Answered step by step

Verified Expert Solution

Question

1 Approved Answer

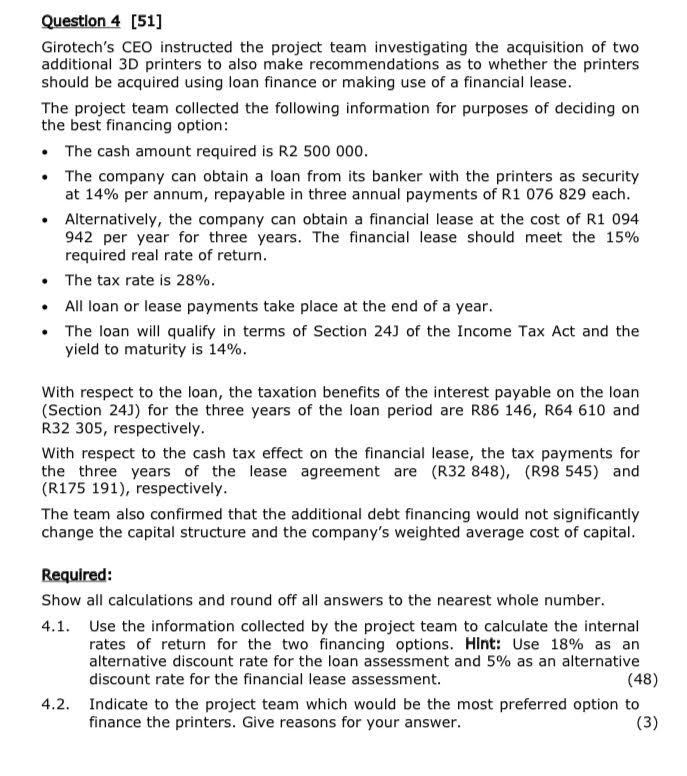

Questlon 4 [51] Girotech's CEO instructed the project team investigating the acquisition of two additional 3D printers to also make recommendations as to whether

Questlon 4 [51] Girotech's CEO instructed the project team investigating the acquisition of two additional 3D printers to also make recommendations as to whether the printers should be acquired using loan finance or making use of a financial lease. The project team collected the following information for purposes of deciding on the best financing option: The cash amount required is R2 500 000. The company can obtain a loan from its banker with the printers as security at 14% per annum, repayable in three annual payments of R1 076 829 each. Alternatively, the company can obtain a financial lease at the cost of R1 094 942 per year for three years. The financial lease should meet the 15% required real rate of return. The tax rate is 28%. All loan or lease payments take place at the end of a year. The loan will qualify in terms of Section 24J of the Income Tax Act and the yield to maturity is 14%. With respect to the loan, the taxation benefits of the interest payable on the loan (Section 24J) for the three years of the loan period are R86 146, R64 610 and R32 305, respectively. With respect to the cash tax effect on the financial lease, the tax payments for the three years of the lease agreement are (R32 848), (R98 545) and (R175 191), respectively. The team also confirmed that the additional debt financing would not significantly change the capital structure and the company's weighted average cost of capital. Required: Show all calculations and round off all answers to the nearest whole number. 4.1. Use the information collected by the project team to calculate the internal rates of return for the two financing options. Hint: Use 18% as an alternative discount rate for the loan assessment and 5% as an alternative (48) discount rate for the financial lease assessment. 4.2. Indicate to the project team which would be the most preferred option to (3) finance the printers. Give reasons for your answer.

Step by Step Solution

★★★★★

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Present value R 2500000 1If loan is taken each installment is R 1076829 Each year outflow after tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started