Question

Radical Winter Boot Company creates custom snowboard boots for serious snowboarders. The key to success of the snowboard boots is a computer program that scans

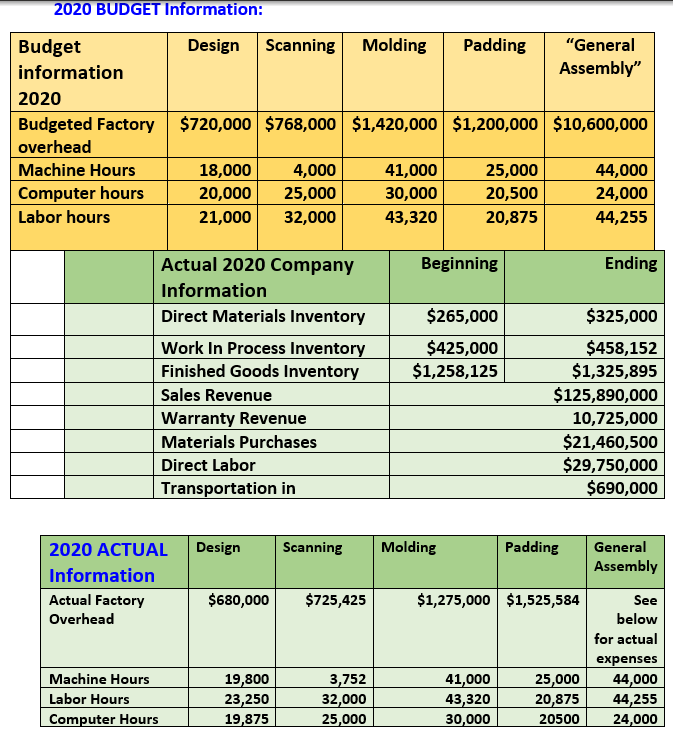

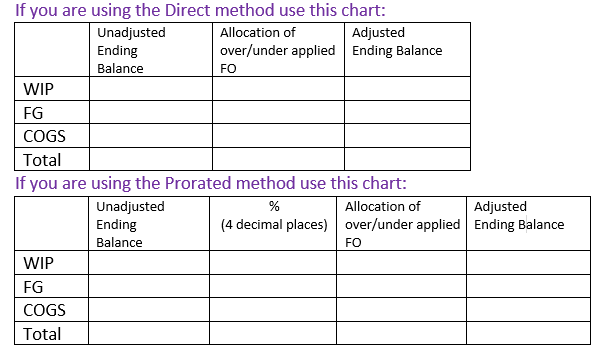

Radical Winter Boot Company creates custom snowboard boots for serious snowboarders. The key to success of the snowboard boots is a computer program that scans the exact shape of the feet, the thickness of the leg to the midcalf, weight distribution in key parts of the foot, amount of arch support needed, etc. The boot can also be customized for the needs of the individual including extra padding, heat control, cooling, and ventilation, etc. The production of the boot will potentially go through five cost departments, Design, Scanning, Plastic boot Molding, Padding molding, and General Assembly. The Design department applies factory overhead on computer hours, The Scanning department applies Factory overhead on the basis of computer hours, Plastic boot Molding department applies factory overhead cost on the basis of machine-hours, and the Padding department applies factory overhead costs on the basis of direct labor hours. All other factory overhead costs of running the factory are lumped into the General Assembly and are allocated on the basis of machine-hours. All rates should have a maximum of 4 decimal places. Factory over/underapplied overhead is allocated using the direct or prorated method at the company level based on materiality. Over or underapplied factory overhead is considered material if the total amount of over or underapplied factory overhead for the company is greater than 3.5% of the actual factory overhead dollar amount for the company as a whole. Over or underapplied factory overhead that is deemed to be material is applied as an adjustment to COGS on a prorated basis to WIP, FG, and COGS.

Required:

- Prepare a detailed schedule that shows the computation for Predetermined OH rate, Applied Factory overhead, and Over or under applied Factory overhead for each department.

- Prepare a summary schedule that shows how the total over/under applied factory head is allocated. Use of the 2 charts listed below.

3. In detail, explain why you chose either the direct or prorated method to allocate the over/under applied factory overhead.

2020 BUDGET Information: Budget Design Scanning Molding Padding "General information Assembly" 2020 Budgeted Factory $720,000 $768,000 $1,420,000 $1,200,000 $10,600,000 overhead Machine Hours 18,000 4,000 41,000 25,000 44,000 Computer hours 20,000 25,000 30,000 20,500 24,000 Labor hours 21,000 32,000 43,320 20,875 44,255 Beginning Ending Actual 2020 Company Information Direct Materials Inventory Work In Process Inventory Finished Goods Inventory Sales Revenue Warranty Revenue Materials Purchases Direct Labor Transportation in $265,000 $425,000 $1,258,125 $325,000 $458,152 $1,325,895 $125,890,000 10,725,000 $21,460,500 $29,750,000 $690,000 Design Scanning 2020 ACTUAL Information Actual Factory Overhead $680,000 $725,425 Molding Padding General Assembly $1,275,000 $1,525,584 See below for actual expenses 41,000 25,000 44,000 43,320 20,875 44,255 30,000 20500 24,000 Machine Hours Labor Hours Computer Hours 19,800 23,250 19,875 3,752 32,000 25,000 FO If you are using the Direct method use this chart: Unadjusted Allocation of Adjusted Ending over/under applied Ending Balance Balance WIP FG COGS Total If you are using the Prorated method use this chart: Unadjusted % Allocation of Adjusted Ending (4 decimal places) over/under applied Ending Balance Balance FO WIP FG COGS Total 2020 BUDGET Information: Budget Design Scanning Molding Padding "General information Assembly" 2020 Budgeted Factory $720,000 $768,000 $1,420,000 $1,200,000 $10,600,000 overhead Machine Hours 18,000 4,000 41,000 25,000 44,000 Computer hours 20,000 25,000 30,000 20,500 24,000 Labor hours 21,000 32,000 43,320 20,875 44,255 Beginning Ending Actual 2020 Company Information Direct Materials Inventory Work In Process Inventory Finished Goods Inventory Sales Revenue Warranty Revenue Materials Purchases Direct Labor Transportation in $265,000 $425,000 $1,258,125 $325,000 $458,152 $1,325,895 $125,890,000 10,725,000 $21,460,500 $29,750,000 $690,000 Design Scanning 2020 ACTUAL Information Actual Factory Overhead $680,000 $725,425 Molding Padding General Assembly $1,275,000 $1,525,584 See below for actual expenses 41,000 25,000 44,000 43,320 20,875 44,255 30,000 20500 24,000 Machine Hours Labor Hours Computer Hours 19,800 23,250 19,875 3,752 32,000 25,000 FO If you are using the Direct method use this chart: Unadjusted Allocation of Adjusted Ending over/under applied Ending Balance Balance WIP FG COGS Total If you are using the Prorated method use this chart: Unadjusted % Allocation of Adjusted Ending (4 decimal places) over/under applied Ending Balance Balance FO WIP FG COGS TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started