Questions:

Worksheet outline:

Questions:

Worksheet Template:

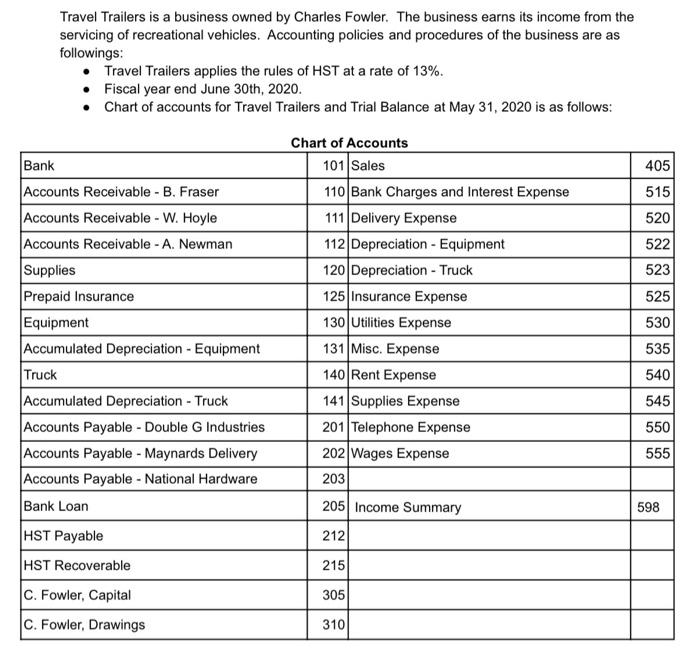

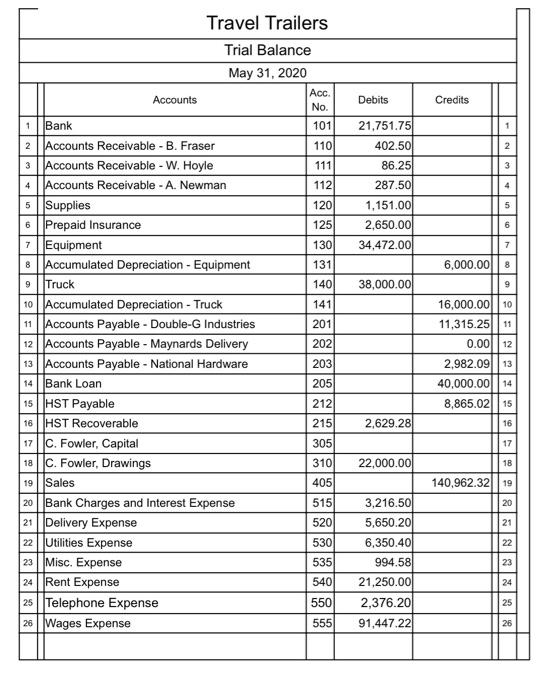

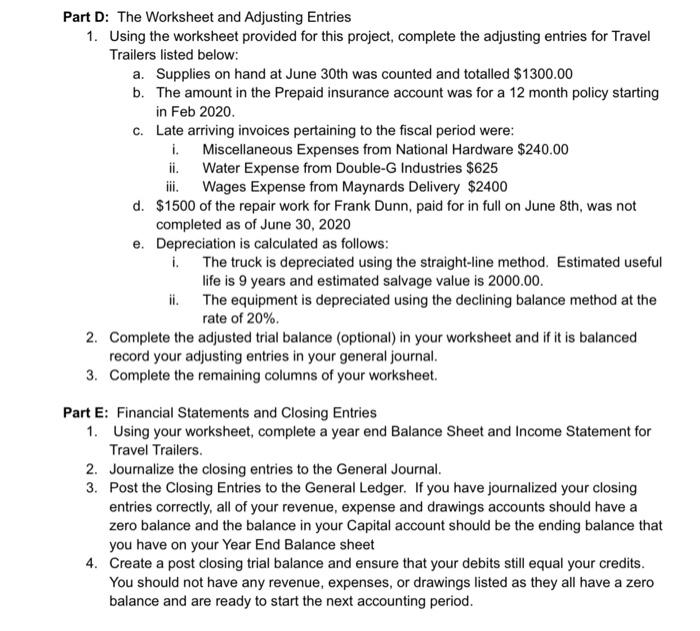

Travel Trailers is a business owned by Charles Fowler. The business earns its income from the servicing of recreational vehicles. Accounting policies and procedures of the business are as followings: Travel Trailers applies the rules of HST at a rate of 13%. Fiscal year end June 30th, 2020. Chart of accounts for Travel Trailers and Trial Balance at May 31, 2020 is as follows: 405 515 520 522 523 525 530 Chart of Accounts 101 Sales 110 Bank Charges and Interest Expense 111 Delivery Expense 112 Depreciation - Equipment 120 Depreciation - Truck 125 Insurance Expense 130 Utilities Expense 131 Misc. Expense 140 Rent Expense 141 Supplies Expense 201 Telephone Expense 202 Wages Expense 203 205 Income Summary 212 Bank Accounts Receivable - B. Fraser Accounts Receivable - W. Hoyle Accounts Receivable - A. Newman Supplies Prepaid Insurance Equipment Accumulated Depreciation - Equipment Truck Accumulated Depreciation - Truck Accounts Payable - Double G Industries Accounts Payable - Maynards Delivery Accounts Payable - National Hardware Bank Loan HST Payable HST Recoverable C. Fowler, Capital 535 540 545 550 555 598 215 305 C. Fowler, Drawings 310 Debits Credits 1 2 2 3 " 4 21,751.75 402.50 86.25 287.50 1,151.00 2,650.00 34,472.00 5 6 7 6,000.00 8 9 38,000.00 9 Travel Trailers Trial Balance May 31, 2020 Acc. Accounts No. Bank 101 Accounts Receivable - B. Fraser 110 Accounts Receivable - W. Hoyle 111 Accounts Receivable - A. Newman 112 5 Supplies 120 6 Prepaid Insurance 125 Equipment 130 8 Accumulated Depreciation - Equipment 131 Truck 140 10 Accumulated Depreciation - Truck 141 11 | Accounts Payable - Double-G Industries 201 12 Accounts Payable - Maynards Delivery 202 13 Accounts Payable - National Hardware 203 14 | Bank Loan 205 15 HST Payable 212 16 HST Recoverable 215 17|c. Fowler, Capital 305 18. Fowler, Drawings 310 Sales 405 20 Bank Charges and Interest Expense 515 21 Delivery Expense 520 22 Utilities Expense 530 23 Misc. Expense 535 24 Rent Expense 540 25 Telephone Expense 550 26 Wages Expense 555 16,000.00 10 11,315.2511 0.00112 2,982.09 13 40,000.00|| 14 8,865.02.15 16 2,629.28 17 22,000.00 18 19 140,962.3219 20 21 22 3,216.50 5,650.20 6,350.40 994.58 21,250.00 2,376.20 91,447.22 24 25 26 Part D: The Worksheet and Adjusting Entries 1. Using the worksheet provided for this project, complete the adjusting entries for Travel Trailers listed below: a. Supplies on hand at June 30th was counted and totalled $1300.00 b. The amount in the Prepaid insurance account was for a 12 month policy starting in Feb 2020. C. Late arriving invoices pertaining to the fiscal period were: i. Miscellaneous Expenses from National Hardware $240.00 ii. Water Expense from Double-G Industries $625 iii. Wages Expense from Maynards Delivery $2400 d. $1500 of the repair work for Frank Dunn, paid for in full on June 8th, was not completed as of June 30, 2020 e. Depreciation is calculated as follows: 1. The truck is depreciated using the straight-line method. Estimated useful life is 9 years and estimated salvage value is 2000.00 ii. The equipment is depreciated using the declining balance method at the rate of 20%. 2. Complete the adjusted trial balance (optional) in your worksheet and if it is balanced record your adjusting entries in your general journal. 3. Complete the remaining columns of your worksheet. Part E: Financial Statements and Closing Entries 1. Using your worksheet, complete a year end Balance Sheet and Income Statement for Travel Trailers. 2. Journalize the closing entries to the General Journal. 3. Post the Closing Entries to the General Ledger. If you have journalized your closing entries correctly, all of your revenue, expense and drawings accounts should have a zero balance and the balance in your Capital account should be the ending balance that you have on your Year End Balance sheet 4. Create a post closing trial balance and ensure that your debits still equal your credits. You should not have any revenue, expenses, or drawings listed as they all have a zero balance and are ready to start the next accounting period. Debits Credits 1 2 2 3 " 4 21,751.75 402.50 86.25 287.50 1,151.00 2,650.00 34,472.00 5 6 7 6,000.00 8 9 38,000.00 9 Travel Trailers Trial Balance May 31, 2020 Acc. Accounts No. Bank 101 Accounts Receivable - B. Fraser 110 Accounts Receivable - W. Hoyle 111 Accounts Receivable - A. Newman 112 5 Supplies 120 6 Prepaid Insurance 125 Equipment 130 8 Accumulated Depreciation - Equipment 131 Truck 140 10 Accumulated Depreciation - Truck 141 11 | Accounts Payable - Double-G Industries 201 12 Accounts Payable - Maynards Delivery 202 13 Accounts Payable - National Hardware 203 14 | Bank Loan 205 15 HST Payable 212 16 HST Recoverable 215 17|c. Fowler, Capital 305 18. Fowler, Drawings 310 Sales 405 20 Bank Charges and Interest Expense 515 21 Delivery Expense 520 22 Utilities Expense 530 23 Misc. Expense 535 24 Rent Expense 540 25 Telephone Expense 550 26 Wages Expense 555 16,000.00 10 11,315.2511 0.00112 2,982.09 13 40,000.00|| 14 8,865.02.15 16 2,629.28 17 22,000.00 18 19 140,962.3219 20 21 22 3,216.50 5,650.20 6,350.40 994.58 21,250.00 2,376.20 91,447.22 24 25 26 Part D: The Worksheet and Adjusting Entries 1. Using the worksheet provided for this project, complete the adjusting entries for Travel Trailers listed below: a. Supplies on hand at June 30th was counted and totalled $1300.00 b. The amount in the Prepaid insurance account was for a 12 month policy starting in Feb 2020. C. Late arriving invoices pertaining to the fiscal period were: i. Miscellaneous Expenses from National Hardware $240.00 ii. Water Expense from Double-G Industries $625 iii. Wages Expense from Maynards Delivery $2400 d. $1500 of the repair work for Frank Dunn, paid for in full on June 8th, was not completed as of June 30, 2020 e. Depreciation is calculated as follows: 1. The truck is depreciated using the straight-line method. Estimated useful life is 9 years and estimated salvage value is 2000.00 ii. The equipment is depreciated using the declining balance method at the rate of 20%. 2. Complete the adjusted trial balance (optional) in your worksheet and if it is balanced record your adjusting entries in your general journal. 3. Complete the remaining columns of your worksheet. Part E: Financial Statements and Closing Entries 1. Using your worksheet, complete a year end Balance Sheet and Income Statement for Travel Trailers. 2. Journalize the closing entries to the General Journal. 3. Post the Closing Entries to the General Ledger. If you have journalized your closing entries correctly, all of your revenue, expense and drawings accounts should have a zero balance and the balance in your Capital account should be the ending balance that you have on your Year End Balance sheet 4. Create a post closing trial balance and ensure that your debits still equal your credits. You should not have any revenue, expenses, or drawings listed as they all have a zero balance and are ready to start the next accounting period. She N Tralala DR CR DR 19 IS DR CR an UT 11 1590. 4050 doo "Jounal Entries 310 Parliculas Debat 'credit Sales Involca borroant amount Report Services ale 001 $590 To sales ale Corey Sodos 3. cheque copy Rent escenges old 091 TO Bank ale 4 sales invoice w Hoylec cleaning service) ak oh $900 To Sales are 5. Puerchase invoice. $ 296 Purchases al D01 $ 236 To National to dwou ale cash receipts. $86.26 cash ale 1486.26 " Cash sales Recipt $ 659 eash ale DJ 16. "To Sales ale . Debit Advice Suoo Interest alc To Bank atc. 001 To w. Hoyle ate. Bank 9 $400 10 cheque cory $ 2000 2000 Drawings atc on To dank alc 10. cheque copy 31357 5433 wagos ale - bon 'To Bank alc 566 18 Purchase Invoice puchose ale - 001 $ 500 To cash $ 2150 To Double G - Industies che que copy $55 Postage changes a le-DO Telephone biti alc_091 TO Bank ale $ 311 utilities Bitt Hydor usage ale D1 $426 To Bills payable. $426 90 cash receipt sup. cash ale 097 $ 900 TO A Necoman ale 200 18 Bank Debit Advice. service charges, alcool $65 To Bank ale 1$65 Coredit Invoice $15 Purchases alc - Da To Double G Industrie Norawing all Inventory -Dor alt $35 To $35 Part D: The Worksheet and Adjusting Entries 1. Using the worksheet provided for this project, complete the adjusting entries for Travel Trailers listed below: a Supplies on hand at June 30th was counted and totalled $1300.00 b. The amount in the Prepaid insurance account was for a 12 month policy starting in Feb 2020. c. Late arriving invoices pertaining to the fiscal period were: i. Miscellaneous Expenses from National Hardware $240.00 i. Water Expense from Double-G Industries $625 iii. Wages Expense from Maynards Delivery $2400 d. $1500 of the repair work for Frank Dunn, paid for in full on June 8th, was not completed as of June 30, 2020 e. Depreciation is calculated as follows: i The truck is depreciated using the straight-line method. Estimated useful life is 9 years and estimated salvage value is 2000.00 ii. The equipment is depreciated using the declining balance method at the rate of 20% 2. Complete the adjusted trial balance (optional) in your worksheet and if it is balanced record your adjusting entries in your general journal. 3. Complete the remaining columns of your worksheet. 4. Post all adjusting entries to the general ledgers. Part E: Financial Statements and Closing Entries 1. Using your worksheet, complete a year end Balance Sheet and Income Statement for Travel Trailers 2. Journalize the closing entries to the General Journal. 3. Post the Closing Entries to the General Ledger. If you have journalized your closing entries correctly, all of your revenue, expense and drawings accounts should have a zero balance and the balance in your Cap account should be the ending balance that you have on your Year End Balance sheet 4. Create a post closing trial balance and ensure that your debits still equal your credits. You should not have any revenue, expenses, or drawings listed as they all have a zero balance and are ready to start the next accounting period. Worksheet Accounts Trial Balance DR CR Adjustments DR CR No Income Statement DR CR Balance Sheet DR CR 4 5 10 10 11 12 13 13 14 14 15 15 19 17 18 19 19 20 21 21 27 23 21 24 24 25 26 27 28 28 29 29 30 11 3 12 12 33 14 14 35 55 16 39 38 15 39