Question

1.Does MMF own or rent its building facilities. How do you know? 2.Calculate the percent change in total assets from 1999 to 2000. 3.Calculate the

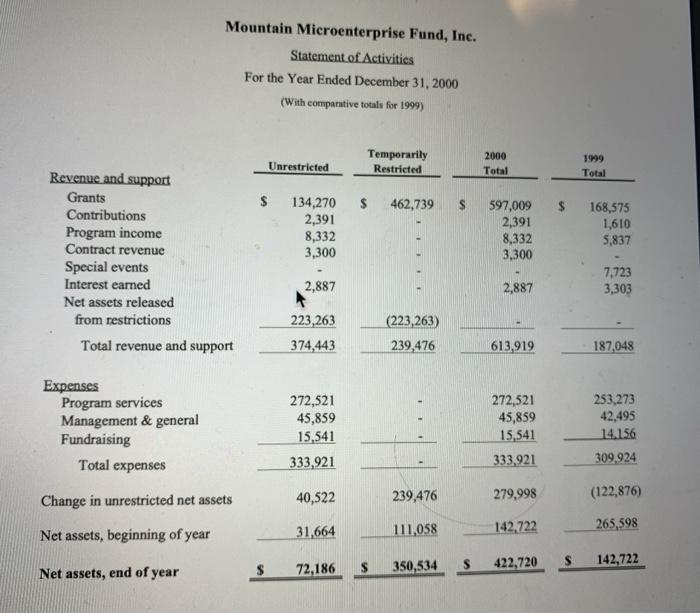

1.Does MMF own or rent its building facilities. How do you know?

2.Calculate the percent change in total assets from 1999 to 2000.

3.Calculate the percent change in temporarily restricted net assets from 1999 to 2000.

4.What proportion of MMF’s net assets were restricted on Dec 31, 2000?

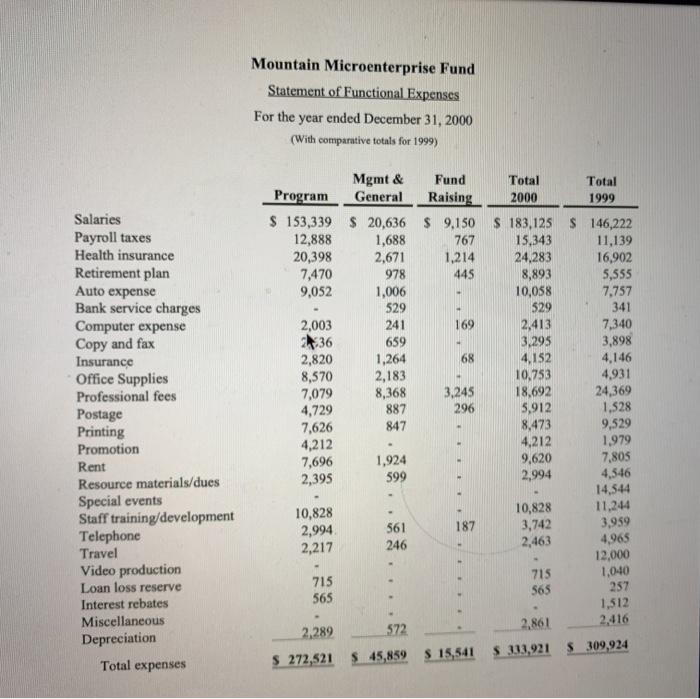

5.The total insurance expense for MMF was 4,152 in 2000. How much of the insurance expense did MMF attribute to program expenses?

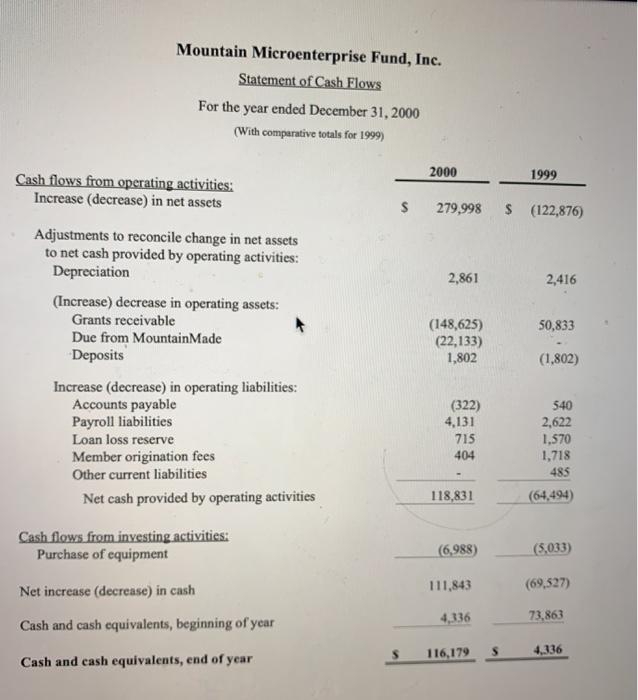

6.Calculate the return on total assets (ROA) for years 1999 and 2000.

Return on total assets = Increase in total net assets / total assets.

Is this trend in the ROA favorable or unfavorable? Explain.

7.Calculate the days of cash on hand ratio for year 2000.

Days of cash on hand = Cash/ [(operating expenses- depreciation)/365]

Does the days of cash on hand ratio indicate a liquidity problem? Explain.

8.Calculate the Grants receivable turnover ratio AND the average grant collection period for years 2000 and 1999.

Grants receivable turnover=Total Grant Revenue / Grants Receivable

Average grant collection period= 365/grants receivable turnover

Is the trend in grants receivable turnover favorable or unfavorable? Explain.

Do the values of the average grant collection period warrant concern over the collection procedures of MMF’s grants? Explain.

9.How much cash did MMF borrow in 2000? Justify your answer.

10.MMF has an asset called ‘Due from MountainMade’ on its 2000 balance sheet. What is MountainMade and why is it called due from rather than an accounts receivable?

11.MMF had negative cash flows from operating activities in 1999. A primary reason for this negative cash flow is:

a.a large increase in grants payable

b.a large decrease in operating liabilities

c.a large decrease in net assets

d. the replacement of damaged equipment

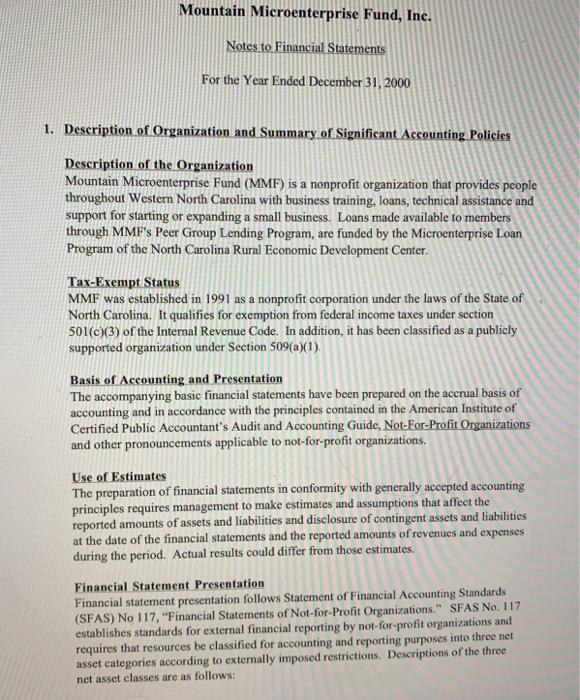

12.MMF is incorporated as a nonprofit organization in which state

a.New York

b.Colorado

c.New Hampshire

d.North Carolina

13. True or False. MMF would classify a T-bill with a six month maturity as a cash equivalent. Justify your answer.

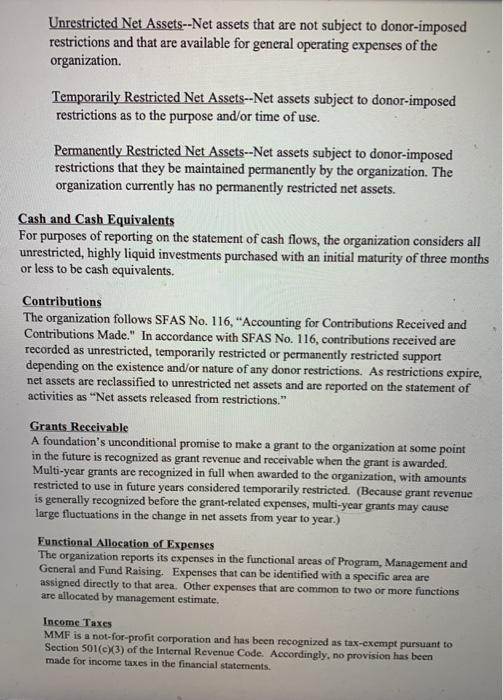

14.In 1999 MMF had a grant receivable of 40,500 from the Charles Stewart Mott Foundation. Was the grant received in 2000? Justify your answer.

15.MMF collects a 10% origination fee on member loans. Why is the fee recorded as a liability rather than revenue and support?

16.Calculate the Program services ratio for MMF in 2000.

Program services ratio= Program expenses / total expenses

Mountain Microenterprise Fund, Inc. Statement of Financial Position December 31, 2000 (With comparative totals at December 31, 1999) Assets 2000 1999 Current assets Cash 116,179 284,125 22,133 4,336 Grants receivable 135,500 Due from MountainMade Deposits 1,802 Total current assets 422,437 141,638 Property and equipment Furniture and equipment, net 14,314 10,187 Total assets 436,751 151,825 Liabilities and net assets Current liabilities Accounts payable Payroll liabilities 1,682 6,753 3,160 2,436 2,004 2,622 2,445 2,032 Loan loss reserve Loan origination fees Total current liabilities 14,031 9,103 Net assets Unrestricted 72,186 31,664 Temporarily restricted 350,534 111.058 Total net assets 422,720 142,722 Total liabilities and net assets 436,751 151,825

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 MMF rents its offices from third parties This information is stated in Note 6 of the financial report Question 2 Percentage change in total assets from statement of financial position436751...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started