Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QuickClean, a rapidly growing company based in Melbourne, Australia, manufactures throwaway paper towel and mop doth and supplies its products to supermarkets in the

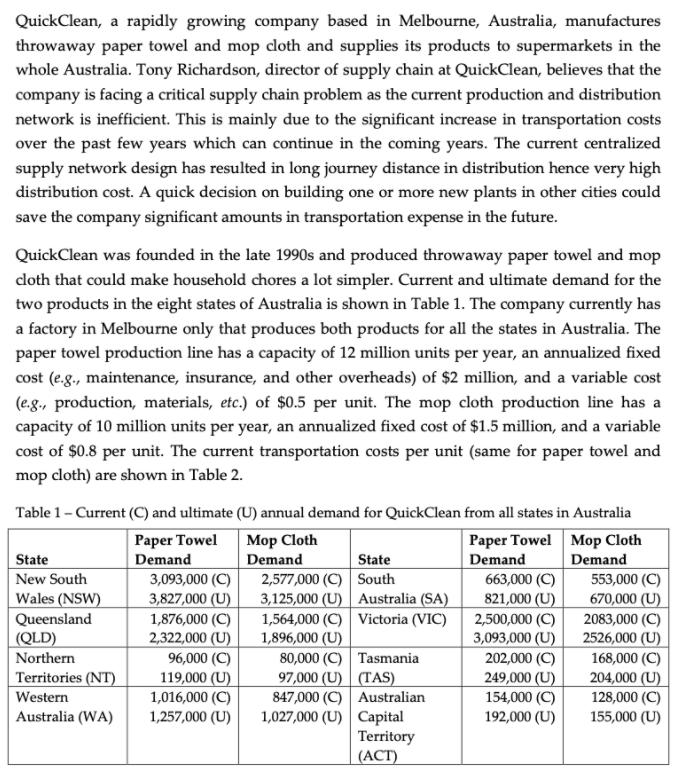

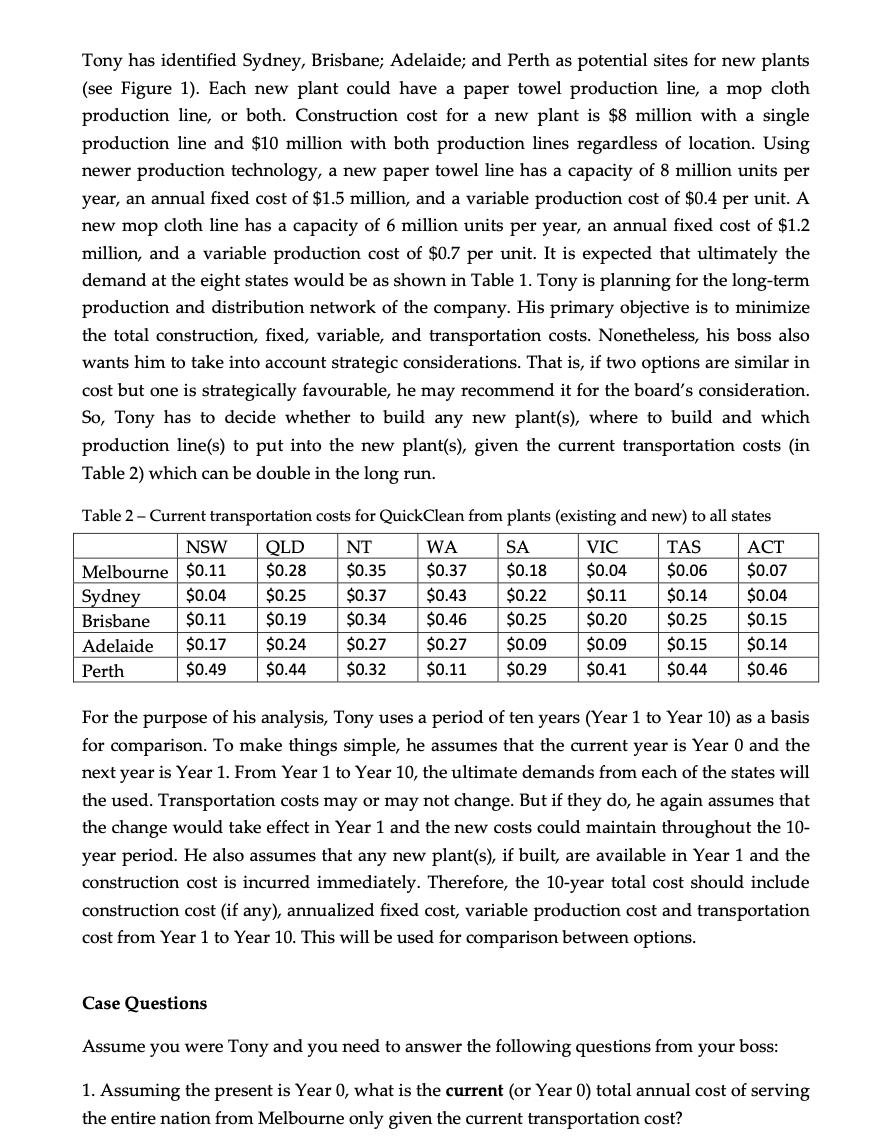

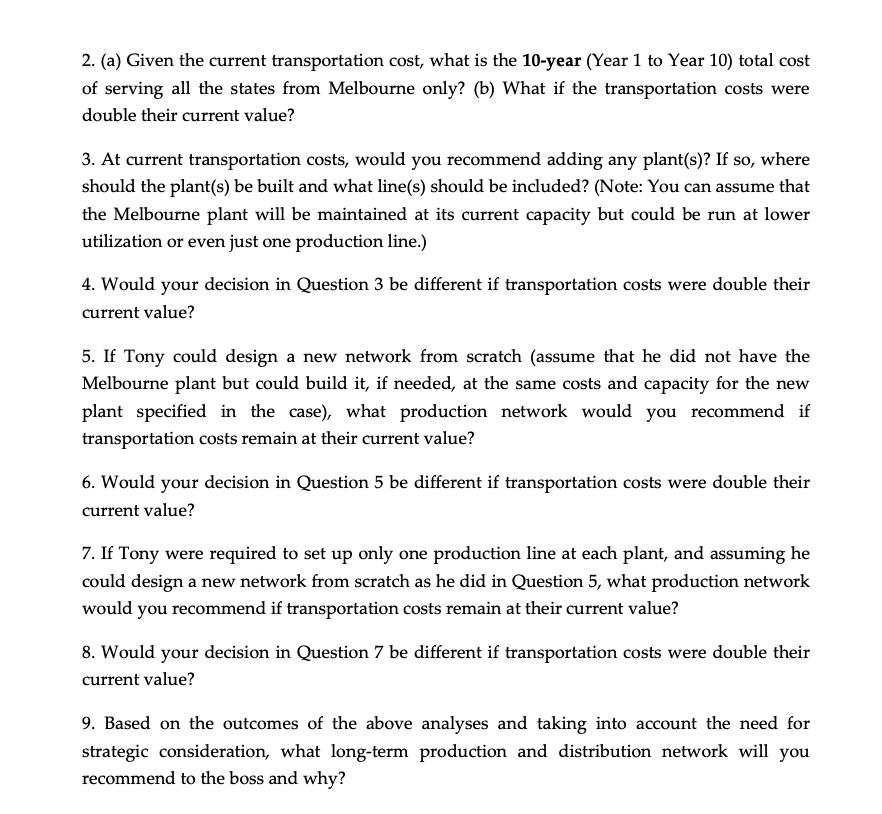

QuickClean, a rapidly growing company based in Melbourne, Australia, manufactures throwaway paper towel and mop doth and supplies its products to supermarkets in the whole Australia. Tony Richardson, director of supply chain at QuickClean, believes that the company is facing a critical supply chain problem as the current production and distribution network is inefficient. This is mainly due to the significant increase in transportation costs over the past few years which can continue in the coming years. The current centralized supply network design has resulted in long journey distance in distribution hence very high distribution cost. A quick decision on building one or more new plants in other cities could save the company significant amounts in transportation expense in the future. QuickClean was founded in the late 1990s and produced throwaway paper towel and mop cloth that could make household chores a lot simpler. Current and ultimate demand for the two products in the eight states of Australia is shown in Table 1. The company currently has a factory in Melbourne only that produces both products for all the states in Australia. The paper towel production line has a capacity of 12 million units per year, an annualized fixed cost (e.g., maintenance, insurance, and other overheads) of $2 million, and a variable cost (e.g., production, materials, etc.) of $0.5 per unit. The mop cloth production line has a capacity of 10 million units per year, an annualized fixed cost of $1.5 million, and a variable cost of $0.8 per unit. The current transportation costs per unit (same for paper towel and mop cloth) are shown in Table 2. Table 1- Current (C) and ultimate (U) annual demand for QuickClean from all states in Australia Paper Towel Mop Cloth Demand 553,000 (C) 670,000 (U) 2083,000 (C) 3,093,000 (U) 2526,000 (U) 168,000 (C) 204,000 (U) 128,000 (C) 155,000 (U) Paper Towel Demand 3,093,000 (C) 3,827,000 (U) Mop Cloth Demand State New South Wales (NSW) Queensland (QLD) Demand 663,000 (C) 821,000 (U) 2,500,000 (C) 1,876,000 (C) 2,322,000 (U) 96,000 (C) 119,000 (U) 1,016,000 (C) 1,257,000 (U) State 2,577,000 (C) South 3,125,000 (U) Australia (SA) 1,564,000 (C) Victoria (VIC) 1,896,000 (U) 80,000 (C) Tasmania 97,000 (U) (TAS) 847,000 (C) Australian 1,027,000 (U) Capital Territory (ACT) Northern Territories (NT) Western Australia (WA) 202,000 (C) 249,000 (U) 154,000 (C) 192,000 (U) Tony has identified Sydney, Brisbane; Adelaide; and Perth as potential sites for new plants (see Figure 1). Each new plant could have a paper towel production line, a mop cloth production line, or both. Construction cost for a new plant is $8 million with a single production line and $10 million with both production lines regardless of location. Using newer production technology, a new paper towel line has a capacity of 8 million units per year, an annual fixed cost of $1.5 million, and a variable production cost of $0.4 per unit. A new mop cloth line has a capacity of 6 million units per year, an annual fixed cost of $1.2 million, and a variable production cost of $0.7 per unit. It is expected that ultimately the demand at the eight states would be as shown in Table 1. Tony is planning for the long-term production and distribution network of the company. His primary objective is to minimize the total construction, fixed, variable, and transportation costs. Nonetheless, his boss also wants him to take into account strategic considerations. That is, if two options are similar in cost but one is strategically favourable, he may recommend it for the board's consideration. So, Tony has to decide whether to build any new plant(s), where to build and which production line(s) to put into the new plant(s), given the current transportation costs (in Table 2) which can be double in the long run. Table 2- Current transportation costs for QuickClean from plants (existing and new) to all states NSW QLD $0.28 NT WA SA VIC TAS T Melbourne $0.11 $0.35 $0.37 $0.18 $0.04 $0.06 $0.07 $0.37 $0.34 $0.43 $0.46 $0.22 $0.11 $0.20 Sydney $0.04 $0.25 $0.14 $0.04 Brisbane $0.11 $0.19 $0.25 $0.25 $0.15 Adelaide $0.17 $0.24 $0.27 $0.27 $0.09 $0.09 $0.15 $0.14 Perth $0.49 $0.44 $0.32 $0.11 $0.29 $0.41 $0.44 $0.46 For the purpose of his analysis, Tony uses a period of ten years (Year 1 to Year 10) as a basis for comparison. To make things simple, he assumes that the current year is Year 0 and the next year is Year 1. From Year 1 to Year 10, the ultimate demands from each of the states will the used. Transportation costs may or may not change. But if they do, he again assumes that the change would take effect in Year 1 and the new costs could maintain throughout the 10- year period. He also assumes that any new plant(s), if built, are available in Year 1 and the construction cost is incurred immediately. Therefore, the 10-year total cost should include construction cost (if any), annualized fixed cost, variable production cost and transportation cost from Year 1 to Year 10. This will be used for comparison between options. Case Questions Assume you were Tony and you need to answer the following questions from your boss: 1. Assuming the present is Year 0, what is the current (or Year 0) total annual cost of serving the entire nation from Melbourne only given the current transportation cost? 2. (a) Given the current transportation cost, what is the 10-year (Year 1 to Year 10) total cost of serving all the states from Melbourne only? (b) What if the transportation costs were double their current value? 3. At current transportation costs, would you recommend adding any plant(s)? If so, where should the plant(s) be built and what line(s) should be included? (Note: You can assume that the Melbourne plant will be maintained at its current capacity but could be run at lower utilization or even just one production line.) 4. Would your decision in Question 3 be different if transportation costs were double their current value? 5. If Tony could design a new network from scratch (assume that he did not have the Melbourne plant but could build it, if needed, at the same costs and capacity for the new plant specified in the case), what production network would you recommend if transportation costs remain at their current value? 6. Would your decision in Question 5 be different if transportation costs were double their current value? 7. If Tony were required to set up only one production line at each plant, and assuming he could design a new network from scratch as he did in Question 5, what production network would you recommend if transportation costs remain at their current value? 8. Would your decision in Question 7 be different if transportation costs were double their current value? 9. Based on the outcomes of the above analyses and taking into account the need for strategic consideration, what long-term production and distribution network will you recommend to the boss and why?

Step by Step Solution

★★★★★

3.31 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS 1 The current or Year 0 total annual cost of serving the entire nation from Melbourne only given the current transportation cost would be Construction cost 0 Annualized fixed cost 35 million V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started