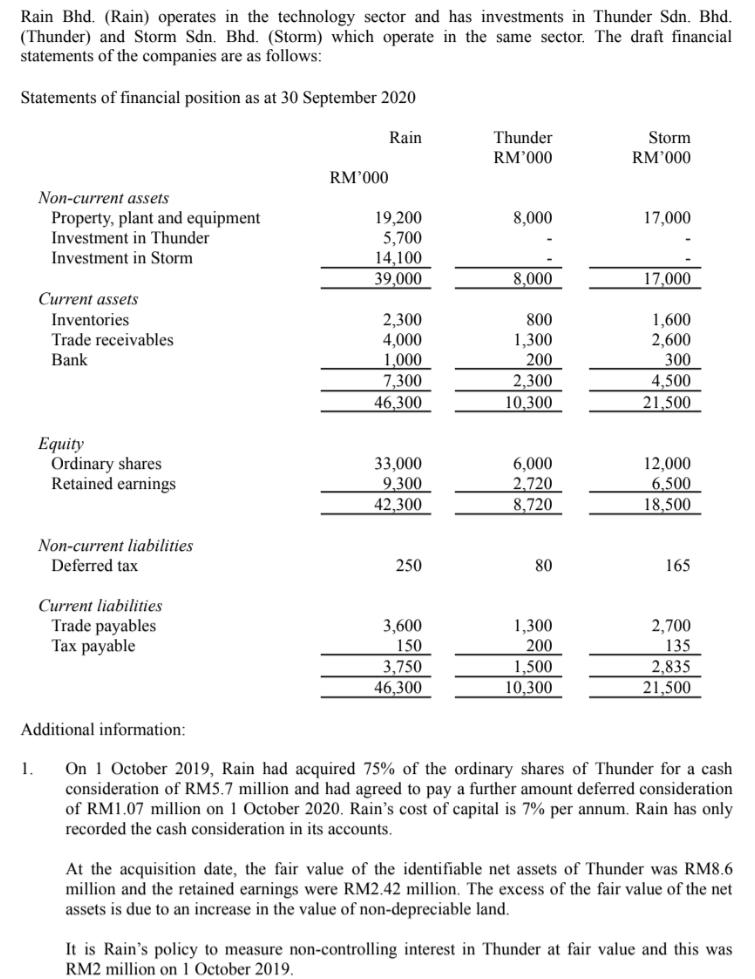

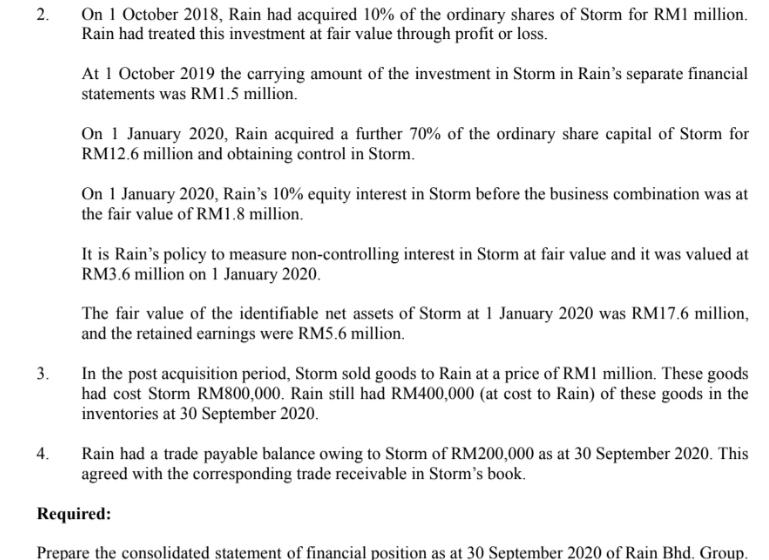

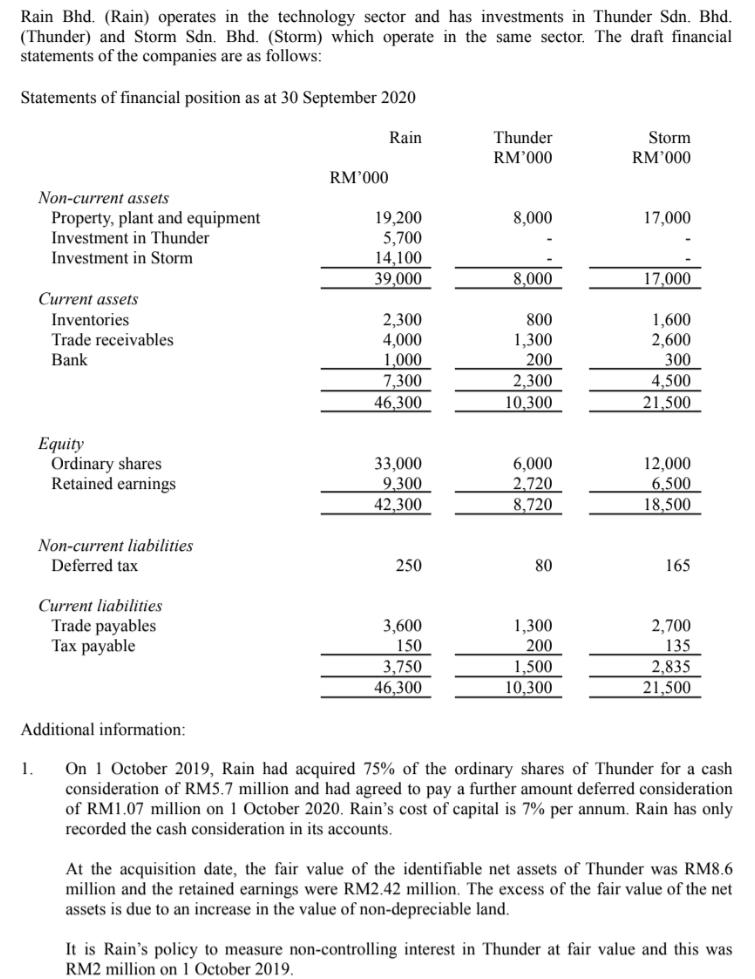

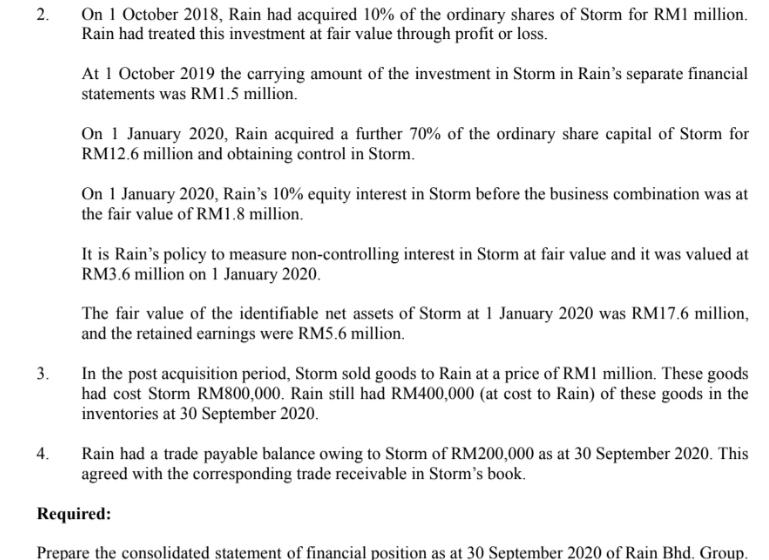

Rain Bhd. (Rain) operates in the technology sector and has investments in Thunder Sdn. Bhd. (Thunder) and Storm Sdn. Bhd. (Storm) which operate in the same sector. The draft financial statements of the companies are as follows: Statements of financial position as at 30 September 2020 Additional information: 1. On 1 October 2019 , Rain had acquired 75% of the ordinary shares of Thunder for a cash consideration of RM5.7 million and had agreed to pay a further amount deferred consideration of RM1.07 million on 1 October 2020. Rain's cost of capital is 7\% per annum. Rain has only recorded the cash consideration in its accounts. At the acquisition date, the fair value of the identifiable net assets of Thunder was RM8.6 million and the retained earnings were RM2.42 million. The excess of the fair value of the net assets is due to an increase in the value of non-depreciable land. It is Rain's policy to measure non-controlling interest in Thunder at fair value and this was RM2 million on 1 October 2019. 2. On 1 October 2018 , Rain had acquired 10% of the ordinary shares of Storm for RM1 million. Rain had treated this investment at fair value through profit or loss. At 1 October 2019 the carrying amount of the investment in Storm in Rain's separate financial statements was RM1.5 million. On 1 January 2020 , Rain acquired a further 70% of the ordinary share capital of Storm for RM12.6 million and obtaining control in Storm. On 1 January 2020, Rain's 10% equity interest in Storm before the business combination was at the fair value of RM1.8 million. It is Rain's policy to measure non-controlling interest in Storm at fair value and it was valued at RM3.6 million on 1 January 2020. The fair value of the identifiable net assets of Storm at 1 January 2020 was RM17.6 million, and the retained earnings were RM5.6 million. 3. In the post acquisition period, Storm sold goods to Rain at a price of RM1 million. These goods had cost Storm RM800,000. Rain still had RM400,000 (at cost to Rain) of these goods in the inventories at 30 September 2020. 4. Rain had a trade payable balance owing to Storm of RM200,000 as at 30 September 2020. This agreed with the corresponding trade receivable in Storm's book. Required