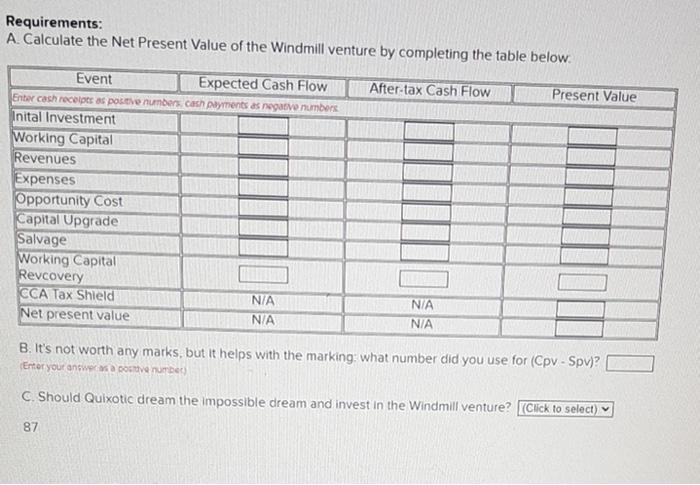

Quixotic Enterprises is about to embark on another venture Poncho Sanchos, the faithful financial analyst, once again will examine the viability of this venture after 31 failures A number of windmills are to be constructed on the southern frontier to generate electricity They will cost $402.000 and will last 9 years at which time they will have an estimated salvage value of $22000 However, a capital upgrade of $96,000 will be required at the end of five years. An inventory of spare parts working capital) amounting to $9.000 will be required during the term of the venture and will be housed in a warehouse that is currently not being used, but which has been used for Quixotic's previous ventures The warehouse could be rented out at $5,000 per year. This enterprise is expected to generate cash from the sale of electricity of S149,000 a year for 9 years Cash expenses for each of the 9 years will be $8,000 The company's tax rate is 29 percent, the CCA rate is 10 percent and the cost of capital is 19 percent Requirements: A Calculate the Net Present Value of the Windmill venture by completing the table below Event Expected Cash Flow Antertax Cash Flow Present Value Inital investment Working Capital Revenues Proy Requirements: A. Calculate the Net Present Value of the Windmill venture by completing the table below After-tax Cash Flow Present Value Event Expected Cash Flow Enter cash recipes as posee numbers. cash payments as negative numbers Inital Investment Working Capital Revenues Expenses Opportunity Cost Capital Upgrade Salvage Working Capital Revcovery CCA Tax Shield NIA Net present value N/A NIA B. It's not worth any marks, but it helps with the marking: what number did you use for (Cpv - Spv)? Enter your answerte number C. Should Quixotic dream the impossible dream and invest in the Windmill venture? (Click to select) 87 Quixotic Enterprises is about to embark on another venture Poncho Sanchos, the faithful financial analyst, once again will examine the viability of this venture after 31 failures A number of windmills are to be constructed on the southern frontier to generate electricity They will cost $402.000 and will last 9 years at which time they will have an estimated salvage value of $22000 However, a capital upgrade of $96,000 will be required at the end of five years. An inventory of spare parts working capital) amounting to $9.000 will be required during the term of the venture and will be housed in a warehouse that is currently not being used, but which has been used for Quixotic's previous ventures The warehouse could be rented out at $5,000 per year. This enterprise is expected to generate cash from the sale of electricity of S149,000 a year for 9 years Cash expenses for each of the 9 years will be $8,000 The company's tax rate is 29 percent, the CCA rate is 10 percent and the cost of capital is 19 percent Requirements: A Calculate the Net Present Value of the Windmill venture by completing the table below Event Expected Cash Flow Antertax Cash Flow Present Value Inital investment Working Capital Revenues Proy Requirements: A. Calculate the Net Present Value of the Windmill venture by completing the table below After-tax Cash Flow Present Value Event Expected Cash Flow Enter cash recipes as posee numbers. cash payments as negative numbers Inital Investment Working Capital Revenues Expenses Opportunity Cost Capital Upgrade Salvage Working Capital Revcovery CCA Tax Shield NIA Net present value N/A NIA B. It's not worth any marks, but it helps with the marking: what number did you use for (Cpv - Spv)? Enter your answerte number C. Should Quixotic dream the impossible dream and invest in the Windmill venture? (Click to select) 87