Question

Yui Kobayashi is the owner of a freestanding restaurant located in Southern Californias Los Altos county. Yuis operation features traditional Japanese cuisine and it has

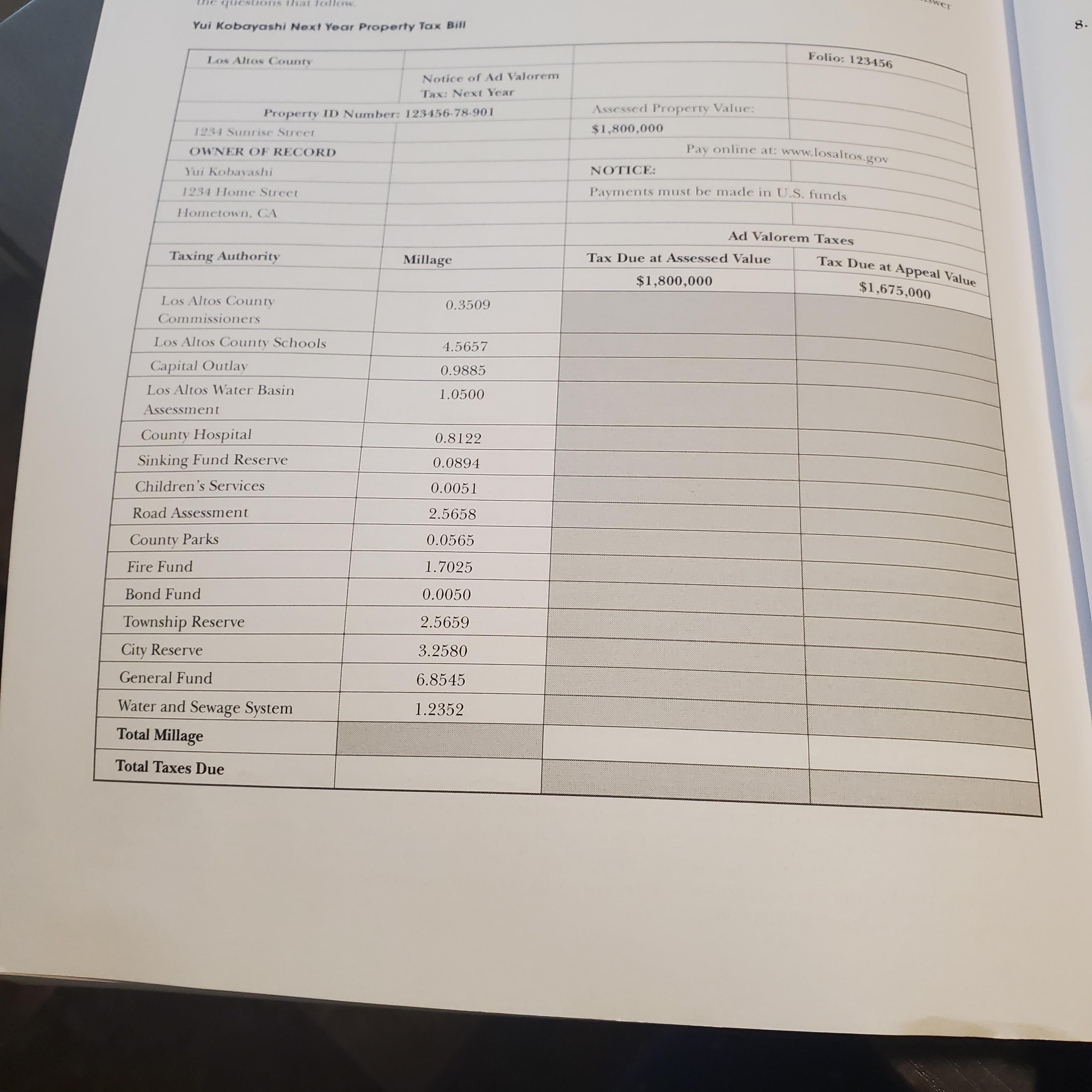

Yui Kobayashi is the owner of a free‐standing restaurant located in Southern California’s Los Altos county. Yui’s operation features traditional Japanese cuisine and it has been very successful for the five years she has operated it. Last year, Yui undertook a renovation of her property that included adding a new roof, new windows, and re‐paving her asphalt parking lot. The total renovation costs were $125,000. The county in which Yui operates her business is responsible for the collection of local ad valorem property taxes. In the previous year, the county assessed the building housing her restaurant at $1,500,000.

Upon opening her mail this week, Yui learned that the county was now notifying her that it was increasing the assessed value of her property to $1,800,000 due to rising property values in the area in which Yui’s restaurant is located, as well as the increased property value resulting from her recent renovation. Yui has determined that she will appeal the tax assessor’s valuation of her property on the basis that the new roof, upgraded windows, and parking lot re‐paving did not truly add value to her property, but rather merely prolonged the life of the property at its current value. For that reason, she feels that the fair value of her property should be $125,000 less than the new amount established by the county tax assessor.

Using the form she has created, calculate the amount of tax Yui will owe on her property at the new assessed value, as well as the amount she would pay if she is successful in her appeal of her property tax assessment, and then answer the questions that follow.

a. What is the total millage amount charged by the county in which Yui’s operation is located?

b. What would be Yui’s property tax bill next year if she does not appeal the county’s new assessed value of her property?

c. What would be Yui’s property tax bill next year if she is successful in her appeal the county’s new assessed value of her property?

d. How much will Yui save if she is successful in getting her property tax value reduced?

e. Assume that Yui made a 15% profit on all of her restaurant sales. How much revenue would she need to generate next year to equal the amount she would save if she is successful in challenging the new assessed value of her property?

questions that follow Yui Kobayashi Next Year Property Tax Bill Los Altos County Property ID Number: 123456-78-901 1234 Sunrise Street OWNER OF RECORD Yui Kobayashi 1234 Home Street Hometown, CA Taxing Authority Millage Los Altos County Commissioners Los Altos County Schools Capital Outlay Los Altos Water Basin Assessment County Hospital Sinking Fund Reserve Children's Services Road Assessment County Parks Fire Fund Bond Fund Township Reserve City Reserve General Fund Water and Sewage System Total Millage Total Taxes Due Notice of Ad Valorem Tax: Next Year 0.3509 4.5657 0.9885 1.0500 0.8122 0.0894 0.0051 2.5658 0.0565 1.7025 0.0050 2.5659 3.2580 6.8545 1.2352 Folio: 123456 Pay online at: www.losaltos.gov Assessed Property Value: $1,800,000 NOTICE: Payments must be made in U.S. funds Ad Valorem Taxes Tax Due at Assessed Value $1,800,000 wer Tax Due at Appeal Value $1,675,000 8.

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Formula Snip Yui Kobayashi Next Year Property Tax Bill Los Altos County Property ID Number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started