Answered step by step

Verified Expert Solution

Question

1 Approved Answer

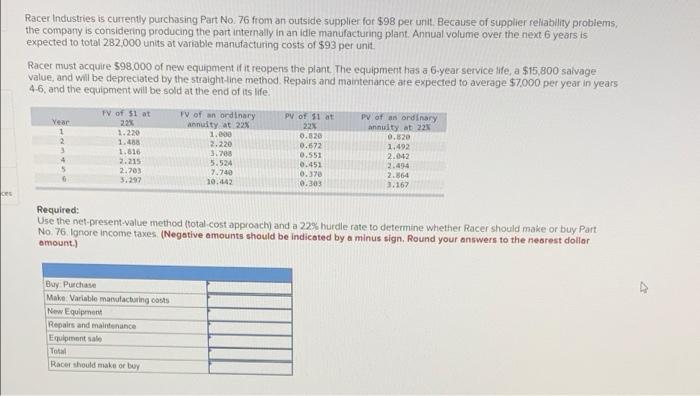

Racer Industries is currently purchasing Part No. 76 from an outside supplier for $98 per unit. Because of supplier reliability problems, the company is

Racer Industries is currently purchasing Part No. 76 from an outside supplier for $98 per unit. Because of supplier reliability problems, the company is considering producing the part internally in an idle manufacturing plant. Annual volume over the next 6 years is expected to total 282,000 units at variable manufacturing costs of $93 per unit. Racer must acquire $98,000 of new equipment if it reopens the plant The equipment has a 6-year service life, a $15,800 salvage value, and will be depreciated by the straight-line method. Repairs and maintenance are expected to average $7,000 per year in years 4-6, and the equipment will be sold at the end of its life. V of an ordinary annuity at 22N PV of $1 at PV of $1 at PV of an ordinary annuity at 22 0.820 Vear 22% 1.220 22% 1.000 0.820 2. 1.488 2.220 3.708 5.524 7.740 0.672 1.492 1.816 2.215 2.703 0.551 0.451 2.042 2.494 2.864 0.370 3.297 10.442 0.303 3.167 ces Required: Use the net-present-value method (total-cost approach) and a 22% hurdle rate to determine whether Racer should make or buy Part No. 76. Ignore income taxes. (Negative amounts should be indicated by a minus sign. Round your answers to the nearest dollar amount.) Buy Purchase Make Variable manutacturing costs New Equipment Repairs and maintenance Equipment sale Total Racer should make or buy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Particulars Amount Buy Purchase Nos of Units purchased A 282000 Unit price B 9...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started