Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questions: Go to Finra org and find the yield to maturity for each of Dell's bonds with issuer name DELL INC (ignore the other issue

questions:

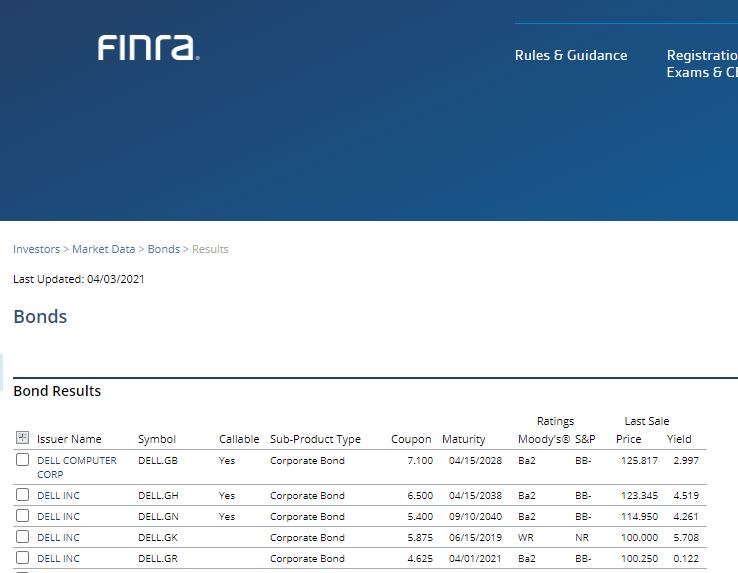

- Go to Finra org and find the yield to maturity for each of Dell's bonds with issuer name DELL INC (ignore the other issue under a different issuer name)

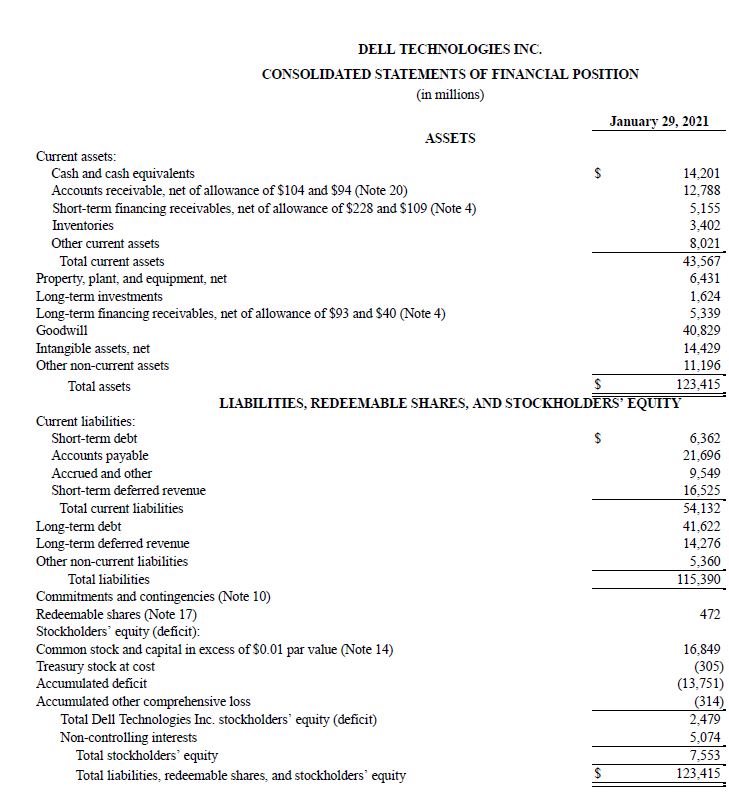

- What is the weighted average cost of debt for Dell using the book value weights and using the market value weights?

- Does it make a difference in this case if you use book value weights or market value weights?

- Calculate this using book value weights and market value weights, assuming Dell has a 35 percent marginal tax rate.

- Which number is more relevant?

Below are some references that might help answer the questions.

DELL TECHNOLOGIES INC. CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (in millions) January 29, 2021 ASSETS Current assets: Cash and cash equivalents $ 14,201 Accounts receivable, net of allowance of $104 and $94 (Note 20) 12,788 Short-term financing receivables, net of allowance of $228 and $109 (Note 4) 5,155 Inventories Other current assets Total current assets 3,402 8.021 43,567 Property, plant, and equipment, net Long-term investments Long-term financing receivables, net of allowance of $93 and $40 (Note 4) Goodwill Intangible assets, net 6.431 1,624 5,339 40,829 14,429 Other non-current assets Total assets Current liabilities: Short-term debt 11,196 $ 123,415 LIABILITIES, REDEEMABLE SHARES, AND STOCKHOLDERS' EQUITY SA $ 6,362 Accounts payable 21,696 Accrued and other Short-term deferred revenue Total current liabilities Long-term debt 9.549 16,525 54,132 41,622 Long-term deferred revenue 14,276 Other non-current liabilities 5,360 Total liabilities 115,390 Commitments and contingencies (Note 10) Redeemable shares (Note 17) 472 Stockholders' equity (deficit): Common stock and capital in excess of $0.01 par value (Note 14) 16,849 Treasury stock at cost (305) Accumulated deficit (13,751) Accumulated other comprehensive loss (314) Total Dell Technologies Inc. stockholders' equity (deficit) Non-controlling interests 2,479 5,074 Total stockholders' equity 7,553 Total liabilities, redeemable shares, and stockholders' equity 123,415

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions we will first gather information about Dells bonds from the data provided 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started