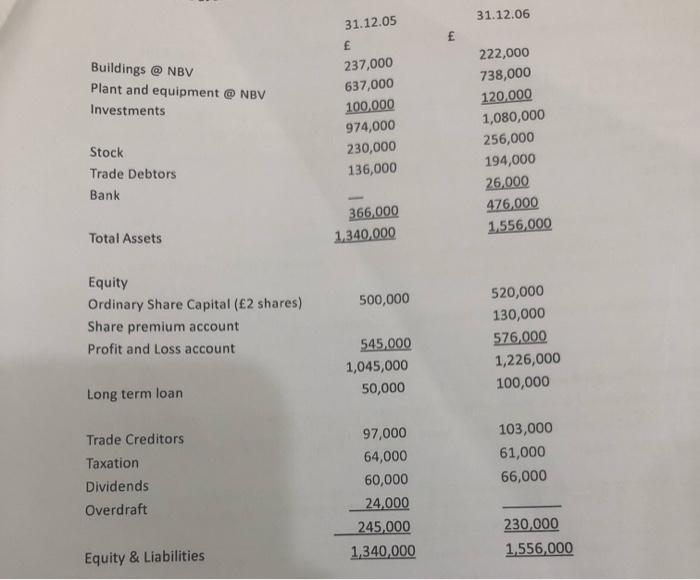

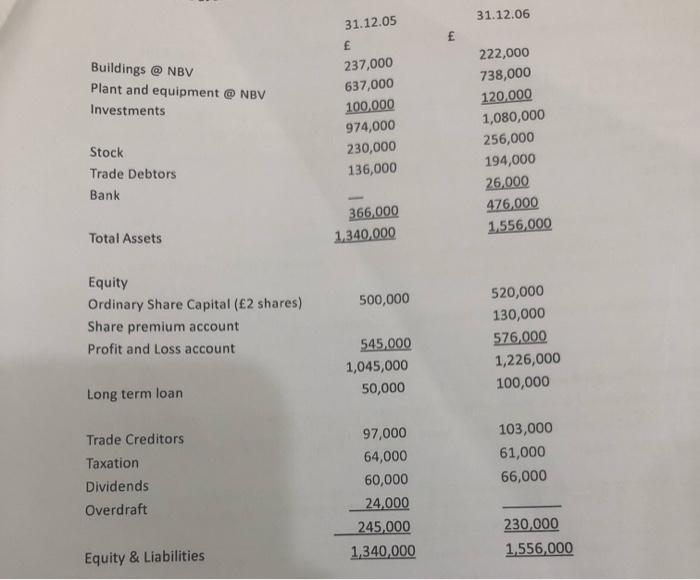

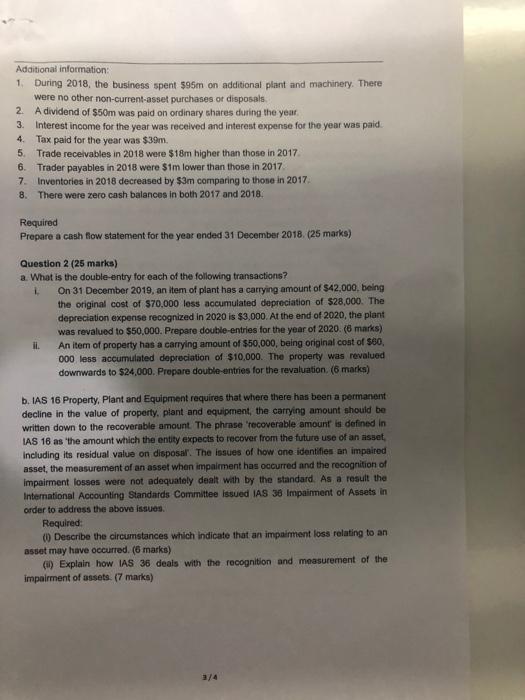

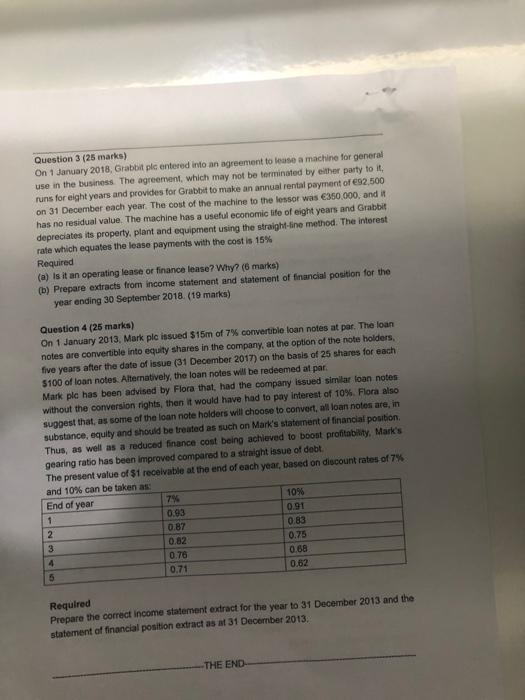

31.12.06 Buildings @ NBV Plant and equipment @ NBV Investments 31.12.05 E 237,000 637,000 100,000 974,000 230,000 136,000 222,000 738,000 120,000 1,080,000 256,000 194,000 26,000 476,000 1,556,000 Stock Trade Debtors Bank 366,000 1.340.000 Total Assets 500,000 Equity Ordinary Share Capital (2 shares) Share premium account Profit and Loss account 545,000 1,045,000 50,000 520,000 130,000 576.000 1,226,000 100,000 Long term loan Trade Creditors Taxation Dividends Overdraft 103,000 61,000 66,000 97,000 64,000 60,000 24,000 245,000 1,340,000 230,000 1,556,000 Equity & Liabilities Additional information: 1. During 2018, the business spent $95m on additional plant and machinery. There were no other non-current-asset purchases or disposals 2. A dividend of $50m was paid on ordinary shares during the year 3. Interest income for the year was received and interest expense for the year was paid. 4. Tax paid for the year was $39m. 5. Trade receivables in 2018 were $18m higher than those in 2017 6. Trader payables in 2018 were $1m lower than those in 2017 7. Inventories in 2018 decreased by $3m comparing to those in 2017 8. There were zero cash balances in both 2017 and 2018 Required Prepare a cash flow statement for the year ended 31 December 2018 (25 marks) Question 2 (25 marks) a. What is the double-entry for each of the following transactions? On 31 December 2019, an item of plant has a carrying amount of $42.000, being the original cost of $70,000 less accumulated depreciation of $28,000. The depreciation expense recognized in 2020 is $3,000. At the end of 2020, the plant was revalued to $50,000. Prepare double-entries for the year of 2020. (8 marks) II. An item of property has a carrying amount of $50,000, being original cost of $60, 000 less accumulated depreciation of $10,000. The property was revalued downwards to $24,000. Prepare double-entries for the revaluation. (6 marks) b. IAS 16 Property, Plant and Equipment requires that where there has been a permanent decline in the value of property, plant and equipment, the carrying amount should be written down to the recoverable amount. The phrase "recoverable amount is defined in IAS 16 as the amount which the entity expects to recover from the future use of an asset, Including its residual value on disposal. The issues of how one identifies an impaired asset, the measurement of an asset when impairment has occurred and the recognition of impairment losses were not adequately dealt with by the standard. As a result the International Accounting Standards Committee issued IAS 36 Impairment of Assets in order to address the above issues Required: (0) Describe the circumstances which indicate that an impairment loss relating to an asset may have occurred. (6 marks) (I) Explain how IAS 36 deals with the recognition and measurement of the impairment of assets. (7 marks) 3/4 Question 3 (25 marks) On 1 January 2018, Grabbit ple entered into an agreement to ease a machine for general use in the business. The agreement, which may not be terminated by either party to it, runs for eight years and provides for Grabbit to make an annual rental payment of 92,500 on 31 December each year. The cost of the machine to the lessor was 350,000, and it has no residual value. The machine has a useful economic life of eight years and Grabbit depreciates its property, plant and equipment using the straight-line method. The interest rate which equates the lease payments with the cost is 15% Required (a) Is it an operating lease or finance lease? Why? (6 marks) (b) Prepare extracts from income statement and statement of financial position for the year ending 30 September 2018 (19 marks) Question 4 (26 marks) On 1 January 2013, Mark ple issued $15m of 7% convertible loan notes at par. The loan notes are convertible into equity shares in the company, at the option of the note holders, five years after the date of issue (31 December 2017) on the basis of 25 shares for each $100 of loan notes. Alternatively, the loan notes will be redeemed at par Mark plc has been advised by Flora that had the company issued similar loan notes without the conversion rights, then it would have had to pay interest of 10%. Flora also suggest that, as some of the loan note holders will choose to convert, all loan notes are, in substance, equity and should be treated as such on Mark's statement of financial position Thus, as well as a reduced finance cost being achieved to boost profitability. Mark's gearing ratio has been improved compared to a straight issue of debt The present value of $1 receivable at the end of each year, based on discount rates of 7% and 10% can be taken at End of year 7% 10% 1 0.91 2 0.87 0.83 3 0.82 0.75 4 0.76 0.68 5 0.71 0.62 0.93 Required Prepare the correct income statement extract for the year to 31 December 2013 and the statement of financial position extract as at 31 December 2013 THE END 31.12.06 Buildings @ NBV Plant and equipment @ NBV Investments 31.12.05 E 237,000 637,000 100,000 974,000 230,000 136,000 222,000 738,000 120,000 1,080,000 256,000 194,000 26,000 476,000 1,556,000 Stock Trade Debtors Bank 366,000 1.340.000 Total Assets 500,000 Equity Ordinary Share Capital (2 shares) Share premium account Profit and Loss account 545,000 1,045,000 50,000 520,000 130,000 576.000 1,226,000 100,000 Long term loan Trade Creditors Taxation Dividends Overdraft 103,000 61,000 66,000 97,000 64,000 60,000 24,000 245,000 1,340,000 230,000 1,556,000 Equity & Liabilities Additional information: 1. During 2018, the business spent $95m on additional plant and machinery. There were no other non-current-asset purchases or disposals 2. A dividend of $50m was paid on ordinary shares during the year 3. Interest income for the year was received and interest expense for the year was paid. 4. Tax paid for the year was $39m. 5. Trade receivables in 2018 were $18m higher than those in 2017 6. Trader payables in 2018 were $1m lower than those in 2017 7. Inventories in 2018 decreased by $3m comparing to those in 2017 8. There were zero cash balances in both 2017 and 2018 Required Prepare a cash flow statement for the year ended 31 December 2018 (25 marks) Question 2 (25 marks) a. What is the double-entry for each of the following transactions? On 31 December 2019, an item of plant has a carrying amount of $42.000, being the original cost of $70,000 less accumulated depreciation of $28,000. The depreciation expense recognized in 2020 is $3,000. At the end of 2020, the plant was revalued to $50,000. Prepare double-entries for the year of 2020. (8 marks) II. An item of property has a carrying amount of $50,000, being original cost of $60, 000 less accumulated depreciation of $10,000. The property was revalued downwards to $24,000. Prepare double-entries for the revaluation. (6 marks) b. IAS 16 Property, Plant and Equipment requires that where there has been a permanent decline in the value of property, plant and equipment, the carrying amount should be written down to the recoverable amount. The phrase "recoverable amount is defined in IAS 16 as the amount which the entity expects to recover from the future use of an asset, Including its residual value on disposal. The issues of how one identifies an impaired asset, the measurement of an asset when impairment has occurred and the recognition of impairment losses were not adequately dealt with by the standard. As a result the International Accounting Standards Committee issued IAS 36 Impairment of Assets in order to address the above issues Required: (0) Describe the circumstances which indicate that an impairment loss relating to an asset may have occurred. (6 marks) (I) Explain how IAS 36 deals with the recognition and measurement of the impairment of assets. (7 marks) 3/4 Question 3 (25 marks) On 1 January 2018, Grabbit ple entered into an agreement to ease a machine for general use in the business. The agreement, which may not be terminated by either party to it, runs for eight years and provides for Grabbit to make an annual rental payment of 92,500 on 31 December each year. The cost of the machine to the lessor was 350,000, and it has no residual value. The machine has a useful economic life of eight years and Grabbit depreciates its property, plant and equipment using the straight-line method. The interest rate which equates the lease payments with the cost is 15% Required (a) Is it an operating lease or finance lease? Why? (6 marks) (b) Prepare extracts from income statement and statement of financial position for the year ending 30 September 2018 (19 marks) Question 4 (26 marks) On 1 January 2013, Mark ple issued $15m of 7% convertible loan notes at par. The loan notes are convertible into equity shares in the company, at the option of the note holders, five years after the date of issue (31 December 2017) on the basis of 25 shares for each $100 of loan notes. Alternatively, the loan notes will be redeemed at par Mark plc has been advised by Flora that had the company issued similar loan notes without the conversion rights, then it would have had to pay interest of 10%. Flora also suggest that, as some of the loan note holders will choose to convert, all loan notes are, in substance, equity and should be treated as such on Mark's statement of financial position Thus, as well as a reduced finance cost being achieved to boost profitability. Mark's gearing ratio has been improved compared to a straight issue of debt The present value of $1 receivable at the end of each year, based on discount rates of 7% and 10% can be taken at End of year 7% 10% 1 0.91 2 0.87 0.83 3 0.82 0.75 4 0.76 0.68 5 0.71 0.62 0.93 Required Prepare the correct income statement extract for the year to 31 December 2013 and the statement of financial position extract as at 31 December 2013 THE END