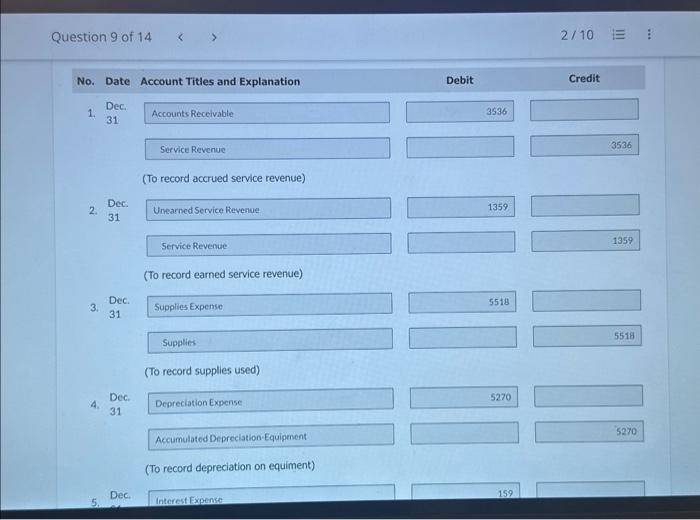

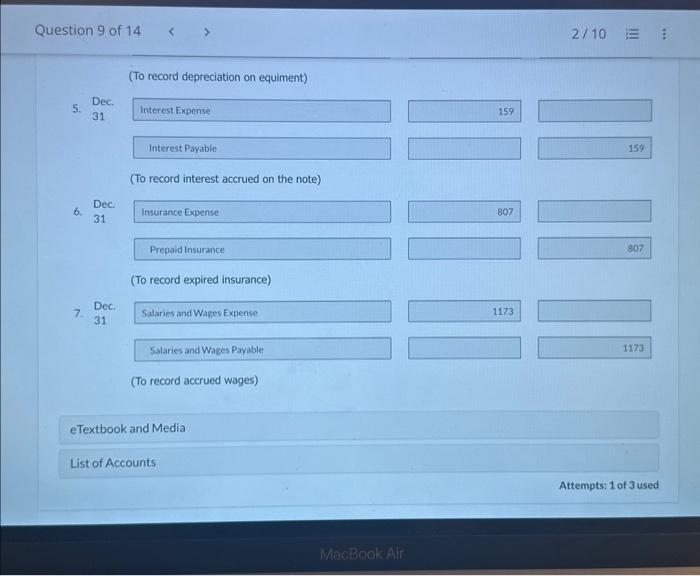

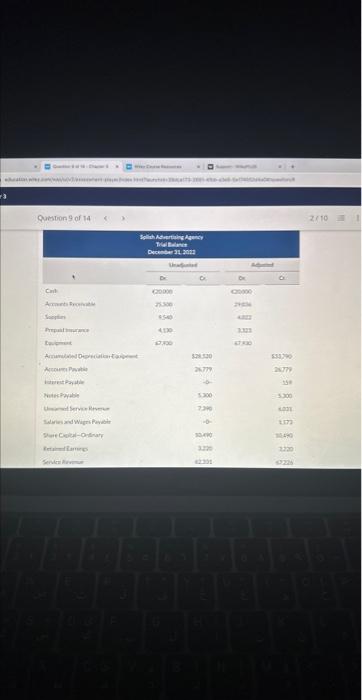

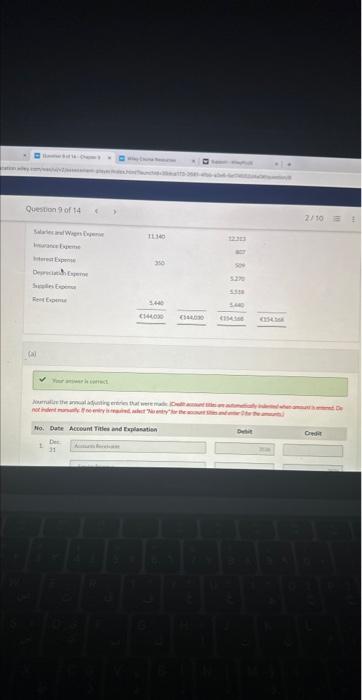

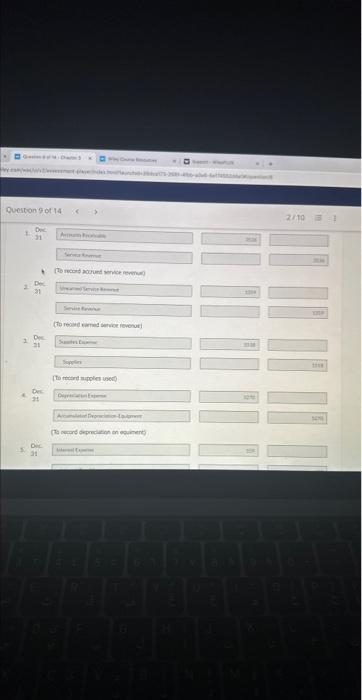

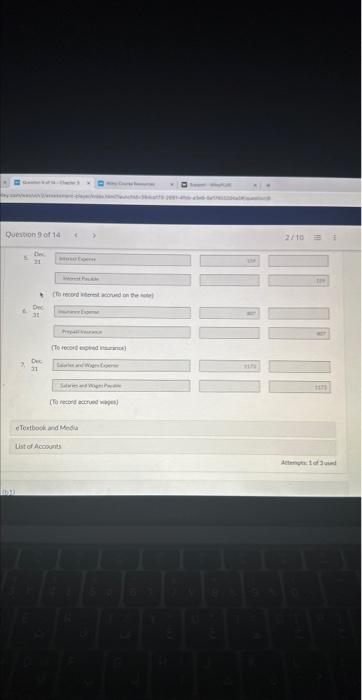

Qumbon 9 of 14 Question 9 of 14 2/10 No. Date Account Titles and Explanation Debit Credit 1. Dec Accounts Reccivable 3536 Service Revenue 3536 (To record accrued service revenue) 2. Dec31 Unearned Service Revenue Service Revenue (To record earned service revenue) 3. Dec Supplies Expense Supplies (To record supplies used) 4. Dec Depreciation Expense Accumulated Depreciation-Equipment (To record depreciation on equiment) 1359 1359 5518 5518 \begin{tabular}{|r|} \hline 5518 \\ \hline \\ \hline \end{tabular} \begin{tabular}{r} 5518 \\ \hline \end{tabular} 5270 32% 5. Dec. Interest Expense: 159 Prepare an income statement for the year ending December 31, 2022. (Enter loss using either a negative sign preceding the number. eg. -45 or parentheses es. (45).) Question 9 of 14 2/10= Quetion 9 or 14 5 in 42tDx Anemtione 21Dr Latwer Whatcone eTertbock and Media tit a Acotonts Aetmont ta 3und SPLISH ADVERTISING AGENCY Income Statement Question 9 of 14 therate berene sienter feerich Feit Expinus 14140 t2an wir 80 520 cisces (a) Ver anurin inet Denie. Orater 1.Det Question 9 of 14 2/10 (To record depreciation on equiment) 5. Dec.31 Interest Expense 159 Interest Payable 159 (To record interest accrued on the note) 6. Dec. Insurance Expense 807 Prepaid Insurance 807 (To record expired insurance) 7. Dec. Salaries and Wages Expense 1173 Salaries and Wages Payable \begin{tabular}{|l|} \hline 1173 \\ \hline \\ \hline \end{tabular} (To record accrued wages) 1173 eTextbook and Media List of Accounts Attempts: 1 of 3 used Qumbon 9 of 14 Question 9 of 14 2/10 No. Date Account Titles and Explanation Debit Credit 1. Dec Accounts Reccivable 3536 Service Revenue 3536 (To record accrued service revenue) 2. Dec31 Unearned Service Revenue Service Revenue (To record earned service revenue) 3. Dec Supplies Expense Supplies (To record supplies used) 4. Dec Depreciation Expense Accumulated Depreciation-Equipment (To record depreciation on equiment) 1359 1359 5518 5518 \begin{tabular}{|r|} \hline 5518 \\ \hline \\ \hline \end{tabular} \begin{tabular}{r} 5518 \\ \hline \end{tabular} 5270 32% 5. Dec. Interest Expense: 159 Prepare an income statement for the year ending December 31, 2022. (Enter loss using either a negative sign preceding the number. eg. -45 or parentheses es. (45).) Question 9 of 14 2/10= Quetion 9 or 14 5 in 42tDx Anemtione 21Dr Latwer Whatcone eTertbock and Media tit a Acotonts Aetmont ta 3und SPLISH ADVERTISING AGENCY Income Statement Question 9 of 14 therate berene sienter feerich Feit Expinus 14140 t2an wir 80 520 cisces (a) Ver anurin inet Denie. Orater 1.Det Question 9 of 14 2/10 (To record depreciation on equiment) 5. Dec.31 Interest Expense 159 Interest Payable 159 (To record interest accrued on the note) 6. Dec. Insurance Expense 807 Prepaid Insurance 807 (To record expired insurance) 7. Dec. Salaries and Wages Expense 1173 Salaries and Wages Payable \begin{tabular}{|l|} \hline 1173 \\ \hline \\ \hline \end{tabular} (To record accrued wages) 1173 eTextbook and Media List of Accounts Attempts: 1 of 3 used