Answered step by step

Verified Expert Solution

Question

1 Approved Answer

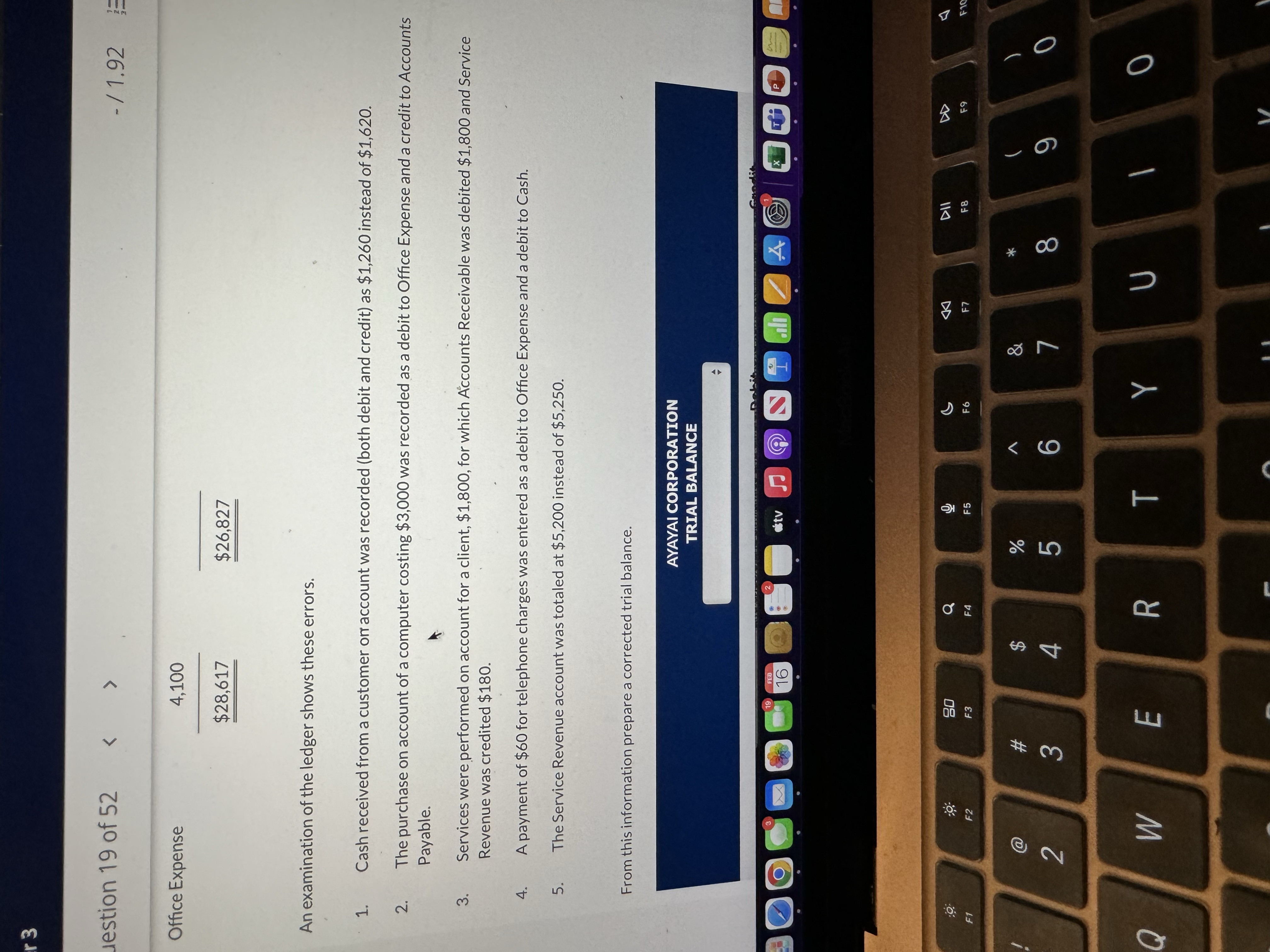

r3 uestion 19 of 52 < > Office Expense 4,100 $28,617 $26,827 F1 10: An examination of the ledger shows these errors. -/1.92 1.

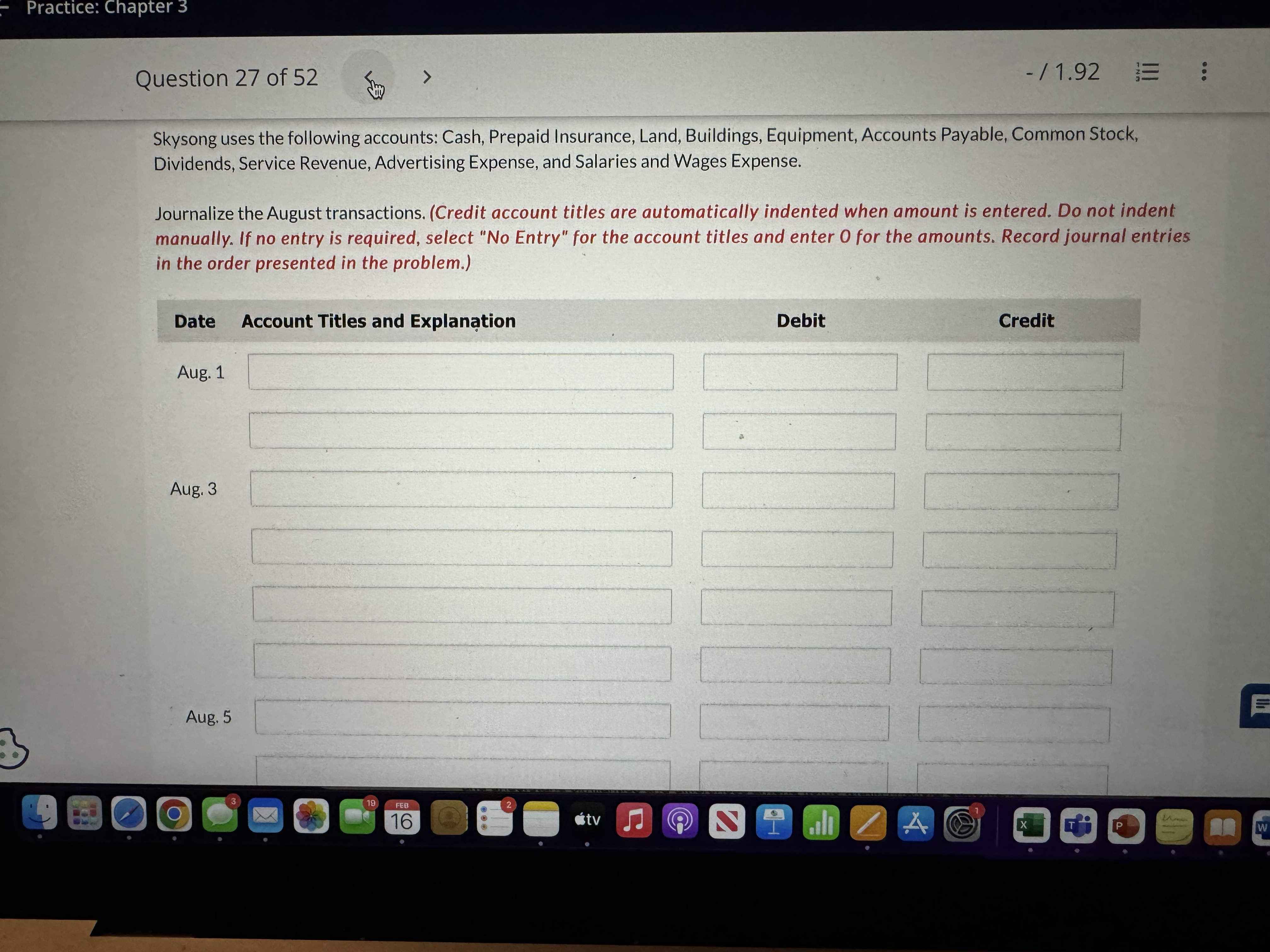

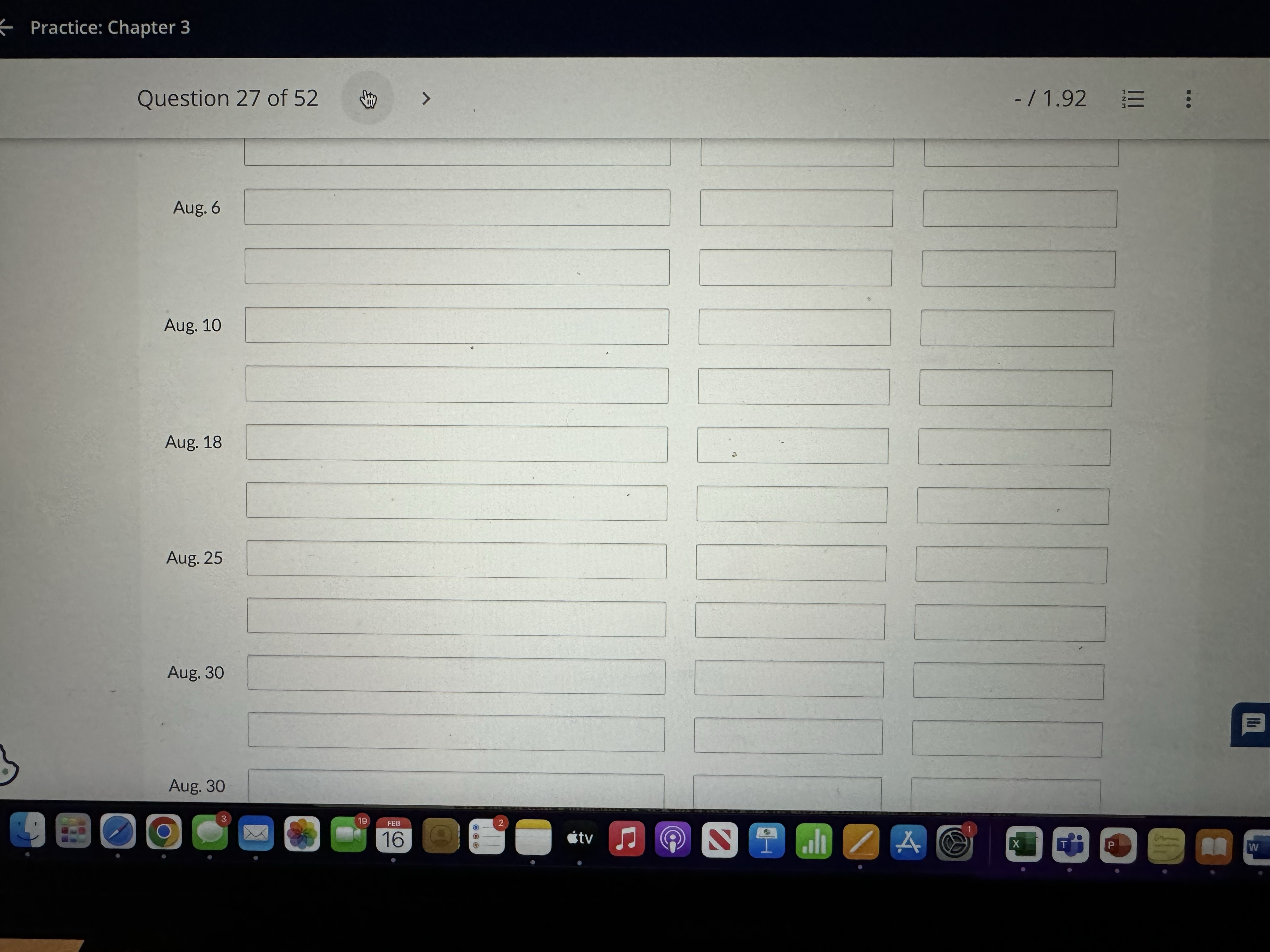

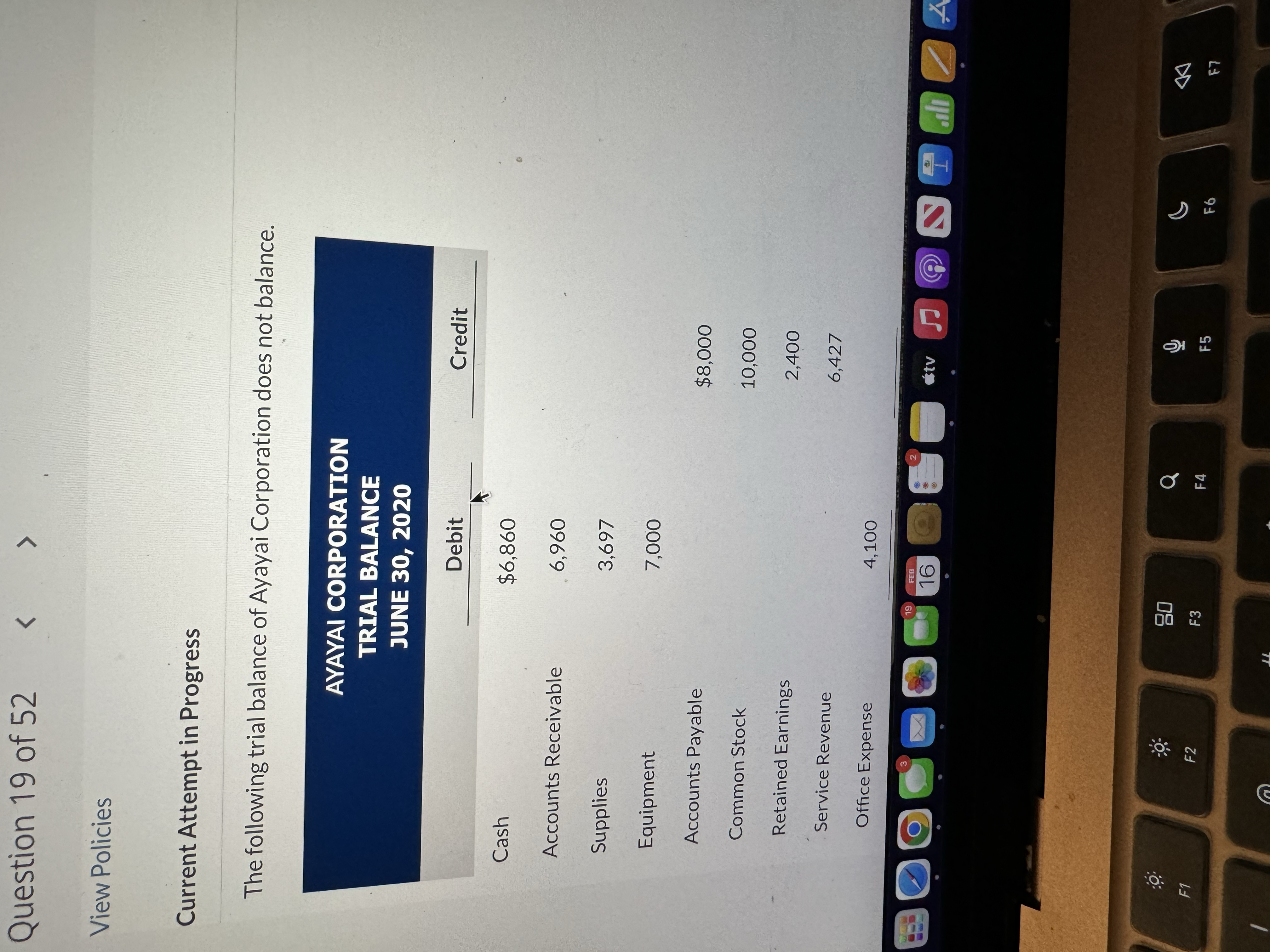

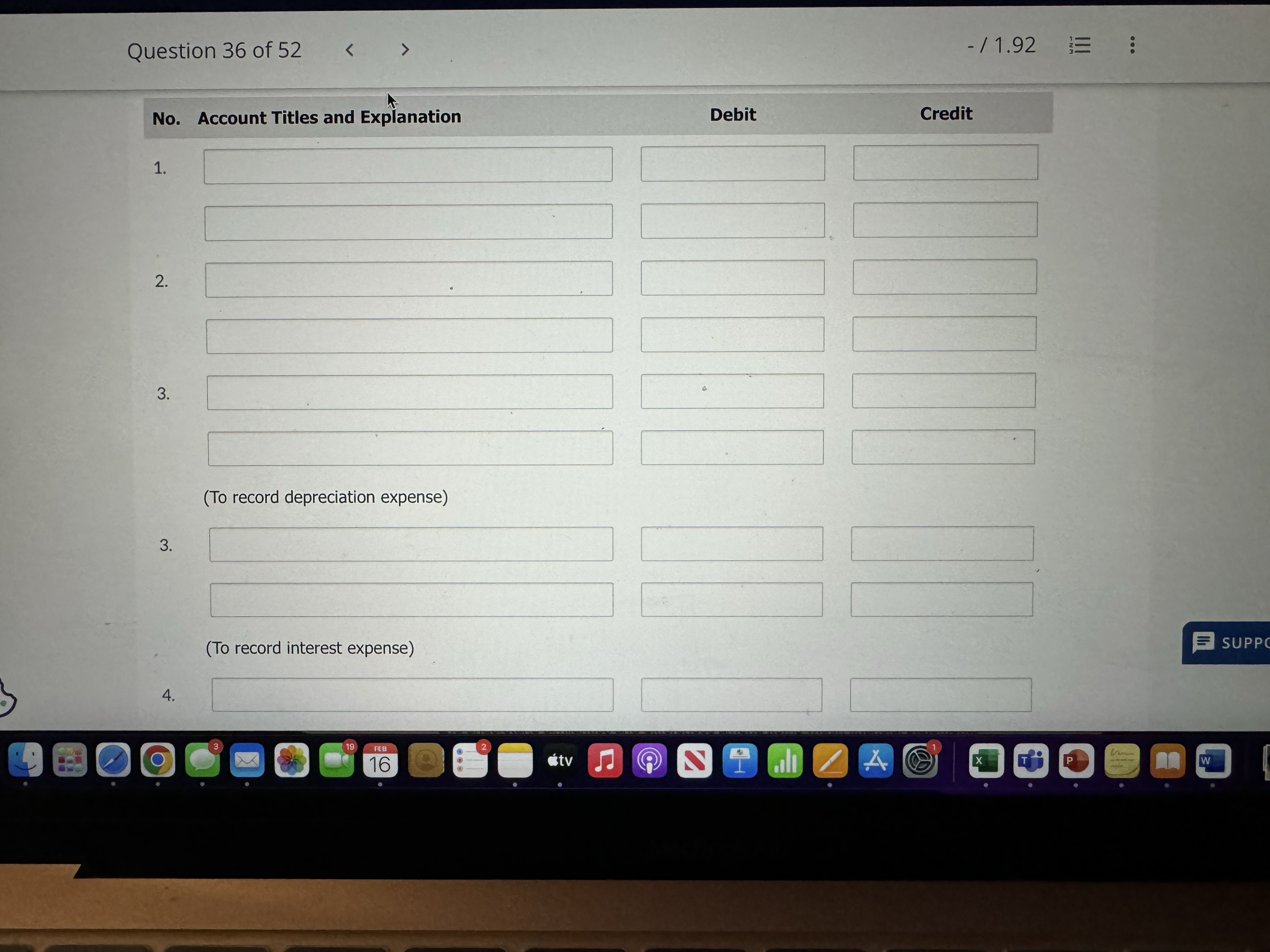

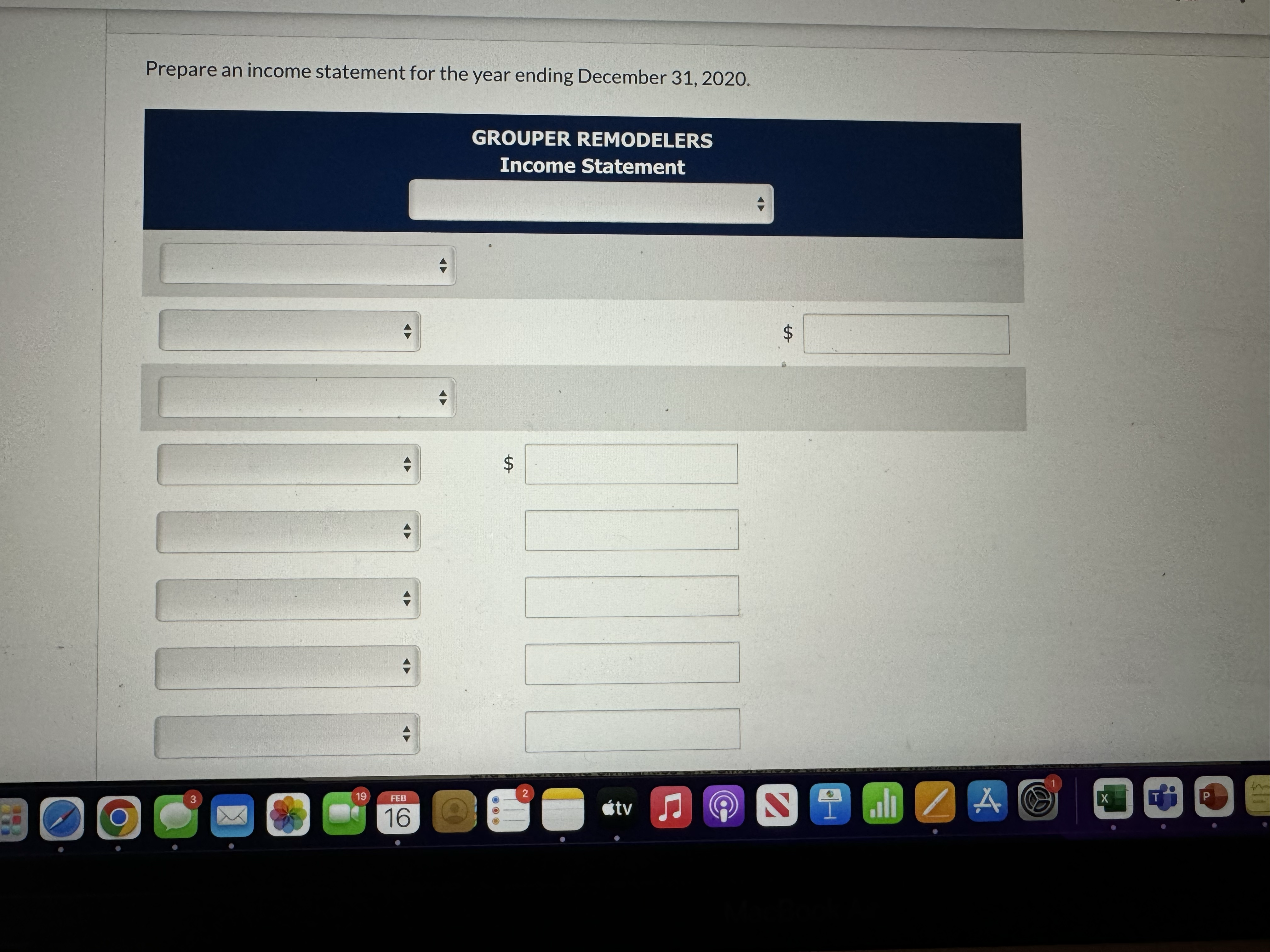

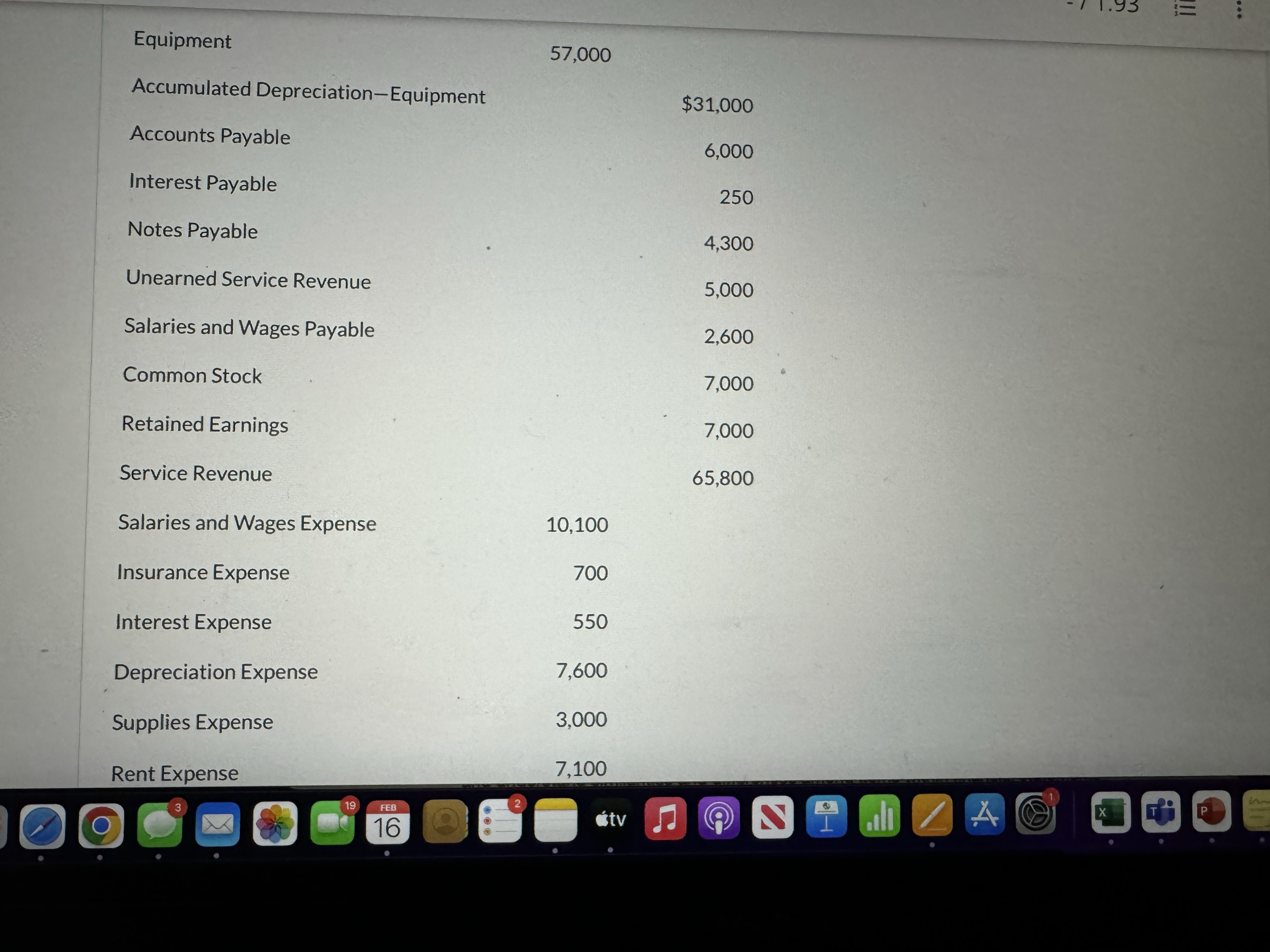

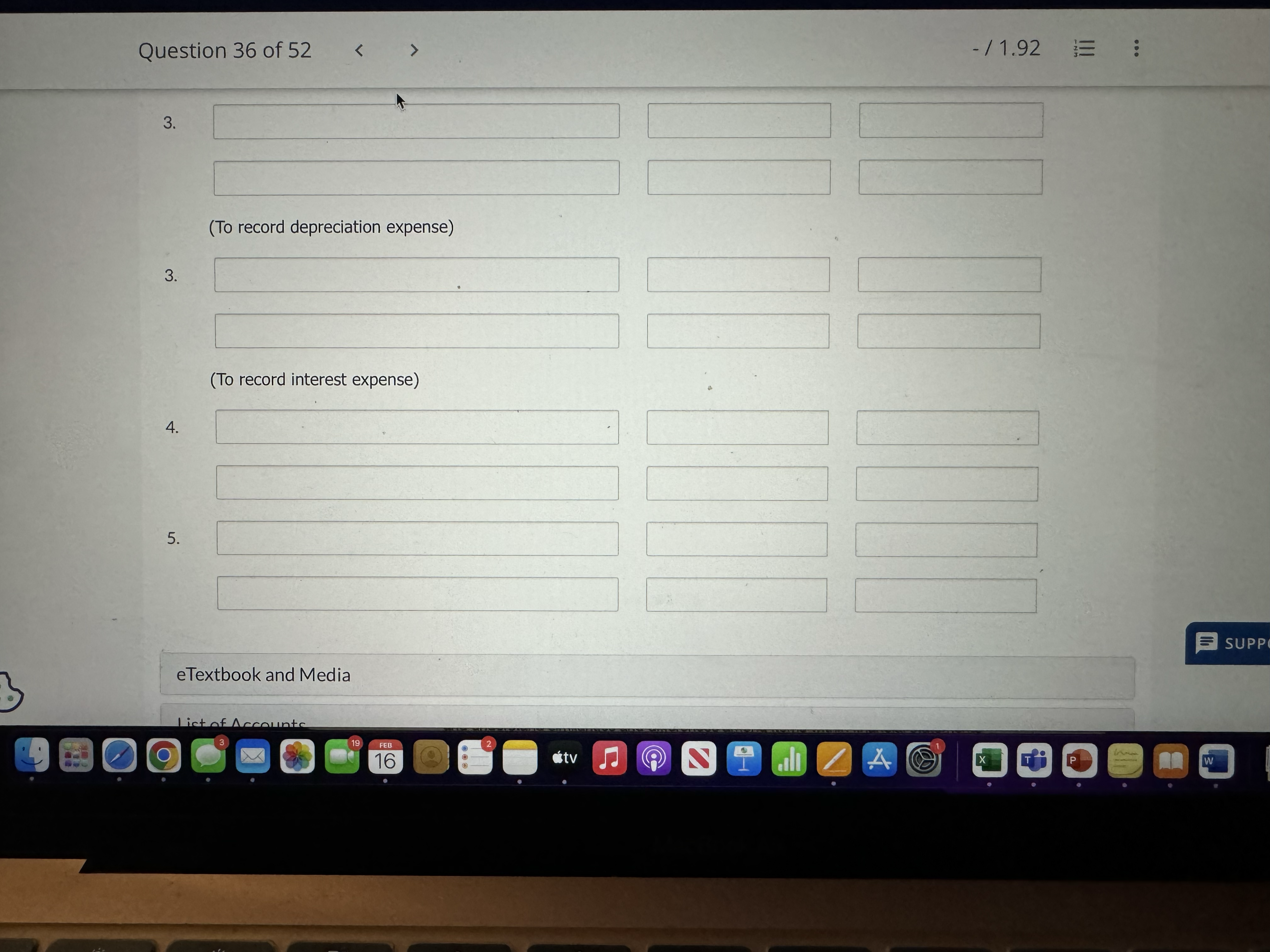

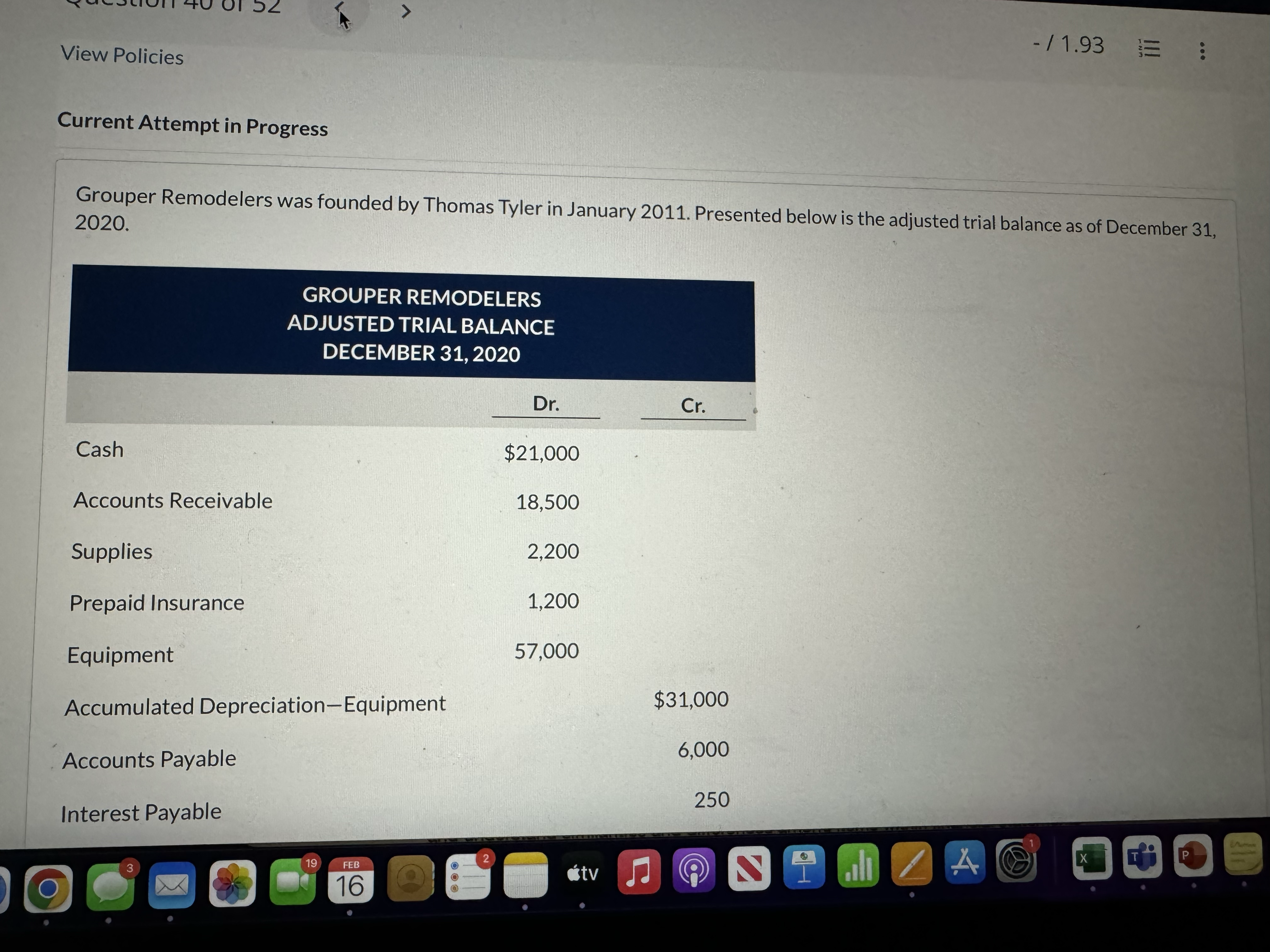

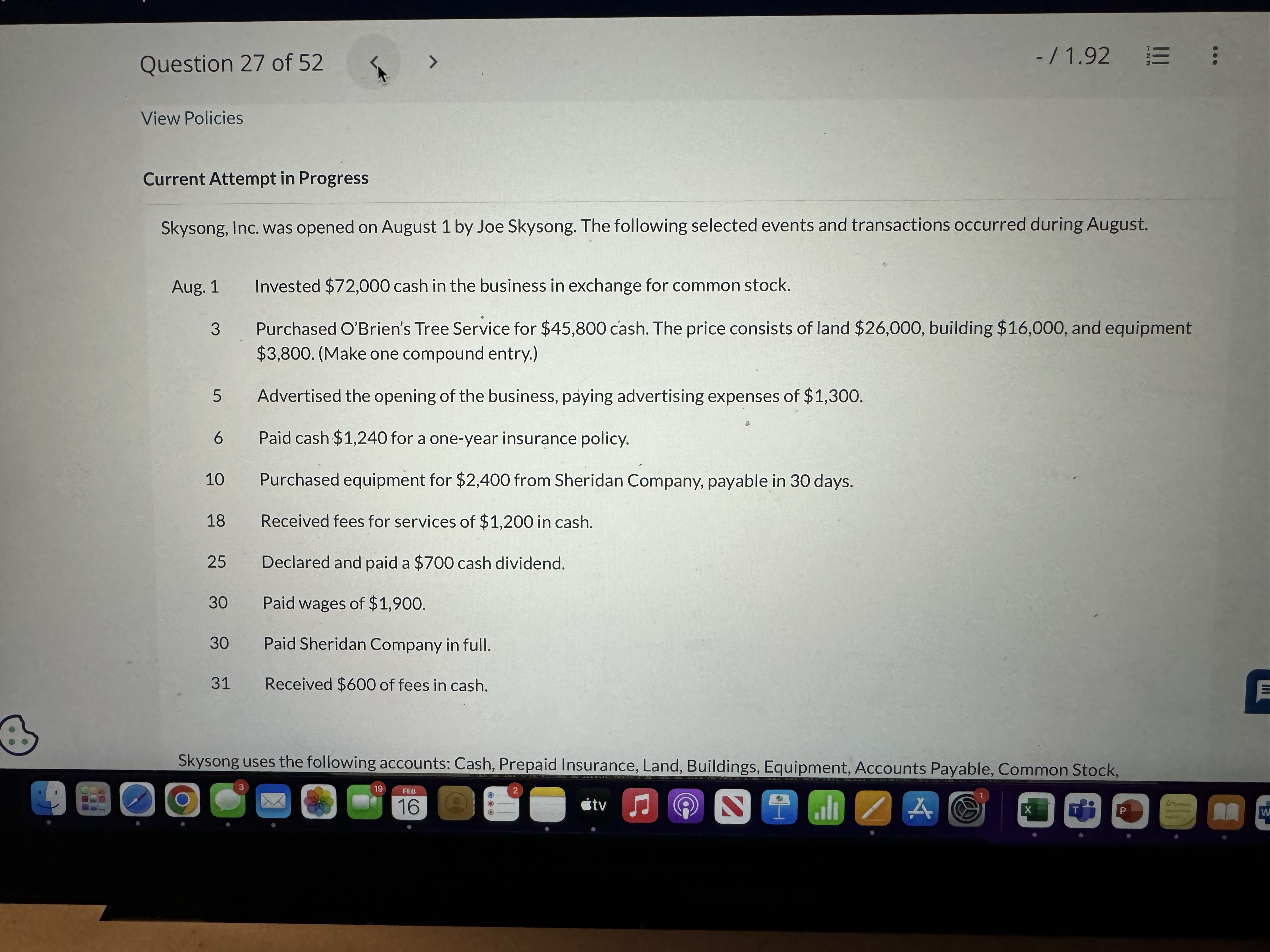

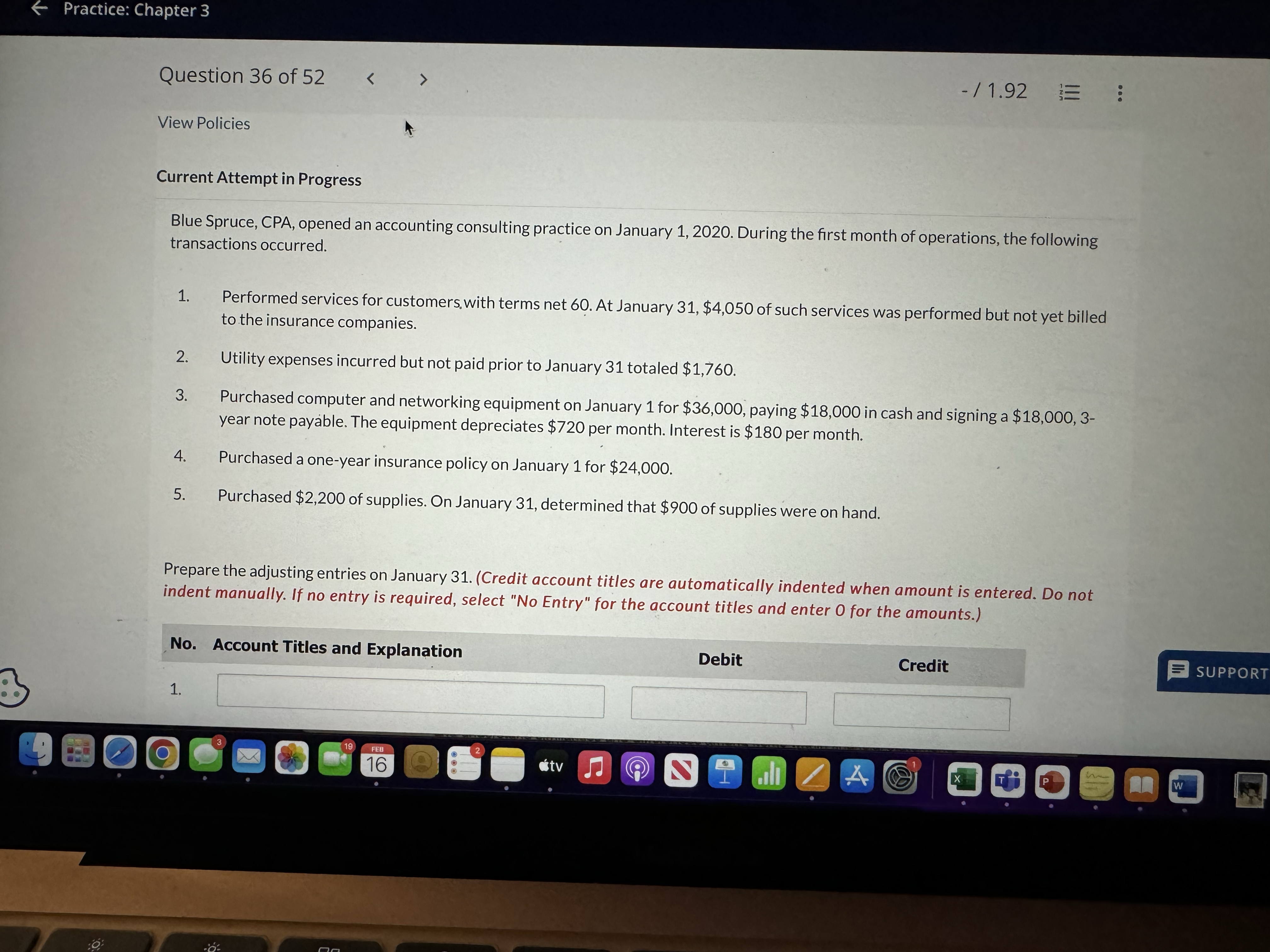

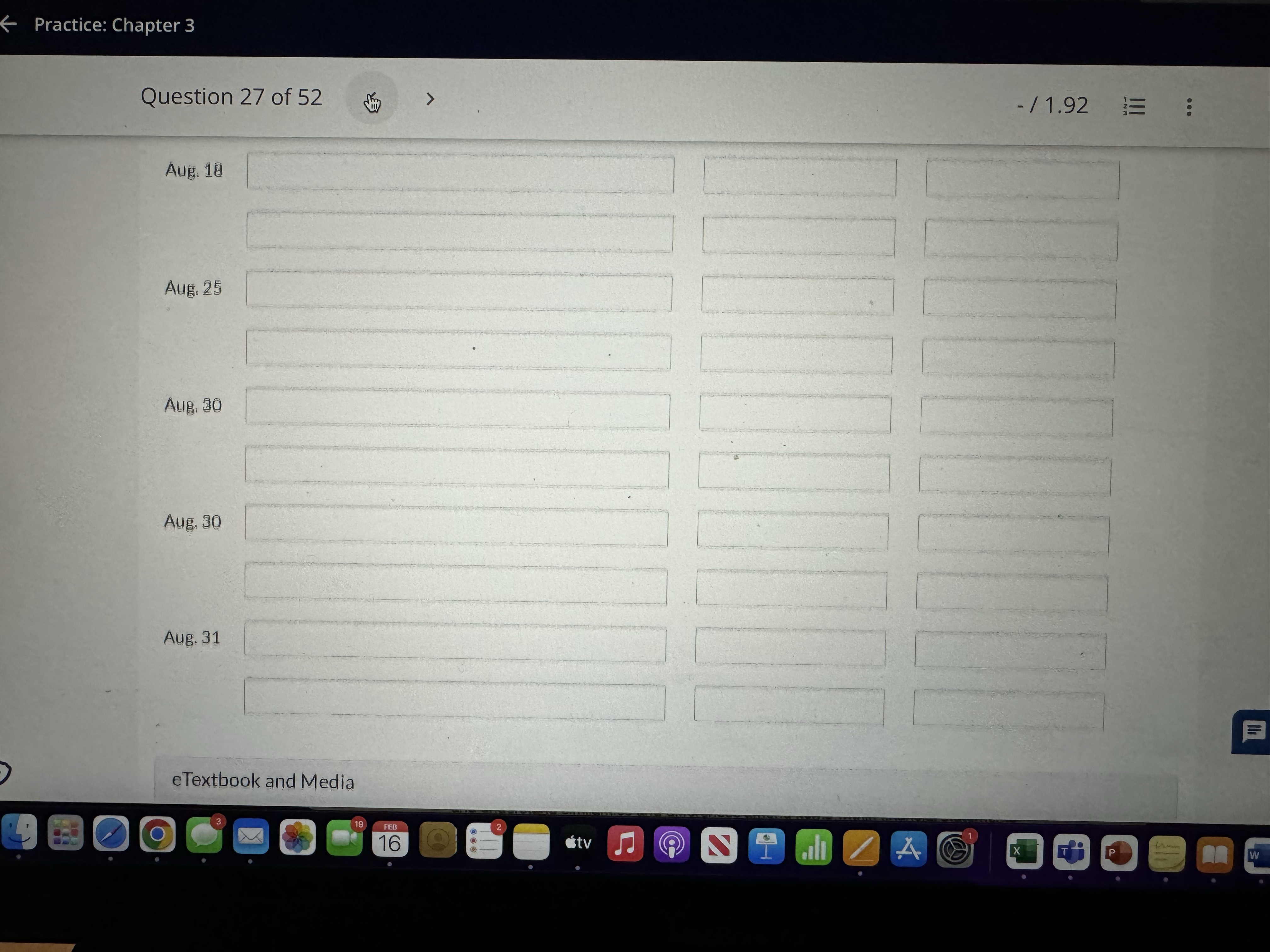

r3 uestion 19 of 52 < > Office Expense 4,100 $28,617 $26,827 F1 10: An examination of the ledger shows these errors. -/1.92 1. Cash received from a customer on account was recorded (both debit and credit) as $1,260 instead of $1,620. 2. The purchase on account of a computer costing $3,000 was recorded as a debit to Office Expense and a credit to Accounts Payable. 3. Services were performed on account for a client, $1,800, for which Accounts Receivable was debited $1,800 and Service Revenue was credited $180. 4. A payment of $60 for telephone charges was entered as a debit to Office Expense and a debit to Cash. 5. The Service Revenue account was totaled at $5,200 instead of $5,250. From this information prepare a corrected trial balance. AYAYAI CORPORATION TRIAL BALANCE O 08 F2 F3 19 FED 16 ! 2 # 3 4 Q M E tv Q F4 F5 % 95 6> MacBook A F6 < F7 DII F8 & 7 * 80 R T Y U ( 9 F9 F10 0 0 E Practice: Chapter 3 -/1.92 : Question 27 of 52 > Skysong uses the following accounts: Cash, Prepaid Insurance, Land, Buildings, Equipment, Accounts Payable, Common Stock, Dividends, Service Revenue, Advertising Expense, and Salaries and Wages Expense. Journalize the August transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Debit Credit Date Account Titles and Explanation Aug. 1 Aug. 3 Aug. 5 19 FEB 16 O 2 tv @ SA X W Practice: Chapter 3 Question 27 of 52 Aug. 6 Aug. 10 > > -/1.92 Aug. 18 Aug. 25 Aug. 30 Aug. 30 19 FEB 16 2 tv @ P W Question 19 of 52 View Policies L Current Attempt in Progress The following trial balance of Ayayai Corporation does not balance. AYAYAI CORPORATION TRIAL BALANCE JUNE 30, 2020 Debit Credit Cash $6,860 Accounts Receivable 6,960 Supplies 3,697 Equipment 7,000 Accounts Payable $8,000 Common Stock 10,000 Retained Earnings 2,400 Service Revenue Office Expense 3 F1 F2 19 4,100 FEB 16 80 F3 6,427 2 tv @ F4 F5 F6 F7 Question 36 of 52 < > -/1.92 No. Account Titles and Explanation Debit Credit 1. 2. 3. 3. 3 4. (To record depreciation expense) (To record interest expense) 3 19 2 FEB 16 atv @ NZA X W SUPPO Prepare an income statement for the year ending December 31, 2020. GROUPER REMODELERS Income Statement 19 3 SA FEB 16 $ 2 Equipment 57,000 Accumulated Depreciation-Equipment Accounts Payable $31,000 6,000 Interest Payable 250 Notes Payable 4,300 Unearned Service Revenue 5,000 Salaries and Wages Payable 2,600 Common Stock 7,000 Retained Earnings 7,000 Service Revenue 65,800 Salaries and Wages Expense 10,100 Insurance Expense 700 Interest Expense 550 Depreciation Expense Supplies Expense Rent Expense 7,600 3,000 7,100 3 19 2 FEB 16 tv C 93 III X P Question 36 of 52 < 7 3. 3. (To record depreciation expense) 4. 5. (To record interest expense) 3 eTextbook and Media List of Accounts 3 19 FEB 16 tv @ SA -/1.92 : X W SUPPO View Policies Current Attempt in Progress 7 -/1.93 : Grouper Remodelers was founded by Thomas Tyler in January 2011. Presented below is the adjusted trial balance as of December 31, 2020. Cash Accounts Receivable Supplies Prepaid Insurance Equipment GROUPER REMODELERS ADJUSTED TRIAL BALANCE DECEMBER 31, 2020 Accumulated Depreciation-Equipment Accounts Payable Interest Payable 3 Dr. Cr. $21,000 18,500 2,200 1,200 57,000 $31,000 2 19 FEB tv 16 6,000 250 X P eTextbook and Media List of Accounts Save for Later SA 1.93 N 11 Attempts: unlimited Submit Answer (a2) The parts of this question must be completed in order. This part will be available when you complete the part above. 3 19 2 FEB E 16 tv @ STIZA X P stion 19 of 52 -/1.92 = Totals eTextbook and Media 42 # % & * 7 2 3 5 6 7 8 9 0 Q W E R T Y A S D F G H U 1 0 J K L estion 19 of 52 < > 7 Q A F1 12 @ 10 16 AYAYAI CORPORATION TRIAL BALANCE SA tv 80 Q F2 F3 F4 F5 W 95 94 $ #3 E R T S D LL 66 Debit S F6 Y $ al 4 Credit -/1.92 = K F7 DII F8 D F9 & 7 * 8 U 9 0 0 A F10 G H J K L Question 27 of 52 View Policies > -/1.92 : Current Attempt in Progress Skysong, Inc. was opened on August 1 by Joe Skysong. The following selected events and transactions occurred during August. Aug. 1 Invested $72,000 cash in the business in exchange for common stock. 3 Purchased O'Brien's Tree Service for $45,800 cash. The price consists of land $26,000, building $16,000, and equipment $3,800. (Make one compound entry.) 5 Advertised the opening of the business, paying advertising expenses of $1,300. 6 Paid cash $1,240 for a one-year insurance policy. 10 Purchased equipment for $2,400 from Sheridan Company, payable in 30 days. 18 Received fees for services of $1,200 in cash. 25 Declared and paid a $700 cash dividend. 30 Paid wages of $1,900. 30 Paid Sheridan Company in full. 31 Received $600 of fees in cash. Skysong uses the following accounts: Cash, Prepaid Insurance, Land, Buildings, Equipment, Accounts Payable, Common Stock, 3 19 FEL 16 2 tv NA X E W Practice: Chapter 3 Question 36 of 52 < < > View Policies -/1.92 Current Attempt in Progress Blue Spruce, CPA, opened an accounting consulting practice on January 1, 2020. During the first month of operations, the following transactions occurred. 1. Performed services for customers, with terms net 60. At January 31, $4,050 of such services was performed but not yet billed to the insurance companies. 2. Utility expenses incurred but not paid prior to January 31 totaled $1,760. 3. Purchased computer and networking equipment on January 1 for $36,000, paying $18,000 in cash and signing a $18,000, 3- year note payable. The equipment depreciates $720 per month. Interest is $180 per month. 4. Purchased a one-year insurance policy on January 1 for $24,000. 5. Purchased $2,200 of supplies. On January 31, determined that $900 of supplies were on hand. Prepare the adjusting entries on January 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit 1. 3 19 FEB 2 16 tv @ SOMZA X P W SUPPORT Practice: Chapter 3 Question 27 of 52 Aug. 18 7 Aug. 25 Aug. 30 Aug. 30 Aug. 31 eTextbook and Media 3 19 FEB 16 tv J @ SIMZA -/1.92 : X W

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started