Answered step by step

Verified Expert Solution

Question

1 Approved Answer

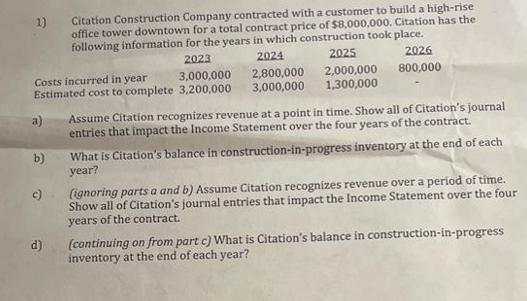

R 3,000,000 Costs incurred in year Estimated cost to complete 3,200,000 a) b) c) Citation Construction Company contracted with a customer to build a

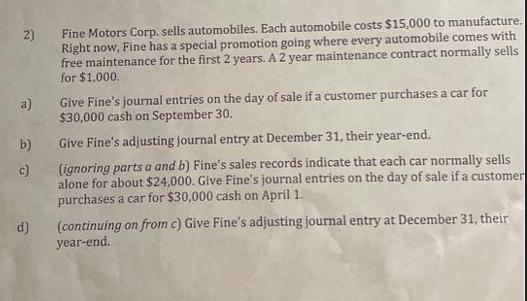

R 3,000,000 Costs incurred in year Estimated cost to complete 3,200,000 a) b) c) Citation Construction Company contracted with a customer to build a high-rise office tower downtown for a total contract price of $8,000,000. Citation has the following information for the years in which construction took place. 2023 2024 2025 2026 2,800,000 800,000 3,000,000 d) 2,000,000 1,300,000 Assume Citation recognizes revenue at a point in time. Show all of Citation's journal entries that impact the Income Statement over the four years of the contract. What is Citation's balance in construction-in-progress inventory at the end of each year? (ignoring parts a and b) Assume Citation recognizes revenue over a period of time. Show all of Citation's journal entries that impact the Income Statement over the four years of the contract. (continuing on from part c) What is Citation's balance in construction-in-progress inventory at the end of each year? 2) a) b) c) d) Fine Motors Corp. sells automobiles. Each automobile costs $15,000 to manufacture. Right now, Fine has a special promotion going where every automobile comes with free maintenance for the first 2 years. A 2 year maintenance contract normally sells for $1,000. Give Fine's journal entries on the day of sale if a customer purchases a car for $30,000 cash on September 30. Give Fine's adjusting journal entry at December 31, their year-end. (ignoring parts a and b) Fine's sales records indicate that each car normally sells alone for about $24,000. Give Fine's journal entries on the day of sale if a customer purchases a car for $30,000 cash on April 1. (continuing on from c) Give Fine's adjusting journal entry at December 31, their year-end. 3) a) b) Platform Inc. sells workout gear. Customers can also pay a monthly membership fee to visit Platform's local gyms. Platform is offering a special package where customers can buy a set of workout gear and a 6 month gym membership together for $400. If sold separately, the workout gear has a selling price of $280, and the monthly membership fee is $50. Give Platform's revenue recognition journal entry if one special package is sold to a customer for cash. Suppose the sale was made on October 31. What would be Platform's adjusting entry at December 31, their year-end?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started