Answered step by step

Verified Expert Solution

Question

1 Approved Answer

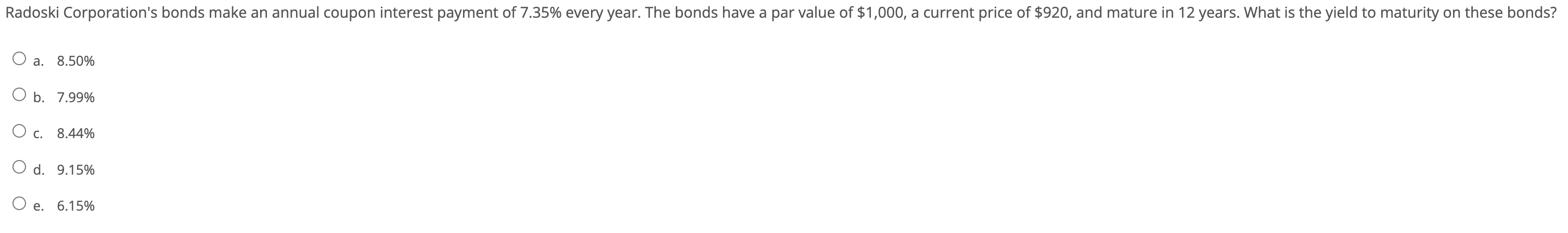

Radoski Corporation's bonds make an annual coupon interest payment of 7.35% every year. The bonds have a par value of $1,000, a current price

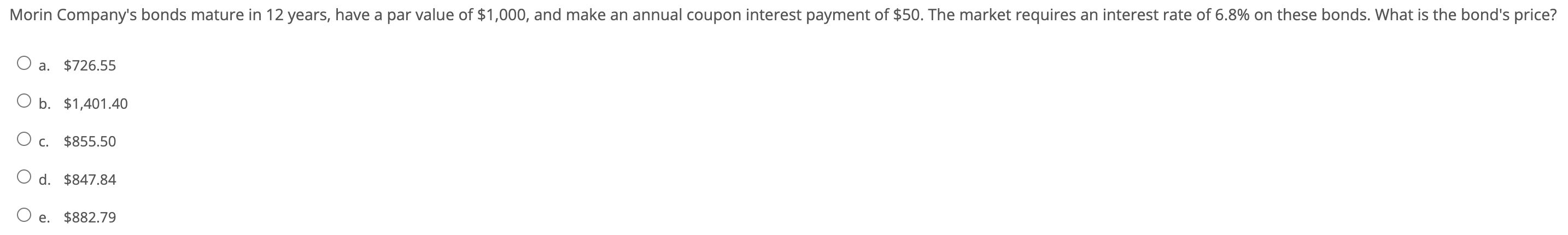

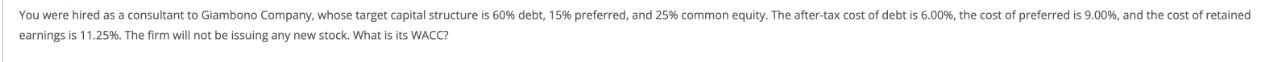

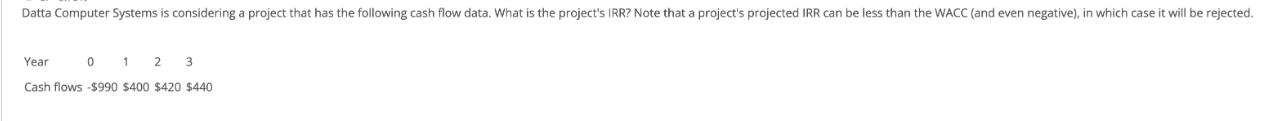

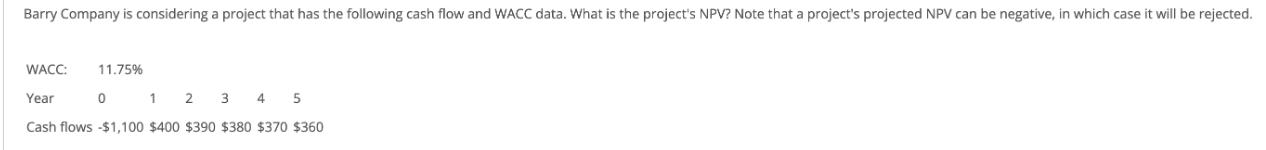

Radoski Corporation's bonds make an annual coupon interest payment of 7.35% every year. The bonds have a par value of $1,000, a current price of $920, and mature in 12 years. What is the yield to maturity on these bonds? a. 8.50% O b. 7.99% O c. O d. 9.15% e. 8.44% 6.15% Morin Company's bonds mature in 12 years, have a par value of $1,000, and make an annual coupon interest payment of $50. The market requires an interest rate of 6.8% on these bonds. What is the bond's price? O a. $726.55 O b. $1,401.40 O c. O d. $847.84 O e. $882.79 $855.50 You were hired as a consultant to Giambono Company, whose target capital structure is 60% debt, 15% preferred, and 25% common equity. The after-tax cost of debt is 6.00%, the cost of preferred is 9.00 %, and the cost of retained earnings is 11.25%. The firm will not be issuing any new stock. What is its WACC? Datta Computer Systems is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. Year 0 1 2 3 Cash flows $990 $400 $420 $440 Barry Company is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's projected NPV can be negative, in which case it will be rejected. 11.75% WACC: Year 1 2 3 4 5 Cash flows -$1,100 $400 $390 $380 $370 $360 0

Step by Step Solution

★★★★★

3.56 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Lets calculate the yield to maturity YTM for Radoski Corporations bonds Coupon payment Par value Coupon interest rate 1000 735 7350 Number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started