Question

Questions: (Note all required information are provided) 1 - Fleetway Transport is an Accelerated threshold 1 remitter. The statutory deductions withheld from the three bi-weekly

Questions: (Note all required information are provided)

1 - Fleetway Transport is an Accelerated threshold 1 remitter. The statutory deductions withheld from the three bi-weekly payrolls in August are as follows:

On the August 3 pay, the employees' Canada Pension Plan contributions were $3,658.20, their Employment Insurance premiums were $1,295.40, their

federal income tax withholding was $13,157.33 and their provincial income tax (non-Quebec) withholding was $6,054.65.

On the August 17 pay, the employees' Canada Pension Plan contributions were $4,558.20, their Employment Insurance premiums were $2,275.40, their

federal income tax withholding was $14,157.33 and their provincial income tax (non-Quebec) withholding was $7,854.65.

On the August 31 pay, the employees' Canada Pension Plan contributions were $3,558.20, their Employment Insurance premiums were $1,275.40, their

federal income tax withholding was $12,157.33 and their provincial income tax (non-Quebec) withholding was $6,854.65.

The employer does not have a reduced Employment Insurance premium rate.

Calculate the total amount to be remitted to the Canada Revenue Agency on September 10.

2 - Statutory deductions are held in trust by a business, except if it is:

an estate in liquidation

in bankruptcy

in receivership

none of the above

3- Lori contributes 2% of her annual earnings of $38,900.00 to her defined contribution pension plan. Her employer matches her contributions. Calculate Lori's pension adjustment.

4 - Adjustments made to employee year-to-date earnings should be:

recorded when a Pensionable and Insurable Earnings Review is requested

accumulated and adjusted with semi-annual reconciliation

accumulated and adjusted at year-end

recorded as the adjustments occur

5 - Employers are classified as regular remitters when their average monthly withholding amount for the second preceding calendar year is:

less than $3,000.00

between $3,000.00 and $24,999.99

between $25,000.00 and $99,999.99

0 $100,000.00 or more

6- Ophelia works in Quebec and her 2019 payroll totals are regular earnings of $78,800.00, regular commission payments of $41,900.00, employer-provided automobile taxable benefit of $6,818.00, employer-paid medical and dental benefits of $812.00, and employee contributions to a Registered Retirement Savings Plan of $2,980.00. Calculate the total to be recorded in Box 14 of Ophelia's T4 information slip.

7 - Preet works in Ontario and her 2019 payroll totals are regular earnings of $41,300.00, regular commission payments of $9,400.00, employer-provided automobile taxable benefit of $3,418.00, employer-paid medical and dental benefits of $648.00, and employee contributions to a Registered Retirement Savings Plan of $1,266.00. Calculate the total to be recorded in Box 14 of Preet's T4 information slip.

8 - Which of the following expenses of an organization is generally accounted for on a continuous accrual basis?

Employer contributions to employees' Registered Retirement Savings Plans

Group term life insurance premiums

Vacation pay

Employer contributions to a defined benefit pension plan

9 - An organization's source deductions remittance frequency depends on the amount of the average monthly withholding amount for:

current year

the second preceding calendar year

the previous calendar year

the third preceding calendar year

10 - Which of the following situations would require that a T4A be issued?

An employee received vacation pay of $1,600.00 on termination

An employee received wages in lieu of notice of $2,500.00

An employee received $35,000.00 in retroactive pay

A former employee's group term life was provided by the employer with a taxable benefit of $450.00

11 - An accelerated threshold 1 remitter has a weekly payroll with total statutory deductions (including employer contributions) each pay period of $7,135.00. Their pay dates in the current month were on Friday the 1st, 8th, 15th, 22nd and 29th. Calculate the amount of the remittance due on the 25th of the current month.

12 - Anjani works in Manitoba and her 2019 payroll totals are regular earnings of $55,000.00, regular commission payments of $12,000.00, employer-provided automobile taxable benefit of $4,294.00 and employer-paid medical and dental benefits of $5,212.00. What amount would be reported using Code 40 in the Other Information area of Anjani's T4 information slip?

automobile taxable benefit of $4,294.00 and employer-paid medical and dental benefits of $5,212.00.

What amount would be reported using Code 40 in the Other Information area of Anjani's T4 information slip?

$4,294.00

$5,212.00

$9,506.00

No amount required

13 - Isabel has a defined benefit pension plan based on final average earnings with her employer. She has a pension benefit of 2% of her final earnings and $43,800.00 of pensionable earnings for this year. Calculate her pension adjustment for 2020.

14 - When the remittance date falls on a weekend or statutory holiday, an employer should ensure that the Canada Revenue Agency is in receipt of the funds:

there are no restrictions

by the previous business date

by the next business date

which are postmarked on the weekend or statutory holiday

15 - Alpha Computing Inc. operates from Monday to Friday and pays its employees bi1-weekl1y. On April 27 employees are paid for the two weeks ending April 27, while on May 11 they are paid for the two weeks ending May 11. Alpha Computing's salary and wages expense for the April 27 pay was $97,500.00. The accounting month-end for April is April 30. How much will Alpha Computing Inc. accrue for salaries and wages for the pay period ending May 11 in the April accounting period in order to accurately reflect these costs for the month. (Note: The current year calendar provided in the course should be used).

16 - When am voluntary deductions withheld from an employee's pay?

At the same time as statutory and legal deductions

Before statutory and legal deductions

After statutory and legal deductions

Voluntary deductions are never withheld from an employee's pay

17 - A garnishment issued by the federal governme11 is subject to:

no grace period and payments are due on receipt or as payments to employees come due

no grace period and payments are due within 10 days of making a deduction from the employee

no grace period and payments are due within 15 days of making a deduction from the employee

no grace period and payments are due within 15 days of service or when payment to employee comes due

18 - After reconciling the payroll accounts for the month of June, you noticed you have made an error and overpaid the amount ow1ing to the Canada Revenue Agency for source deductions. How should there is calculation error be corrected?

Wait for Canada Revenue Agency to advise that there is a discrepancy

Request a refund

Reconcile the payment at year-end

Deduct the over payment from the next remittance

19 - Reese works in Prince Edward Island and has 2019 payroll totals of regular earnings of $62,700.00, vacation pay $$2,680.00, overtime pay of $518.00, interest-free loan taxable benefit of $780.00, group term life insurance taxable benefit of $314.00, pension adjustment of $2,880.00 and employee contributions to a Registered Retirement Savings Plan of $1,890.00. Calculate the total to be recorded in Box 14 of Reese's T 4 information slip.

20 - An employer in Manitoba has a monthly group life insurance prem1ium of $2, 1180.00, excluding taxes. Calculate the payment to be remitted to the benefit carrier.

21 - Stacey works in British Columbia and has 2019 payroll totals of regular earnings of $34,600.00, vacation pay of $1,250.00, overtime pay of $675.00, interest free loan taxab1le benefit of $2,350.00, group term life insurance taxable benefit of $182.00, pension adjustment of $11,215.00 and employee contributions to a Registered Retirement Savings Plan of $1,378.20. Enter the amount to be recorded in the Other information area using Code 40 on Stacey's T4 information slip.

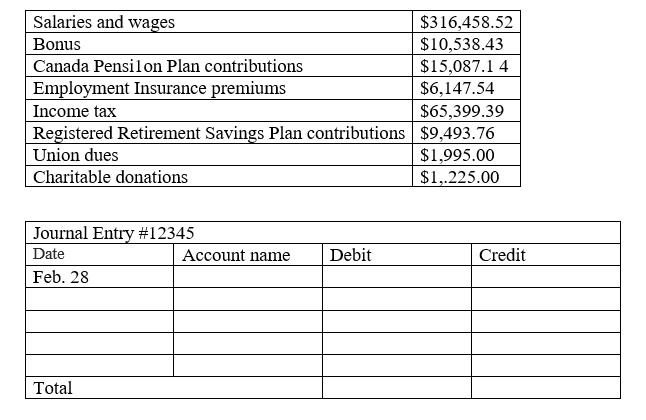

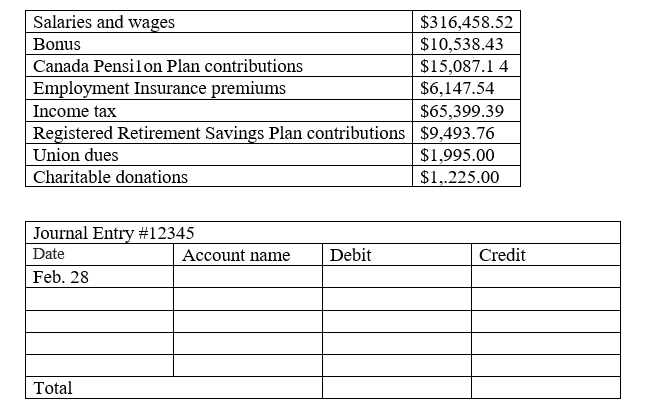

22 - Given the following information from the payroll register, calculate the net pay and full the journal entry for the month of February for Northern Publishers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started