Answered step by step

Verified Expert Solution

Question

1 Approved Answer

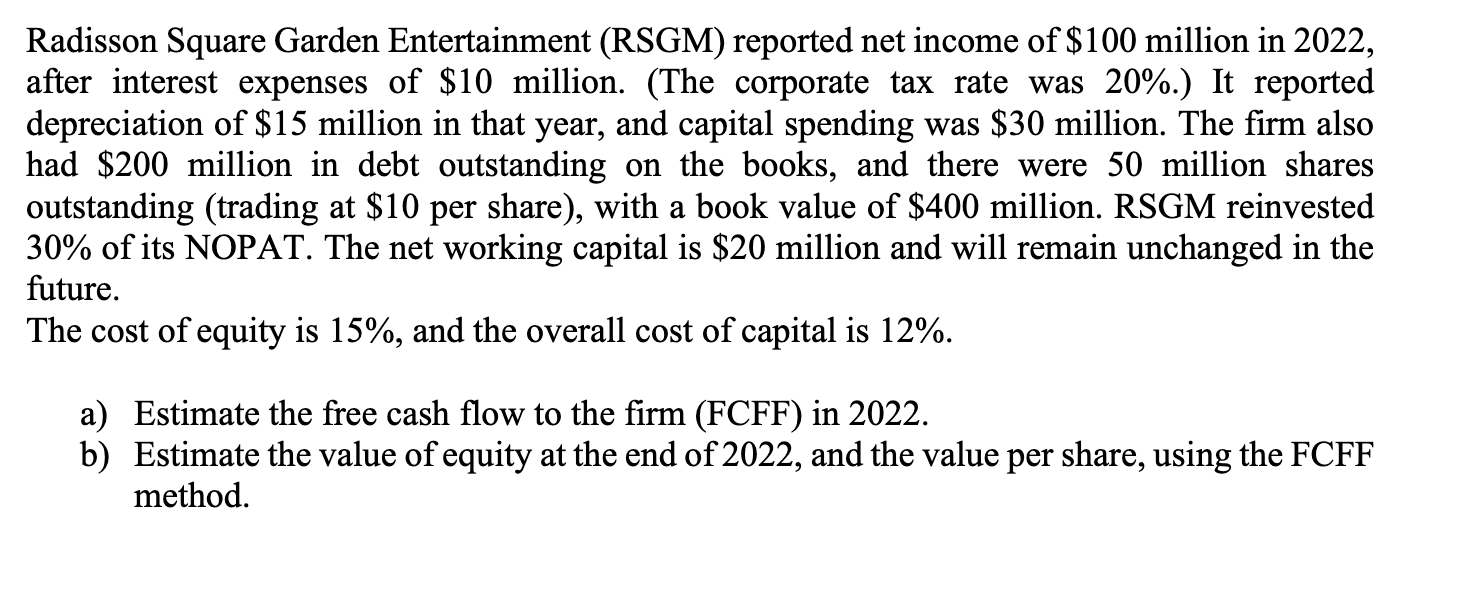

Radisson Square Garden Entertainment (RSGM) reported net income of $100 million in 2022, after interest expenses of $10 million. (The corporate tax rate was

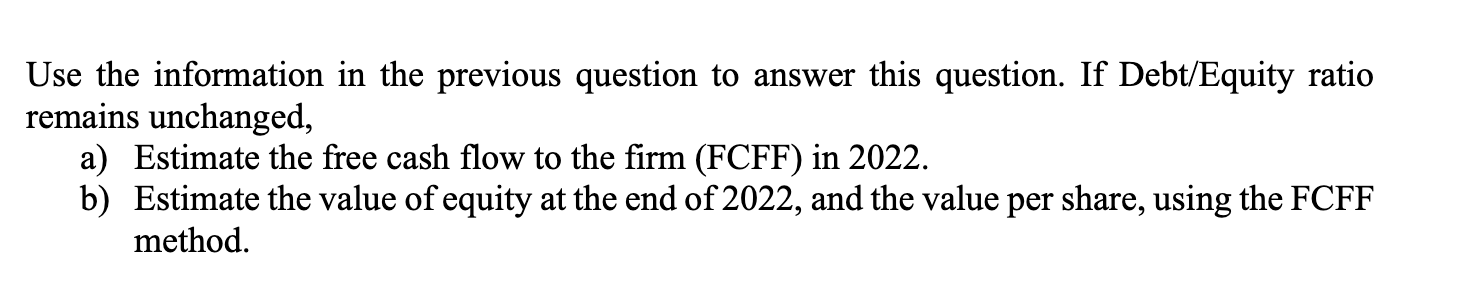

Radisson Square Garden Entertainment (RSGM) reported net income of $100 million in 2022, after interest expenses of $10 million. (The corporate tax rate was 20%.) It reported depreciation of $15 million in that year, and capital spending was $30 million. The firm also had $200 million in debt outstanding on the books, and there were 50 million shares outstanding (trading at $10 per share), with a book value of $400 million. RSGM reinvested 30% of its NOPAT. The net working capital is $20 million and will remain unchanged in the future. The cost of equity is 15%, and the overall cost of capital is 12%. a) Estimate the free cash flow to the firm (FCFF) in 2022. b) Estimate the value of equity at the end of 2022, and the value per share, using the FCFF method. Use the information in the previous question to answer this question. If Debt/Equity ratio remains unchanged, a) Estimate the free cash flow to the firm (FCFF) in 2022. b) Estimate the value of equity at the end of 2022, and the value per share, using the FCFF method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To estimate the Free Cash Flow to the Firm FCFF in 2022 we need to calculate the following compone...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started