Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rachel was born and had lived her life to date in Canada. On August 31, 2020, she left Canada permanently to Germany to start

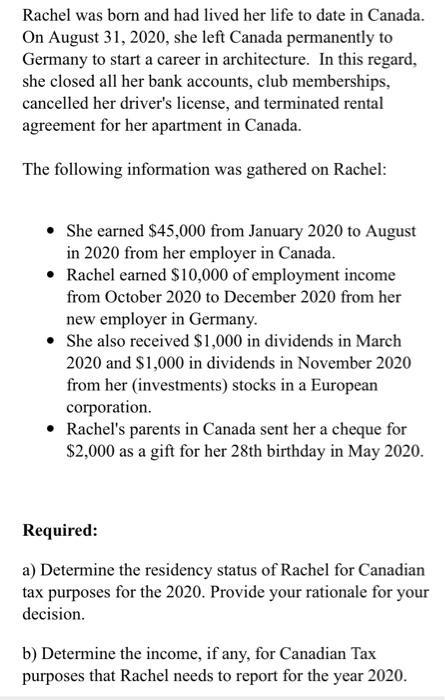

Rachel was born and had lived her life to date in Canada. On August 31, 2020, she left Canada permanently to Germany to start a career in architecture. In this regard, she closed all her bank accounts, club memberships, cancelled her driver's license, and terminated rental agreement for her apartment in Canada. The following information was gathered on Rachel: She earned $45,000 from January 2020 to August in 2020 from her employer in Canada. Rachel earned S10,000 of employment income from October 2020 to December 2020 from her new employer in Germany. She also received $1,000 in dividends in March 2020 and S1,000 in dividends in November 2020 from her (investments) stocks in a European corporation. Rachel's parents in Canada sent her a cheque for $2,000 as a gift for her 28th birthday in May 2020. Required: a) Determine the residency status of Rachel for Canadian tax purposes for the 2020. Provide your rationale for your decision. b) Determine the income, if any, for Canadian Tax purposes that Rachel needs to report for the year 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Rachel will be an emigrant for Income tax purposes from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started