Answered step by step

Verified Expert Solution

Question

1 Approved Answer

quick answer plz Capex, Inc. presented the following comparative income statements for 2001, 2000, and 1999: For the Years Ended 2001 2000 1999 Net sales

quick answer plz

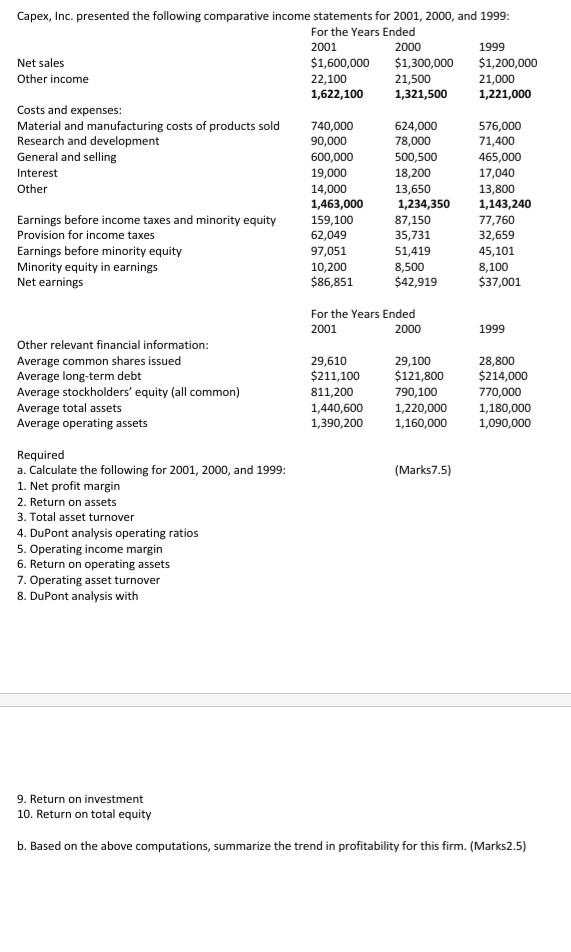

Capex, Inc. presented the following comparative income statements for 2001, 2000, and 1999: For the Years Ended 2001 2000 1999 Net sales $1,600,000 $1,300,000 $1,200,000 Other income 22,100 21,500 21,000 1,622,100 1,321,500 1,221,000 Costs and expenses: Material and manufacturing costs of products sold 740,000 624,000 576,000 Research and development 90,000 78,000 71,400 General and selling 600,000 500,500 465,000 Interest 19,000 18,200 17,040 Other 14,000 13,650 13,800 1,463,000 1,234,350 1,143,240 Earnings before income taxes and minority equity 159,100 87,150 77,760 Provision for income taxes 62,049 35,731 32,659 Earnings before minority equity 97,051 51,419 45,101 Minority equity in earnings 10,200 8,500 8,100 Net earnings $86,851 $42,919 $37,001 For the Years Ended 2001 2000 1999 Other relevant financial information: Average common shares issued Average long-term debt Average stockholders' equity (all common) Average total assets Average operating assets 29,610 $211,100 811,200 1,440,600 1,390,200 29,100 $121,800 790,100 1,220,000 1,160,000 28,800 $214,000 770,000 1,180,000 1,090,000 (Marks7.5) Required a. Calculate the following for 2001, 2000, and 1999: 1. Net profit margin 2. Return on assets 3. Total asset turnover 4. DuPont analysis operating ratios 5. Operating income margin 6. Return on operating assets 7. Operating asset turnover 8. DuPont analysis with 9. Return on investment 10. Return on total equity b. Based on the above computations, summarize the trend in profitability for this firm. (Marks2.5)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started