Answered step by step

Verified Expert Solution

Question

1 Approved Answer

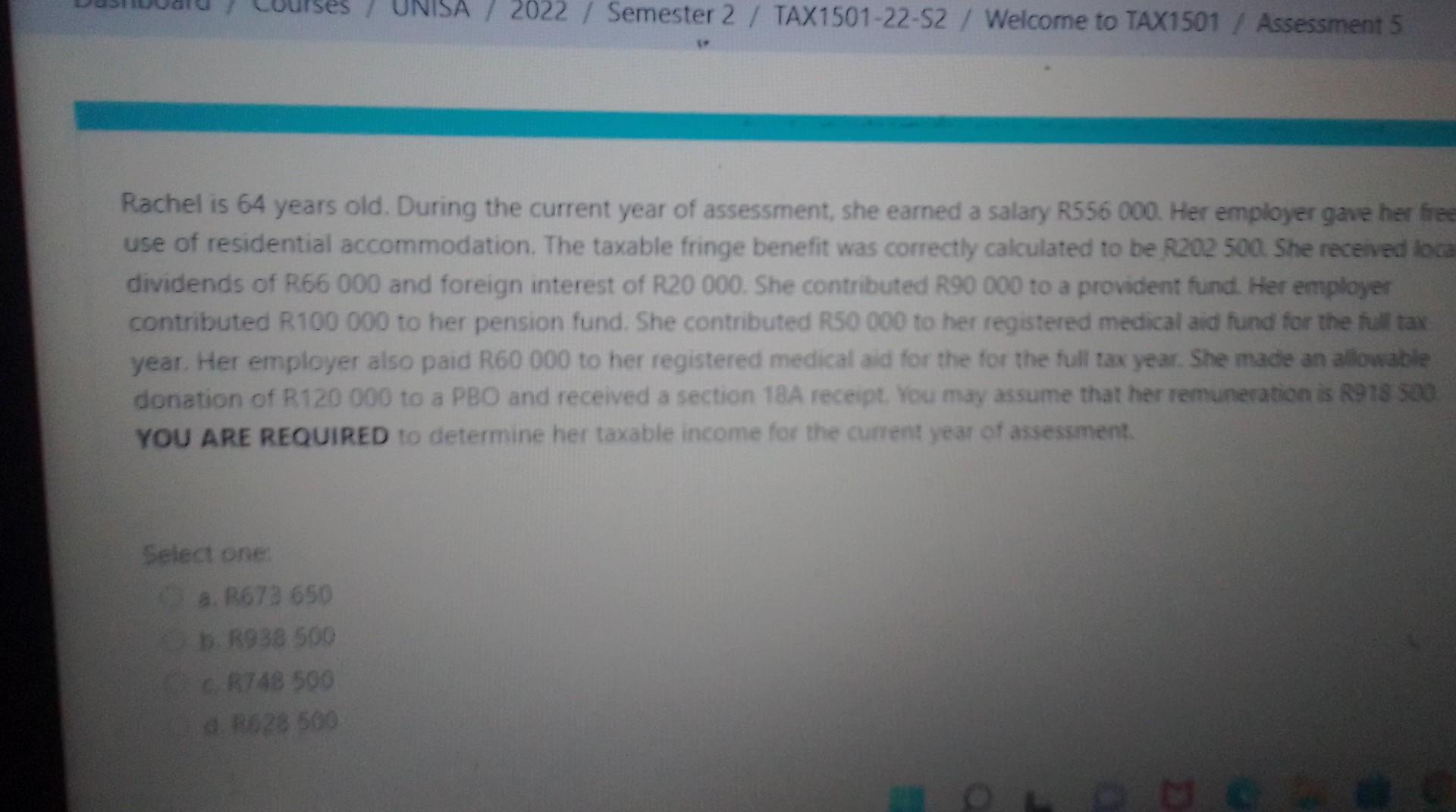

Rachel is 64 years old. During the current year of assessment, she earned a salary R556 000 . Her employer gave her fre use of

Rachel is 64 years old. During the current year of assessment, she earned a salary R556 000 . Her employer gave her fre use of residential accommodation. The taxable fringe benefit was correctly calculated to be R202 500 . She received loc dividends of R.66 000 and foreign interest of R20 000 . She contributed R90 000 to a provident fund. Her employer contributed R100 000 to her pension fund. She contributed R50 000 to her registered medical aid fund for the full tax year. Her employer also paid R60 000 to her registered medical aid for the for the full rax year. She made an allowable donation of R120000 to a PBO and received a section 18A receipt. You may assume that her remuneration is R918 SO0. YOU ARE REQUIRED to determine her taxable income for the current year of assessment. Select one

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started