Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTIONS Is the derivatives program at Link Technologies reducing risk? Are Ms. Cohens arguments correct, or is the program performing as expected? What impact, if

QUESTIONS

- Is the derivatives program at Link Technologies reducing risk? Are Ms. Cohens arguments correct, or is the program performing as expected?

- What impact, if any, does the corporate culture have on the implementation of the derivatives program at Link Technologies? How should the programs success or failure be judged?

[*] Copyright Ananth Madhavan, 1994. This case was developed for teaching purposes at the School of Business Administration at the University of Southern California; please do not reproduce or use without permission.

Please do the excel analysis for the two questions. Thanks

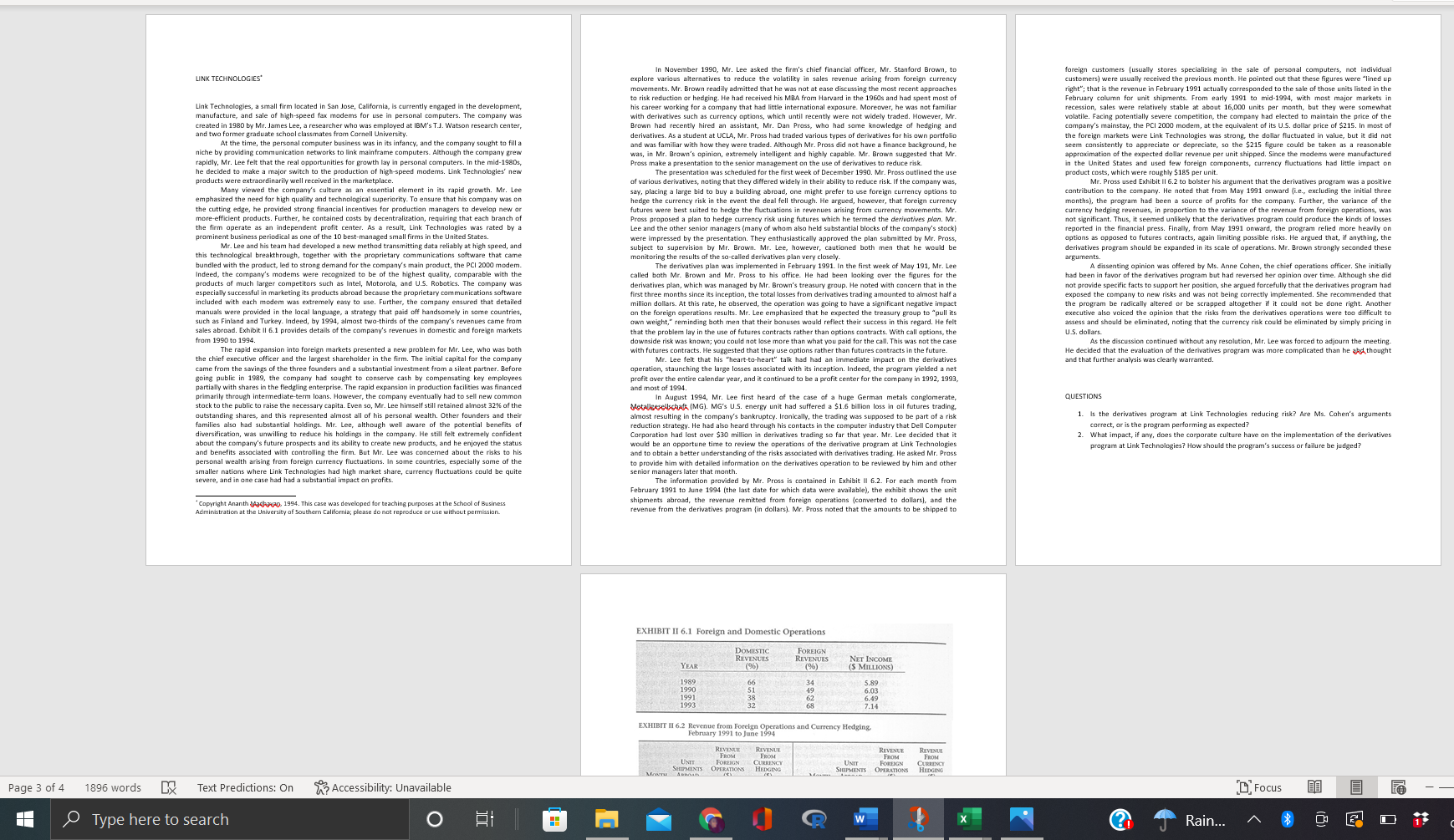

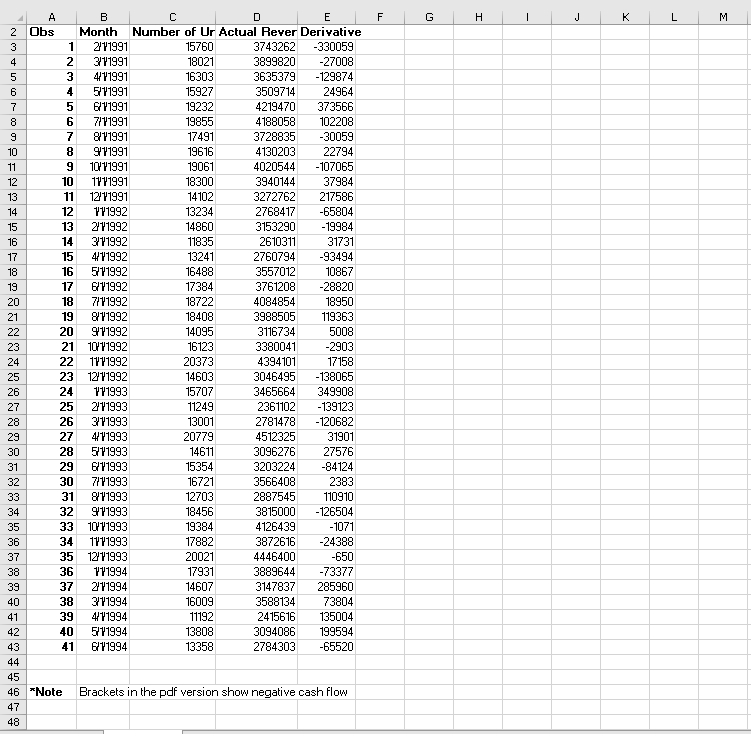

LINK TECHNOLOGIES movements, Mr Link Technologies, a small firm located in San Jose, California, is currently engaged in the development, manufacture, and sale of high-speed fax modems for use in personal computers. The company was created in 1980 by Mr. James Lee, a researcher who was employed at IBM's T.J. Watson research center, and two former graduate school classmates from Cornell University. At the time, the personal computer business was in its infancy, and the company sought to fill a niche by providing communication networks to link mainframe computers. Although the company grew rapidly, Mr. Lee felt that the real opportunities for growth lay in personal computers. In the mid-1980s, he decided to make a major switch to the production of high-speed modems. Link Technologies' new products were extraordinarily well received in the marketplace. Many viewed the company's culture as an essential element in its rapid growth. Mr. Lee emphasized the need for high quality and technological superiority. To ensure that his company was on the cutting edge, he provided strong financial incentives for production managers to develop new or more efficient products. Further, he contained costs by decentralization, requiring that each branch of the firm operate as an independent profit center. As a result, Link Technologies was rated by a prominent business periodical as one of the 10 best-managed small firms in the United States. Mr. Lee and his team had developed a new method transmitting data reliably at high speed, and this technological breakthrough, together with the proprietary communications software that came bundled with the product, led to strong demand for the company's main product, the PCI 2000 modem. Indeed, the company's madems were recognized to be of the highest quality, comparable with the products of much larger competitors such as Intel, Motorola, and U.S. Robotics. The company was especially successful in marketing its products abroad because the proprietary communications software included with each modem was extremely easy to use. Further, the company ensured that detailed manuals were provided in the local language, a strategy that paid off handsomely in some countries, such as Finland and Turkey. Indeed, by 1994, almost two-thirds of the company's revenues came from sales abroad. Exhibit II 6.1 provides details of the company's revenues in domestic and foreign markets from 1990 to 1994 The rapid expansion into foreign markets presented a new problem for Mr. Lee, who was both the chief executive officer and the largest shareholder in the firm. The initial capital for the company came from the savings of the three founders and a substantial investment from a silent partner. Before going public in 1989, the company had sought to conserve cash by compensating key employees partially with sha in the fledgling enterprise. The rapid expansion in production facilities financed primarily through intermediate-term loans. However, the company eventually had to sell new common stock to the public to raise the necessary capita. Even so, Mr. Lee himself still retained almost 32% of the outstanding shares, and this represented almost all of his personal wealth. Other founders and their families also had substantial holdings. Mr. Lee, although well aware of the potential benefits of diversification, was unwilling to reduce his holdings in the company. He still felt extremely confident about the company's future prospects and its ability to create new products, and he enjoyed the status and benefits associated with controlling the firm. But Mr. Lee was concerned about the risks to his personal wealth arising from foreign currency fluctuations. In some countries, especially some of the smaller nations where Link Technologies had high market share, currency fluctuations could be quite severe, and in one case had had a substantial impact on profits. In November 1990, Mr. Lee asked the firm's chief financial officer, Mr. Stanford Brown, to explore various alternatives to reduce the volatility in sales revenue arising from foreign currency Ir. Brown readily admitted that he w e was not at ease discussing the most recent approaches to risk reduction or hedging. He had received his MBA from Harvard in the 1960s and had spent most of his career working for a company that had little international exposure. Moreover, he was not familiar with derivatives such as currency options, which until recently were not widely traded. However, Mr. Brown had recently hired an assistant, Mr. Dan Prass, who had some knowledge of hedging and derivatives. As a student at UCLA, Mr. Pross had traded various types of derivatives for his own portfolio and was familiar with how they were traded. Although Mr. Pross did not have a finance background, he was, in Mr. Brown's opinion, extremely intelligent and highly capable. Mr. Brown suggested that Mr. Prass make a presentation to the senior management on the use of derivatives to reduce risk The presentation was scheduled for the first week of December 1990. Mr. Pross outlined the use of various derivatives, nating that they differed widely in their ability to reduce risk. If the company was, say, placing a large bid to buy a building abroad, one might prefer to use foreign currency options to hedge the currency risk in the event the deal fell through. He argued, however, that foreign currency futures were best suited to hedge the fluctuations in revenues arising from currency movements. Mr. Prass proposed a plan to hedge currency risk using futures which he termed the derivatives plan. Mr. Lee and the other senior managers (many of whom also held substantial blocks of the company's stock) were impressed by the presentation. They enthusiastically approved the plan submitted by Mr. Pross, subject to supervision by Mr. Brown. Mr. however, cautioned both men that he would be monitoring the results of the so-called derivatives plan very closely The derivatives plan was implemented in February 1991. In the first week of May 191, Mr. Lee called both Mr. Brown and Mr. Pross to his office. He had been looking over the figures for the derivatives plan, which was managed by Mr. Brown's treasury group. He noted with concern that in the first three months since its inception, the total losses from derivatives trading amounted to almost half a million dollars. At this rate, he observed, the operation was going to have a significant negative impact on the foreign operations results. Mr. Lee emphasized that he expected the treasury group to pull its own weight," reminding both men that their bonuses would reflect their success in this reg s regard. He felt that the problem lay in the use of futures contracts rather than options contracts. With call options, the downside risk was known; you could not lose more than what you paid for the call. This was not the case with futures contracts. He suggested that they use options rather than futures contracts in the future. Mr. Lee felt that his "heart-to-heart" talk had had an immediate impact on the derivatives operation, staunching the large losses associated with its inception. Indeed, the program yielded a net profit over the entire calendar year, and it continued to be a profit center for the company in 1992, 1993, and most of 1994. In August 1994, Mr. Lee first heard of the case of a huge German metals conglomerate, Metallereschat. (MG), MG's U.S. energy unit had suffered a $1.6 billion loss in oil futures trading almost resulting in the company's bankruptcy. Ironically, the trading was supposed to be part of a risk reduction strategy. He had also heard through his contacts in the computer industry that Dell Computer Corporation had lost over $30 million in derivatives trading so far that year. Mr. Lee decided that it would be an opportune time to review the operations of the derivative program at Link Technologies and to obtain a better understanding of the risks associated with derivatives trading. He asked Mr. Press to provide him with detailed information on the derivatives operation to be reviewed by him and other senior managers later that month. The information provided by Mr. Pross is contained in Exhibit II 6.2. For each month from February 1991 to June 1994 (the last date for which data were available), the exhibit shows the unit shipments abroad, the revenue remitted from foreign operations (converted to dollars), and the revenue from the derivatives program in dollars). Mr. Pross noted that the amounts to be shipped to foreign customers (usually stores specializing in the sale of personal computers, not individual customers) were usually received the previous month. He pointed out that these figures were "lined up right"; that is the revenue in February 1991 actually corresponded to the sale of those units listed in the February column for unit shipments. From early 1991 to mid-1994, with most major markets in recession, sales were relatively stable at about 16,000 units per month, but they were somewhat volatile. Facing potentially severe competition, the company had elected to maintain the price of the company's mainstay, the PCI 2000 modem, at the equivalent of its U.S. dollar price of $215. In most of the foreign markets were Link Technologies was strong, the dollar fluctuated in value, but it did not seem consistently to appreciate or depreciate, sa the $215 figure could be taken as a reasonable approximation of the expected dollar revenue per unit shipped. Since the modems were manufactured in the United States and used few foreign components, currency fluctuations had little impact on praduct costs, which were roughly $185 per unit. Mr. Pross used Exhibit 11 6.2 to bolster his argument that the derivatives program was a positive contribution to the company. He noted that from May 1991 onward (ie., excluding the initial three months), the program had been a source of profits for the company. Further, the variance of the currency hedging revenues, in proportion to the variance of the revenue from foreign operations, was not significant. Thus, it seemed unlikely that the derivatives program could produce the kinds of losses reported in the financial press. Finally, from May 1991 onward, the program relied more heavily on options as opposed to futures contracts, again limiting possible risks. He argued that, if anything, the derivatives program should be expanded in its scale of operations. Mr. Brown strongly seconded these arguments A dissenting opinion was offered by Ms. Anne Cohen, the chief operations officer. She initially had been in favor of the derivatives program but had reversed her opinion over time. Although she did not provide specific facts to support her position, she argued forcefully that the derivatives program had exposed the company to new risks and was not being correctly implemented. She recommended that the program be radically altered or be scrapped altogether if it could not be done right. Another executive also voiced the opinion that the risks from the derivatives operations were too difficult to assess and should be eliminated, noting that the currency risk could be eliminated by simply pricing in U.S. dollars As the discussion continued without any resolution, Mr. Lee was forced to adjourn the meeting He decided that the evaluation of the derivatives program was more complicated than he and thought and that further analysis was clearly warranted. QUESTIONS 1. is the derivatives program at Link Technologies reducing risk? Are Ms. Cohen's arguments correct, or is the program performing as expected? 2. What impact, if any, does the corporate culture have on the implementation of the derivatives program at Link Technologies? How should the program's success or failure be judged? Copyright Ananth Aadhav, 1994. This case was developed for teaching purposes at the School of Business Administration at the University of Southern California, please do not reproduce or use without permission. EXHIBIT II 6.1 Foreign and Domestic Operations DOMESTIC FOREIGN REVENUES REVENUES YEAR (96) (96) NET INCOME (S MILLIONS) 34 49 1990 1991 51 98 5.89 6.03 6.49 7.14 1993 68 EXHIBIT II 6.2 Revenue from Foreign Operations and Currency Hedging February 1991 to June 1994 REVENUE REVENUE To REVENUE UNT FOREIGN CURRENCY FROM Hansen UNIT ONIT FOREIGN More SNIS OPERATIONS HEGING SHIPMENTS OPERATIONS REVENUE FROM CURRENCY HEDGING Page 3 of 4 1896 words Text Predictions: On Accessibility: Unavailable Focus 20 IH Type here to search O Rain... (8) C F G H . - J J K K L M A B C D E 2 Obs Month Number of Ur Actual Rever Derivative 3 1 211991 15760 3743262 -330059 4 2 3171991 18021 3899820 -27008 5 3 4/11991 16303 3635379 -129874 6 4 5171991 15927 3509714 24964 7 5 6/11991 19232 4219470 373566 8 6 7171991 19855 4188058 102208 9 7 8171991 17491 3728835 -30059 10 8 911991 19616 4130203 22794 11 9 10/11991 19061 4020544 -107065 12 10 1141991 18300 3940144 37984 13 11 12/11991 14102 3272762 217586 14 12 191992 13234 2768417 -65804 15 13 211992 14860 3153290 -19984 16 14 3111992 11835 2610311 31731 17 15 4/11992 13241 2760794 -93494 18 16 5171992 16488 3557012 10867 19 17 6/11992 17384 3761208 -28820 20 18 7171992 18722 4084854 18950 21 19 8111992 18408 3988505 119363 22 20 911992 14095 3116734 5008 23 21 10/11992 16123 3380041 -2903 24 22 1171992 20373 4394101 17158 25 23 12/11992 14603 3046495 -138065 26 24 171993 15707 3465664 349908 27 25 2171993 11249 2361102 -139123 28 26 3111993 13001 2781478 -120682 29 27 4/11993 20779 4512325 31901 30 28 5171993 14611 3096276 27576 31 29 6/11993 15354 3203224 -84124 32 30 7171993 16721 3566408 2383 33 31 8171993 12703 2887545 110910 34 32 911993 18456 3815000 -126504 35 33 10/11993 19384 4126439 -1071 36 34 1171993 17882 3872616 -24388 37 35 12111993 20021 4446400 -650 38 36 111994 17931 3889644 -73377 39 37 2111994 14607 3147837 285960 40 38 3171994 16009 3588134 73804 41 39 411994 11192 2415616 135004 42 40 5171994 13808 3094086 199594 43 41 6/11994 13358 2784303 -65520 44 45 46 *Note Brackets in the pdf version show negative cash flow 47 48 LINK TECHNOLOGIES movements, Mr Link Technologies, a small firm located in San Jose, California, is currently engaged in the development, manufacture, and sale of high-speed fax modems for use in personal computers. The company was created in 1980 by Mr. James Lee, a researcher who was employed at IBM's T.J. Watson research center, and two former graduate school classmates from Cornell University. At the time, the personal computer business was in its infancy, and the company sought to fill a niche by providing communication networks to link mainframe computers. Although the company grew rapidly, Mr. Lee felt that the real opportunities for growth lay in personal computers. In the mid-1980s, he decided to make a major switch to the production of high-speed modems. Link Technologies' new products were extraordinarily well received in the marketplace. Many viewed the company's culture as an essential element in its rapid growth. Mr. Lee emphasized the need for high quality and technological superiority. To ensure that his company was on the cutting edge, he provided strong financial incentives for production managers to develop new or more efficient products. Further, he contained costs by decentralization, requiring that each branch of the firm operate as an independent profit center. As a result, Link Technologies was rated by a prominent business periodical as one of the 10 best-managed small firms in the United States. Mr. Lee and his team had developed a new method transmitting data reliably at high speed, and this technological breakthrough, together with the proprietary communications software that came bundled with the product, led to strong demand for the company's main product, the PCI 2000 modem. Indeed, the company's madems were recognized to be of the highest quality, comparable with the products of much larger competitors such as Intel, Motorola, and U.S. Robotics. The company was especially successful in marketing its products abroad because the proprietary communications software included with each modem was extremely easy to use. Further, the company ensured that detailed manuals were provided in the local language, a strategy that paid off handsomely in some countries, such as Finland and Turkey. Indeed, by 1994, almost two-thirds of the company's revenues came from sales abroad. Exhibit II 6.1 provides details of the company's revenues in domestic and foreign markets from 1990 to 1994 The rapid expansion into foreign markets presented a new problem for Mr. Lee, who was both the chief executive officer and the largest shareholder in the firm. The initial capital for the company came from the savings of the three founders and a substantial investment from a silent partner. Before going public in 1989, the company had sought to conserve cash by compensating key employees partially with sha in the fledgling enterprise. The rapid expansion in production facilities financed primarily through intermediate-term loans. However, the company eventually had to sell new common stock to the public to raise the necessary capita. Even so, Mr. Lee himself still retained almost 32% of the outstanding shares, and this represented almost all of his personal wealth. Other founders and their families also had substantial holdings. Mr. Lee, although well aware of the potential benefits of diversification, was unwilling to reduce his holdings in the company. He still felt extremely confident about the company's future prospects and its ability to create new products, and he enjoyed the status and benefits associated with controlling the firm. But Mr. Lee was concerned about the risks to his personal wealth arising from foreign currency fluctuations. In some countries, especially some of the smaller nations where Link Technologies had high market share, currency fluctuations could be quite severe, and in one case had had a substantial impact on profits. In November 1990, Mr. Lee asked the firm's chief financial officer, Mr. Stanford Brown, to explore various alternatives to reduce the volatility in sales revenue arising from foreign currency Ir. Brown readily admitted that he w e was not at ease discussing the most recent approaches to risk reduction or hedging. He had received his MBA from Harvard in the 1960s and had spent most of his career working for a company that had little international exposure. Moreover, he was not familiar with derivatives such as currency options, which until recently were not widely traded. However, Mr. Brown had recently hired an assistant, Mr. Dan Prass, who had some knowledge of hedging and derivatives. As a student at UCLA, Mr. Pross had traded various types of derivatives for his own portfolio and was familiar with how they were traded. Although Mr. Pross did not have a finance background, he was, in Mr. Brown's opinion, extremely intelligent and highly capable. Mr. Brown suggested that Mr. Prass make a presentation to the senior management on the use of derivatives to reduce risk The presentation was scheduled for the first week of December 1990. Mr. Pross outlined the use of various derivatives, nating that they differed widely in their ability to reduce risk. If the company was, say, placing a large bid to buy a building abroad, one might prefer to use foreign currency options to hedge the currency risk in the event the deal fell through. He argued, however, that foreign currency futures were best suited to hedge the fluctuations in revenues arising from currency movements. Mr. Prass proposed a plan to hedge currency risk using futures which he termed the derivatives plan. Mr. Lee and the other senior managers (many of whom also held substantial blocks of the company's stock) were impressed by the presentation. They enthusiastically approved the plan submitted by Mr. Pross, subject to supervision by Mr. Brown. Mr. however, cautioned both men that he would be monitoring the results of the so-called derivatives plan very closely The derivatives plan was implemented in February 1991. In the first week of May 191, Mr. Lee called both Mr. Brown and Mr. Pross to his office. He had been looking over the figures for the derivatives plan, which was managed by Mr. Brown's treasury group. He noted with concern that in the first three months since its inception, the total losses from derivatives trading amounted to almost half a million dollars. At this rate, he observed, the operation was going to have a significant negative impact on the foreign operations results. Mr. Lee emphasized that he expected the treasury group to pull its own weight," reminding both men that their bonuses would reflect their success in this reg s regard. He felt that the problem lay in the use of futures contracts rather than options contracts. With call options, the downside risk was known; you could not lose more than what you paid for the call. This was not the case with futures contracts. He suggested that they use options rather than futures contracts in the future. Mr. Lee felt that his "heart-to-heart" talk had had an immediate impact on the derivatives operation, staunching the large losses associated with its inception. Indeed, the program yielded a net profit over the entire calendar year, and it continued to be a profit center for the company in 1992, 1993, and most of 1994. In August 1994, Mr. Lee first heard of the case of a huge German metals conglomerate, Metallereschat. (MG), MG's U.S. energy unit had suffered a $1.6 billion loss in oil futures trading almost resulting in the company's bankruptcy. Ironically, the trading was supposed to be part of a risk reduction strategy. He had also heard through his contacts in the computer industry that Dell Computer Corporation had lost over $30 million in derivatives trading so far that year. Mr. Lee decided that it would be an opportune time to review the operations of the derivative program at Link Technologies and to obtain a better understanding of the risks associated with derivatives trading. He asked Mr. Press to provide him with detailed information on the derivatives operation to be reviewed by him and other senior managers later that month. The information provided by Mr. Pross is contained in Exhibit II 6.2. For each month from February 1991 to June 1994 (the last date for which data were available), the exhibit shows the unit shipments abroad, the revenue remitted from foreign operations (converted to dollars), and the revenue from the derivatives program in dollars). Mr. Pross noted that the amounts to be shipped to foreign customers (usually stores specializing in the sale of personal computers, not individual customers) were usually received the previous month. He pointed out that these figures were "lined up right"; that is the revenue in February 1991 actually corresponded to the sale of those units listed in the February column for unit shipments. From early 1991 to mid-1994, with most major markets in recession, sales were relatively stable at about 16,000 units per month, but they were somewhat volatile. Facing potentially severe competition, the company had elected to maintain the price of the company's mainstay, the PCI 2000 modem, at the equivalent of its U.S. dollar price of $215. In most of the foreign markets were Link Technologies was strong, the dollar fluctuated in value, but it did not seem consistently to appreciate or depreciate, sa the $215 figure could be taken as a reasonable approximation of the expected dollar revenue per unit shipped. Since the modems were manufactured in the United States and used few foreign components, currency fluctuations had little impact on praduct costs, which were roughly $185 per unit. Mr. Pross used Exhibit 11 6.2 to bolster his argument that the derivatives program was a positive contribution to the company. He noted that from May 1991 onward (ie., excluding the initial three months), the program had been a source of profits for the company. Further, the variance of the currency hedging revenues, in proportion to the variance of the revenue from foreign operations, was not significant. Thus, it seemed unlikely that the derivatives program could produce the kinds of losses reported in the financial press. Finally, from May 1991 onward, the program relied more heavily on options as opposed to futures contracts, again limiting possible risks. He argued that, if anything, the derivatives program should be expanded in its scale of operations. Mr. Brown strongly seconded these arguments A dissenting opinion was offered by Ms. Anne Cohen, the chief operations officer. She initially had been in favor of the derivatives program but had reversed her opinion over time. Although she did not provide specific facts to support her position, she argued forcefully that the derivatives program had exposed the company to new risks and was not being correctly implemented. She recommended that the program be radically altered or be scrapped altogether if it could not be done right. Another executive also voiced the opinion that the risks from the derivatives operations were too difficult to assess and should be eliminated, noting that the currency risk could be eliminated by simply pricing in U.S. dollars As the discussion continued without any resolution, Mr. Lee was forced to adjourn the meeting He decided that the evaluation of the derivatives program was more complicated than he and thought and that further analysis was clearly warranted. QUESTIONS 1. is the derivatives program at Link Technologies reducing risk? Are Ms. Cohen's arguments correct, or is the program performing as expected? 2. What impact, if any, does the corporate culture have on the implementation of the derivatives program at Link Technologies? How should the program's success or failure be judged? Copyright Ananth Aadhav, 1994. This case was developed for teaching purposes at the School of Business Administration at the University of Southern California, please do not reproduce or use without permission. EXHIBIT II 6.1 Foreign and Domestic Operations DOMESTIC FOREIGN REVENUES REVENUES YEAR (96) (96) NET INCOME (S MILLIONS) 34 49 1990 1991 51 98 5.89 6.03 6.49 7.14 1993 68 EXHIBIT II 6.2 Revenue from Foreign Operations and Currency Hedging February 1991 to June 1994 REVENUE REVENUE To REVENUE UNT FOREIGN CURRENCY FROM Hansen UNIT ONIT FOREIGN More SNIS OPERATIONS HEGING SHIPMENTS OPERATIONS REVENUE FROM CURRENCY HEDGING Page 3 of 4 1896 words Text Predictions: On Accessibility: Unavailable Focus 20 IH Type here to search O Rain... (8) C F G H . - J J K K L M A B C D E 2 Obs Month Number of Ur Actual Rever Derivative 3 1 211991 15760 3743262 -330059 4 2 3171991 18021 3899820 -27008 5 3 4/11991 16303 3635379 -129874 6 4 5171991 15927 3509714 24964 7 5 6/11991 19232 4219470 373566 8 6 7171991 19855 4188058 102208 9 7 8171991 17491 3728835 -30059 10 8 911991 19616 4130203 22794 11 9 10/11991 19061 4020544 -107065 12 10 1141991 18300 3940144 37984 13 11 12/11991 14102 3272762 217586 14 12 191992 13234 2768417 -65804 15 13 211992 14860 3153290 -19984 16 14 3111992 11835 2610311 31731 17 15 4/11992 13241 2760794 -93494 18 16 5171992 16488 3557012 10867 19 17 6/11992 17384 3761208 -28820 20 18 7171992 18722 4084854 18950 21 19 8111992 18408 3988505 119363 22 20 911992 14095 3116734 5008 23 21 10/11992 16123 3380041 -2903 24 22 1171992 20373 4394101 17158 25 23 12/11992 14603 3046495 -138065 26 24 171993 15707 3465664 349908 27 25 2171993 11249 2361102 -139123 28 26 3111993 13001 2781478 -120682 29 27 4/11993 20779 4512325 31901 30 28 5171993 14611 3096276 27576 31 29 6/11993 15354 3203224 -84124 32 30 7171993 16721 3566408 2383 33 31 8171993 12703 2887545 110910 34 32 911993 18456 3815000 -126504 35 33 10/11993 19384 4126439 -1071 36 34 1171993 17882 3872616 -24388 37 35 12111993 20021 4446400 -650 38 36 111994 17931 3889644 -73377 39 37 2111994 14607 3147837 285960 40 38 3171994 16009 3588134 73804 41 39 411994 11192 2415616 135004 42 40 5171994 13808 3094086 199594 43 41 6/11994 13358 2784303 -65520 44 45 46 *Note Brackets in the pdf version show negative cash flow 47 48Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started