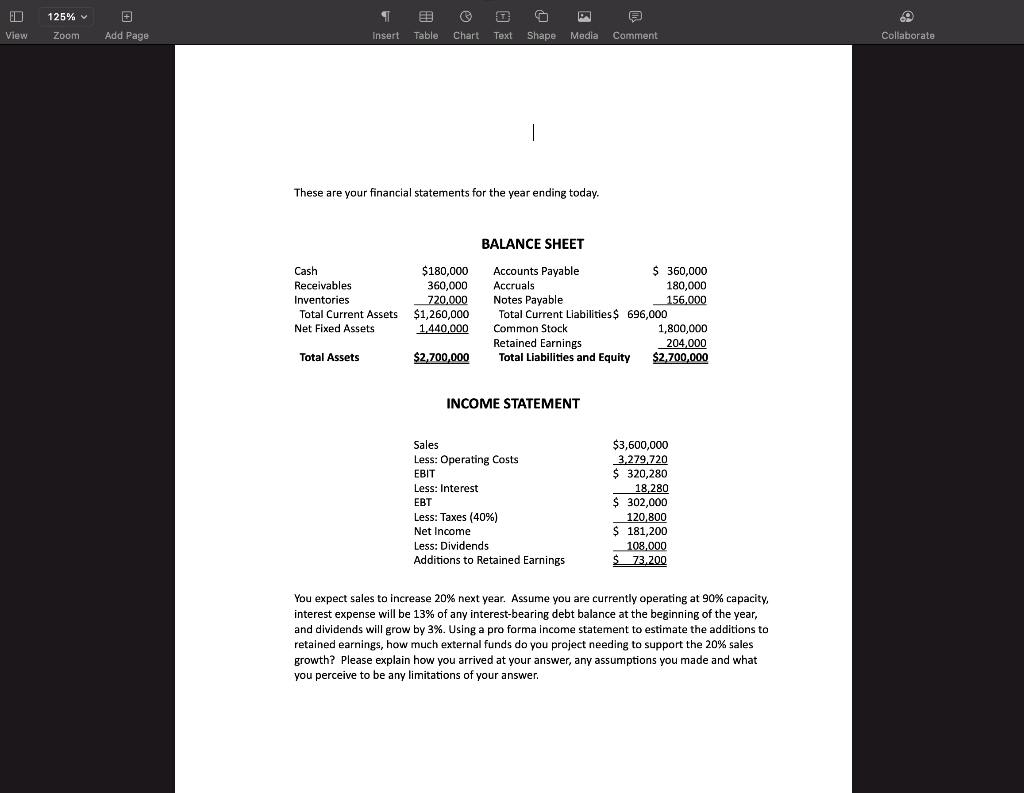

+ R 125% Zoom View Add Page Insert Table Chart Text Shape Media Comment Collaborate These are your financial statements for the year ending today. BALANCE SHEET Cash $180,000 Receivables 360,000 Inventories 720,000 Total Current Assets $1,260,000 Net Fixed Assets 1,440,000 Accounts Payable $360,000 Accruals 180,000 Notes Payable 156,000 Total Current Liabilities$ 696,000 Common Stock 1,800,000 Retained Earnings 204,000 Total Liabilities and Equity $2,700,000 Total Assets $2,700,000 INCOME STATEMENT Sales Less: Operating costs EBIT Less: Interest EBT Less: Taxes (40%) Net Income Less: Dividends Additions to Retained Earnings $3,600,000 3,279,720 $ 320,280 18,280 $ 302,000 120,800 $ 181,200 108,000 $ 73,200 You expect sales to increase 20% next year. Assume you are currently operating at 90% capacity, interest expense will be 13% of any interest-bearing debt balance at the beginning of the year, and dividends will grow by 3%. Using a pro forma income statement to estimate the additions to retained earnings, how much external funds do you project needing to support the 20% sales growth? Please explain how you arrived at your answer, any assumptions you made and what you perceive to be any limitations of your answer. + R 125% Zoom View Add Page Insert Table Chart Text Shape Media Comment Collaborate These are your financial statements for the year ending today. BALANCE SHEET Cash $180,000 Receivables 360,000 Inventories 720,000 Total Current Assets $1,260,000 Net Fixed Assets 1,440,000 Accounts Payable $360,000 Accruals 180,000 Notes Payable 156,000 Total Current Liabilities$ 696,000 Common Stock 1,800,000 Retained Earnings 204,000 Total Liabilities and Equity $2,700,000 Total Assets $2,700,000 INCOME STATEMENT Sales Less: Operating costs EBIT Less: Interest EBT Less: Taxes (40%) Net Income Less: Dividends Additions to Retained Earnings $3,600,000 3,279,720 $ 320,280 18,280 $ 302,000 120,800 $ 181,200 108,000 $ 73,200 You expect sales to increase 20% next year. Assume you are currently operating at 90% capacity, interest expense will be 13% of any interest-bearing debt balance at the beginning of the year, and dividends will grow by 3%. Using a pro forma income statement to estimate the additions to retained earnings, how much external funds do you project needing to support the 20% sales growth? Please explain how you arrived at your answer, any assumptions you made and what you perceive to be any limitations of your