Answered step by step

Verified Expert Solution

Question

1 Approved Answer

R & S entered into a joint venture and opened a Joint Bank account with an amount 1,50,00,000 towards which R contributed 1,00,00,000. They

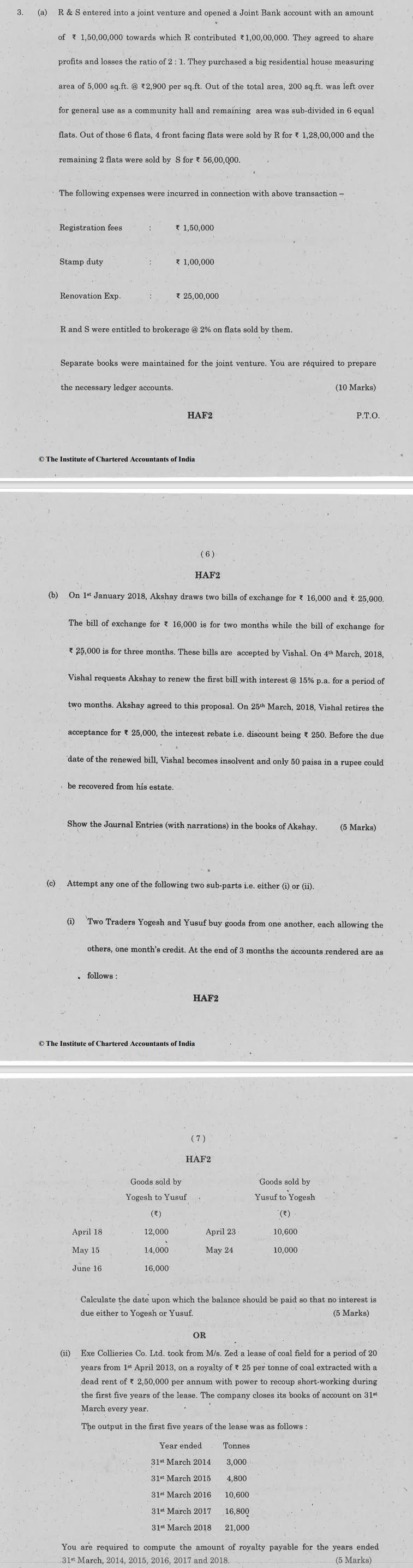

R & S entered into a joint venture and opened a Joint Bank account with an amount 1,50,00,000 towards which R contributed 1,00,00,000. They agreed to share profits and losses the ratio of 2 : 1. They purchased a big residential house measuring area of 5,000 sq.ft. @ 12,900 per sq.ft. Out of the total area, 200 sq.ft. was left over for general use as a community hall and remaining area was sub-divided in 6 equal of flats. Out of those 6 flats, 4 front facing flats were sold by R for 1,28,00,000 and the (c) remaining 2 flats were sold by S for 56,00,000. The following expenses were incurred in connection with above transaction - Registration fees Stamp duty Renovation Exp. the necessary ledger accounts. R. and S were entitled to brokerage @ 2% on flats sold by them. Separate books were maintained for the joint venture. You are required to prepare The Institute of Chartered Accountants of India * 1,50,000 * 1,00,000 * 25,00,000 (6) HAF2 (b) On 1st January 2018, Akshay draws two bills of exchange for 16,000 and 25,000. The bill of exchange for 16,000 is for two months while the bill of exchange for be recovered from his estate. * 25,000 is for three months. These bills are accepted by Vishal. On 4th March, 2018, HAF2 Vishal requests Akshay to renew the first bill with interest @ 15% p.a. for a period of two months. Akshay agreed to this proposal. On 25th March, 2018, Vishal retires the (i) acceptance for 25,000, the interest rebate i.e. discount being 250. Before the due date of the renewed bill, Vishal becomes insolvent and only 50 paisa in a rupee could (ii) Attempt any one of the following two sub-parts i.e. either (i) or (ii). Show the Journal Entries (with narrations) in the books of Akshay. (5 Marks) . follows: April 18 May 15 June 16 Two Traders Yogesh and Yusuf buy goods from one another, each allowing the others, one month's credit. At the end of 3 months the accounts rendered are as The Institute of Chartered Accountants of India 16,000 (10 Marks) Goods sold by Yogesh to (*) 12,000 14,000 P.T.O. HAF2 Yusuf (7) HAF2 April 23 May 24 Goods sold by Yusuf to Yogesh () 10,600 10,000 Tonnes 31st March 2014 3,000 31st March 2015 4,800 31st March 2016 10,600 31st March 2017 16,800 31st March 2018 21,000 Calculate the date upon which the balance should be paid so that no interest is due either to Yogesh or Yusuf. (5 Marks) OR Exe Collieries Co. Ltd. took from M/s. Zed a lease of coal field for a period of 20 years from 1st April 2013, on a royalty of 25 per tonne of coal extracted with a dead rent of 2,50,000 per annum with power to recoup short-working during the first five years of the lease. The company closes its books of account on 31st March every year. The output in the first five years of the lease was as follows: Year ended You are required to compute the amount of royalty payable for the years ended (5 Marks) 31st March, 2014, 2015, 2016, 2017 and 2018.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started