Answered step by step

Verified Expert Solution

Question

1 Approved Answer

R. U. Ready acquired Machine B on 1/1/13 by signing a 9% installment note to be paid in 5 equal installments of $65,000. Each payment

- R. U. Ready acquired Machine B on 1/1/13 by signing a 9% installment note to be paid in 5 equal installments of $65,000. Each payment is due on 12/31, with the first payment due 12/31/13. The useful life of Machine B is 8 years with no residual value. Assume double declining balance depreciation.

- On 1/1/10, R-U Ready issued $100,000, 6.5%, 10-year bonds at an effective rate of 4.75%. Interest is paid annually on 12/31 of each year.

- R-U Ready acquired land with a FMV of $220,000 on 1/1/14 by issuing a 3-year non-interest-bearing note due 12/13/16. Assume 8% as the effective rate of interest. (You are not provided the face value of the note, but have enough information to determine it.)

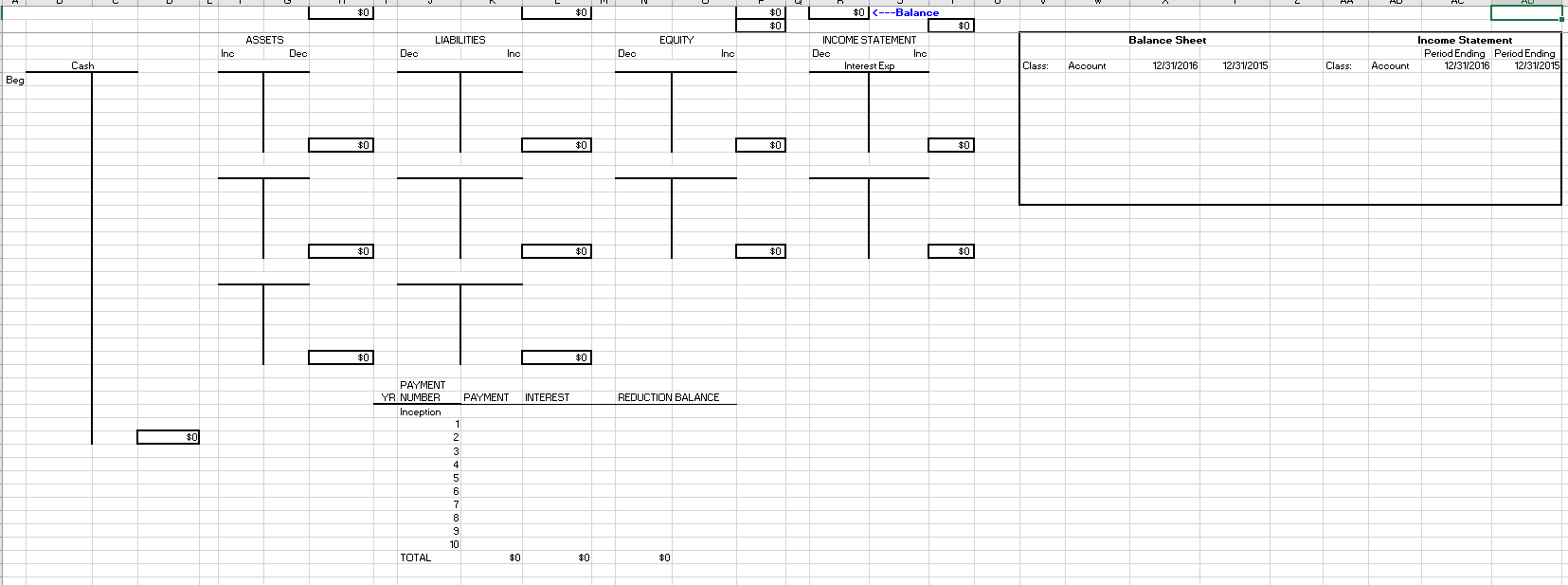

present the accounts and dollar amounts that would appear on comparative balance sheets and income statements for the years ending 12/31/16 and 12/31/15. (See the example listed above, answers to which are provided in the template.)

- Please submit one solution workbook per group. An excel workbook is attached below, which is a template to use to create comparative balance sheets and income statements for R-U Ready for the calendar years ending 12/31/16 and 12/31/15.

- List all accounts and dollar amounts. Round dollar amounts to the nearest dollar. You do not need to include cash. Also, you do not need to worry about the classification of cash flows in the t-accounts. You have been provided with a separate worksheet for each situation. Please show your work in each worksheet and the impact on the financial statements in the matrix provided on each worksheet.

- For the Classification (Class) column of the Balance Sheet use:

- A for Asset

- L for Liability

- E for Equity

For the Classification (Class) column of the Income Statement use:

- R for Revenue

- E for Expense

*Excel sheet is for question 3. Please answer question 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started