Question: R130 . Risk Financing Assignment 2 R130: Risk Financing Assignment 2 This assignment includes questions based on content from Lessons 4 and 5. Instructions Review

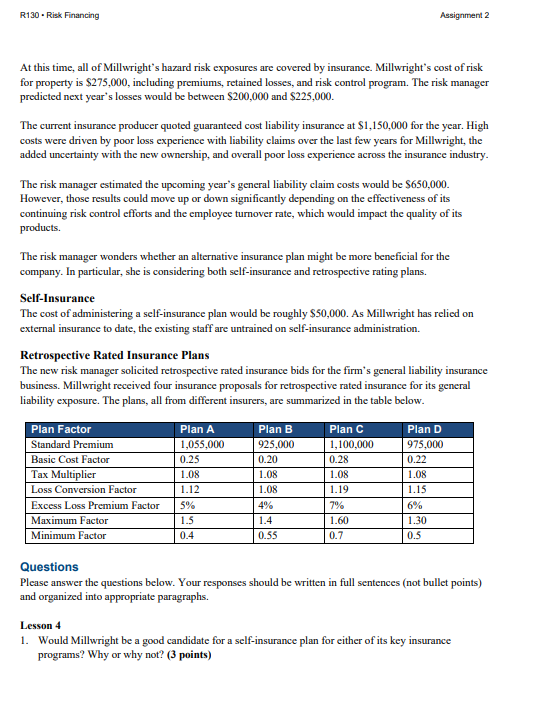

R130 . Risk Financing Assignment 2 R130: Risk Financing Assignment 2 This assignment includes questions based on content from Lessons 4 and 5. Instructions Review all sections of this document before starting the assignment. Upload your work (the written responses and the Excel spreadsheet with your calculations) to the assignment drop box located in the Assignment section of Lesson 5 on the course website. If you have any questions, post them on the "Course Questions & Announcements" discussion board. Your work needs to adhere to the program's policy on academic integrity. Key Requirements Your assignment should be single-spaced, font size 12. Your responses should be written in your own words, demonstrating that you understand the concepts well enough to discuss them. Answers that are found to include passages identical to the textbook, to another published source (including web pages), or to the work of another student will be subject to academic penalty. As a guideline, the expected length for the written responses is about 750-1000 words. However, grading will ultimately be based on the requirements set forth in the rubrics. Marks are provided for both content and clarity of expression. See the grading rubrics for details. Case Study Millwright Industries manufactures high quality, custom-made china hutches, display cases, and kitchen cabinets. For 75 years, Millwright operated as a family business; but 18 months ago, a death in the family led to the firm's sale. In order to re-evaluate the company's insurance options, the new owners hired a risk management professional. Millwright's revenue is earned through both direct sales and distribution to retailers throughout Canada. The company has a solid reputation of producing high-quality and well-made products. Sales have been reliable, growing steadily and predictably throughout the years. Overall, Millwright is in excellent financial condition, and it has a healthy risk appetite. Millwright provides its employees with healthcare benefits. Employees are provided with incentives to demonstrate their use of safe work practices, take part in exercise classes, and share nutritious meal plans. Millwright trains its employees in health and safety procedures and proper use of equipment in their initial orientation, with additional sessions conducted as required by law. This instruction includes how to use personal protective equipment (PPE) when operating equipment. Due to the age of the manufacturing facility, Millwright's operation team has created a detailed plan to inspect, maintain, and repair all equipment and buildings on site. The team keeps an inventory of critical spare parts and "as-built" drawings of all production equipment and buildings. As a result, when property insurance claims arise, they tend to be with high frequency but low severity. The Insurance Institute of Canada Page 1 of 5R130 - Risk Financing Assignment 2 At this time, all of Millwright's hazard risk exposures are covered by insurance. Millwright's cost of risk for property is $275,000, including premiums, retained losses, and risk control program. The risk manager predicted next year's losses would be between $200,000 and $225,000. The current insurance producer quoted guaranteed cost liability insurance at $1,150,000 for the year. High costs were driven by poor loss experience with liability claims over the last few years for Millwright, the added uncertainty with the new ownership, and overall poor loss experience across the insurance industry. The risk manager estimated the upcoming year's general liability claim costs would be $650,000. However, those results could move up or down significantly depending on the effectiveness of its continuing risk control efforts and the employee turnover rate, which would impact the quality of its products. The risk manager wonders whether an alternative insurance plan might be more beneficial for the company. In particular, she is considering both self-insurance and retrospective rating plans. Self-Insurance The cost of administering a self-insurance plan would be roughly $50,000. As Millwright has relied on external insurance to date, the existing staff are untrained on self-insurance administration. Retrospective Rated Insurance Plans The new risk manager solicited retrospective rated insurance bids for the firm's general liability insurance business. Millwright received four insurance proposals for retrospective rated insurance for its general liability exposure. The plans, all from different insurers, are summarized in the table below. Plan Factor Plan A Plan B Plan C Plan D Standard Premium 1,055.000 925.000 1,100,000 975.000 Basic Cost Factor 0.25 0.20 0.28 0.22 Tax Multiplier 1.08 1.08 -08 1.08 Loss Conversion Factor 1.12 1.08 1.19 1.15 Excess Loss Premium Factor 5% 4% 7% 6%% Maximum Factor 1.5 1.4 .60 1.30 Minimum Factor 0.4 0.55 0.7 0.5 Questions Please answer the questions below. Your responses should be written in full sentences (not bullet points) and organized into appropriate paragraphs. Lesson 4 1. Would Millwright be a good candidate for a self-insurance plan for either of its key insurance programs? Why or why not? (3 points)R130 - Risk Financing Assignment 2 2. Describe THREE (3) advantages and disadvantages of self-insurance for Millwright. Include ONE (1) advantage, ONE (1) disadvantage, and a third option of your choice. (3 points x 3) 3. What conditions of Millwright's operations most influence the viability of a self-insurance plan? Name THREE (3) factors that, if different, would change Millwright's approach to self-insurance. (3 points x 3) Lesson 5 Download the Excel spreadsheet from the course website. Complete all work for questions 4 and 5 within the Excel spreadsheet and submit this file along with your written answers. Your spreadsheet should include the formulas you used, not just your final numbers. 4. For each of the retrospective rating plans (Plans A-D, as summarized in the table above), calculate: a. The basic premium amount (4 points) b. The excess loss premium (4 points) c. The maximum and minimum premiums for each plan (8 points) 5. For each of the retrospective rating plans, calculate the premium that would be paid given the following losses: a. $375,000 (4 points) b. $550,000 (4 points) c. $775,000 (4 points) 6. Millwright has three risk financing objectives that play a role in determining the best potential plan. Answer each of the questions below to illustrate which plan (A, B, C, or D. as summarized in the table above) would best achieve each of the goals. a. Goal 1: Maximize profits-Which of the plans would allow the corporation to retain more of its earnings? Why? (3 points) b. Goal 2: Increase risk control incentives-Which of the plans would allow the corporation to improve loss prevention and loss reduction? Why? (3 points) C. Goal 3: Minimize cash outflows-Which of the plans would allow the corporation to reduce the money spent on mitigating risks? Why? (3 points) See grading rubrics on the next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts