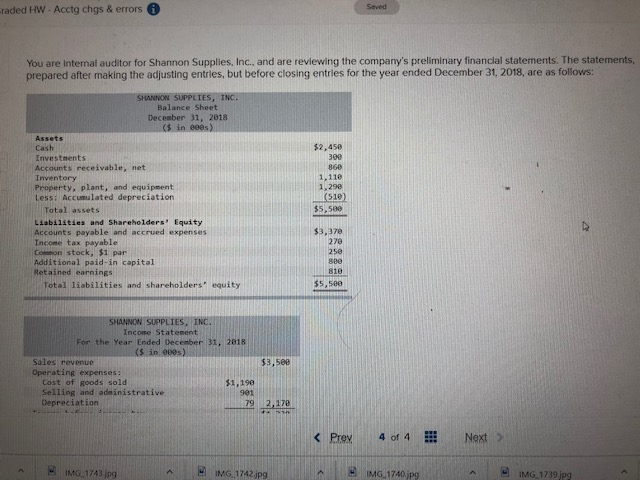

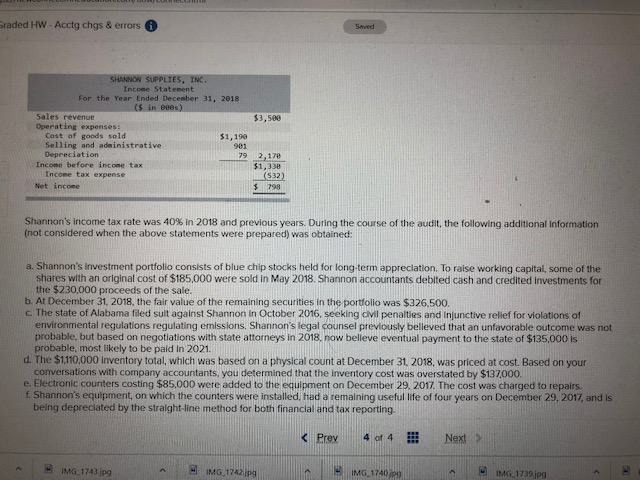

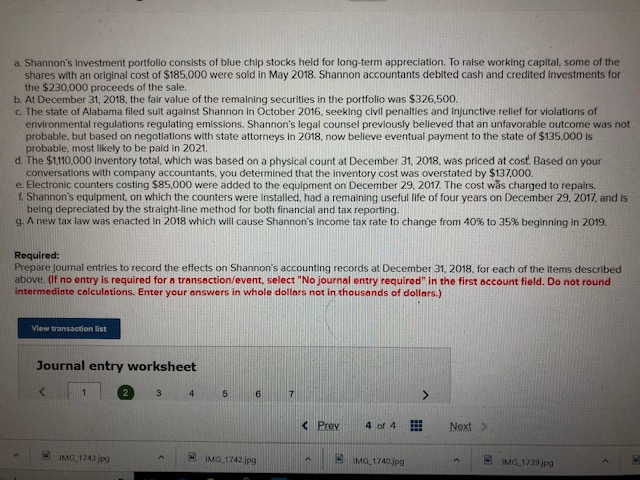

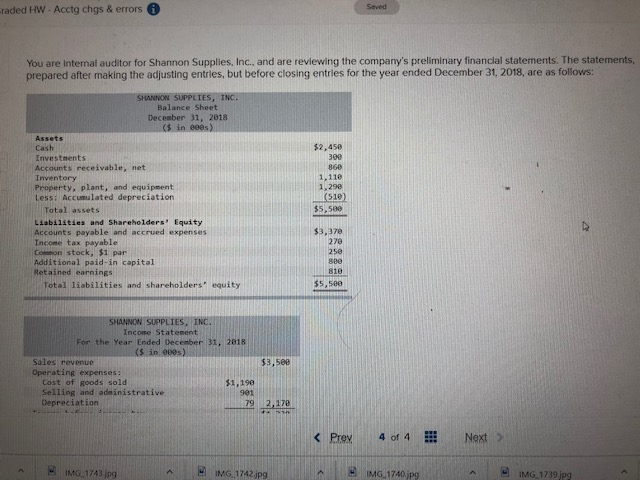

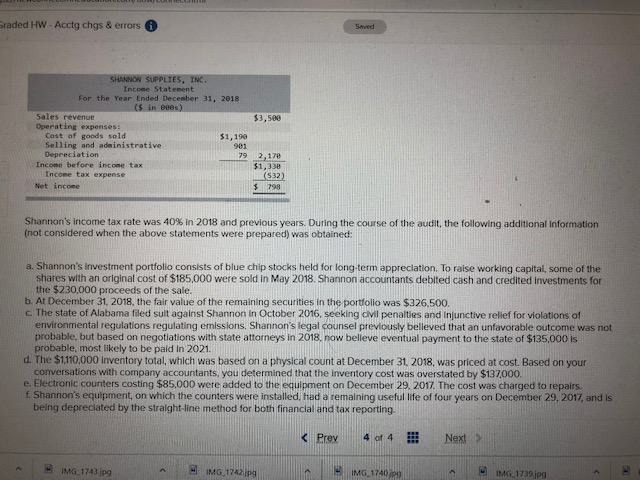

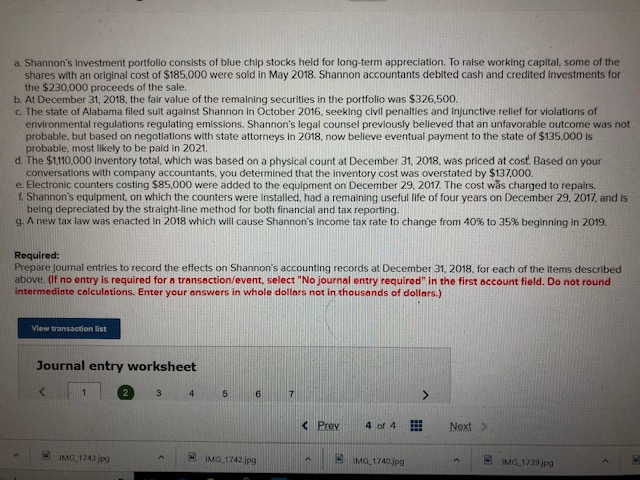

raded HW- Acctg chgs & errors Saved You are internal auditor for Shannon Supplies, Inc., and are reviewing the company's preliminary financial statements. The statements, prepared after making the adjusting entries, but before closing entries for the year ended December 31, 2018, are as follows: SUPPLI Balance Sheet December 31, 2018 ($ in eees) Assets Cash Investments Accounts receivable, net Inventory Property, plant, and equipment Less: Accumulated depreciation $2,450 300 860 1,110 1,290 (510) Total assets $5, 500 Liabilitses and Shareholders' Equity $3,37e 279 Accounts payable and accrued expenses Income tax payable Conmon stock, $1 pa Additional paid-in capital Retained earnings rotal liabilities and shareholders' equity 258 880 810 $5, se0 SHANNON SUPPLIES, Income Statement For the Year Ended Deceaber 31, 2818 . (s in 900s) Sales revenue 3,588 Operating expenses: Cost of goods sold Selling and adeinistrative Depreciation 31,190 9e1 79 72,170 K Prev4 of 4 Next> H IMMG.1743 jpg 1M6.1742.jpg 1MG_1 739jpg raded HW - Acctg chgs & errors SHANNON SUPPLIES, INC. Income Statenent For the Year Ended December 31, 2018 s in ee0s) Sales revenue $3,500 Operating expenses: Cost of goods sold Selling and administrative Depereciation $1,190 901 92,170 31,338 (532) Income before income tax Income tax expense Net income $ 798 Shannon's income tax rate was 40% in 2018 and previous years. During the course of the audit, the following additional information not consldered when the above statements were prepared) was obtained: a. Shannon's investment portfolio consists of blue chip stocks held for long-term appreclation. To raise working capital, some of the shares with an original cost of $185.000 were sold in May 2018. Shannon accountants debited cash and credited investments for the $230,000 proceeds of the sale. b. At December 31, 2018, the fair value of the remaining securities in the portolio was $326,500. C. The state of Alabama filed suit agalnst Shannon in October 2016, seeking dvil penalties and Injunctive relief for violations of environmental regulations regulating emissions. Shannon's legal counsel previously belleved that an unfavorable outcome was not probable, but based on negotiations with state attorneys in 2018, now belleve eventual payment to the state of $135,000 is probable, most likely to be paid in 2021. e $1110,000 inventory total, which was based on a physical count at December 31. 2018, was priced at cost. Based on your conversations with company accountants, you determined that the inventory cost was overstated by $137000. e. Electronic counters costing $85.000 were added to the equipment on December 29, 2017. The cost was charged to repairs f. Shannon's equipment, on which the counters were installed. thad a remaining useful life of four years on December 29, 2017, and is being depreciated by the straight -ine method for both financlal and tax reporting d t nentorytoal which as based on a physical coumtat December at. 2018, was priced at cost. Basecd on your K Prev4 of 4i Next IMG 1742jpg IMG 1740 P9 IMG 1743 jpg IMG 173 a. Shannon's investment portfolio consists of blue chip stocks held for long-term appreclation. To ralse working capital, some of the shares with an original cost of $185.000 were sold in May 2018. Shannon accountants debited cash and credited investments for the $230,000 proceeds of the sale b. At December 31, 2018, the fair value of the remaining securities in the portfolio was $326,500. c. The state of Alabama filed suit against Shannon in October 2016, seeking civil penalties and injunctive rellef for violations of environmental regulations regulating emissions. Shannon's legal counsel previously belleved that an unfavorable outcome was not probable, but based on negotiations with state attorneys in 2018, now believe eventual payment to the state of $135,000 is probable, most likely to be paid in 2021. d. The $1110,000 inventory total, which was based on a physical count at December 31, 2018, was priced at cost. Based on your conversations with company accountants, you determined that the inventory cost was overstated by $137,000. e. Electronic counters costing $85,000 were added to the equipment on December 29, 2017. The cost was charged to repairs. f Shannon's equipment, on which the counters were installed, had a remaining useful life of four years on December 29. 2017, and is belng depreciated by the straight-line method for both financlal and tax reporting. g. A new tax law was enacted in 2018 which will cause Shannon's income tax rate to change from 40% to 35% beginning in 2019. Required: Prepare journal entries to record the effects on Shannon's accounting records at December 31. 2018, for each of the items described bove. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in whole dollars not in thousands of dollars.) View transaction list Journal entry worksheet Prev 4 of 4 N Next 1MG_1742.jpg aIMG 1740.jpg A IMG 1739.jpg