Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Radiance Clothing us a manufacturer of designer suits. The cost of each suit is the sum of the three variable costs and one fixed-cosr category.

Radiance Clothing us a manufacturer of designer suits. The cost of each suit is the sum of the three variable costs and one fixed-cosr category.

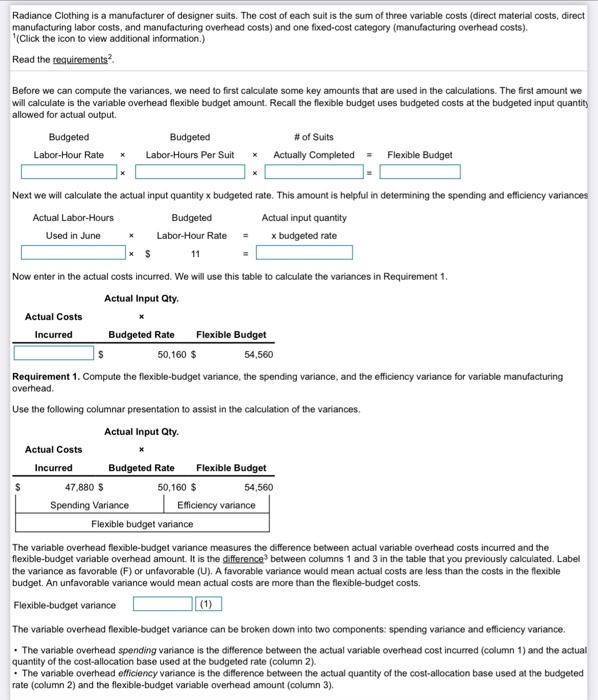

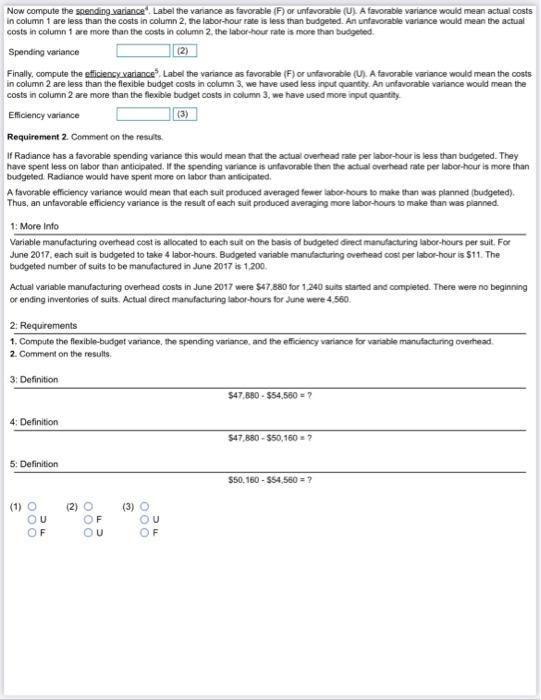

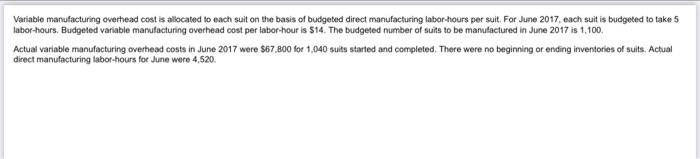

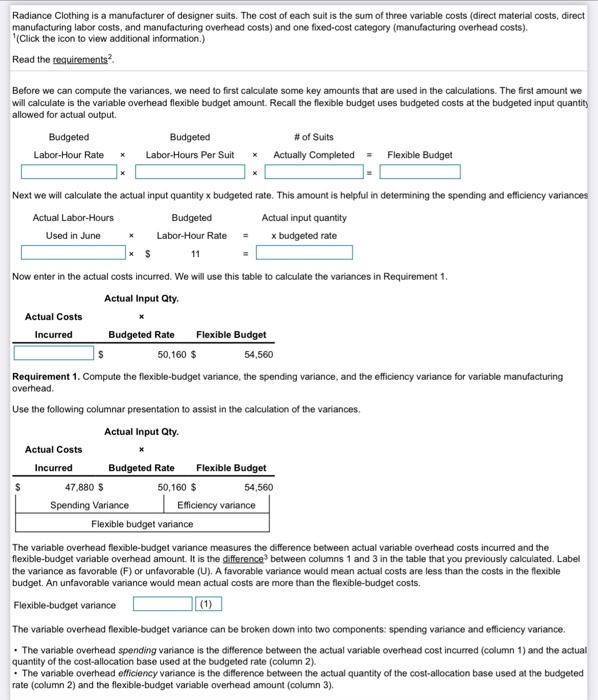

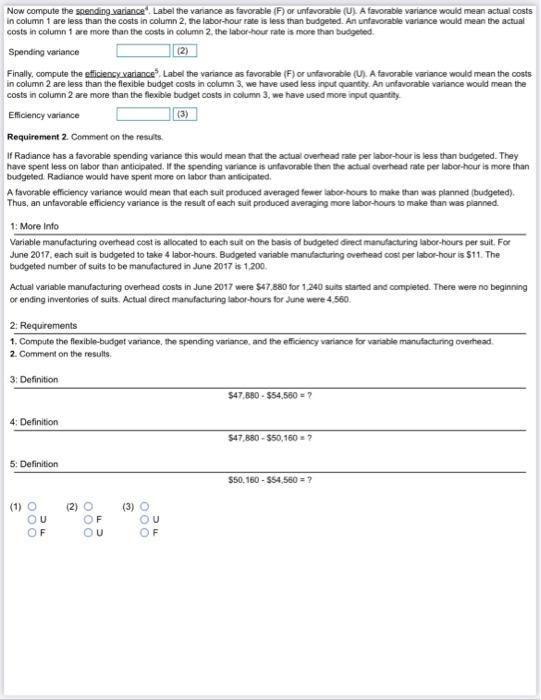

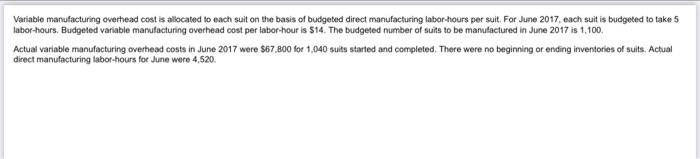

Radiance Clothing is a manufacturer of designer suits. The cost of each suit is the sum of three variable costs (direct material costs, direct manufacturing labor costs, and manufacturing overhead costs) and one fixed-cost category (manufacturing overhead costs). (Click the icon to view additional information.) Read the requirements Before we can compute the variances, we need to first calculate some key amounts that are used in the calculations. The first amount we will calculate is the variable overhead flexible budget amount. Recall the flexible budget uses budgeted costs at the budgeted input quantity allowed for actual output Budgeted Budgeted # of Suits Labor-Hour Rate * Labor-Hours Per Suit Actually completed - Flexible Budget Next we will calculate the actual input quantity x budgeted rate. This amount is helpful in determining the spending and efficiency variances Actual Labor-Hours Budgeted Actual input quantity Used in June * Labor-Hour Rate * budgeted rate * $ 11 Now enter in the actual costs incurred. We will use this table to calculate the variances in Requirement 1. Actual Input Qty. Actual Costs Incurred Budgeted Rate Flexible Budget 50,160 $ 54,560 Requirement 1. Compute the flexible-budget variance, the spending variance, and the efficiency variance for variable manufacturing overhead. Use the following columnar presentation to assist in the calculation of the variances Actual Input Qty. Actual Costs Incurred Budgeted Rate Flexible Budget 47,880 $ 50,160 $ 54,560 Spending Variance Efficiency variance Flexible budget variance The variable overhead flexible-budget variance measures the difference between actual variable overhead costs incurred and the flexible-budget variable overhead amount. It is the difference between columns 1 and 3 in the table that you previously calculated. Label the variance as favorable (F) or unfavorable (U). A favorable variance would mean actual costs are less than the costs in the flexible budget. An unfavorable variance would mean actual costs are more than the flexible-budget costs. Flexible-budget variance (1) The variable overhead flexible-budget variance can be broken down into two components: spending variance and efficiency variance. The variable overhead spending variance is the difference between the actual variable overhead cost incurred (column 1) and the actual quantity of the cost-allocation base used at the budgeted rate (column 2). . The variable overhead efficiency variance is the difference between the actual quantity of the cost-allocation base used at the budgeted rate (column 2) and the flexible-budget variable overhead amount (column 3). Now compute the spending variance Label the vanance as favorable (F) or unfavorable (UL A favorable variance would mean actual costs in column 1 are less than the costs in column 2, the labor-hour rate is less than budgeted. An unfavorable variance would mean the actual costs in column 1 are more than the costs in column 2 the labor-hour rate is more than budgeted. Spending variance (2) Finally, compute the efficiency variance Label the variance as favorable (F) or unfavorable (U) A favorable variance would mean the costs in column 2 are less than the flexible budget costs in column 3, we have used less inout quantity. An unfavorable variance would mean the costs in column 2 are more than the flexible budget costs in column 3 we have used more input quantity Eficiency variance (3) Requirement 2. Comment on the results, If Radiance has a favorable spending variance this would mean that the actual overhead rate per labor-hour is less than budgeted. They have spent less on labor than anticipated. If the spending variance is unfavorable then the actual overhead rate per labor-hour is more than budgeted. Radiance would have spent more on labor than anticipated. A favorable efficiency variance would mean that each suit produced averaged fewer labor-hous to make than was planned (budgeted). Thus, an unfavorable efficiency variance is the result of each suit produced averaging more labor hours to make than was planned 1: More Info Variable manufacturing overhead cost is allocated to each sut on the basis of budgeted direct manufacturing labor-hours per suit. For June 2017, each suit is budgeted to take 4 labor-hours. Budgeted variable manufacturing overhead cost per labor-hour is $11. The budgeted number of suits to be manufactured in June 2017 is 1.200. Actual variable manufacturing overhead costs in June 2017 were $47.880 for 1.240 suls staned and completed. There were no beginning or ending inventories of suits. Actual direct manufacturing labor-hours for June were 4560 2. Requirements 1. Compute the flexible-budget variance, the spending variance, and the efficiency variance for variabile manufacturing overhead. 2. Comment on the results 3. Definition $47.880 - $54,560 4: Definition 547.880 - $50,160 5: Definition $50, 160 - $54,560 ? (2) ) (1) O OU F F OU (3) O OU F Variable manufacturing overhead cost is allocated to each suit on the basis of budgeted direct manufacturing labor-hours per suit. For June 2017, each suit is budgeted to take 5 labor-hours. Budgeted variable manufacturing overhead cost per labor-hour is $14. The budgeted number of suits to be manufactured in June 2017 is 1.100 Actual variable manufacturing overhead costs in June 2017 were $67,800 for 1,040 suits started and completed. There were no beginning or ending inventories of suits. Actual direct manufacturing labor-hours for June were 4,520

Radiance Clothing is a manufacturer of designer suits. The cost of each suit is the sum of three variable costs (direct material costs, direct manufacturing labor costs, and manufacturing overhead costs) and one fixed-cost category (manufacturing overhead costs). (Click the icon to view additional information.) Read the requirements Before we can compute the variances, we need to first calculate some key amounts that are used in the calculations. The first amount we will calculate is the variable overhead flexible budget amount. Recall the flexible budget uses budgeted costs at the budgeted input quantity allowed for actual output Budgeted Budgeted # of Suits Labor-Hour Rate * Labor-Hours Per Suit Actually completed - Flexible Budget Next we will calculate the actual input quantity x budgeted rate. This amount is helpful in determining the spending and efficiency variances Actual Labor-Hours Budgeted Actual input quantity Used in June * Labor-Hour Rate * budgeted rate * $ 11 Now enter in the actual costs incurred. We will use this table to calculate the variances in Requirement 1. Actual Input Qty. Actual Costs Incurred Budgeted Rate Flexible Budget 50,160 $ 54,560 Requirement 1. Compute the flexible-budget variance, the spending variance, and the efficiency variance for variable manufacturing overhead. Use the following columnar presentation to assist in the calculation of the variances Actual Input Qty. Actual Costs Incurred Budgeted Rate Flexible Budget 47,880 $ 50,160 $ 54,560 Spending Variance Efficiency variance Flexible budget variance The variable overhead flexible-budget variance measures the difference between actual variable overhead costs incurred and the flexible-budget variable overhead amount. It is the difference between columns 1 and 3 in the table that you previously calculated. Label the variance as favorable (F) or unfavorable (U). A favorable variance would mean actual costs are less than the costs in the flexible budget. An unfavorable variance would mean actual costs are more than the flexible-budget costs. Flexible-budget variance (1) The variable overhead flexible-budget variance can be broken down into two components: spending variance and efficiency variance. The variable overhead spending variance is the difference between the actual variable overhead cost incurred (column 1) and the actual quantity of the cost-allocation base used at the budgeted rate (column 2). . The variable overhead efficiency variance is the difference between the actual quantity of the cost-allocation base used at the budgeted rate (column 2) and the flexible-budget variable overhead amount (column 3). Now compute the spending variance Label the vanance as favorable (F) or unfavorable (UL A favorable variance would mean actual costs in column 1 are less than the costs in column 2, the labor-hour rate is less than budgeted. An unfavorable variance would mean the actual costs in column 1 are more than the costs in column 2 the labor-hour rate is more than budgeted. Spending variance (2) Finally, compute the efficiency variance Label the variance as favorable (F) or unfavorable (U) A favorable variance would mean the costs in column 2 are less than the flexible budget costs in column 3, we have used less inout quantity. An unfavorable variance would mean the costs in column 2 are more than the flexible budget costs in column 3 we have used more input quantity Eficiency variance (3) Requirement 2. Comment on the results, If Radiance has a favorable spending variance this would mean that the actual overhead rate per labor-hour is less than budgeted. They have spent less on labor than anticipated. If the spending variance is unfavorable then the actual overhead rate per labor-hour is more than budgeted. Radiance would have spent more on labor than anticipated. A favorable efficiency variance would mean that each suit produced averaged fewer labor-hous to make than was planned (budgeted). Thus, an unfavorable efficiency variance is the result of each suit produced averaging more labor hours to make than was planned 1: More Info Variable manufacturing overhead cost is allocated to each sut on the basis of budgeted direct manufacturing labor-hours per suit. For June 2017, each suit is budgeted to take 4 labor-hours. Budgeted variable manufacturing overhead cost per labor-hour is $11. The budgeted number of suits to be manufactured in June 2017 is 1.200. Actual variable manufacturing overhead costs in June 2017 were $47.880 for 1.240 suls staned and completed. There were no beginning or ending inventories of suits. Actual direct manufacturing labor-hours for June were 4560 2. Requirements 1. Compute the flexible-budget variance, the spending variance, and the efficiency variance for variabile manufacturing overhead. 2. Comment on the results 3. Definition $47.880 - $54,560 4: Definition 547.880 - $50,160 5: Definition $50, 160 - $54,560 ? (2) ) (1) O OU F F OU (3) O OU F Variable manufacturing overhead cost is allocated to each suit on the basis of budgeted direct manufacturing labor-hours per suit. For June 2017, each suit is budgeted to take 5 labor-hours. Budgeted variable manufacturing overhead cost per labor-hour is $14. The budgeted number of suits to be manufactured in June 2017 is 1.100 Actual variable manufacturing overhead costs in June 2017 were $67,800 for 1,040 suits started and completed. There were no beginning or ending inventories of suits. Actual direct manufacturing labor-hours for June were 4,520

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started