QUESTIONS NEEDED TO BE ANSWERED FROM THE CASE

1. Using the fraud triangle explain to Mike why Jack may indeed be stealing from his own company

2.What documents should be reviewed and what other investigative steps should be taken in order to verify suspicions that Jack might be stealing?

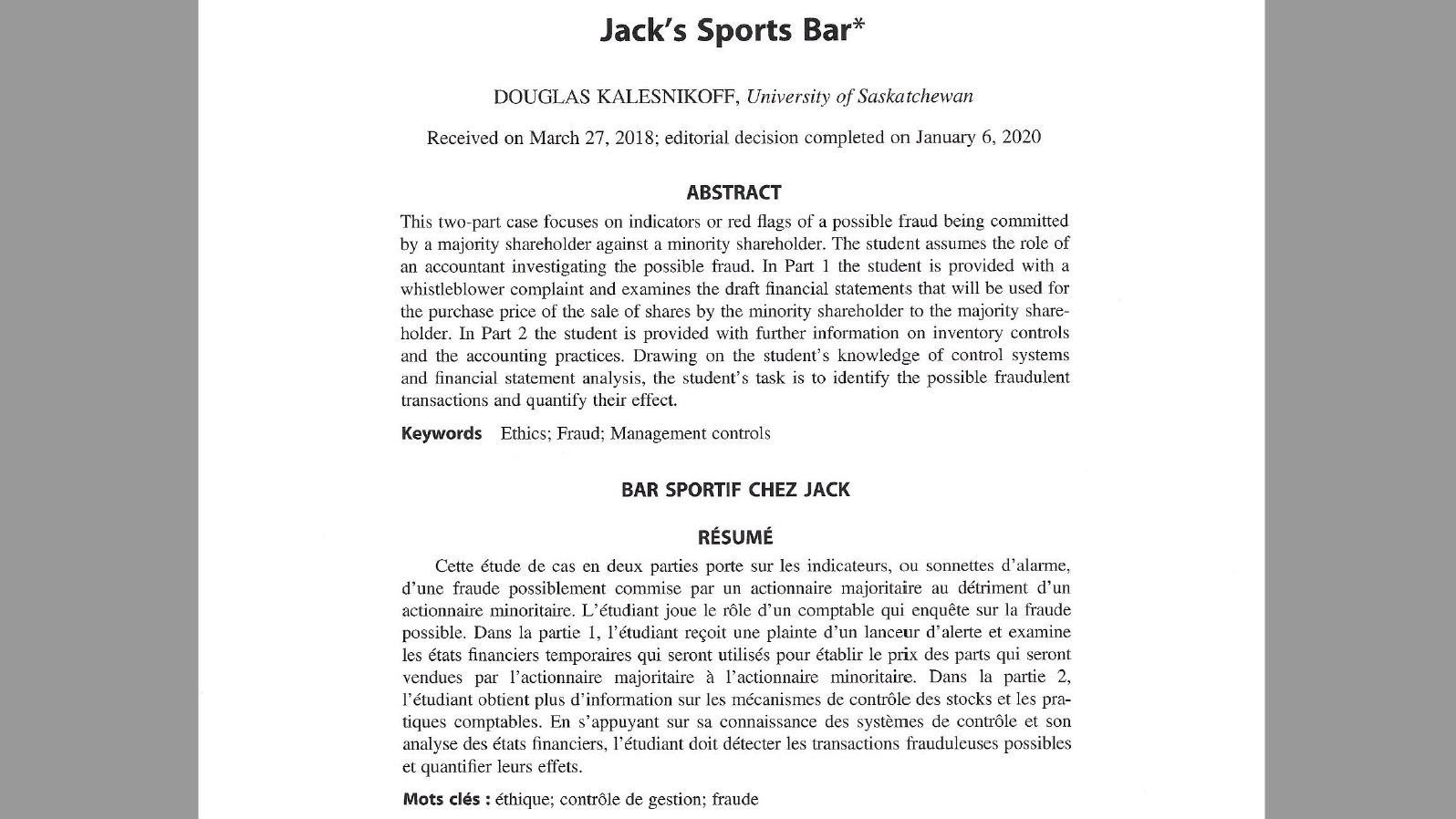

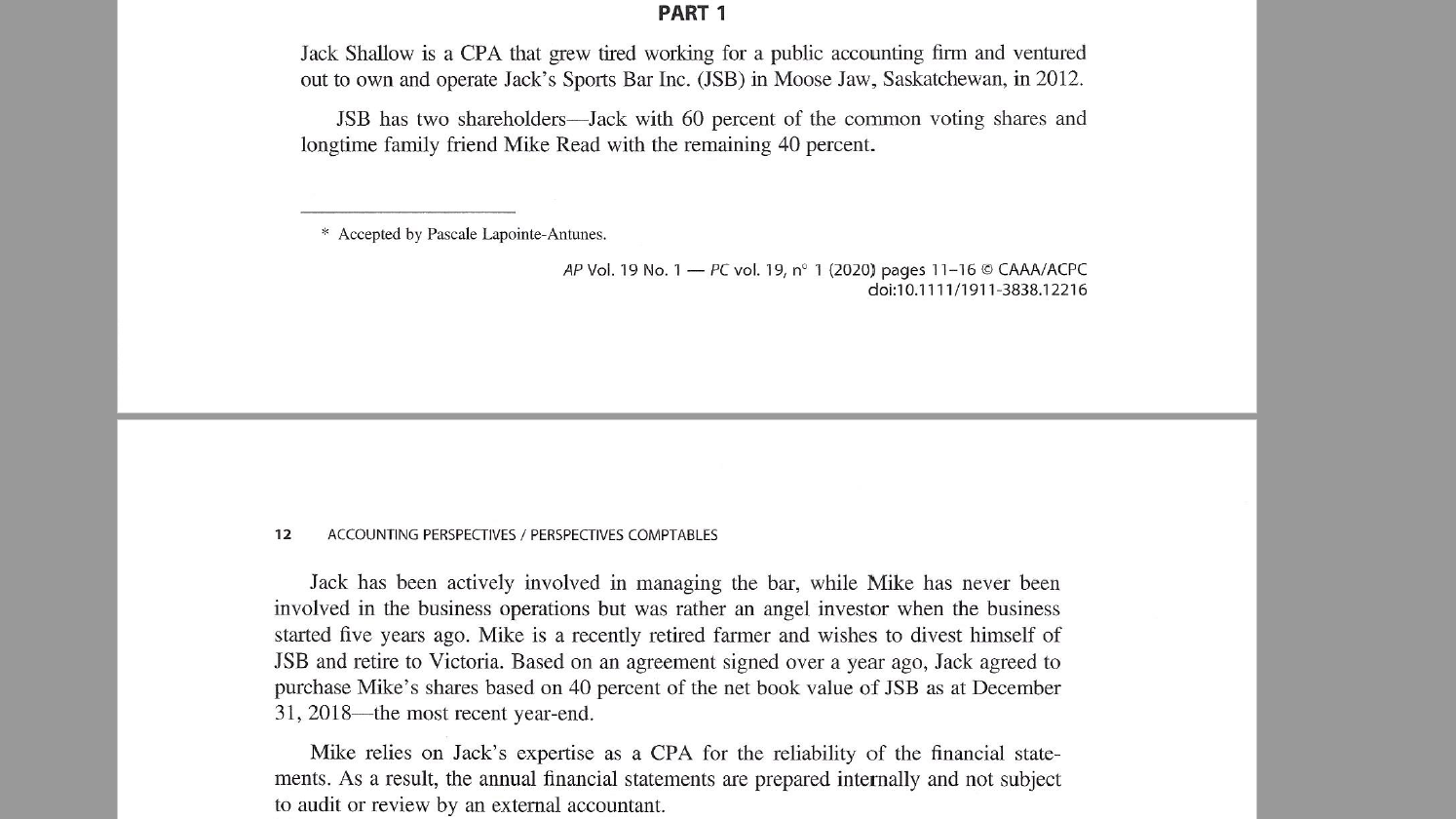

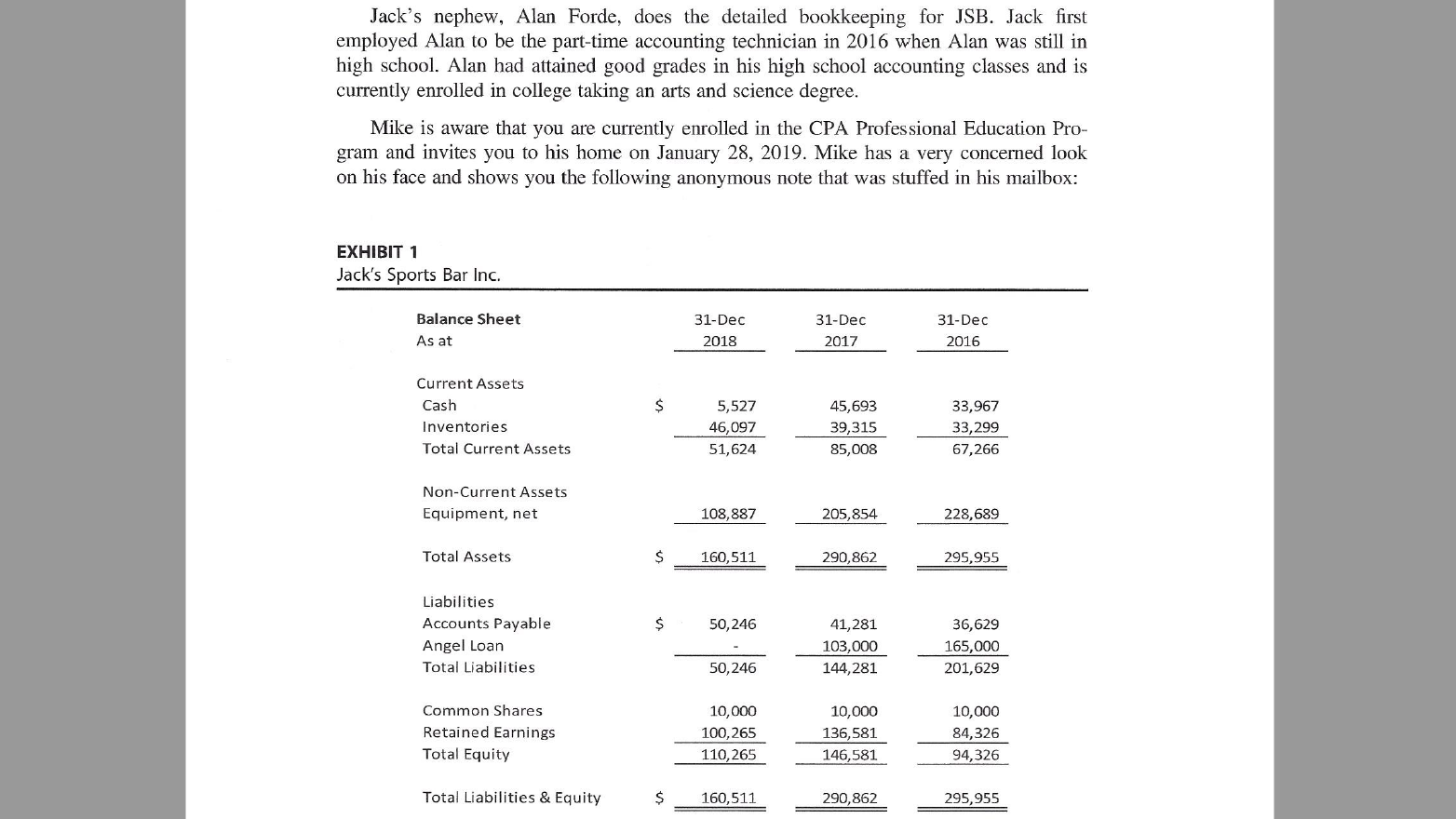

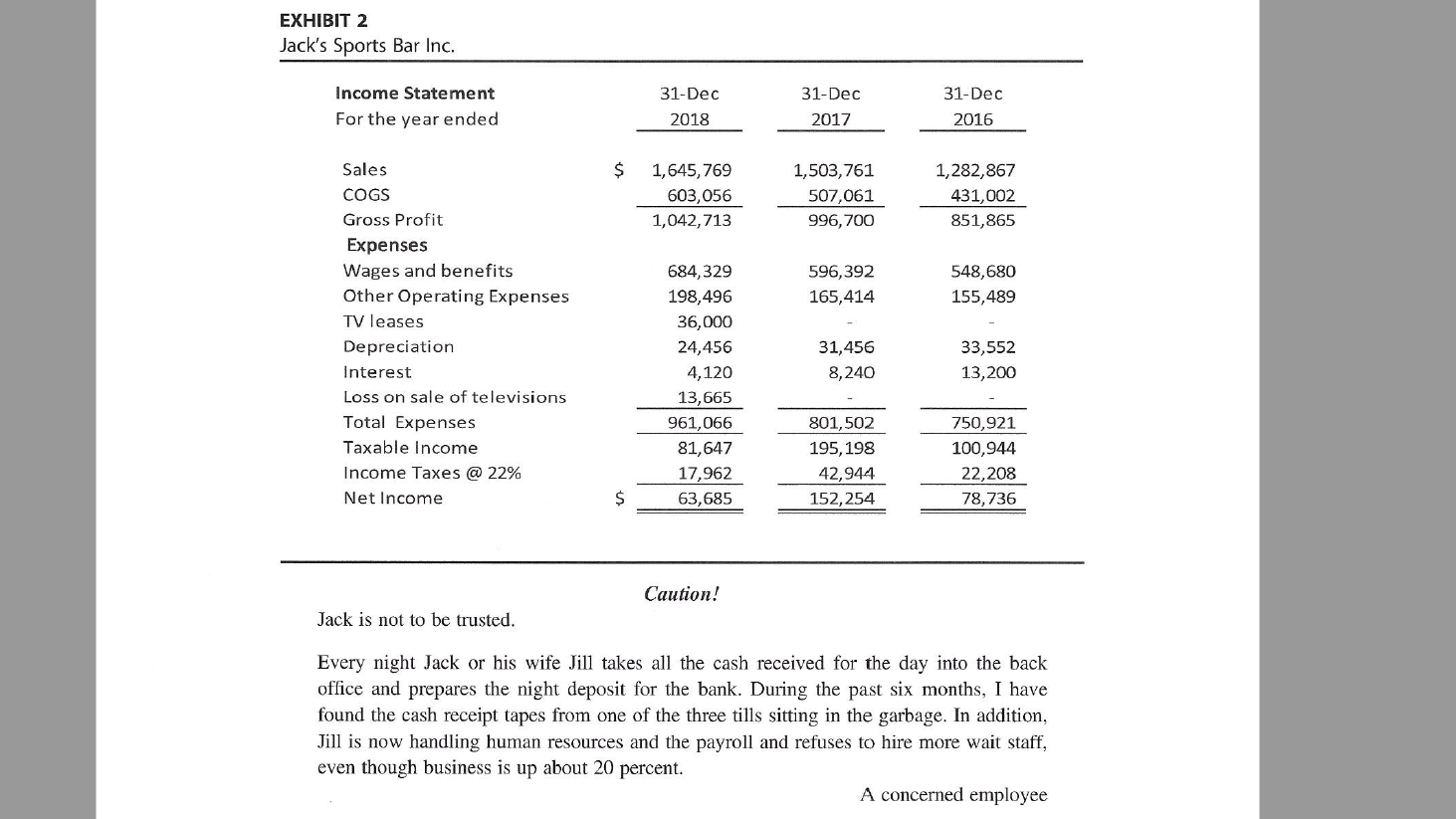

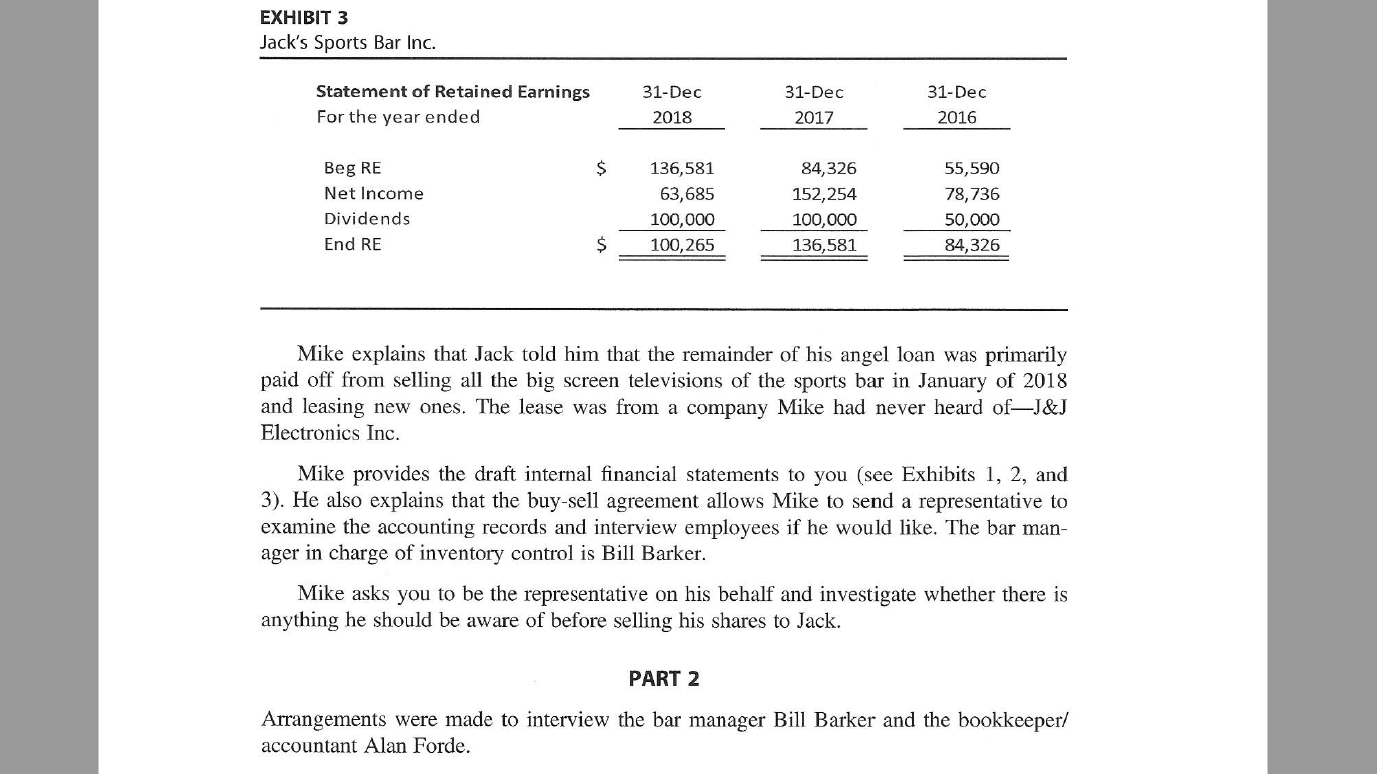

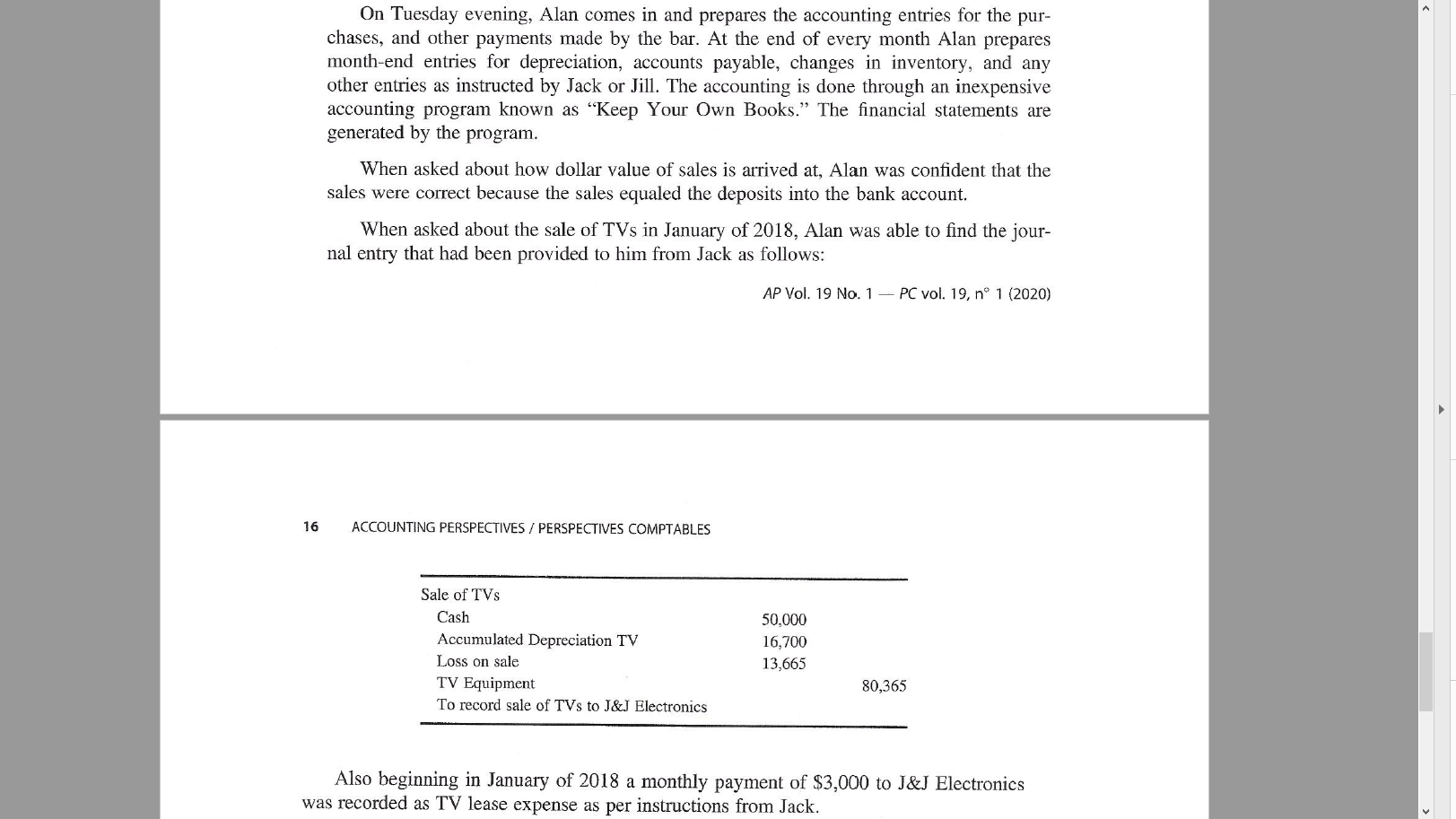

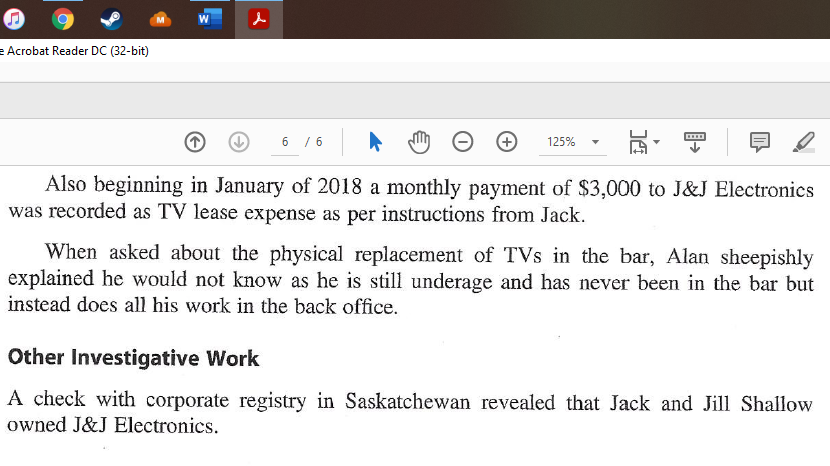

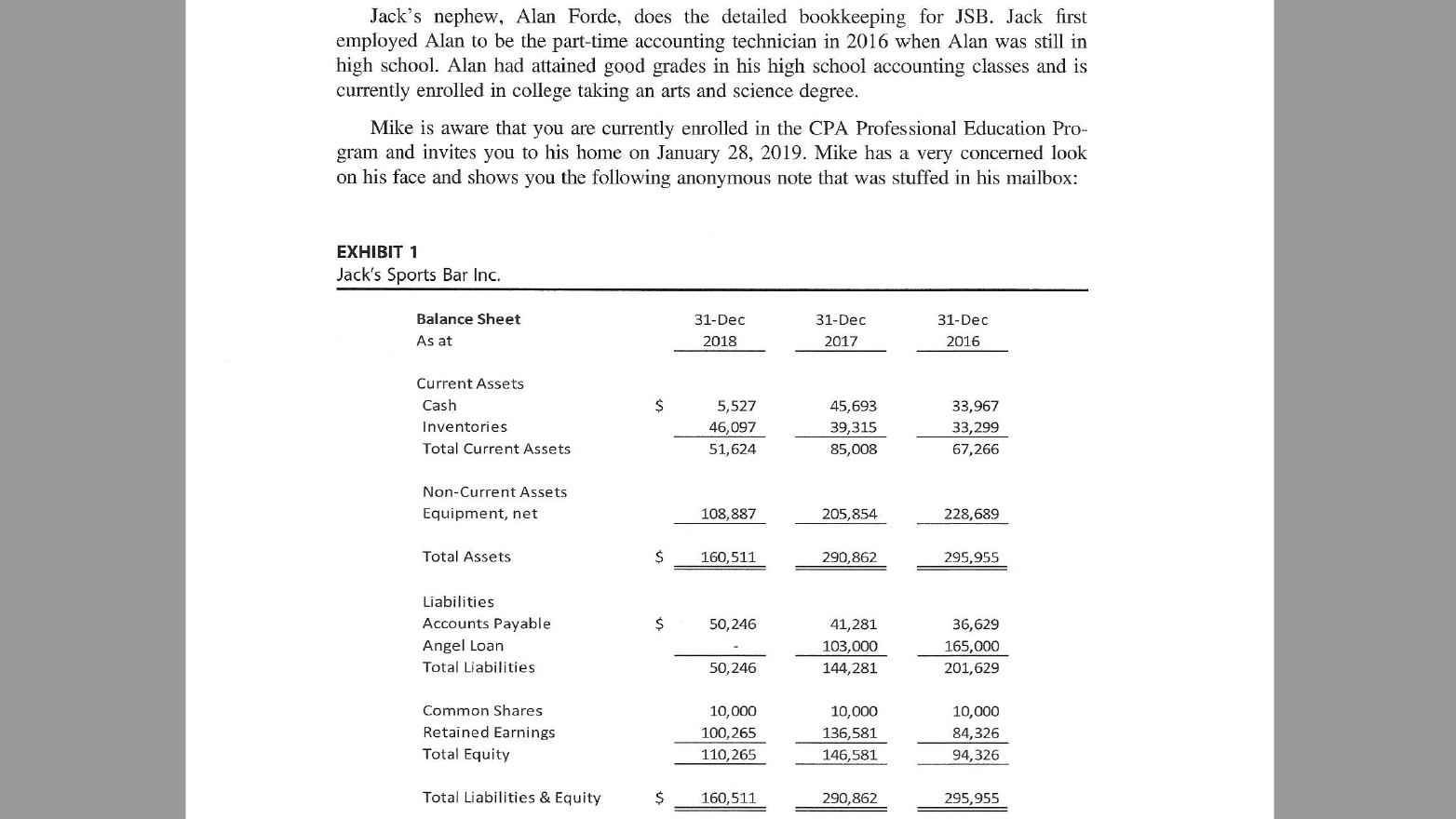

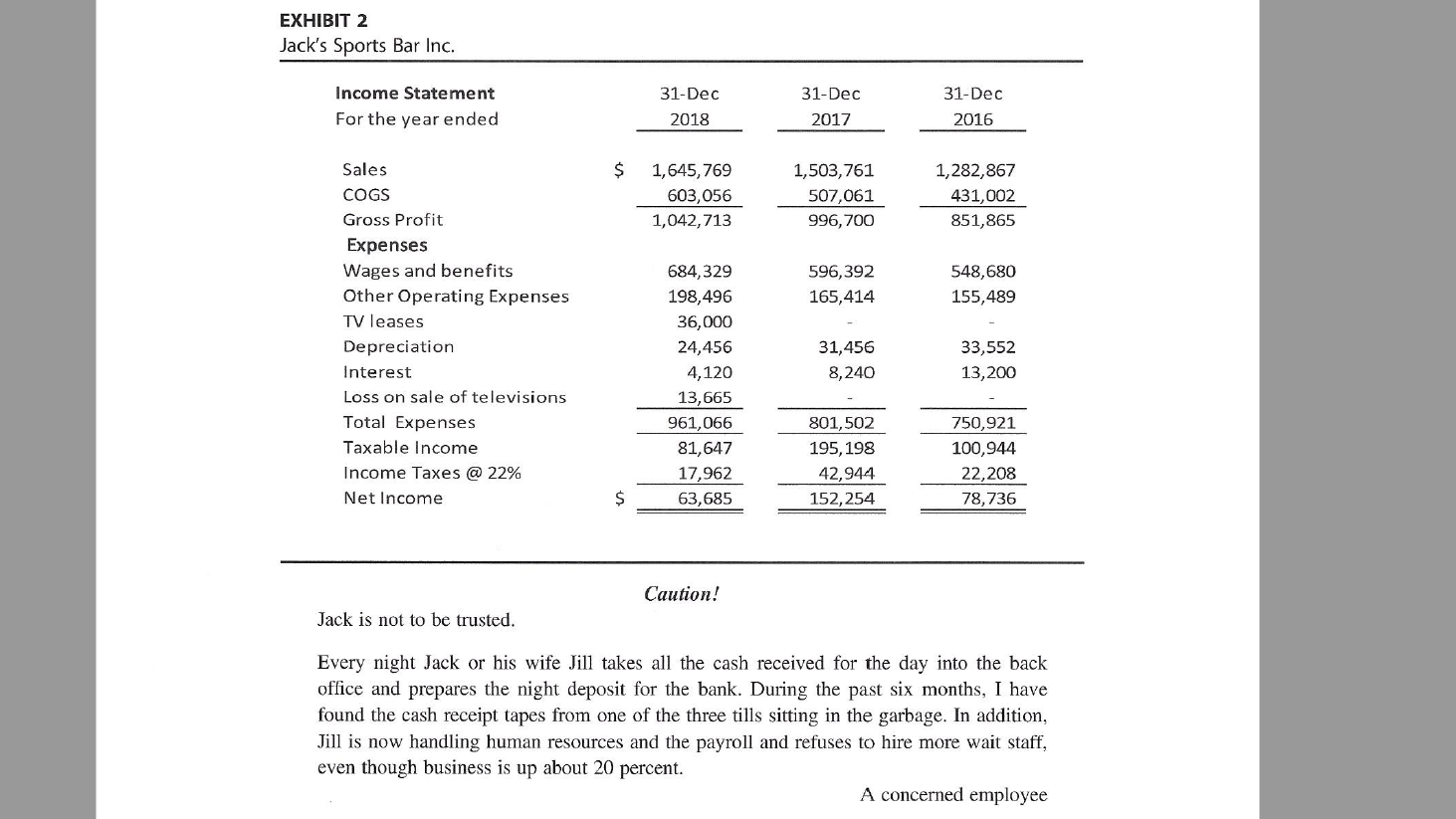

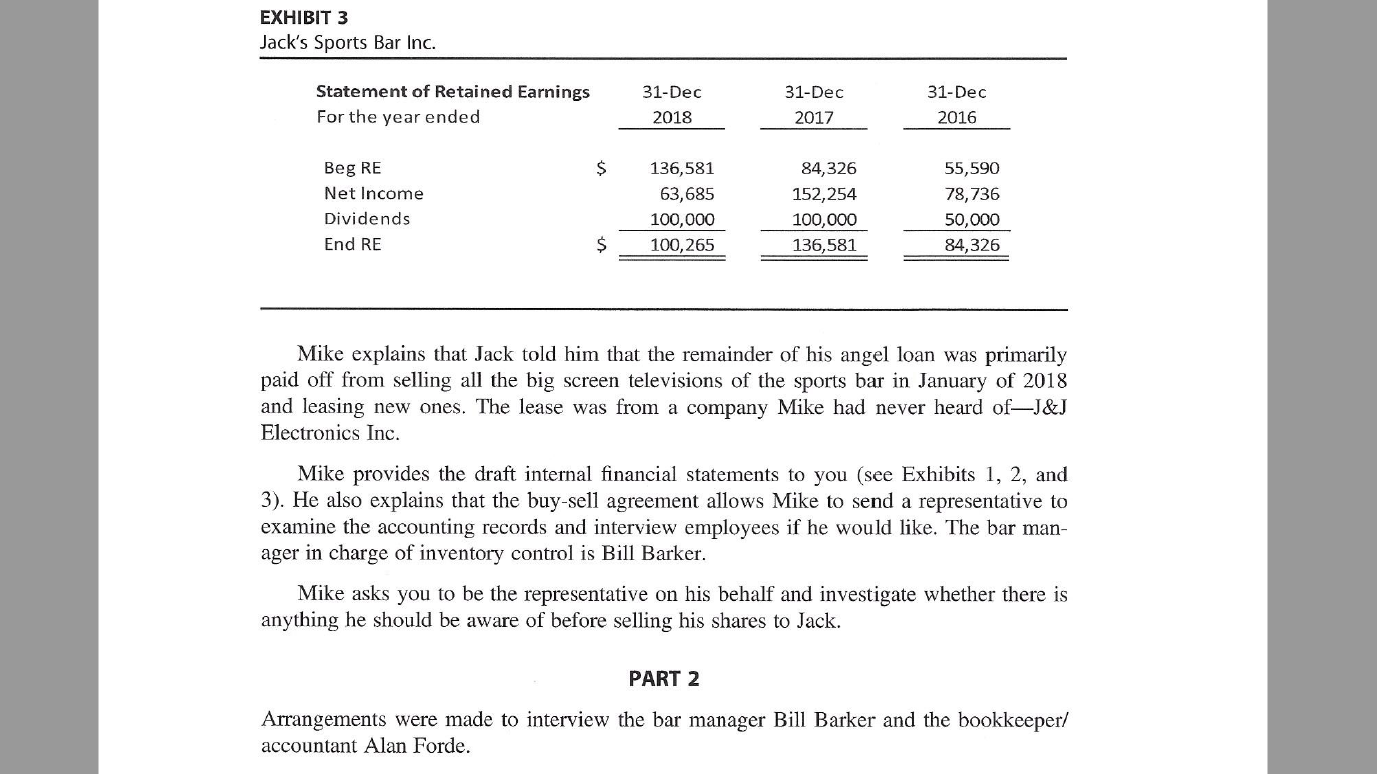

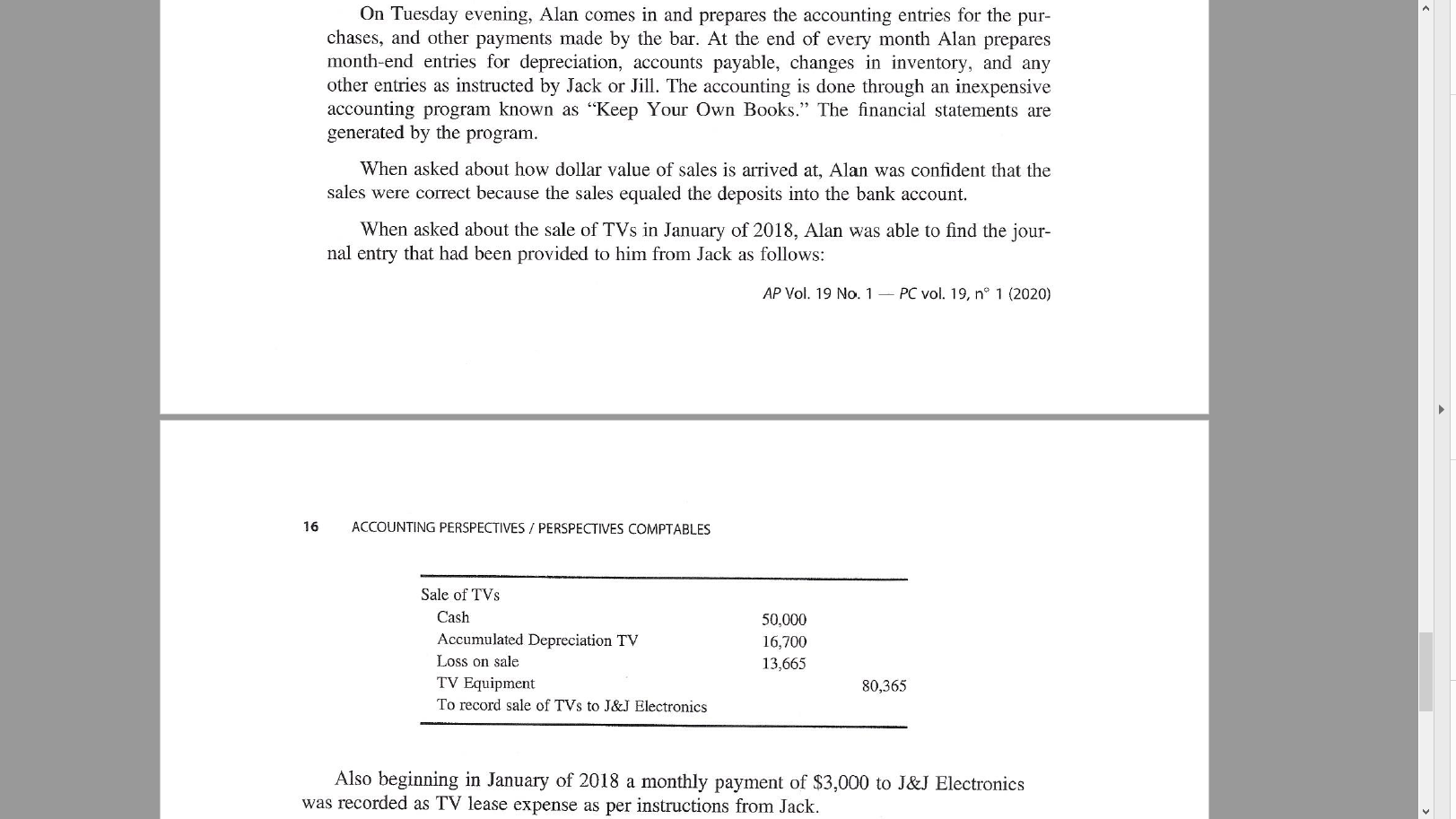

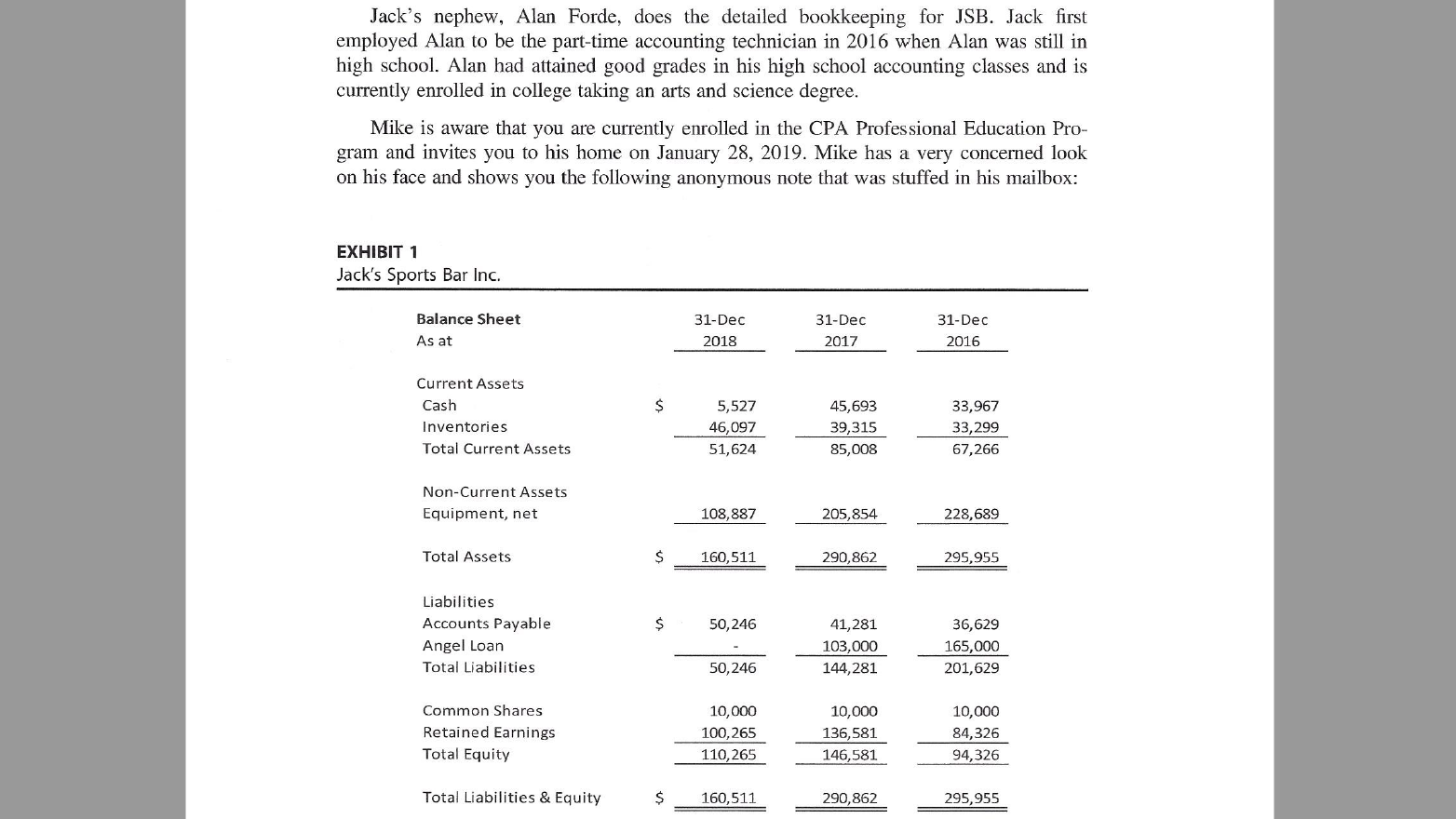

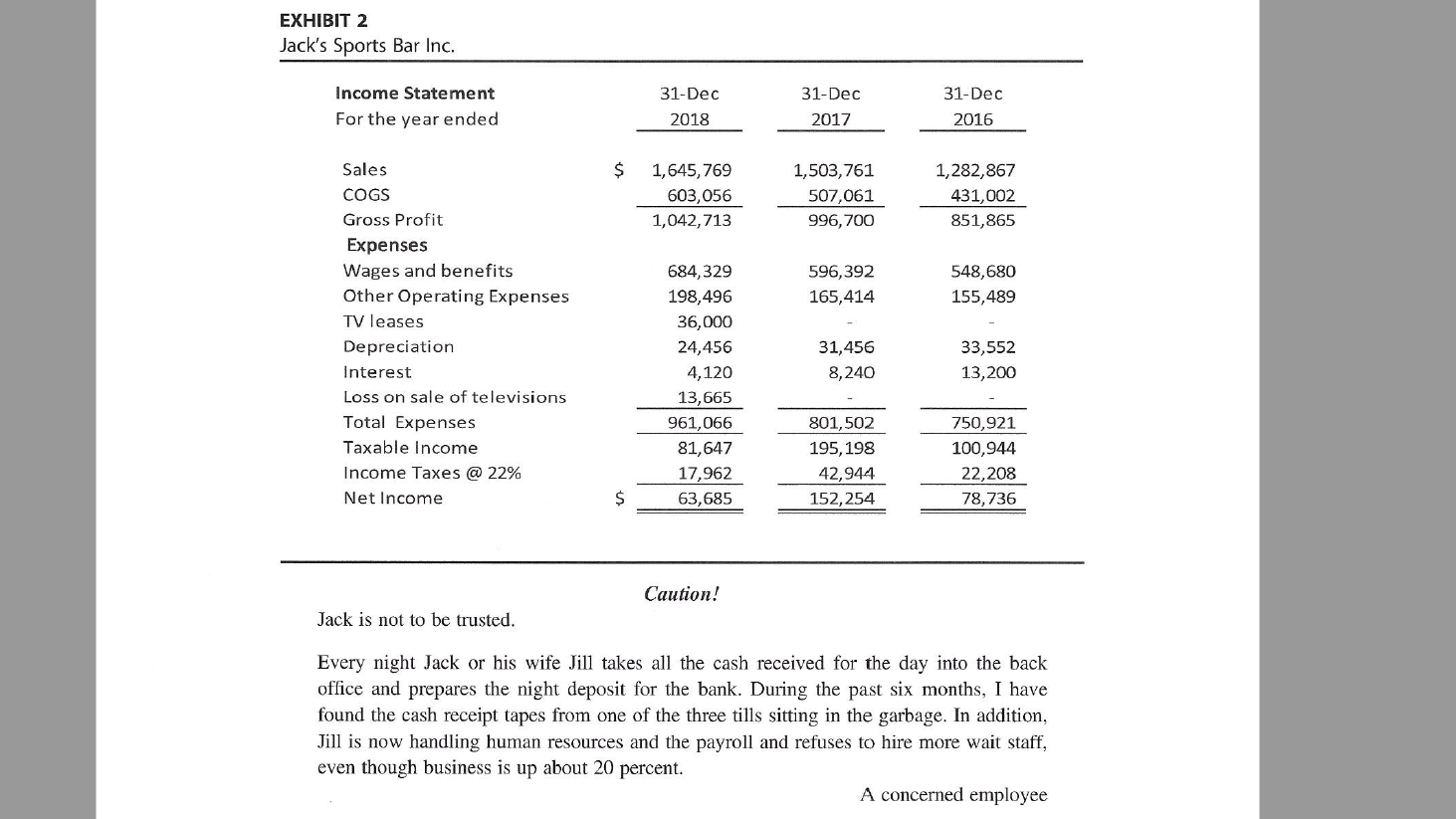

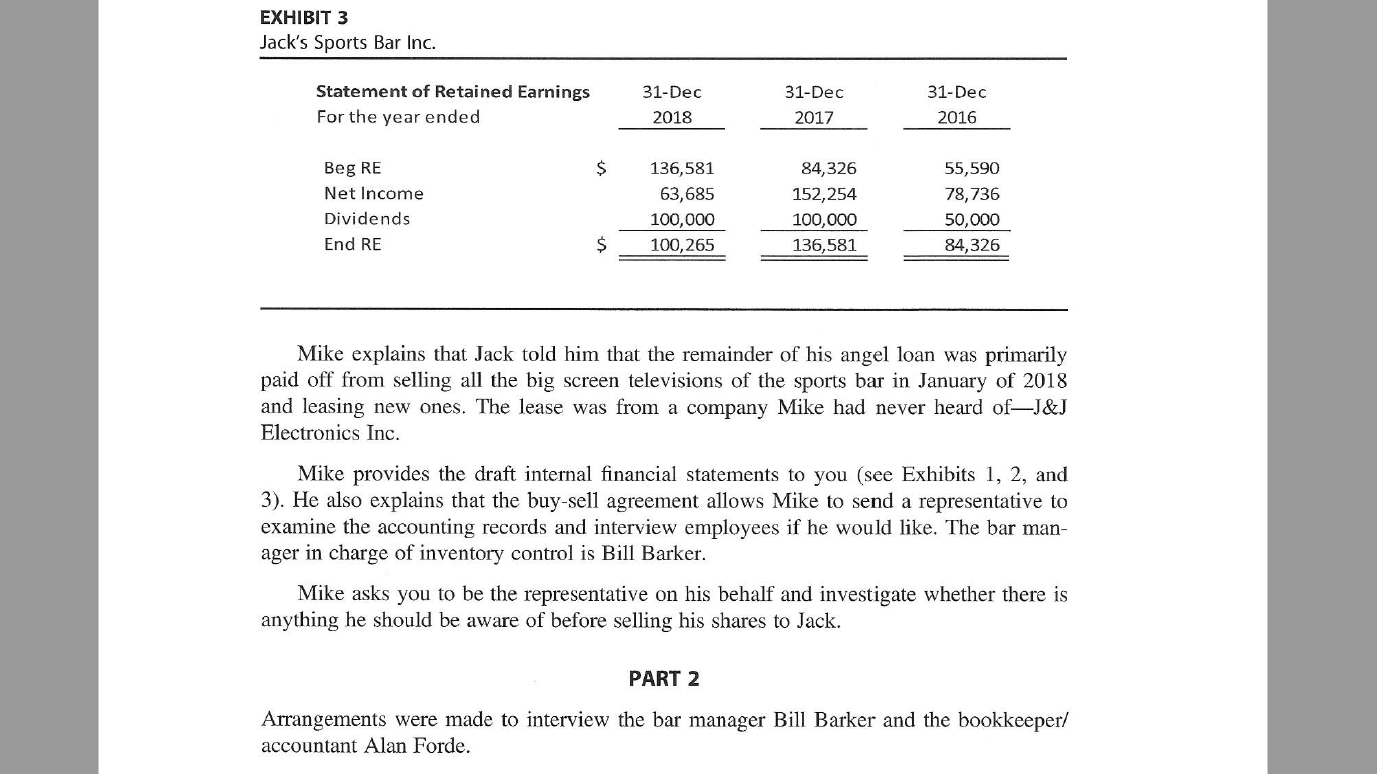

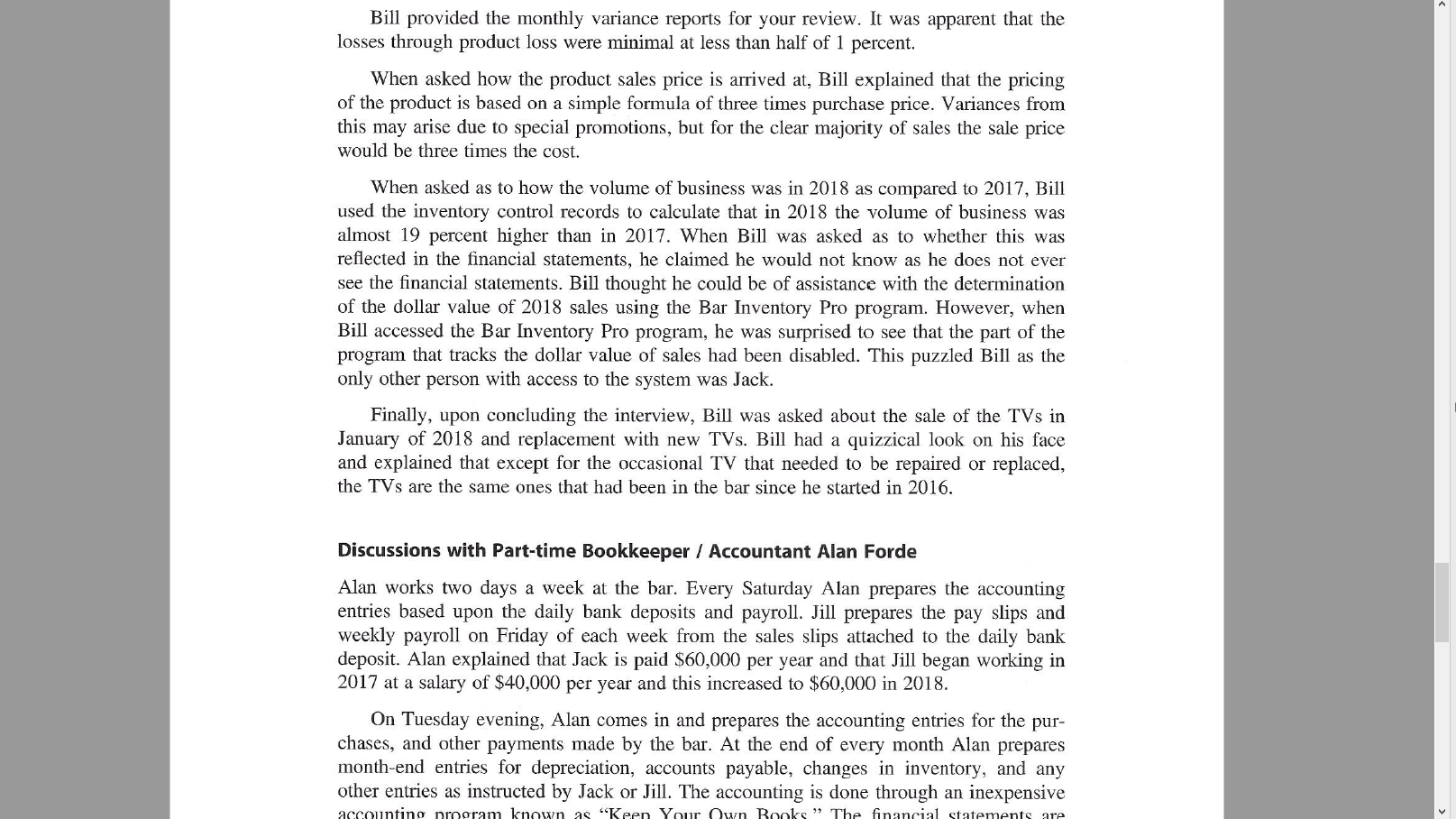

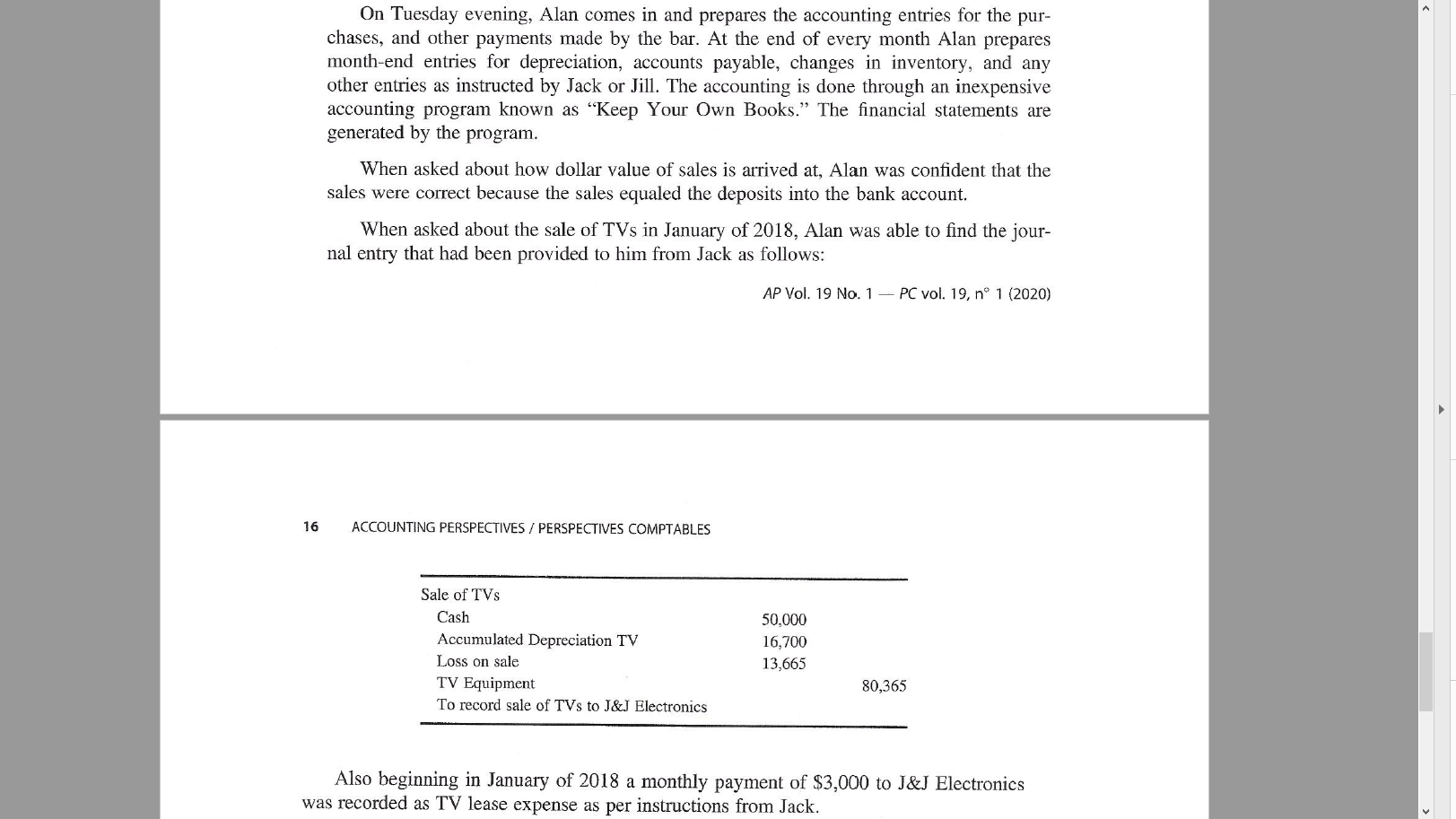

Jack's Sports Bar* DOUGLAS KALESNIKOFF, University of Saskatchewan Received on March 27, 2018; editorial decision completed on January 6, 2020 ABSTRACT This two-part case focuses on indicators or red flags of a possible fraud being committed by a majority shareholder against a minority shareholder. The student assumes the role of an accountant investigating the possible fraud. In Part 1 the student is provided with a whistleblower complaint and examines the draft financial statements that will be used for the purchase price of the sale of shares by the minority shareholder to the majority share- holder. In Part 2 the student is provided with further information on inventory controls and the accounting practices. Drawing on the student's knowledge of control systems and financial statement analysis, the student's task is to identify the possible fraudulent transactions and quantify their effect. Keywords Ethics; Fraud; Management controls BAR SPORTIF CHEZ JACK RESUME Cette etude de cas en deux parties porte sur les indicateurs, ou sonnettes d'alarme, d'une fraude possiblement commise par un actionnaire majoritaire au detriment d'un actionnaire minoritaire. L'etudiant joue le role d'un comptable qui enquete sur la fraude possible. Dans la partie 1, l'etudiant recoit une plainte d'un lanceur d'alerte et examine les etats financiers temporaires qui seront utilises pour etablir le prix des parts qui seront vendues par l'actionnaire majoritaire a l'actionnaire minoritaire. Dans la partie 2, I'etudiant obtient plus d'information sur les mecanismes de controle des stocks et les pra- tiques comptables. En s'appuyant sur sa connaissance des systemes de controle et son analyse des etats financiers, l'etudiant doit detecter les transactions fraudulentes possibles et quantifier leurs effets. Mots cles : ethique; controle de gestion; fraudePART 1 Jack Shallow is a CPA that grew tired working for a public accounting firm and ventured out to own and operate Jack's Sports Bar Inc. (JSB) in Moose Jaw, Saskatchewan, in 2012. JSB has two shareholders-Jack with 60 percent of the common voting shares and longtime family friend Mike Read with the remaining 40 percent. * Accepted by Pascale Lapointe-Antunes. AP Vol. 19 No. 1 - PC vol. 19, no 1 (2020) pages 11-16 @ CAAA/ACPC doi:10.1111/1911-3838.12216 12 ACCOUNTING PERSPECTIVES / PERSPECTIVES COMPTABLES Jack has been actively involved in managing the bar, while Mike has never been involved in the business operations but was rather an angel investor when the business started five years ago. Mike is a recently retired farmer and wishes to divest himself of JSB and retire to Victoria. Based on an agreement signed over a year ago, Jack agreed to purchase Mike's shares based on 40 percent of the net book value of JSB as at December 31, 2018-the most recent year-end. Mike relies on Jack's expertise as a CPA for the reliability of the financial state- ments. As a result, the annual financial statements are prepared internally and not subject to audit or review by an external accountant.Jack's nephew, Alan Forde, does the detailed bookkeeping for JSB. Jack first employed Alan to be the part-time accounting technician in 2016 when Alan was still in high school. Alan had attained good grades in his high school accounting classes and is currently enrolled in college taking an arts and science degree. Mike is aware that you are currently enrolled in the CPA Professional Education Pro- gram and invites you to his home on January 28, 2019. Mike has a very concerned look on his face and shows you the following anonymous note that was stuffed in his mailbox: EXHIBIT 1 Jack's Sports Bar Inc. Balance Sheet 31-Dec 31-Dec 31-Dec As at 2018 2017 2016 Current Assets Cash 5,527 45,693 33,967 Inventories 46,097 39,315 33,299 Total Current Assets 51,624 85,008 67,266 Non-Current Assets Equipment, net 108,887 205,854 228,689 Total Assets S 160,511 290,862 295,955 Liabilities Accounts Payable S 50,246 41,281 36,629 Angel Loan 103,000 165,000 Total Liabilities 50,246 144,281 201,629 Common Shares 10,000 10,000 10,000 Retained Earnings 100,265 136,581 84,326 Total Equity 110,265 146,581 94,326 Total Liabilities & Equity 160,511 290,862 295,955EXHIBIT 2 Jack's Sports Bar Inc. Income Statement 31-Dec 31-Dec 31-Dec For the year ended 2018 2017 2016 Sales $ 1,645, 769 1,503,761 1,282,867 COGS 603,056 507,061 431,002 Gross Profit 1,042,713 996,700 851,865 Expenses Wages and benefits 684,329 596,392 548,680 Other Operating Expenses 198,496 165,414 155,489 TV leases 36,000 Depreciation 24,456 31,456 33,552 Interest 4,120 8,240 13,200 Loss on sale of televisions 13,665 Total Expenses 961, 066 801,502 750,921 Taxable Income 81,647 195, 198 100,944 Income Taxes @ 22% 17,962 42,944 22,208 Net Income S 63,685 152,254 78,736 Caution! Jack is not to be trusted. Every night Jack or his wife Jill takes all the cash received for the day into the back office and prepares the night deposit for the bank. During the past six months, I have found the cash receipt tapes from one of the three tills sitting in the garbage. In addition, Jill is now handling human resources and the payroll and refuses to hire more wait staff, even though business is up about 20 percent. A concerned employeeMike was not concerned about the deal to sell his shares until receiving the note. Scratching his head, he says, "this doesn't make sense to me. Is this employee suggesting that Jack is stealing? Why would he steal from his own company?" Mike explains that recently Jack has appeared to be resentful that his hard work has built a thriving bar while Mike has been repaid his entire initial angel loan with interest and has enjoyed 40 percent of the dividends from the company. As per the shareholders' agreement, Jack draws a salary of $60,000 per year. However, he has been complaining that he works about 80 hours a week and his salary is largely consumed by the mortgage payments on the new house he and Jill acquired in 2017. Mike feels Jack fails to under- stand that without his initial loan, the bar would not be operating and, in the beginning, Mike took on all of the risks. AP Vol. 19 No. 1 - PC vol. 19, no 1 (2020)EXHIBIT 3 Jack's Sports Bar Inc. Statement of Retained Earnings 31-De: 31-Dec 31-Dec For the year ended 2018 2017 2015 Bag RE 3 136,581 84,326 55,590 Net Income 63,685 152,254 78,736 Dividends 100,000 100,000 50,000 End RE 5 1&1265 136,581 34,326 Mike explains that Jack told him that the remainder of his angel loan was primarily paid off from selling all the big screen televisions of the sports bar in January of 2018 and leasing new ones. The lease was from a company Mike had never heard ofJ&J Electronics Inc. Mike provides the draft internal nancial statements to you (see Exhibits 1, 2, and 3). He also explains that the buyisell agreement allows Mike to send a representative to examine the accounting records and interview employees if he would like. The bar mane ager in charge of inventory control is Bill Barker. Mike asks you to be the representative on his behalf and investigate whether there is anything he should be aware of before selling his shares to Jack. PART 2 Arrangements were made to interview the bar manager Bill Barker and the bookkeeper! accountant Alan Forde. Notes from Discussions with Bar Manager Bill Barker Bill Barker was brought in from another successful sports bar as bar manager in 2016. Bill explained that inventory control is key for the success of a bar operation. Bill had extensive experience in inventory control for a similar bar and implemented a compre hensive inventory control system at 1513. The inventory control system has allowed ISB to lower the inventory held to about four weeks' supply. Liquor and food inventory is tightly controlled in a computerized perpetual inventory system using a popular program known as \"Bar Inventory Pro.\" All purchases of product are keyed into the program as they are delivered. Product sales are updated through the \"Point of Sale\" feature on the cash registers that tracks sales by product. Bill constantly does random counts of the various beers and other liquor supplies and compares these to the perpetual records. As well, Bill and Jack take a complete physical inventory together monthly. Any adjustments for product loss or breakage are entered at the end of the month after production of a product variance report from the Bar Inventory Pro program. AP Vol. 19 N0. '| PC vol. 19, n\" 'l (2020) JACK'S SPORTS BAR 15 Bill explained that this tight control has allowed the bar to greatly control for theft of product by employees. In 2017. they were able to detect the theft of a few cases of beer by one of the bartenders when the perpetual records showed a greater number of cases than were in the supply room. The employee was promptly ned. Bill provided the monthly variance reports for your review. It was apparent that the losses through product loss were minimal at less than half of 1 percent. When asked how the product sales price is arrived at, Bill explained that the pricing of the product is based on a simple formula of three times purchase price. Variances from this may arise due to special promotions, but for the clear majority of sales the sale price would be three times the cost. When asked as to how the volume of business was in 2018 as compared to 2017, Bill used the inventory control records to calculate that in 2018 the volume of business was almost 19 percent higher than in 2017. When Bill was asked as to whether this was reflected in the financial statements, he claimed he would not know as he does not ever see the financial statements. Bill thought he could be of assistance with the determination of the dollar value of 2018 sales using the Bar Inventory Pro program. However, when Bill accessed the Bar Inventory Pro program, he was surprised to see that the part of the program that tracks the dollar value of sales had been disabled. This puzzled Bill as the only other person with access to the system was Jack. Finally, upon concluding the interview, Bill was asked about the sale of the TVs in January of 2018 and replacement with new TVs. Bill had a quizzical look on his face and explained that except for the occasional TV that needed to be repaired or replaced, the TVs are the same ones that had been in the bar since he started in 2016. Discussions with Part-time Bookkeeper / Accountant Alan Forde Alan works two days a week at the bar. Every Saturday Alan prepares the accounting entries based upon the daily bank deposits and payroll. Jill prepares the pay slips and weekly payroll on Friday of each week from the sales slips attached to the daily bank deposit. Alan explained that Jack is paid $60,000 per year and that Jill began working in 2017 at a salary of $40,000 per year and this increased to $60,000 in 2018. On Tuesday evening, Alan comes in and prepares the accounting entries for the pur- chases, and other payments made by the bar. At the end of every month Alan prepares month-end entries for depreciation, accounts payable, changes in inventory, and any other entries as instructed by Jack or Jill. The accounting is done through an inexpensiveOn Tuesday evening, Alan comes in and prepares the accounting entries for the pur- chases, and other payments made by the bar. At the end of every month Alan prepares month-end entries for depreciation, accounts payable, changes in inventory, and any other entries as instructed by Jack or Jill. The accounting is done through an inexpensive accounting program known as "Keep Your Own Books." The financial statements are generated by the program. When asked about how dollar value of sales is arrived at, Alan was confident that the sales were correct because the sales equaled the deposits into the bank account. When asked about the sale of TVs in January of 2018, Alan was able to find the jour- nal entry that had been provided to him from Jack as follows: AP Vol. 19 No. 1 - PC vol. 19, no 1 (2020) 16 ACCOUNTING PERSPECTIVES / PERSPECTIVES COMPTABLES Sale of TVs Cash 50,000 Accumulated Depreciation TV 16,700 Loss on sale 13,665 TV Equipment 80,365 To record sale of TVs to J&J Electronics Also beginning in January of 2018 a monthly payment of $3,000 to J&J Electronics was recorded as TV lease expense as per instructions from Jack.a Acrobat Reader DC (32bit) Also beginning in Jammy of 2018 a monthly payment of $3,000 to 18:} Electronics was recorded as TV lease expense as per instructions from Jack. When asked about the physical replacement of TVs in the bar, Alan sheepishly explained he would not know as he is still underage and has never been in the bar but instead does all his work in the back ofce. Other Investigative Work A check with corporate registry in Saskatchewan revealed that Jack and Jill Shallow owned J St] Electmnics