Question

Rahim and Chong have prepared their draft accounts for the year ended 30 April 2022. The draft accounts report a gross profit of RM157,846 and

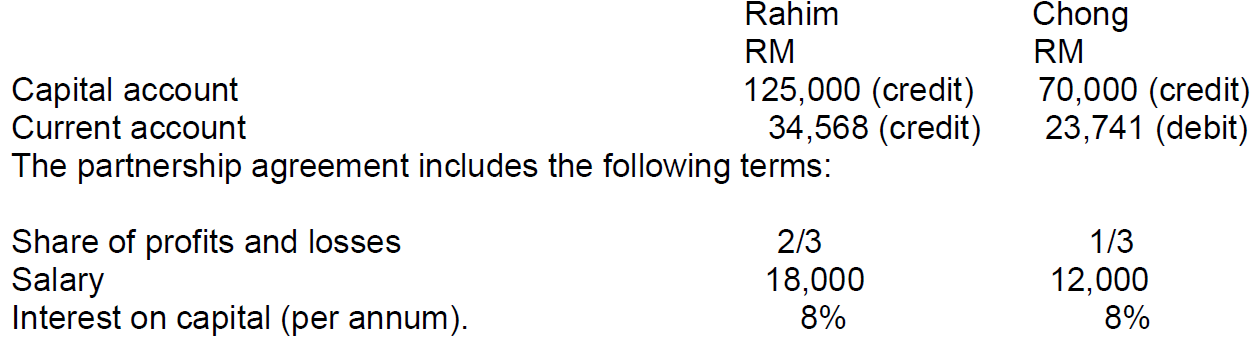

Rahim and Chong have prepared their draft accounts for the year ended 30 April 2022. The draft accounts report a gross profit of RM157,846 and a net profit of RM51,024. Cash payments of RM15,000 to each partner have been included in expenses. At 1 May 2021 the balances on the partners capital and current accounts were:

The partnership agreement also states that the partners capital account balances will remain fixed, and that the balances on the partners current accounts should not be included in the calculation of interest on capital.

Required: Calculate: a. the correct gross profit and net profit to be reported in the partnership profit and loss account for the year ended 30 April 2022. (2 marks) b. the amount of profit which will be credited to each partners current account for the year to 30 April 2022. (8 marks) c. the balance on each partners current account at 30 April 2022. (5 marks)

CapitalaccountCurrentaccountThepartnershipagreementincludesthefollowingterms:ShareofprofitsandlossesSalaryRahimRM125,000(credit)34,568(credit)2/318,000ChongRM70,000(credit)23,741(debit)1/312,0008%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started