Question

R. Rhodes, Inc. is a contract manufacturer for guitar makers. Last year, the company invested $10 million dollars to acquire a manufacturing facility, $2.7 million

R. Rhodes, Inc. is a contract manufacturer for guitar makers. Last year, the company invested $10 million dollars to acquire a manufacturing facility, $2.7 million dollars to acquiremanufacturing equipment (please note, that it cost the company $300,000 for each piece of manufacturing equipment and each piece of manufacturing equipment can produce 100 units), and $500,000 to obtain trademarks and copyrights. These investments allow the company to manufacture components parts for guitar makers. The company produces “Guitar Kits” which includes all the necessary components for guitar makers to assemble their guitars. Currently, the company sell 900 units of these “Guitar Kits” every month and is running at full capacity.

Recently, R. Rhodes was approached by its largest customer with a proposal for R. Rhodes to do the final guitar assembly and provide the finish product to this guitar maker who would then place its own logos on the guitars. The customer is willing to commit for 3 years to buy a minimum of 300 units per month of the fully assembled guitars but is forecasting that purchases could be even higher. However, since this is not a binding contract, there is also the possibility the customer may not be able to meet its minimum commitment. As noted, R. Rhodes is currently running at full capacity and has the facility space to only produce 900 units per month of either the “Guitar Kit” or the “Assembled Guitar”. As a result, this new contract will require the company to reduce its sales of the of the “Guitar Kit” from 900 units to 600 units.

From a costing perspective, this contract will require R. Rhodes to source new raw materials for the “Assembled Guitar” which are more expensive than the raw materials found in the “Guitar Kit”. In addition, as the volume of the “Guitar Kit” production goes down, the volume discounts given to R. Rhodes by its suppliers will be eliminated increasing the raw material costs for the “Guitar Kit”. Also, the efficiency to produce “Guitar Kit” units will go down increasing the direct labor cost. Lastly, the company will need to invest in new equipment to make the “Assembled Guitar”. It will need to spend $350,000 per each piece of manufacturing equipment for every 50 units of the assembled guitar that it produces.

Part 1: Accept this new contract or reject it?

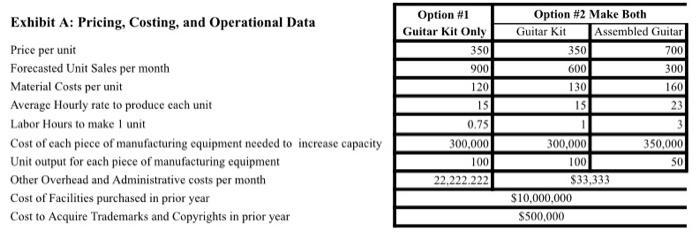

“Exhibit A: Pricing, Costing, and Operational Data” contains detail information on the pricing for each product as well as the direct costs, overhead costs, and equipment purchases. Based on this information and the information given in the Situational Analysis answer questions 1 and 2.

• Question 1: Do you accept or reject this new contract if profit is the only consideration? In your analysis of this question, make sure to identify the relevant costs, irrelevantcosts, opportunity costs, and opportunity gains of your decision. Support your answer by calculating the total potential profit of both options over 3 years.

• Question 2: From a strategic standpoint, which option “Produce only the Guitar Kit” or “Produce both the Guitar Kit and Assembled Guitar”, is the better option if the demand for the “Assembled Guitar” is greater than the minimum purchase request of 300 units? Which option is the better option if the customer is unable to meet its commitment and orders less then 300 units per month? For this question you may want to incorporate “Breakeven” and “Operational Leverage” analysis in your answer.

Exhibit A: Pricing, Costing, and Operational Data Price per unit Forecasted Unit Sales per month Material Costs per unit Average Hourly rate to produce each unit Labor Hours to make 1 unit Cost of each piece of manufacturing equipment needed to increase capacity Unit output for each piece of manufacturing equipment Other Overhead and Administrative costs per month Cost of Facilities purchased in prior year Cost to Acquire Trademarks and Copyrights in prior year Option #1 Guitar Kit Only 350 900 120 15 0.75 300,000 100 22.222.222 Option # 2 Make Both Guitar Kit 350 600 130 15 1 Assembled Guitar 300,000 100 $33,333 $10,000,000 $500,000 700 300 160 23 350,000 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Fixed Costs and Operating Leverage Are fixed costs evil And if they are evil then why do businesses willingly take them on Should management depend en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started