Answered step by step

Verified Expert Solution

Question

1 Approved Answer

quwstion # 6 1. Your uncle has $375,000 and wants to retire. He expects to live for another 25 years and to carn 7.5% compounded

quwstion # 6

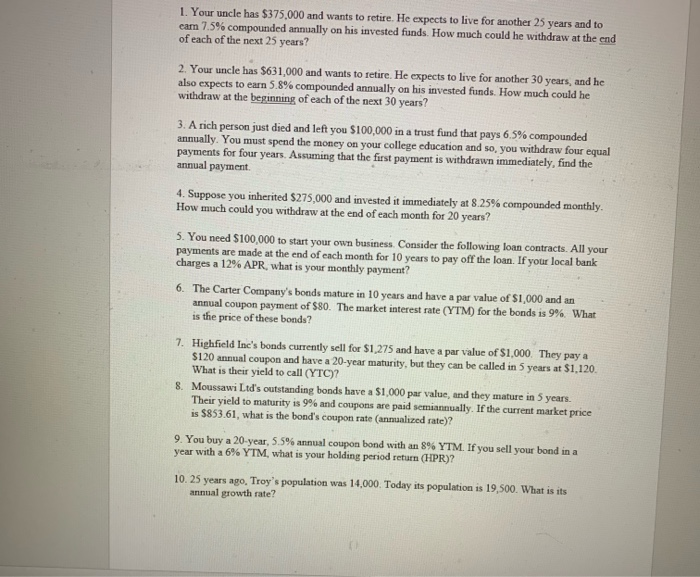

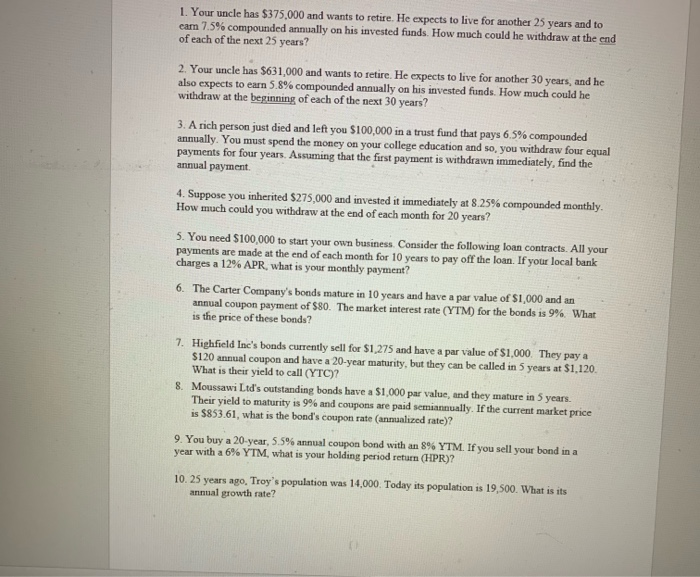

1. Your uncle has $375,000 and wants to retire. He expects to live for another 25 years and to carn 7.5% compounded annually on his invested funds. How much could he withdraw at the end of each of the next 25 years? 2. Your uncle has $631,000 and wants to retire. He expects to live for another 30 years, and he also expects to earn 5.8% compounded annually on his invested funds. How much could he withdraw at the beginning of each of the next 30 years? 3. A rich person just died and left you $100,000 in a trust fund that pays 6.5% compounded annually. You must spend the money on your college education and so, you withdraw four equal payments for four years. Assuming that the first payment is withdrawn immediately, find the annual payment 4. Suppose you inherited $275,000 and invested it immediately at 8.25% compounded monthly How much could you withdraw at the end of each month for 20 years? 5. You need $100,000 to start your own business. Consider the following loan contracts. All your payments are made at the end of each month for 10 years to pay off the loan. If your local bank charges a 12% APR, what is your monthly payment? 6. The Carter Company's bonds mature in 10 years and have a par value of $1,000 and an annual coupon payment of $80. The market interest rate (YTM) for the bonds is 9%. What is the price of these bonds? 7. Highfield Inc's bonds currently sell for $1.275 and have a par value of $1,000. They pay a $120 annual coupon and have a 20-year maturity, but they can be called in 5 years at $1,120. What is their yield to call (YTC)? 8. Moussawi Ltd's outstanding bonds have a $1,000 par value, and they mature in 5 years. Their yield to maturity is 9% and coupons are paid semiannually. If the current market price is $853.61, what is the bond's coupon rate (annualized rate)? 9. You buy a 20-year, 5.5% annual coupon bond with an 8% YTM. If you sell your bond in a year with a 6% YTM, what is your holding period return (HPR)? 10. 25 years ago, Troy's population was 14,000. Today its population is 19,500. What is its annual growth rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started