Answered step by step

Verified Expert Solution

Question

1 Approved Answer

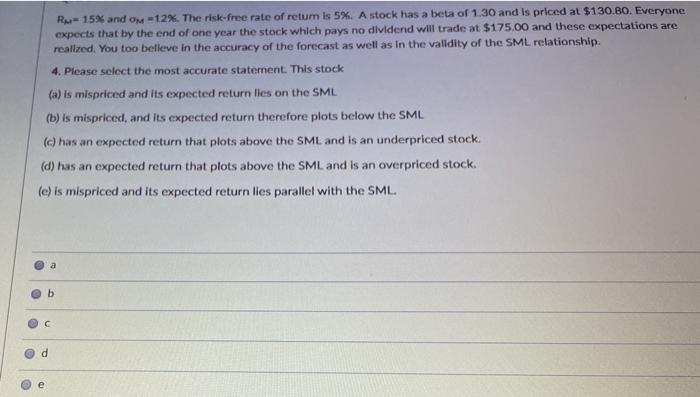

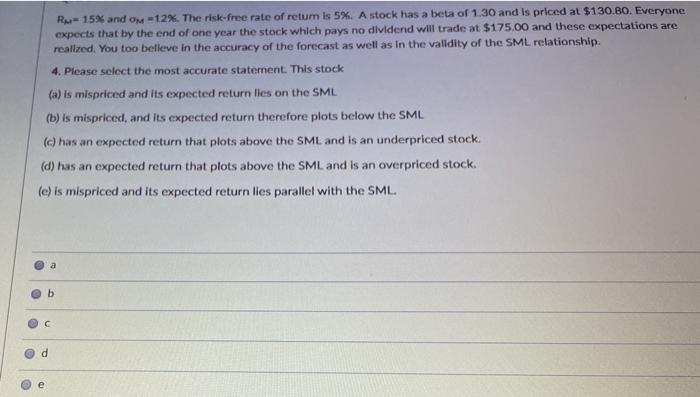

R-15% and OM -12%. The risk-free rate of return is 5%. A stock has a beta of 1.30 and is priced at $130.BO. Everyone expects

R-15% and OM -12%. The risk-free rate of return is 5%. A stock has a beta of 1.30 and is priced at $130.BO. Everyone expects that by the end of one year the stock which pays no dividend will trade at $175.00 and these expectations are realized. You too believe in the accuracy of the forecast as well as in the valldity of the SML relationship. 4. Please select the most accurate statement. This stock (a) is mispriced and its expected return lles on the SML (b) is mispriced, and its expected return therefore plots below the SML (c) has an expected return that plots above the SML and is an underpriced stock. (d) has an expected return that plots above the SML and is an overpriced stock. (e) is mispriced and its expected return lies parallel with the SML. a b C d

R-15% and OM -12%. The risk-free rate of return is 5%. A stock has a beta of 1.30 and is priced at $130.BO. Everyone expects that by the end of one year the stock which pays no dividend will trade at $175.00 and these expectations are realized. You too believe in the accuracy of the forecast as well as in the valldity of the SML relationship. 4. Please select the most accurate statement. This stock (a) is mispriced and its expected return lles on the SML (b) is mispriced, and its expected return therefore plots below the SML (c) has an expected return that plots above the SML and is an underpriced stock. (d) has an expected return that plots above the SML and is an overpriced stock. (e) is mispriced and its expected return lies parallel with the SML. a b C d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started