Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions: Prepare the following journal entries 1. Transition of WIP 3 goods to Finished Goods 2. Sale of Basic vacuums Jackson's Vacuum company makes two

Questions:

Questions:

Prepare the following journal entries

1. Transition of WIP 3 goods to Finished Goods

2. Sale of Basic vacuums

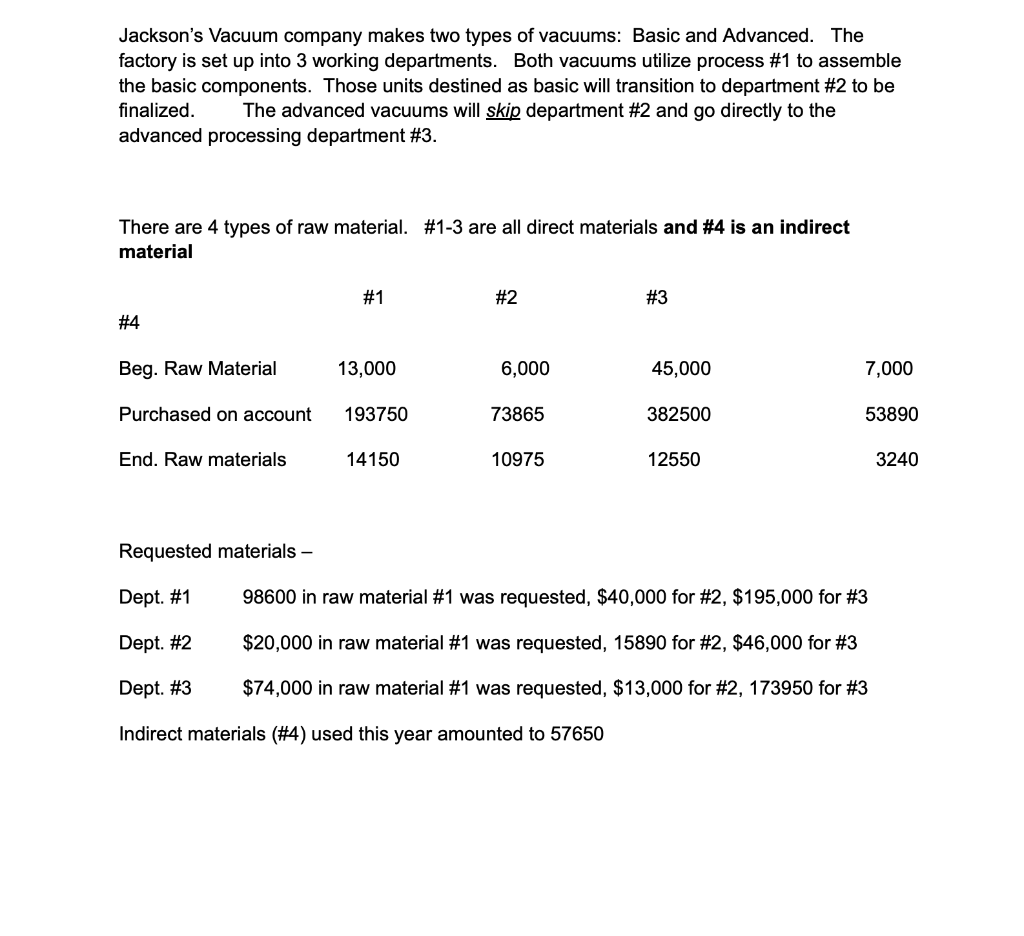

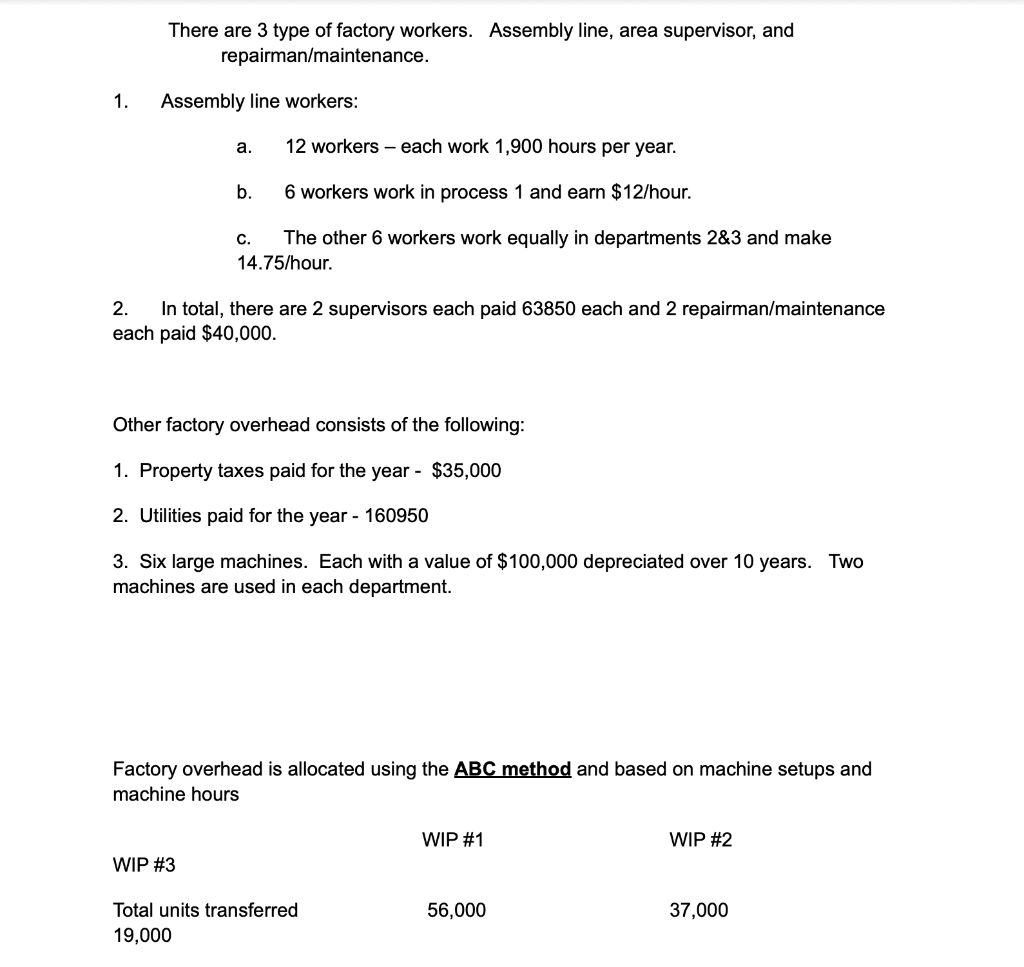

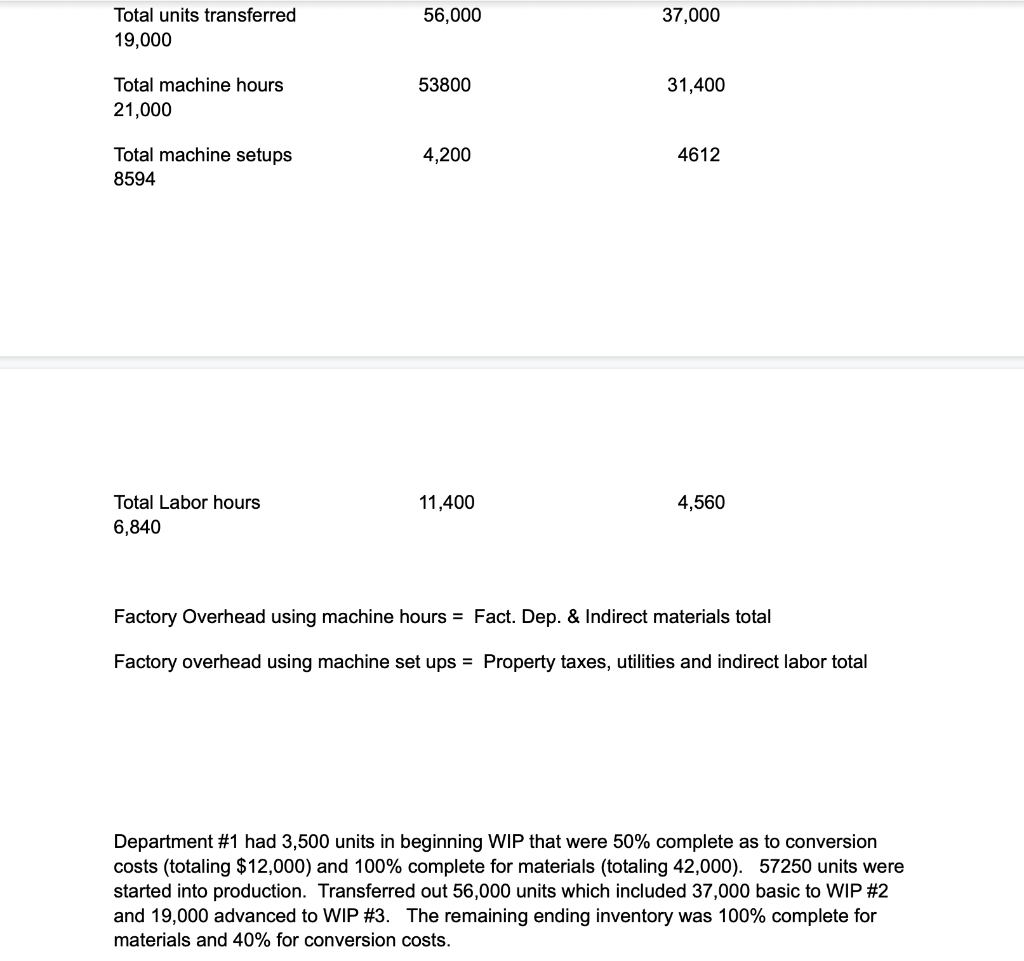

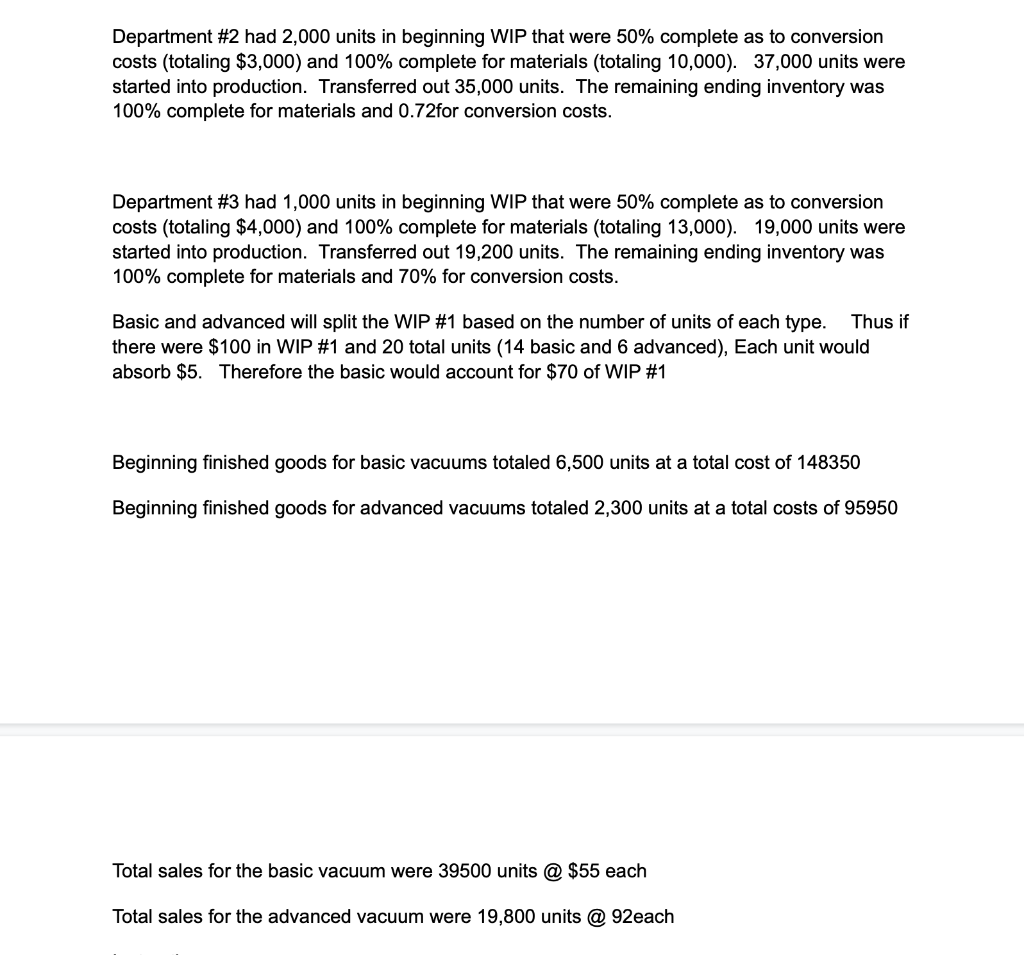

Jackson's Vacuum company makes two types of vacuums: Basic and Advanced. The factory is set up into 3 working departments. Both vacuums utilize process #1 to assemble the basic components. Those units destined as basic will transition to department #2 to be finalized. The advanced vacuums will skip department #2 and go directly to the advanced processing department #3. There are 4 types of raw material. #1-3 are all direct materials and #4 is an indirect material Requested materials - Dept. #1 98600 in raw material #1 was requested, $40,000 for #2, $195,000 for #3 Dept. #2 $20,000 in raw material #1 was requested, 15890 for #2,$46,000 for #3 Dept. #3 $74,000 in raw material #1 was requested, $13,000 for #2,173950 for #3 Indirect materials (\#4) used this year amounted to 57650 repairman/maintenance. 1. Assembly line workers: a. 12 workers each work 1,900 hours per year. b. 6 workers work in process 1 and earn $12 /hour. c. The other 6 workers work equally in departments 2&3 and make 14.75/ hour. 2. In total, there are 2 supervisors each paid 63850 each and 2 repairman/maintenance each paid $40,000. Other factory overhead consists of the following: 1. Property taxes paid for the year - $35,000 2. Utilities paid for the year 160950 3. Six large machines. Each with a value of $100,000 depreciated over 10 years. Two machines are used in each department. Factory overhead is allocated using the ABC method and based on machine setups and machine hours Factory Overhead using machine hours = Fact. Dep. \& Indirect materials total Factory overhead using machine set ups = Property taxes, utilities and indirect labor total Department #1 had 3,500 units in beginning WIP that were 50% complete as to conversion costs (totaling \$12,000) and 100\% complete for materials (totaling 42,000). 57250 units were started into production. Transferred out 56,000 units which included 37,000 basic to WIP #2 and 19,000 advanced to WIP #3. The remaining ending inventory was 100% complete for materials and 40% for conversion costs. Department #2 had 2,000 units in beginning WIP that were 50% complete as to conversion costs (totaling $3,000 ) and 100% complete for materials (totaling 10,000). 37,000 units were started into production. Transferred out 35,000 units. The remaining ending inventory was 100% complete for materials and 0.72 for conversion costs. Department #3 had 1,000 units in beginning WIP that were 50% complete as to conversion costs (totaling $4,000 ) and 100% complete for materials (totaling 13,000). 19,000 units were started into production. Transferred out 19,200 units. The remaining ending inventory was 100% complete for materials and 70% for conversion costs. Basic and advanced will split the WIP #1 based on the number of units of each type. Thus if there were $100 in WIP #1 and 20 total units (14 basic and 6 advanced), Each unit would absorb $5. Therefore the basic would account for $70 of WIP #1 Beginning finished goods for basic vacuums totaled 6,500 units at a total cost of 148350 Beginning finished goods for advanced vacuums totaled 2,300 units at a total costs of 95950 Total sales for the basic vacuum were 39500 units @ \$55 each Total sales for the advanced vacuum were 19,800 units@ 92each Jackson's Vacuum company makes two types of vacuums: Basic and Advanced. The factory is set up into 3 working departments. Both vacuums utilize process #1 to assemble the basic components. Those units destined as basic will transition to department #2 to be finalized. The advanced vacuums will skip department #2 and go directly to the advanced processing department #3. There are 4 types of raw material. #1-3 are all direct materials and #4 is an indirect material Requested materials - Dept. #1 98600 in raw material #1 was requested, $40,000 for #2, $195,000 for #3 Dept. #2 $20,000 in raw material #1 was requested, 15890 for #2,$46,000 for #3 Dept. #3 $74,000 in raw material #1 was requested, $13,000 for #2,173950 for #3 Indirect materials (\#4) used this year amounted to 57650 repairman/maintenance. 1. Assembly line workers: a. 12 workers each work 1,900 hours per year. b. 6 workers work in process 1 and earn $12 /hour. c. The other 6 workers work equally in departments 2&3 and make 14.75/ hour. 2. In total, there are 2 supervisors each paid 63850 each and 2 repairman/maintenance each paid $40,000. Other factory overhead consists of the following: 1. Property taxes paid for the year - $35,000 2. Utilities paid for the year 160950 3. Six large machines. Each with a value of $100,000 depreciated over 10 years. Two machines are used in each department. Factory overhead is allocated using the ABC method and based on machine setups and machine hours Factory Overhead using machine hours = Fact. Dep. \& Indirect materials total Factory overhead using machine set ups = Property taxes, utilities and indirect labor total Department #1 had 3,500 units in beginning WIP that were 50% complete as to conversion costs (totaling \$12,000) and 100\% complete for materials (totaling 42,000). 57250 units were started into production. Transferred out 56,000 units which included 37,000 basic to WIP #2 and 19,000 advanced to WIP #3. The remaining ending inventory was 100% complete for materials and 40% for conversion costs. Department #2 had 2,000 units in beginning WIP that were 50% complete as to conversion costs (totaling $3,000 ) and 100% complete for materials (totaling 10,000). 37,000 units were started into production. Transferred out 35,000 units. The remaining ending inventory was 100% complete for materials and 0.72 for conversion costs. Department #3 had 1,000 units in beginning WIP that were 50% complete as to conversion costs (totaling $4,000 ) and 100% complete for materials (totaling 13,000). 19,000 units were started into production. Transferred out 19,200 units. The remaining ending inventory was 100% complete for materials and 70% for conversion costs. Basic and advanced will split the WIP #1 based on the number of units of each type. Thus if there were $100 in WIP #1 and 20 total units (14 basic and 6 advanced), Each unit would absorb $5. Therefore the basic would account for $70 of WIP #1 Beginning finished goods for basic vacuums totaled 6,500 units at a total cost of 148350 Beginning finished goods for advanced vacuums totaled 2,300 units at a total costs of 95950 Total sales for the basic vacuum were 39500 units @ \$55 each Total sales for the advanced vacuum were 19,800 units@ 92each

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started