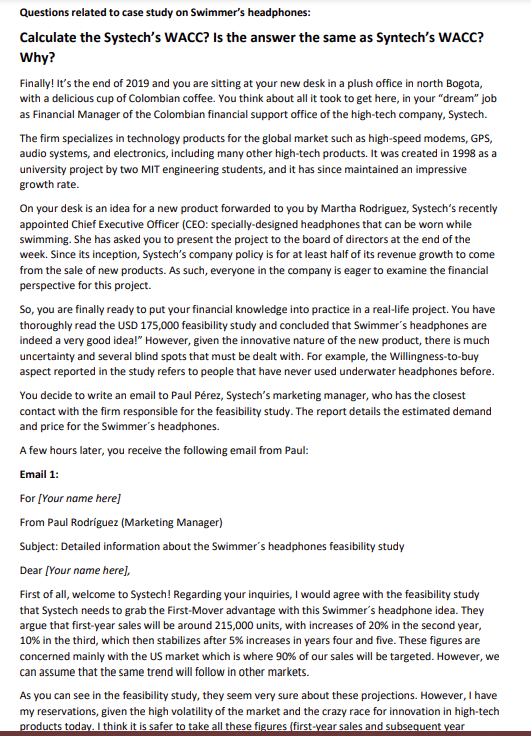

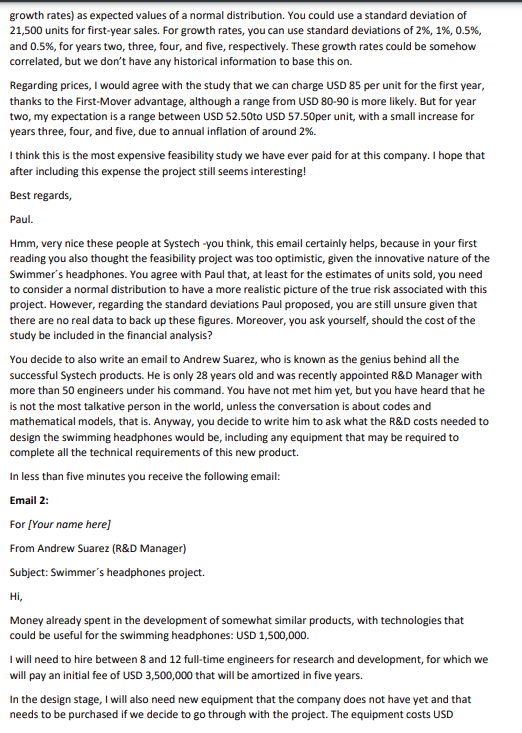

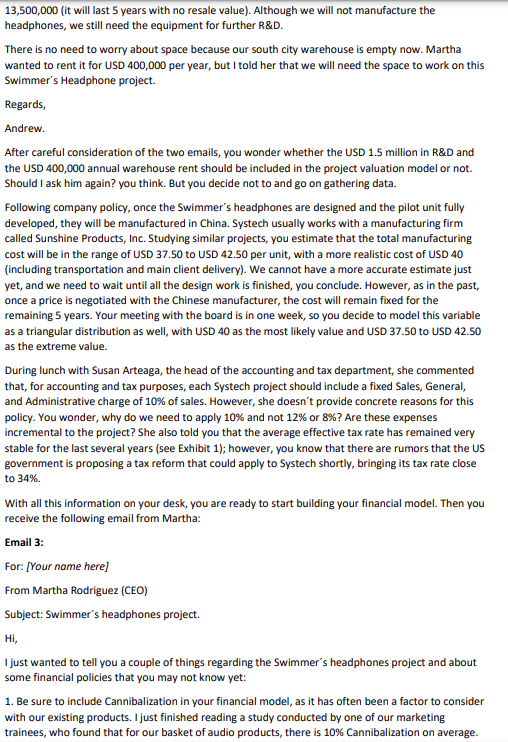

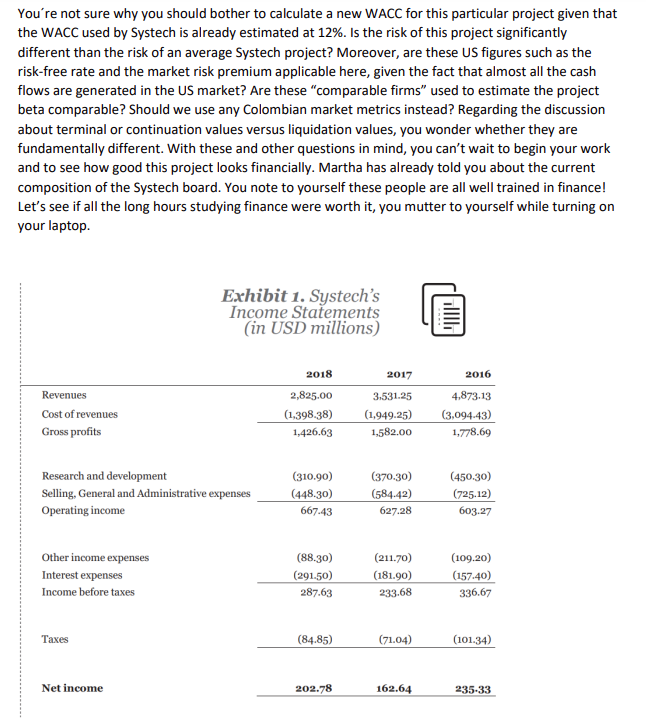

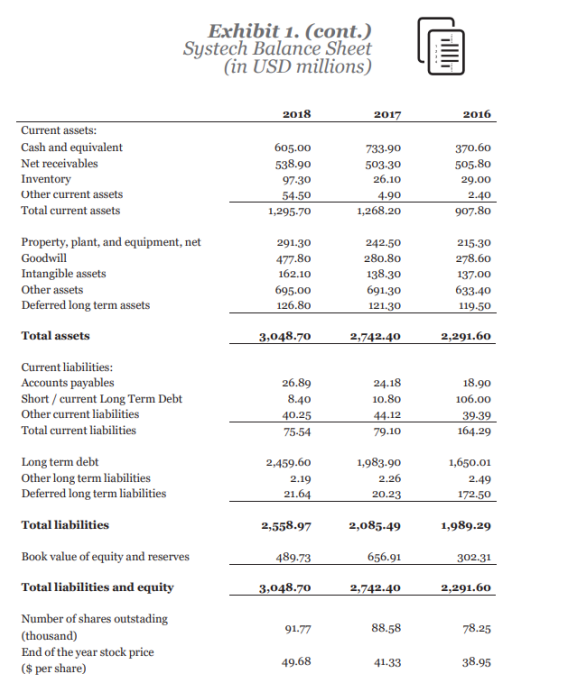

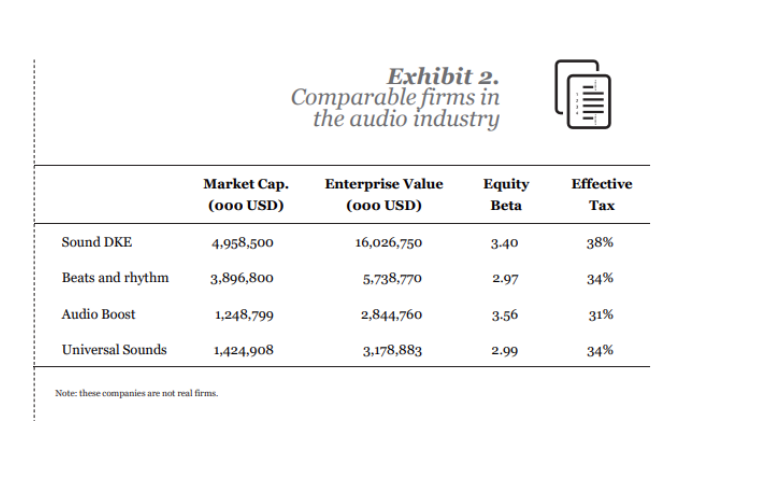

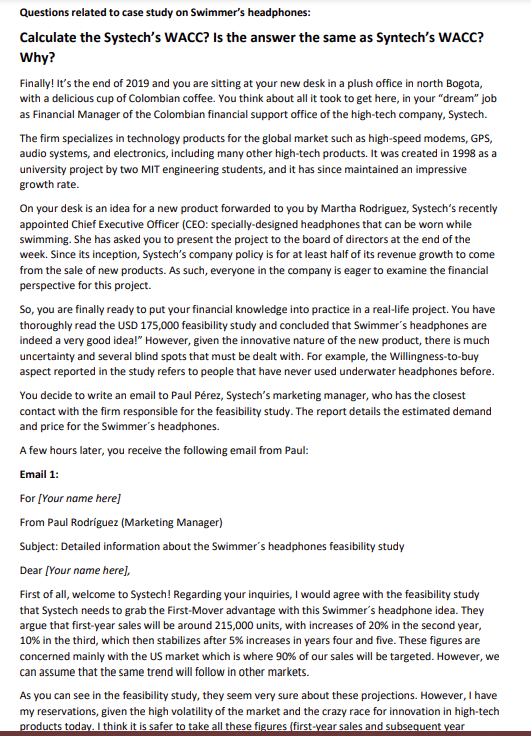

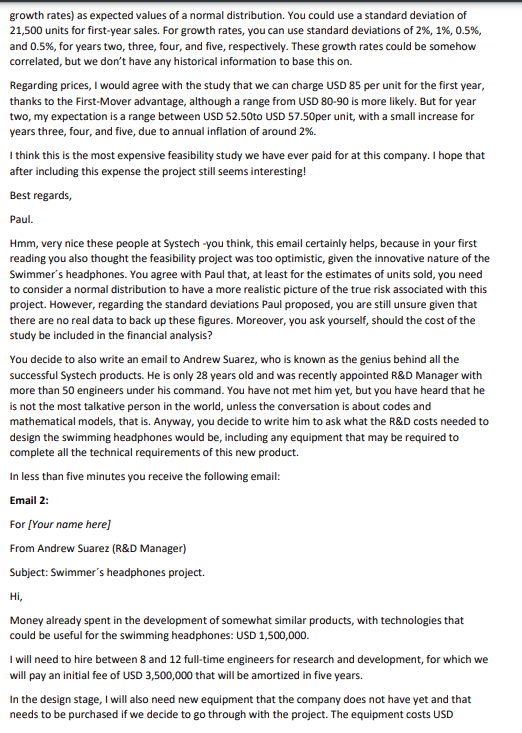

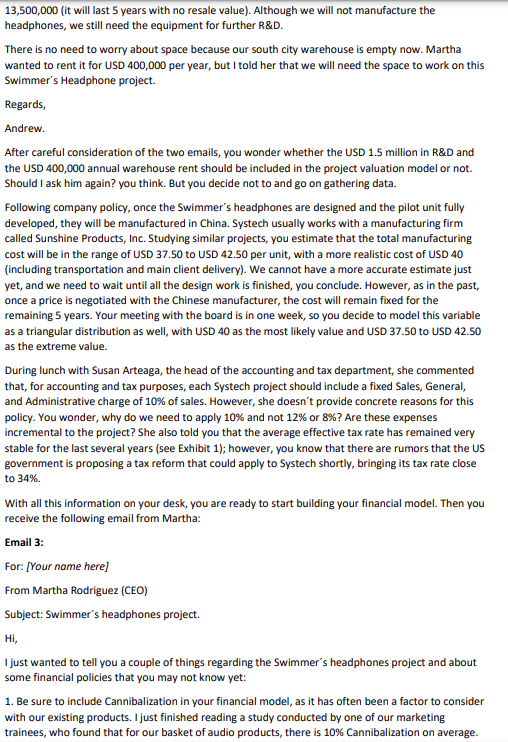

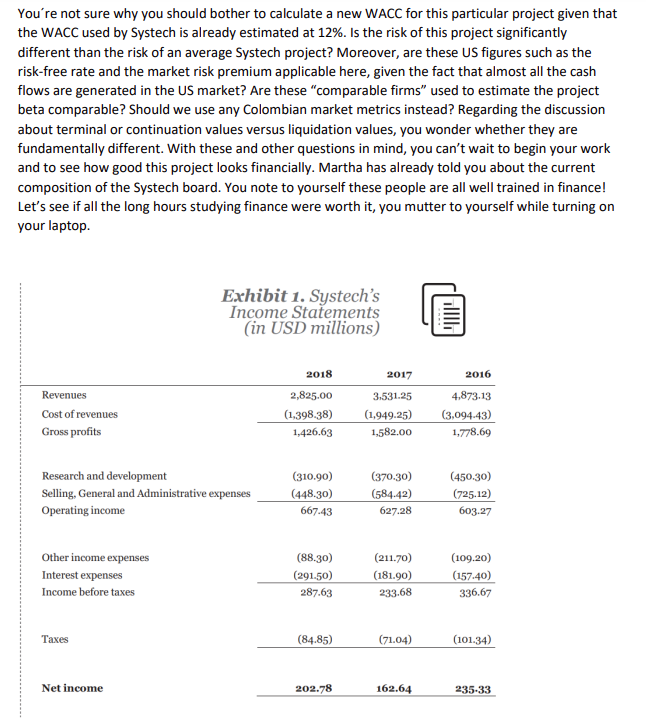

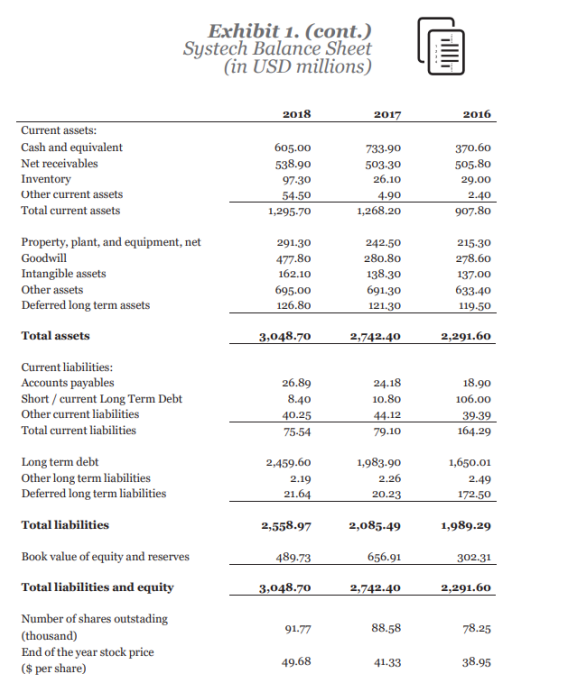

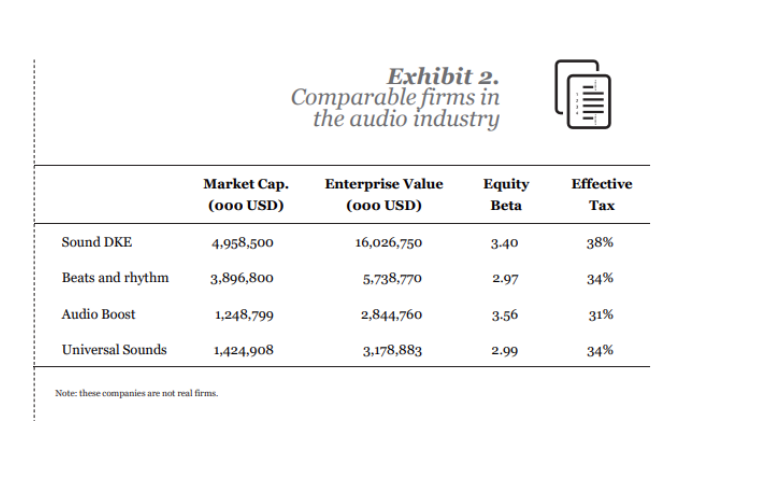

Questions related to case study on Swimmer's headphones: Calculate the Systech's WACC? Is the answer the same as Syntech's WACC? Why? Finally! It's the end of 2019 and you are sitting at your new desk in a plush office in north Bogota, with a delicious cup of Colombian coffee. You think about all it took to get here, in your "dream" job as Financial Manager of the Colombian financial support office of the high-tech company, Systech. The firm specializes in technology products for the global market such as high-speed modems, GPS, audio systems, and electronics, including many other high-tech products. It was created in 1998 as a university project by two MIT engineering students, and it has since maintained an impressive growth rate. On your desk is an idea for a new product forwarded to you by Martha Rodriguez, Systech's recently appointed Chief Executive Officer (CEO: specially-designed headphones that can be worn while swimming. She has asked you to present the project to the board of directors at the end of the week. Since its inception, Systech's company policy is for at least half of its revenue growth to come from the sale of new products. As such, everyone in the company is eager to examine the financial perspective for this project. So, you are finally ready to put your financial knowledge into practice in a real-life project. You have thoroughly read the USD 175,000 feasibility study and concluded that Swimmer's headphones are indeed a very good idea!" However, given the innovative nature of the new product, there is much uncertainty and several blind spots that must be dealt with. For example, the Willingness-to-buy aspect reported in the study refers to people that have never used underwater headphones before. You decide to write an email to Paul Prez, Systech's marketing manager, who has the closest contact with the firm responsible for the feasibility study. The report details the estimated demand and price for the Swimmer's headphones. A few hours later, you receive the following email from Paul: Email 1: For [Your name here) From Paul Rodrguez (Marketing Manager) Subject: Detailed information about the Swimmer's headphones feasibility study Dear [Your name here), First of all, welcome to Systech! Regarding your inquiries, I would agree with the feasibility study that Systech needs to grab the First-Mover advantage with this Swimmer's headphone idea. They argue that first-year sales will be around 215,000 units, with increases of 20% in the second year, 10% in the third, which then stabilizes after 5% increases in years four and five. These figures are concerned mainly with the US market which is where 90% of our sales will be targeted. However, we can assume that the same trend will follow in other markets. As you can see in the feasibility study, they seem very sure about these projections. However, I have my reservations, given the high volatility of the market and the crazy race for innovation in high-tech products today. I think it is safer to take all these figures (first-year sales and subsequent year growth rates) as expected values of a normal distribution. You could use a standard deviation of 21,500 units for first-year sales. For growth rates, you can use standard deviations of 2%, 1%, 0.5%, and 0.5%, for years two, three, four, and five, respectively. These growth rates could be somehow correlated, but we don't have any historical information to base this on. Regarding prices, I would agree with the study that we can charge USD 85 per unit for the first year, thanks to the First-Mover advantage, although a range from USD 80-90 is more likely. But for year two, my expectation is a range between USD 52.50to USD 57.5Oper unit, with a small increase for years three, four, and five, due to annual inflation of around 2%. I think this is the most expensive feasibility study we have ever paid for at this company. I hope that after including this expense the project still seems interesting! Best regards, Paul. Hmm, very nice these people at Systech -you think, this email certainly helps, because in your first reading you also thought the feasibility project was too optimistic, given the innovative nature of the Swimmer's headphones. You agree with Paul that, at least for the estimates of units sold, you need to consider a normal distribution to have a more realistic picture of the true risk associated with this project. However, regarding the standard deviations Paul proposed, you are still unsure given that there are no real data to back up these figures. Moreover, you ask yourself, should the cost of the study be included in the financial analysis? You decide to also write an email to Andrew Suarez, who is known as the genius behind all the successful Systech products. He is only 28 years old and was recently appointed R&D Manager with more than 50 engineers under his command. You have not met him yet, but you have heard that he is not the most talkative person in the world, unless the conversation is about codes and mathematical models, that is. Anyway, you decide to write him to ask what the R&D costs needed to design the swimming headphones would be, including any equipment that may be required to complete all the technical requirements of this new product. In less than five minutes you receive the following email: Email 2: For [Your name here] From Andrew Suarez (R&D Manager) Subject: Swimmer's headphones project. Hi, Money already spent in the development of somewhat similar products, with technologies that could be useful for the swimming headphones: USD 1,500,000. I will need to hire between 8 and 12 full-time engineers for research and development, for which we will pay an initial fee of USD 3,500,000 that will be amortized in five years. In the design stage, I will also need new equipment that the company does not have yet and that needs to be purchased if we decide to go through with the project. The equipment costs USD 13,500,000 (it will last 5 years with no resale value). Although we will not manufacture the headphones, we still need the equipment for further R&D. There is no need to worry about space because our south city warehouse is empty now. Martha wanted to rent it for USD 400,000 per year, but I told her that we will need the space to work on this Swimmer's Headphone project. Regards, Andrew. After careful consideration of the two emails, you wonder whether the USD 1.5 million in R&D and the USD 400,000 annual warehouse rent should be included in the project valuation model or not. Should I ask him again? you think. But you decide not to and go on gathering data. Following company policy, once the Swimmer's headphones are designed and the pilot unit fully developed, they will be manufactured in China. Systech usually works with a manufacturing firm called Sunshine Products, Inc. Studying similar projects, you estimate that the total manufacturing cost will be in the range of USD 37.50 to USD 42.50 per unit, with a more realistic cost of USD 40 (including transportation and main client delivery). We cannot have a more accurate estimate just yet, and we need to wait until all the design work is finished, you conclude. However, as in the past, once a price is negotiated with the Chinese manufacturer, the cost will remain fixed for the remaining 5 years. Your meeting with the board is in one week, so you decide to model this variable as a triangular distribution as well with USD 40 as the most likely value and USD 37.50 to USD 42.50 as the extreme value. During lunch with Susan Arteaga, the head of the accounting and tax department, she commented that, for accounting and tax purposes, each Systech project should include a fixed Sales, General, and Administrative charge of 10% of sales. However, she doesn't provide concrete reasons for this policy. You wonder, why do we need to apply 10% and not 12% or 8%? Are these expenses incremental to the project? She also told you that the average effective tax rate has remained very stable for the last several years (see Exhibit 1); however, you know that there are rumors that the US government is proposing a tax reform that could apply to Systech shortly, bringing its tax rate close to 34%. With all this information on your desk, you are ready to start building your financial model. Then you receive the following email from Martha: Email 3: For: [Your name here] From Martha Rodriguez (CEO) Subject: Swimmer's headphones project. Hi, I just wanted to tell you a couple of things regarding the Swimmer's headphones project and about some financial policies that you may not know yet: 1. Be sure to include Cannibalization in your financial model, as it has often been a factor to consider with our existing products. I just finished reading a study conducted by one of our marketing trainees, who found that for our basket of audio products, there is 10% Cannibalization on average. In the same vein, the average price and cost of our basket of audio products is around 85% of the projected price and cost for the Swimmer's headphones. I want to be clear on this important issue that has got me into trouble a couple of times before. If we assume that we will sell 215,000 headphones in year 1, that will reduce the sale of the firm's other audio products by 21,500 (=215,000*10%) units. Therefore, our sale estimate for that year must be reduced by an average of USD 85*85% = 72.25*21,500 = 1,553,375 due to cannibalization. Of course, we also need to reduce the cost by USD 40*85% = 34-21,500 = 731,000 for that year. I know you may be wondering how reliable these 10% and 85% figures are. Unfortunately, I have not had the time to go through the report thoroughly and we should probably not take these figures at face value, but I think for the moment, we can model them with a normal distribution. 2. Given the difficulty of calculating the incremental impact of any given project on the Systech working capital accounts, in this case, we estimate that after the project begins (Time 1) the cash needed could be the following: 5% of sales, accounts receivable of 10% sales, inventory of 7% sales, and accounts payable of 8% of the cost of goods sold. Of course, all these figures are average values, so you can model them using a normal distribution with those figures as expected values and a standard deviation of +/-10% of the given expected value. The initial (Time zero) working capital will be around USD 2,000,000 3. As I once mentioned to you, the average WACC for Syntech is 12%; however, we are trying to differentiate the WACC calculations among different lines of business, given different market risks and financing possibilities. For this project, we can use the average market-based Debt-to-Equity ratio using only long-term financial debt (see Exhibit 1). The cost of debt has been very stable through the last couple of years so you can use the average implicit cost of debt that could be extracted from Exhibit 1. To estimate the WACC, there are always discussions and disagreements among the members of the board concerning the adequate cost of equity. I would recommend that we use the CAPM with a 4% risk- free interest rate and a 7% market risk premium. I gathered this data from professor Damodaran's web page a few months ago. I have also sent attached information about four other companies that also make audio products. This may help you to estimate the project Beta (see Exhibit 2), although it is important to notice (and this observation could be raised by a board member during the discussion), that none of these comparable firms make Swimmer's headphones. Finally, it is a common practice in Systech's project analysis to assume a Terminal or Continuation Value equal to a perpetual growth rate of 2% per year after the last Free Cash Flow of each project considered. However, some regional managers believe that after 5 years all competitors will already be producing a similar product and that we will be better off ending the project by selling the brand, the equipment, and the working capital for USD 20 million (assuming that the sale of the project will take place at the end of the fifth year and the USD 20 million represent the net Free Cash Flow you will receive - net of taxes). In case we decide to use the liquidation value of USD 20 million, we will assume that the recovery of the initial working capital will be included in that. In this case, if we decide to go on with the traditional practice of using the terminal value instead, we don't need to consider the recovery of the working capital in the analysis. Regards, Martha. You're not sure why you should bother to calculate a new WACC for this particular project given that the WACC used by Systech is already estimated at 12%. Is the risk of this project significantly different than the risk of an average Systech project? Moreover, are these US figures such as the risk-free rate and the market risk premium applicable here, given the fact that almost all the cash flows are generated in the US market? Are these "comparable firms" used to estimate the project beta comparable? Should we use any Colombian market metrics instead? Regarding the discussion about terminal or continuation values versus liquidation values, you wonder whether they are fundamentally different. With these and other questions in mind, you can't wait to begin your work and to see how good this project looks financially. Martha has already told you about the current composition of the Systech board. You note to yourself these people are all well trained in finance! Let's see if all the long hours studying finance were worth it, you mutter to yourself while turning on your laptop. Exhibit 1. Systech's Income Statements (in USD millions) UIT 2017 Revenues Cost of revenues Gross profits 2018 2,825.00 (1,398.38) 1,426.63 3,531.25 (1,949.25) 1.582.00 2016 4.873.13 (3,094-43) 1,778.69 Research and development Selling, General and Administrative expenses Operating income (310.90) (448.30) 667.43 (370:30) (584.42) 627.28 (450.30) (725.12) 603.27 Other income expenses Interest expenses Income before taxes (88.30) (291.50) 287.63 (211.70) (181.90) 233.68 (109.20) (157.40) 336.67 Taxes (84.85) (71.04) (101.34) Net income 202.78 162.64 235-33 Exhibit 1. (cont.) Systech Balance Sheet (in USD millions) 2018 2017 2016 605.00 538.90 97.30 54.50 1,295.70 733-90 503-30 26.10 4.90 1,268.20 370.60 505.80 29.00 2.40 907.80 Current assets: Cash and equivalent Net receivables Inventory Other current assets Total current assets Property, plant, and equipment, net Goodwill Intangible assets Other assets Deferred long term assets 291.30 477.80 162.10 695.00 126.80 242.50 280.80 138.30 691.30 121.30 215-30 278.60 137.00 633.40 119.50 Total assets 3,048.70 2,742.40 2,291.60 Current liabilities: Accounts payables Short / current Long Term Debt Other current liabilities Total current liabilities 26.89 8.40 40.25 75-54 24.18 10.80 44.12 79.10 18.90 106.00 39.39 164.29 Long term debt Other long term liabilities Deferred long term liabilities 2,459.60 2.19 21.64 1,983.90 2.26 20.23 1,650.01 2.49 172.50 2,558.97 2,085-49 1,989.29 489.73 656.91 302.31 3,048.70 2,742.40 2,291.60 Total liabilities Book value of equity and reserves Total liabilities and equity Number of shares outstading (thousand) End of the year stock price ($ per share) 91.77 88.58 78.25 49.68 41.33 38.95 Exhibit 2. Comparable firms in the audio industry Market Cap. (000 USD) Enterprise Value (000 USD) Equity Beta Effective Tax Sound DKE 4,958,500 16,026,750 3.40 38% Beats and rhythm 3,896,800 5.738,770 2.97 34% Audio Boost 1,248,799 2,844,760 3.56 31% Universal Sounds 1,424,908 3,178,883 2.99 34% Note: these companies are not real firms, Questions related to case study on Swimmer's headphones: Calculate the Systech's WACC? Is the answer the same as Syntech's WACC? Why? Finally! It's the end of 2019 and you are sitting at your new desk in a plush office in north Bogota, with a delicious cup of Colombian coffee. You think about all it took to get here, in your "dream" job as Financial Manager of the Colombian financial support office of the high-tech company, Systech. The firm specializes in technology products for the global market such as high-speed modems, GPS, audio systems, and electronics, including many other high-tech products. It was created in 1998 as a university project by two MIT engineering students, and it has since maintained an impressive growth rate. On your desk is an idea for a new product forwarded to you by Martha Rodriguez, Systech's recently appointed Chief Executive Officer (CEO: specially-designed headphones that can be worn while swimming. She has asked you to present the project to the board of directors at the end of the week. Since its inception, Systech's company policy is for at least half of its revenue growth to come from the sale of new products. As such, everyone in the company is eager to examine the financial perspective for this project. So, you are finally ready to put your financial knowledge into practice in a real-life project. You have thoroughly read the USD 175,000 feasibility study and concluded that Swimmer's headphones are indeed a very good idea!" However, given the innovative nature of the new product, there is much uncertainty and several blind spots that must be dealt with. For example, the Willingness-to-buy aspect reported in the study refers to people that have never used underwater headphones before. You decide to write an email to Paul Prez, Systech's marketing manager, who has the closest contact with the firm responsible for the feasibility study. The report details the estimated demand and price for the Swimmer's headphones. A few hours later, you receive the following email from Paul: Email 1: For [Your name here) From Paul Rodrguez (Marketing Manager) Subject: Detailed information about the Swimmer's headphones feasibility study Dear [Your name here), First of all, welcome to Systech! Regarding your inquiries, I would agree with the feasibility study that Systech needs to grab the First-Mover advantage with this Swimmer's headphone idea. They argue that first-year sales will be around 215,000 units, with increases of 20% in the second year, 10% in the third, which then stabilizes after 5% increases in years four and five. These figures are concerned mainly with the US market which is where 90% of our sales will be targeted. However, we can assume that the same trend will follow in other markets. As you can see in the feasibility study, they seem very sure about these projections. However, I have my reservations, given the high volatility of the market and the crazy race for innovation in high-tech products today. I think it is safer to take all these figures (first-year sales and subsequent year growth rates) as expected values of a normal distribution. You could use a standard deviation of 21,500 units for first-year sales. For growth rates, you can use standard deviations of 2%, 1%, 0.5%, and 0.5%, for years two, three, four, and five, respectively. These growth rates could be somehow correlated, but we don't have any historical information to base this on. Regarding prices, I would agree with the study that we can charge USD 85 per unit for the first year, thanks to the First-Mover advantage, although a range from USD 80-90 is more likely. But for year two, my expectation is a range between USD 52.50to USD 57.5Oper unit, with a small increase for years three, four, and five, due to annual inflation of around 2%. I think this is the most expensive feasibility study we have ever paid for at this company. I hope that after including this expense the project still seems interesting! Best regards, Paul. Hmm, very nice these people at Systech -you think, this email certainly helps, because in your first reading you also thought the feasibility project was too optimistic, given the innovative nature of the Swimmer's headphones. You agree with Paul that, at least for the estimates of units sold, you need to consider a normal distribution to have a more realistic picture of the true risk associated with this project. However, regarding the standard deviations Paul proposed, you are still unsure given that there are no real data to back up these figures. Moreover, you ask yourself, should the cost of the study be included in the financial analysis? You decide to also write an email to Andrew Suarez, who is known as the genius behind all the successful Systech products. He is only 28 years old and was recently appointed R&D Manager with more than 50 engineers under his command. You have not met him yet, but you have heard that he is not the most talkative person in the world, unless the conversation is about codes and mathematical models, that is. Anyway, you decide to write him to ask what the R&D costs needed to design the swimming headphones would be, including any equipment that may be required to complete all the technical requirements of this new product. In less than five minutes you receive the following email: Email 2: For [Your name here] From Andrew Suarez (R&D Manager) Subject: Swimmer's headphones project. Hi, Money already spent in the development of somewhat similar products, with technologies that could be useful for the swimming headphones: USD 1,500,000. I will need to hire between 8 and 12 full-time engineers for research and development, for which we will pay an initial fee of USD 3,500,000 that will be amortized in five years. In the design stage, I will also need new equipment that the company does not have yet and that needs to be purchased if we decide to go through with the project. The equipment costs USD 13,500,000 (it will last 5 years with no resale value). Although we will not manufacture the headphones, we still need the equipment for further R&D. There is no need to worry about space because our south city warehouse is empty now. Martha wanted to rent it for USD 400,000 per year, but I told her that we will need the space to work on this Swimmer's Headphone project. Regards, Andrew. After careful consideration of the two emails, you wonder whether the USD 1.5 million in R&D and the USD 400,000 annual warehouse rent should be included in the project valuation model or not. Should I ask him again? you think. But you decide not to and go on gathering data. Following company policy, once the Swimmer's headphones are designed and the pilot unit fully developed, they will be manufactured in China. Systech usually works with a manufacturing firm called Sunshine Products, Inc. Studying similar projects, you estimate that the total manufacturing cost will be in the range of USD 37.50 to USD 42.50 per unit, with a more realistic cost of USD 40 (including transportation and main client delivery). We cannot have a more accurate estimate just yet, and we need to wait until all the design work is finished, you conclude. However, as in the past, once a price is negotiated with the Chinese manufacturer, the cost will remain fixed for the remaining 5 years. Your meeting with the board is in one week, so you decide to model this variable as a triangular distribution as well with USD 40 as the most likely value and USD 37.50 to USD 42.50 as the extreme value. During lunch with Susan Arteaga, the head of the accounting and tax department, she commented that, for accounting and tax purposes, each Systech project should include a fixed Sales, General, and Administrative charge of 10% of sales. However, she doesn't provide concrete reasons for this policy. You wonder, why do we need to apply 10% and not 12% or 8%? Are these expenses incremental to the project? She also told you that the average effective tax rate has remained very stable for the last several years (see Exhibit 1); however, you know that there are rumors that the US government is proposing a tax reform that could apply to Systech shortly, bringing its tax rate close to 34%. With all this information on your desk, you are ready to start building your financial model. Then you receive the following email from Martha: Email 3: For: [Your name here] From Martha Rodriguez (CEO) Subject: Swimmer's headphones project. Hi, I just wanted to tell you a couple of things regarding the Swimmer's headphones project and about some financial policies that you may not know yet: 1. Be sure to include Cannibalization in your financial model, as it has often been a factor to consider with our existing products. I just finished reading a study conducted by one of our marketing trainees, who found that for our basket of audio products, there is 10% Cannibalization on average. In the same vein, the average price and cost of our basket of audio products is around 85% of the projected price and cost for the Swimmer's headphones. I want to be clear on this important issue that has got me into trouble a couple of times before. If we assume that we will sell 215,000 headphones in year 1, that will reduce the sale of the firm's other audio products by 21,500 (=215,000*10%) units. Therefore, our sale estimate for that year must be reduced by an average of USD 85*85% = 72.25*21,500 = 1,553,375 due to cannibalization. Of course, we also need to reduce the cost by USD 40*85% = 34-21,500 = 731,000 for that year. I know you may be wondering how reliable these 10% and 85% figures are. Unfortunately, I have not had the time to go through the report thoroughly and we should probably not take these figures at face value, but I think for the moment, we can model them with a normal distribution. 2. Given the difficulty of calculating the incremental impact of any given project on the Systech working capital accounts, in this case, we estimate that after the project begins (Time 1) the cash needed could be the following: 5% of sales, accounts receivable of 10% sales, inventory of 7% sales, and accounts payable of 8% of the cost of goods sold. Of course, all these figures are average values, so you can model them using a normal distribution with those figures as expected values and a standard deviation of +/-10% of the given expected value. The initial (Time zero) working capital will be around USD 2,000,000 3. As I once mentioned to you, the average WACC for Syntech is 12%; however, we are trying to differentiate the WACC calculations among different lines of business, given different market risks and financing possibilities. For this project, we can use the average market-based Debt-to-Equity ratio using only long-term financial debt (see Exhibit 1). The cost of debt has been very stable through the last couple of years so you can use the average implicit cost of debt that could be extracted from Exhibit 1. To estimate the WACC, there are always discussions and disagreements among the members of the board concerning the adequate cost of equity. I would recommend that we use the CAPM with a 4% risk- free interest rate and a 7% market risk premium. I gathered this data from professor Damodaran's web page a few months ago. I have also sent attached information about four other companies that also make audio products. This may help you to estimate the project Beta (see Exhibit 2), although it is important to notice (and this observation could be raised by a board member during the discussion), that none of these comparable firms make Swimmer's headphones. Finally, it is a common practice in Systech's project analysis to assume a Terminal or Continuation Value equal to a perpetual growth rate of 2% per year after the last Free Cash Flow of each project considered. However, some regional managers believe that after 5 years all competitors will already be producing a similar product and that we will be better off ending the project by selling the brand, the equipment, and the working capital for USD 20 million (assuming that the sale of the project will take place at the end of the fifth year and the USD 20 million represent the net Free Cash Flow you will receive - net of taxes). In case we decide to use the liquidation value of USD 20 million, we will assume that the recovery of the initial working capital will be included in that. In this case, if we decide to go on with the traditional practice of using the terminal value instead, we don't need to consider the recovery of the working capital in the analysis. Regards, Martha. You're not sure why you should bother to calculate a new WACC for this particular project given that the WACC used by Systech is already estimated at 12%. Is the risk of this project significantly different than the risk of an average Systech project? Moreover, are these US figures such as the risk-free rate and the market risk premium applicable here, given the fact that almost all the cash flows are generated in the US market? Are these "comparable firms" used to estimate the project beta comparable? Should we use any Colombian market metrics instead? Regarding the discussion about terminal or continuation values versus liquidation values, you wonder whether they are fundamentally different. With these and other questions in mind, you can't wait to begin your work and to see how good this project looks financially. Martha has already told you about the current composition of the Systech board. You note to yourself these people are all well trained in finance! Let's see if all the long hours studying finance were worth it, you mutter to yourself while turning on your laptop. Exhibit 1. Systech's Income Statements (in USD millions) UIT 2017 Revenues Cost of revenues Gross profits 2018 2,825.00 (1,398.38) 1,426.63 3,531.25 (1,949.25) 1.582.00 2016 4.873.13 (3,094-43) 1,778.69 Research and development Selling, General and Administrative expenses Operating income (310.90) (448.30) 667.43 (370:30) (584.42) 627.28 (450.30) (725.12) 603.27 Other income expenses Interest expenses Income before taxes (88.30) (291.50) 287.63 (211.70) (181.90) 233.68 (109.20) (157.40) 336.67 Taxes (84.85) (71.04) (101.34) Net income 202.78 162.64 235-33 Exhibit 1. (cont.) Systech Balance Sheet (in USD millions) 2018 2017 2016 605.00 538.90 97.30 54.50 1,295.70 733-90 503-30 26.10 4.90 1,268.20 370.60 505.80 29.00 2.40 907.80 Current assets: Cash and equivalent Net receivables Inventory Other current assets Total current assets Property, plant, and equipment, net Goodwill Intangible assets Other assets Deferred long term assets 291.30 477.80 162.10 695.00 126.80 242.50 280.80 138.30 691.30 121.30 215-30 278.60 137.00 633.40 119.50 Total assets 3,048.70 2,742.40 2,291.60 Current liabilities: Accounts payables Short / current Long Term Debt Other current liabilities Total current liabilities 26.89 8.40 40.25 75-54 24.18 10.80 44.12 79.10 18.90 106.00 39.39 164.29 Long term debt Other long term liabilities Deferred long term liabilities 2,459.60 2.19 21.64 1,983.90 2.26 20.23 1,650.01 2.49 172.50 2,558.97 2,085-49 1,989.29 489.73 656.91 302.31 3,048.70 2,742.40 2,291.60 Total liabilities Book value of equity and reserves Total liabilities and equity Number of shares outstading (thousand) End of the year stock price ($ per share) 91.77 88.58 78.25 49.68 41.33 38.95 Exhibit 2. Comparable firms in the audio industry Market Cap. (000 USD) Enterprise Value (000 USD) Equity Beta Effective Tax Sound DKE 4,958,500 16,026,750 3.40 38% Beats and rhythm 3,896,800 5.738,770 2.97 34% Audio Boost 1,248,799 2,844,760 3.56 31% Universal Sounds 1,424,908 3,178,883 2.99 34% Note: these companies are not real firms