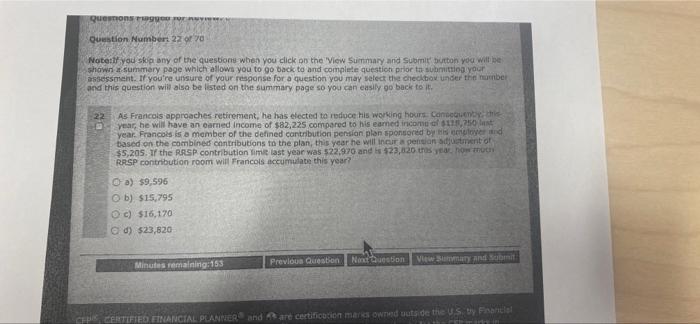

Questions regge for Question Number: 22 of 70- Note:If you skip any of the questions when you click on the 'View Summary and Submit button you will be shown a summery page which allows you to go back to and complete question prior to submitting your assessment. If you're unsure of your response for a question you may select the checkbox under the number and this question will also be listed on the summary page so you can easily go back to it. As Francois approaches retirement, he has elected to reduce his working hours. Consequently, this year, he will have an earned income of $82,225 compared to his earned income of $118,750 last year. Francois is a member of the defined contribution pension plan sponsored by his employer and based on the combined contributions to the plan, this year he will incur a pension adjustment of $5,205. If the RRSP contribution limit last year was $22,970 and is $23,820 this year, how much RRSP contribution room will Francois accumulate this year? a) $9,595 Ob) $15,795 Oc) $16,170 d) $23,820 Minutes remaining:153 Previous Question Next Question View Summary and Submit S4433 GES CFP CERTIFIED FINANCIAL PLANNER and are certification marks owned outside the U.S. by Financial Farbe in Questions regge for Question Number: 22 of 70- Note:If you skip any of the questions when you click on the 'View Summary and Submit button you will be shown a summery page which allows you to go back to and complete question prior to submitting your assessment. If you're unsure of your response for a question you may select the checkbox under the number and this question will also be listed on the summary page so you can easily go back to it. As Francois approaches retirement, he has elected to reduce his working hours. Consequently, this year, he will have an earned income of $82,225 compared to his earned income of $118,750 last year. Francois is a member of the defined contribution pension plan sponsored by his employer and based on the combined contributions to the plan, this year he will incur a pension adjustment of $5,205. If the RRSP contribution limit last year was $22,970 and is $23,820 this year, how much RRSP contribution room will Francois accumulate this year? a) $9,595 Ob) $15,795 Oc) $16,170 d) $23,820 Minutes remaining:153 Previous Question Next Question View Summary and Submit S4433 GES CFP CERTIFIED FINANCIAL PLANNER and are certification marks owned outside the U.S. by Financial Farbe in