Answered step by step

Verified Expert Solution

Question

1 Approved Answer

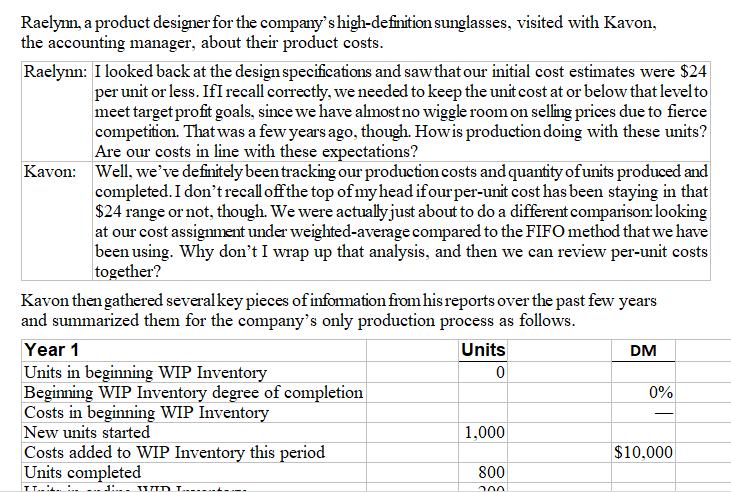

Raelynn, a product designer for the company's high-definition sunglasses, visited with Kavon, the accounting manager, about their product costs. Raelynn: I looked back at

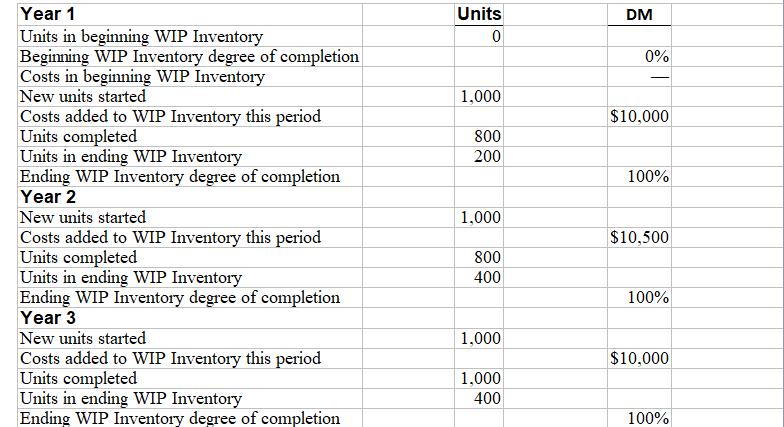

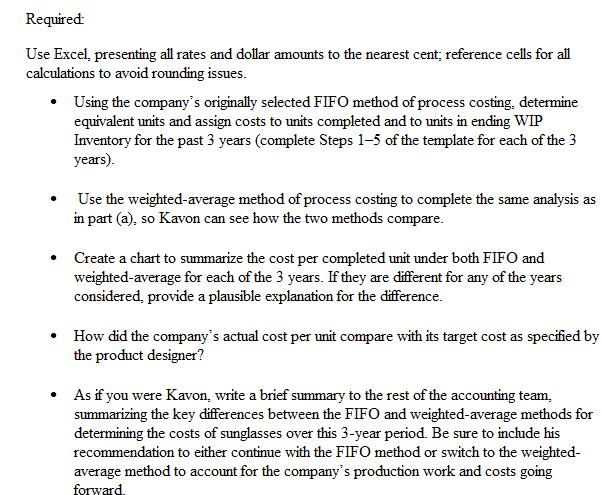

Raelynn, a product designer for the company's high-definition sunglasses, visited with Kavon, the accounting manager, about their product costs. Raelynn: I looked back at the design specifications and saw that our initial cost estimates were $24 per unit or less. If I recall correctly, we needed to keep the unit cost at or below that level to meet target profit goals, since we have almost no wiggle room on selling prices due to fierce competition. That was a few years ago, though. How is production doing with these units? Are our costs in line with these expectations? Kavon: Well, we've definitely been tracking our production costs and quantity of units produced and completed. I don't recall off the top of my head if our per-unit cost has been staying in that $24 range or not, though. We were actually just about to do a different comparison: looking at our cost assignment under weighted-average compared to the FIFO method that we have been using. Why don't I wrap up that analysis, and then we can review per-unit costs together? Kavon then gathered several key pieces of information from his reports over the past few years and summarized them for the company's only production process as follows. Year 1 Units in beginning WIP Inventory Units 0 Beginning WIP Inventory degree of completion Costs in beginning WIP Inventory New units started 1,000 Costs added to WIP Inventory this period Units completed 800 17 T 200 DM 0% - $10,000 Year 1 Units Units in beginning WIP Inventory 0 Beginning WIP Inventory degree of completion DM 0% Costs in beginning WIP Inventory - New units started 1,000 Costs added to WIP Inventory this period $10,000 Units completed 800 Units in ending WIP Inventory 200 Ending WIP Inventory degree of completion Year 2 100% New units started 1,000 Costs added to WIP Inventory this period $10,500 Units completed 800 Units in ending WIP Inventory 400 Ending WIP Inventory degree of completion Year 3 100% New units started 1,000 Costs added to WIP Inventory this period $10,000 Units completed 1,000 Units in ending WIP Inventory 400 Ending WIP Inventory degree of completion 100% Required: Use Excel, presenting all rates and dollar amounts to the nearest cent; reference cells for all calculations to avoid rounding issues. Using the company's originally selected FIFO method of process costing, determine equivalent units and assign costs to units completed and to units in ending WIP Inventory for the past 3 years (complete Steps 1-5 of the template for each of the 3 years). . Use the weighted-average method of process costing to complete the same analysis as in part (a), so Kavon can see how the two methods compare. Create a chart to summarize the cost per completed unit under both FIFO and weighted-average for each of the 3 years. If they are different for any of the years considered, provide a plausible explanation for the difference. How did the company's actual cost per unit compare with its target cost as specified by the product designer? As if you were Kavon, write a brief summary to the rest of the accounting team. summarizing the key differences between the FIFO and weighted-average methods for determining the costs of sunglasses over this 3-year period. Be sure to include his recommendation to either continue with the FIFO method or switch to the weighted- average method to account for the company's production work and costs going forward.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Certainly Kavon is comparing two inventory valuation methods weightedaverage and FIFO First In First ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started